Cetus is a DEX and liquidity protocol built on the Aptos and Sui blockchains, with Move as their common programming language. They focus on delivering a solid trading experience with an upgraded capital efficiency to DeFi users by building its concentrated liquidity protocol and series of functional modules.

Recently, Cetus’s partnership with two exchange giants for it’s token launch saw it rack up over 13,500% oversubscribed numbers, something only the bull market could pull. Being one of the hypest IDO drops this season, their decision to drop their tokens could be a strategic one, following the footsteps to how $SUI only did their token launch on exchanges instead of the widely anticipated airdrop.

13,500% Oversubscribed $CETUS is probably one of the most hyped IDO this szn lol

— 0xJeff (@LandfSmile) May 10, 2023

✅Kucoin Listing

✅OKX Listing

Page getting clunky & slow due to the traffic but people can started claiming now pic.twitter.com/On4FcxxDb6

As the title suggest, yes their TVL broke a little above $30M in the first two days of launch, and since then it is hovering comfortable around the 18-22M range. But we are still in early days.

Now when we look at the DeFi activity of the two mother blockchains, Aptos and SUI, we start to see that these two chains are in it’s infancy stage. Many other ‘Ethereum killers’ from the lights of Avalanche, Solana and Fantom have welcomed over three digits in protocol count, but that still falls short when you talk about activity.

Ethereum have been a leader across many departments (Total active users/DeFi activity/volume) so it will be interesting to see if Cetus riding on the hype of Aptos and SUI could compete for any of their trophies.

Rome was not built in a day, and even Ethereum right now, is still building the blocks for its infrastructure. We all saw what the markets can do to the best of us (tokens), and even the strongest layer1s in the bull market stumbled, projects in their early days will always promise the dream, but when the bear hits, it is the ones with strong product market fit who will survive.

Here is a brief introduction about what you can do with $CETUS after you get it.👇https://t.co/fd9sWUdb20

— Cetus🐳 (@CetusProtocol) May 10, 2023

Of course, as much as SUI is giving me the vibe of Aptos, there is some money to be made. Cetus at this moment of time, positions itself as the largest DEX/concentrated liquidity on Aptos and SUI, and with big VCs backing them, things could get interesting.

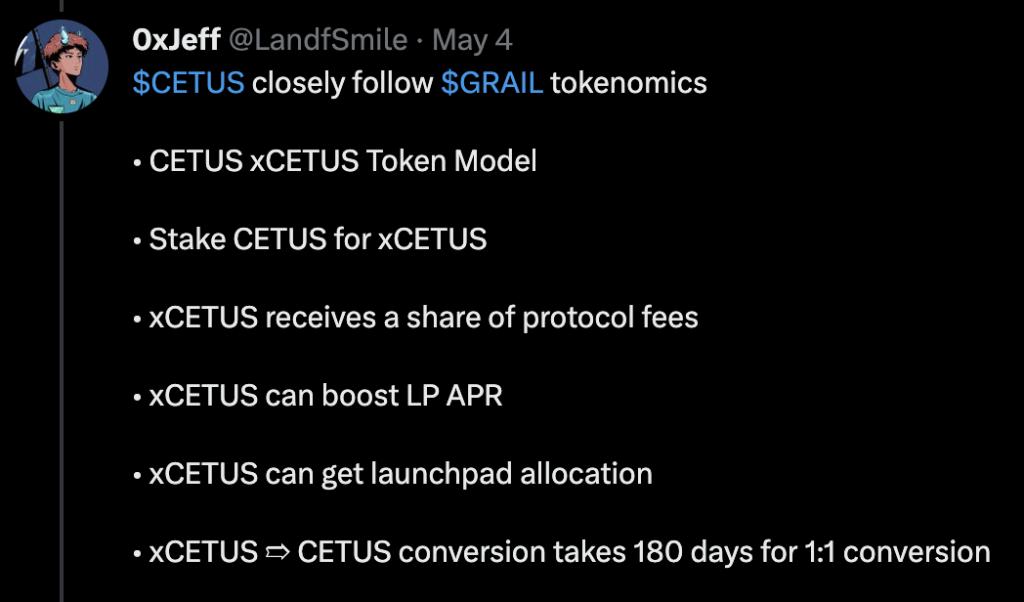

But that begs the question, what are we able to do using the $CETUS token after we get it? Well, there are about five things you can do.

Staking rewards. Users can convert their CETUS tokens to xCETUS instantly at anytime. A considerable portion of staking rewards will be distributed to all xCETUS holders weekly. For the first 3 months, the staking rewards will be distributed in the form of SUI tokens.

Liquidity from transaction fees and farming. The CETUS-SUI and CETUS-USDC pools that are on Cetus will allow users to constitute their liquidity positions and add CETUS liquidity to these pools. Depending on the performance of each LP will directly affect the transaction fees and farming rewards you can earn from the protocol.

Launchpad. Cetus has its very own in-DEX launchpad which means projects who are looking to launch their tokens can do so via the Cetus protocol. This, often done via incubation intermediaries eg. exchanges etc, is a unique way for the future of token launch. CETUS and xCETUS ownership will be important criteria for evaluating launchpad participation eligibility.

Farm boosting. Just like other boosting platforms, farm boosting will be prominent here. Users can use CETUS tokens to accelerate their farming rewards from particular pools to achieve a better yield performance.

Governance. In Cetus, they believe the most important utility is to participate in DAO governance by voting for proposals regarding key parameter settings on Cetus such as emissions and farming distributions. This will like sparks farming wars from LPs just like we see in the Curve wars.

According to 0xJeff, this could be one way you farm $CETUS.

Furthermore, Cetus opted for an allocation of the token to be forfeited for fast redemption to the treasury to further incentivize stakeholders instead of a burning tokenomic. This way, token distributions could be see higher volumes and fees on a longer time scale.

While the act of staking could alleviate selling pressure, farmers tend to get restless fast, and when there’s protocols out there giving them decent rewards out there, it would be hard to Cetus to deliver or out pace competition out there.

It is hard to tell right now if Cetus is worth the hype but utilizing similar tokenomics from successful projects could give them the edge amongst the crowd. In addition, with the SUI narrative still rather warm, investors are looking at developments within the SUI ecosystem to place their bets, and it seems Cetus is best primed for that throne.

However, we should not be fooled by the big numbers and shiny products, as we all know of platforms who can’t sustain the initial hype on their launch, the real battle only begins with strong alignment in product market fit.

Also Read: Designing Better Cryptocurrencies: 7 Tokenomic Insights from a16z

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief