NFT marketplaces have been an alternative to investing in NFTs without purchasing animals like JPEGS or an actual NFT. Instead of grinding whitelists and flipping NFTs, you are betting on the entire NFT ecosystem and the new use cases it offers.

Today, we look at competitors of Opensea and find out how they may overthrow Opensea by bringing to the table new use cases within the NFT space.

Have you ever wondered how @opensea became the largest NFT Marketplace? Who were predecessors before them? Who paved the way and who may unseat the champs in the future?

— jake.bit (@jakegallen_) January 4, 2023

This NFT Marketplace Roadmap will take you down the path of of NFT Marketplace History. Here we go! (1/38) pic.twitter.com/ZFYJUhqBfk

LooksRare $LOOKS

If any project, LooksRare is gunning for the Opensea’s throne. They are an NFT trading platform with their own token $LOOKS and bring innovative ways to reward NFT creators and holders.

Applying the concept of “real yield” in their tokenomics allows creators and stakers of $LOOKS to receive huge parts of yield from the revenue (transaction fees) the platform generates.

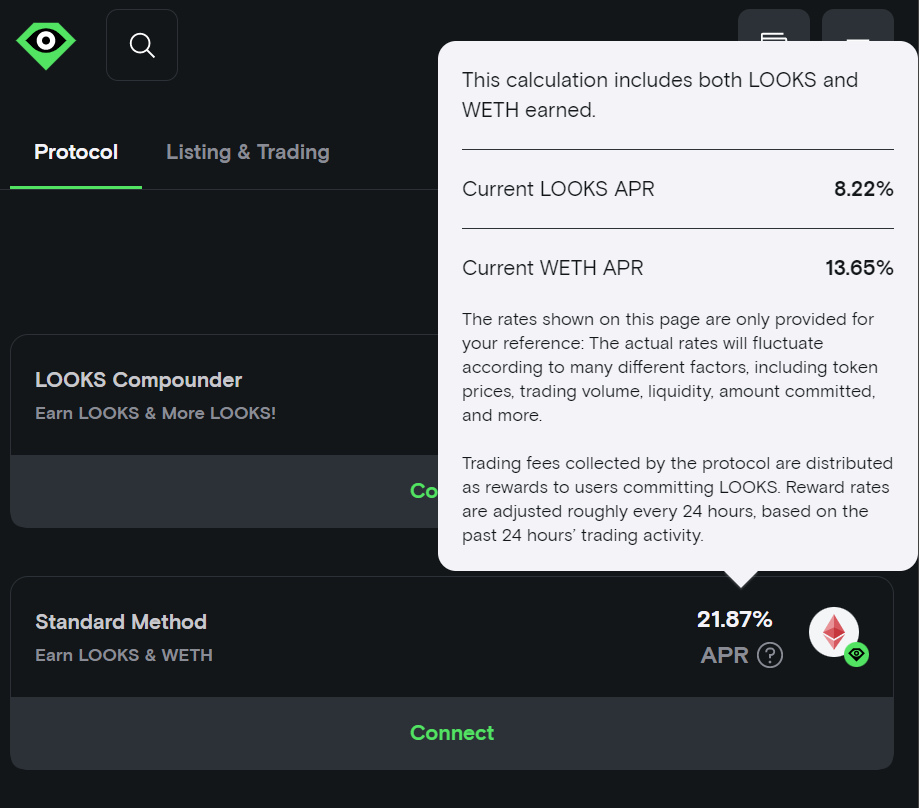

On the platform right now, committing LOOKS will get you about 21.87% APY, where you earn a combination of WETH (the currency NFTs are priced on LooksRare) and LOOKS itself in the percentage denominations below.

Based on the global stats, the total number of LOOKS committed is ~597M, valued at $180M. Comparing this to the total supply of LOOKS of 836,931,120 means that around 80% of all tokens are staked, and 83.6% of the circulating supply is already in the market, keeping in mind the 1 billion max supply.

As we head towards phase 4 of LOOKS emission, on top of the decreasing inflation emission schedule for the token, rewards for stakers will also be slashed. While this may come as bad news for stakers, in the long term, it is a green flag as when inflation is reduced, likely the selling pressure of the token would as well.

Currently, LooksRare is charging 2% platform fees, and half of that goes to creators of the NFTs. This means that LooksRare’s revenue-sharing model will drive demand and use for the LOOKS token and create a sustainable ecosystem for all participants.

But for that to work, volume and liquidity are needed.

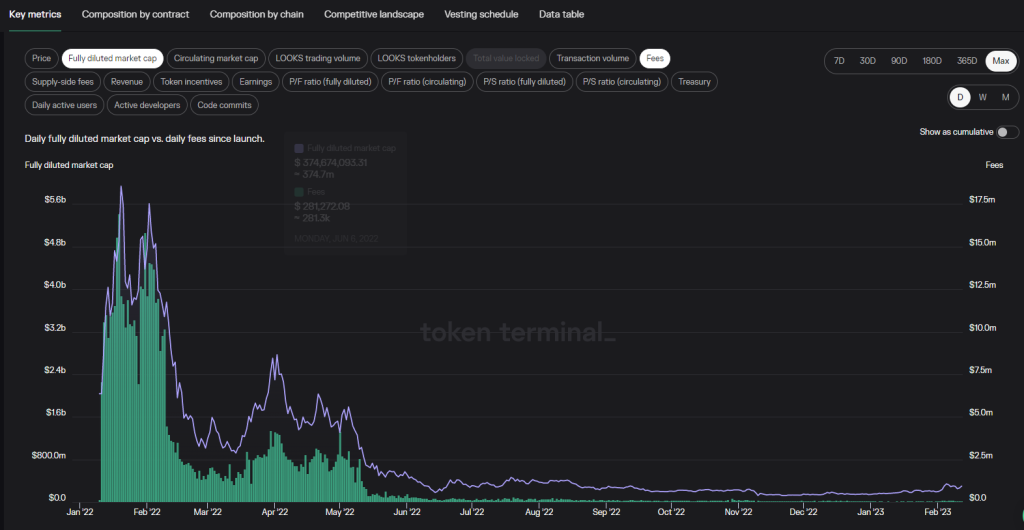

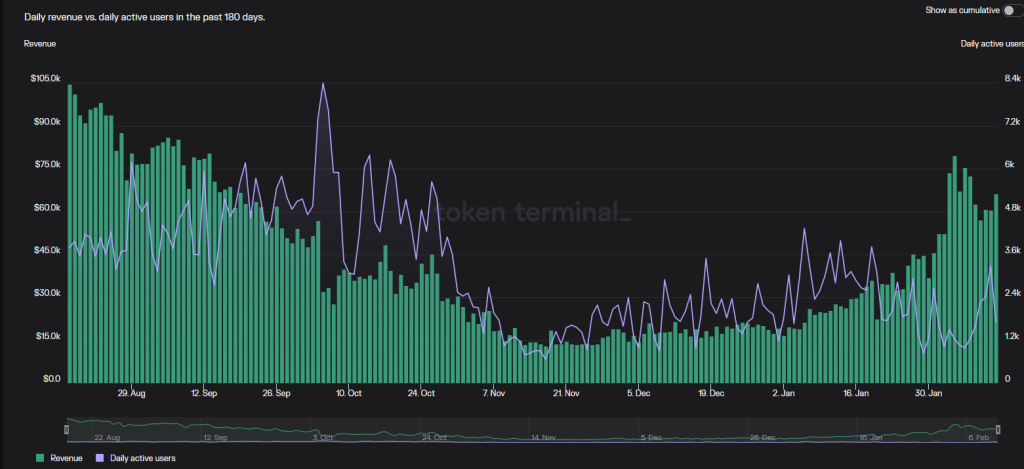

The aftermath of the NFT bull run comes with less exciting statistics, but even so, the platform still brought $600M in cumulative fees in 2022 and now averaging ~1-2M in costs post-LUNA crash.

However, by looking at the daily active users, we see them bringing in ~300-400 users in Jan and Feb this year. Something seems strange, though, with 456 users bringing in ~$2M in fees. How many transactions is that even???

Well-known crypto thought leader Arthur Hayes is currently the largest individual holding address of LOOKS. He must be seeing something we don’t.

1/ Arthur Hayes (@CryptoHayes) is currently the largest individual holding address of $LOOKS, holding 17M $LOOKS ($5.14M).https://t.co/YKyINyarvS pic.twitter.com/e0Hun5Ds4J

— Lookonchain (@lookonchain) February 8, 2023

X2Y2

The next Opensea killer is X2Y2, and as of the present day, it is dubbed as one of the most undervalued tokens from all the competitors. They are creating an NFT marketplace with instant push notifications; combined wrapped ETH and ETH trades with zero trade offers and rarity tools.

100% of their fees collected are rewarded to those who stake X2Y2, and they are currently the 2nd biggest marketplace on Ethereum with over $41M in trading volume in the last 30 days and $976M since its inception.

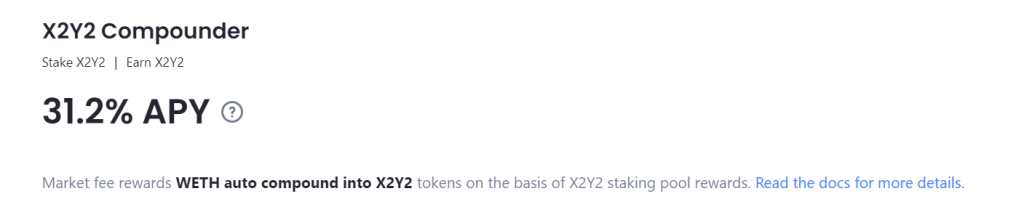

Staking X2Y2 currently would yield you 31.2% APY.

X2Y2 also enables NFT holders to use their NFTs as collateral to take loans in ETH. They offer increased safety with verified offers before going on the chain and allow for multiple loan offers with different durations.

Regarding royalties, users can decide to pay the royalty, and NFT holders can vote to enforce the royalty. As of September 2022, 98.11% of the sales happening on X2Y2 are paid royalties.

We believe there should be a “Fair Royalty” model (user decides what they want to pay, and creator decides who they want to serve).

— X2Y2 (@the_x2y2) September 29, 2022

This is something we fundamentally believe Web3 should be about.

5/n

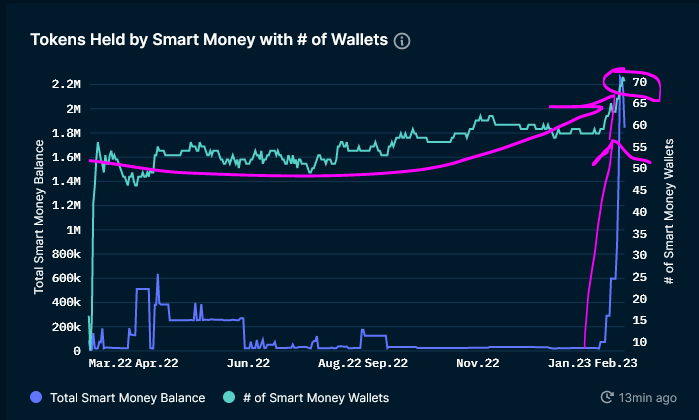

Looking deeper into some On-chain analytics with Nansen, X2Y2 smart money holdings are at its all-time high. The whales are looking into the NFT marketplaces and getting into positions before the next NFT bull run.

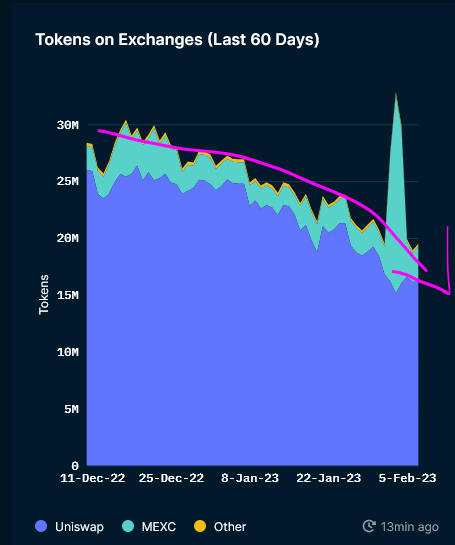

Furthermore, with tokens on exchanges decreasing 7.73% from 21.1M to 19.5M in the last seven days, this represents bullish signals to users withdrawing tokens to the X2Y2 platform for staking.

The 60-day stats for tokens on exchanges also reflect a downtrend, while unique addresses show a long-term uptrend, double bullish news.

The revenue generated for the token holders has also seen significant interest after its recovery period from the FTX crash. Based on the monthly statistics, January 2023 saw over 2.5k active users pay ~$937K in revenue. That is an average of $374 in fees generated for each user.

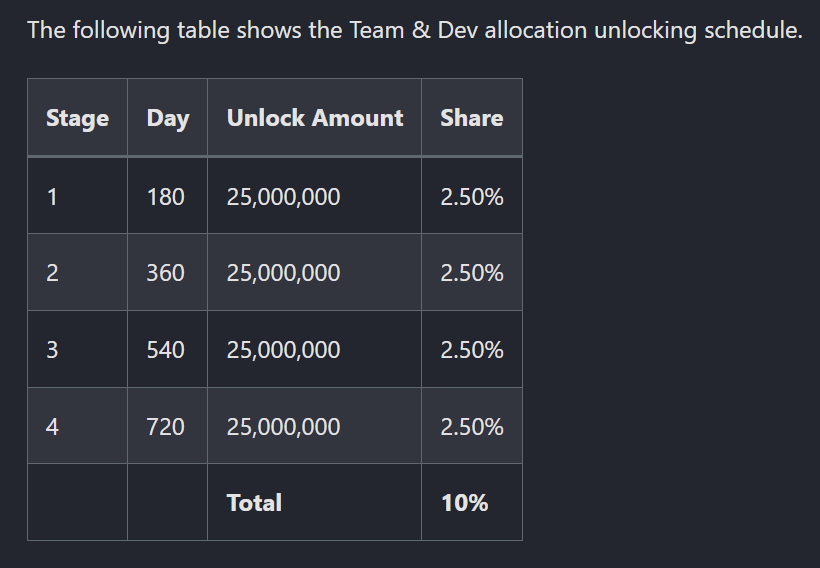

With more than 20% of the supply in circulation, ~30% of the remaining total supply is dedicated to staking rewards. It is good to note that with a max supply of 1B X2Y2 tokens, a significant inflow of new X2Y2 tokens will still be released to the market.

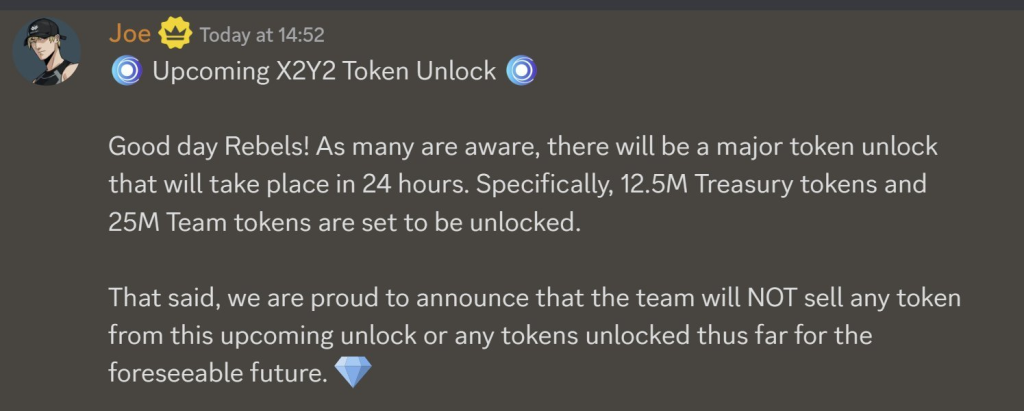

The upcoming X2Y2 unlock imminently, but as mentioned below, it is also said the team will not sell any of the $7.32M unlock for the foreseeable future. Bullish? But that means liquidity is in their hands, and if ever, you are their exit plan.

New kid on the block, $Blur

$BLUR airdrops are happening today (14th Feb 2023). Blur is one of the leading NFT aggregators/marketplaces launched in Oct 2022, the platform positioned itself as a top NFT platform with transactions of more than $1.4B in transaction volume since its inception.

IT'S TIME FOR $BLUR

— Blur (@blur_io) February 13, 2023

Care Packages can be opened on Feb 14 at 12PM EST, 1AM HKG, 6PM CET.

Make sure the launch announcement comes from our official @BLUR_io account tomorrow and double check all URLs before claiming. pic.twitter.com/tSbOPLqYTW

It positioned itself as a solid rival to Opensea and is currently leading the NFT market share with 38.7% volume vs the 48% of Opensea.

With investors from Paradigm, top advisors such as Zeneca and $11M seed funding, Blur currently stands with huge potential, but probably nothing.

Find out more on how you can play the airdrop game, referencing previous NFT airdrops such as ENS and LOOKS, which brought 4 to 5-figure gains.

The $BLUR airdrop is going to print millions

— Hunter Solaire ᵍᵐ (Right-of-Game) (@huntersolaire_) February 13, 2023

and the smartest traders will come out on top

Here's your 3-step game plan to maximize this opportunity 🧵 pic.twitter.com/3oWSjyKK31

But some may wonder, how can a project derive such high numbers of trading volume when there is little to no info about its tokenomics and no whitepaper? Where do you see this project stand as an Opensea killer? or will it fall short in expectations?

4/ What could $Blur worth? There's little known of the tokenomic.

— SpaceBeast (@spacebeast) February 13, 2023

Just to put it into perspective. The market cap of tokens of some top NFT marketplaces (fully diluted)$Looks – $269,636,976

$X2Y2 – $186,010,071

The trading volume of $Blur are 2x Looksrare + X2Y2 combined pic.twitter.com/XU9Pyd80hT

Closing thoughts

Undoubtedly, innovation in the NFT marketplaces will eventually find its place in the web3 future. But it must go through a battle-tested period before we see it handling significant adoption. Opensea had the first mover advantage, and its value proposition lies in the simplicity and what it is used for, buying and selling of NFTs.

But as that simple concept of NFT will be taken to another level, the introduction of NFTfi will likely be an eventful winner within the NFT space. However, what does it take to get there successfully? As we see Opensea killers crafting more use cases beyond just buying and selling NFTs, the ball is in Opensea’s court in their actions in 2023 to push known boundaries in the space.

Also Read: Who Will Benefit From SEC Banning Kraken’s Staking-As-A-Service?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief