In our previous article, we broke down Messari’s 165-page 2022 theses and identified certain top crypto themes to look out for in 2022.

Recently, Crypto.com released a research paper on some of its predictions for 2022. This report included projections, forecasts and other predictive statements which represent Crypto.com’s assumptions and expectations of the crypto space in the light of currently available information.

In this article, we analysed the research paper and picked out some of the top predictions of 2022:

1. Inevitability of crypto

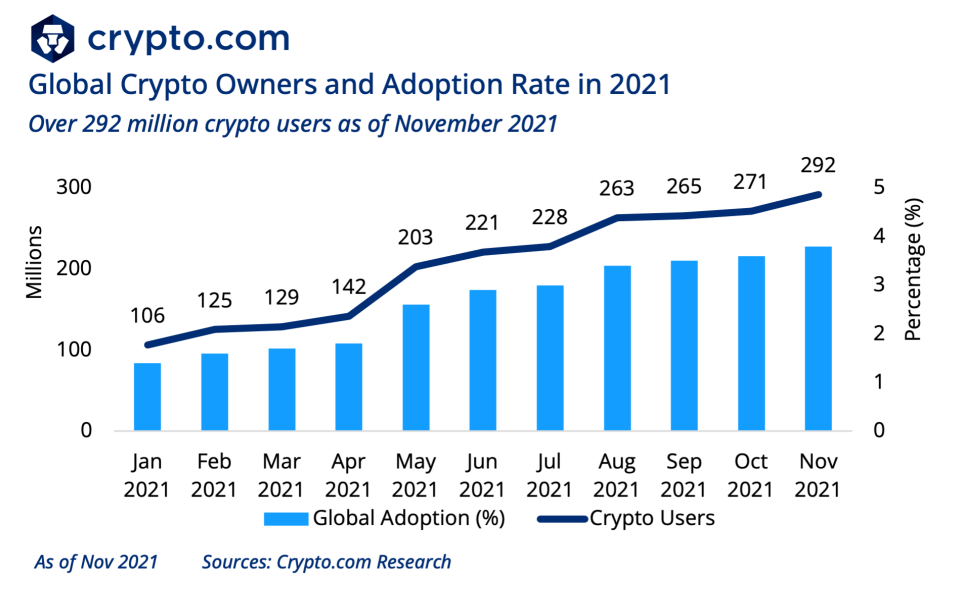

With over 292 million crypto owners worldwide, crypto has become too large to ignore. The global adoption rate is growing at a steady rate of 2-4% per month, and is projected to increase steadily at the current rate and hit 1 billion users by the end of 2022.

More and more nations are expected to develop legal framework for crypto assets. The structured legal framework would help the general public have more confidence in crypto and generate a positive attitude towards crypto adoption.

In 2021 alone, countries like El Salvador, Panama, and Ukraine have adopted cryptocurrencies, while Singapore has approved a physical Bitcoin fund.

Countries plagued with highly inflationary economy and unstable currency may follow El Salvador and adopt crypto as legal tender.

The ease of access to crypto would also be beneficial to the 1.7 billion unbanked people worldwide. Furthermore, remittance using crypto can significantly reduce the remittance fees which can be up to 12.5%.

With clear legal framework and mainstream adoption, it is not too farfetched to say that global crypto users would reach one billion by the end of 2022.

2. Crypto as an investment staple

According to Crypto.com’s research paper, crypto will become a mainstream investment staple. There will be an influx of crypto-related instruments like Bitcoin and Ethereum ETF.

Last month, Singapore approved Fintonia to launch a physical Bitcoin fund. Similar to mutual funds, the fund allows investors to subscribe and redeem anytime they want. While it is only available to accredited investors, it is the start of incorporating crypto into traditional finance.

Major banks and financial houses like Morgan Stanley and Goldman Sachs have also started to integrate crypto into their portfolio and offeringss.

Temasek Holdings, Singapore’s sovereign wealth fund, has also expanded its scope beyond traditional finance and looking into blockchain-related opportunities.

We are expecting a demand push where more and more banks start to offer crypto investment-related products or risk being left behind and crypto becoming a fixture in traditional investment portfolios.

3. DAOs will be everywhere

We're witnessing one of the coolest human experiments ever.

— Alex Lieberman (⛳️•🏌️) (@businessbarista) November 15, 2021

More than 2,000 people have contributed $3,000,000 in less than 24 hours.

Why?

We're trying to buy the Constitution.

Here's the wild story of @constitutiondao 🧵

Decentralised autonomous organisations or DAOs are not controlled by a single entity but by members that are holding onto their governance token.

There any many different types of DAOs but they mainly fall into one of the two categories: those that make investments and those that manage projects.

A more recent example of an investment DAO is when more than 2,000 users contributed US$3 million to buy the US constitution. While they were out bided, this showed the power of community and how like-minded people can enter a DAO and commit funds to a specific cause.

The future of corporations could be very different as DAOs take on legacy businesses. It’s the ultimate combination of capitalism and progressivism. Entrepreneurs that enable DAOs can make $. If the community excels at governance, everyone shares in the upside. Trustless can pay

— Mark Cuban (@mcuban) May 31, 2021

Billionaire Mark Cuban called DAOs “the ultimate combination of capitalism and progressivism”. Looking ahead, DAOs governance structure will be widely accepted and even expand beyond the crypto space.

At the end of the day, it is believed that DAOs would disrupt traditional structures of business and one day be accepted as legal entities.

4. GameFi will catalyze crypto adoption

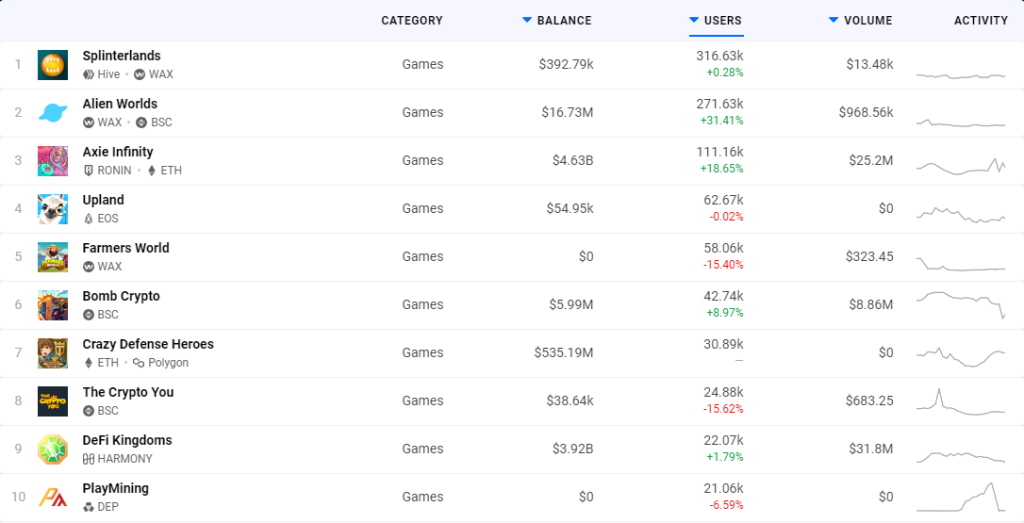

GameFi will be the main driving force of mass adoption of crypto. 2021 was the year of GameFi and NFTs, as GameFi surpassed DeFi in user popularity.

Using gaming as the medium would make crypto easy to grasp due to the nature of being fun. Traditional game studios like Ubisoft are racing to incorporate NFT into their games. These NFT collectables would act as a stepping stone between traditional games and the crypto world.

Another reason is the play-to-earn (P2E) feature. Users like that they can make money while playing games. GameFi has already impacted the lives of many from developing nations. In some developing nations like Ghana, players are able to earn several times above the country’s minimum wage.

With the phenomenon of play to earn and the addition of traditional games incorporating blockchain technology, we believe GameFi would onboard millions of users and pave the way to mass adoption of crypto.

Love it or hate it, crypto is here to stay. Overall these are our predictions for 2022 but things might play out differently as new innovations are constantly in the making and it might revolutionize the crypto space.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Atmhaber

Also Read: Here Are The Top Crypto Themes And Trends To Look Out For In 2022