With regulations heating up, it may be wise to diversify the exchanges you use.

For those not used to On and Off-ramping, they are methods of depositing your funds into Centralized Exchanges (CEXs), swapping them for cryptocurrencies and vice versa.

Choosing where to buy and sell crypto differs from person to person, but there are a few main factors we should consider. Ideally, they should have a great user interface, low fees, and quick response times

In this article, we will go through five CEXs for those in Malaysia, along with their pros and cons.

1. LUNO

Arguably having the best on-ramping experience, LUNO is one of the earliest exchanges established in Malaysia. With a seamless user interface and mobile app, it is also very beginner-friendly.

However, their fees, limited number of tokens, as well as deposit limit, may be an issue for more experienced investors.

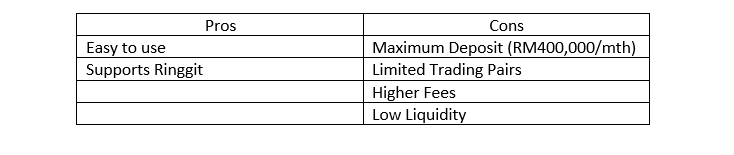

2. Huobi

Founded in 2013, Huobi is one of the most well-known cryptocurrency exchanges. In 2020, they started offering their services in Labuan, Malaysia after securing a digital asset trading brokerage license service.

While the platform may not offer seamless fiat integration for Malaysians, they do have other advantages to offer.

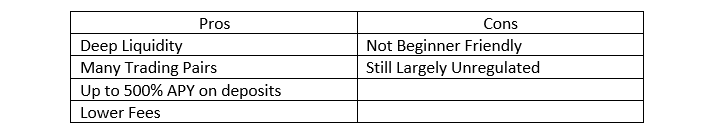

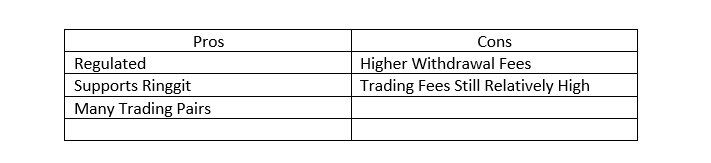

3. Sinegy

Founded in 2017, Sinegy is another exchange that offers Ringgit pairing, allowing for an easy on and off-ramp experience. It is also recognized by the Malaysian Securities Commission, making it a good choice for those with regulatory concerns.

Recently, the exchange slashed withdrawal fees for certain cryptocurrencies and introduced Market Maker Fee rebates to help deepen liquidity.

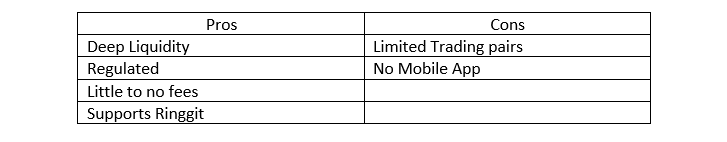

4. Tokenize

Along with Sinegy and Luno, Tokenize was given the approval to operate in Malaysia by their Securities and Exchange Commission in 2020. It also offers the largest number of Cryptocurrency pairs amongst the three.

They also recently lowered trading fees, incentivizing more users to come on board.

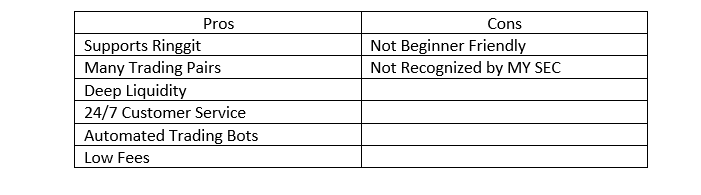

5. KuCoin

One of the largest names in the space, KuCoin is an exchange already trusted by many users. Established in 2017, they recently expanded to support the Ringgit back in December 2020.

While their user interface may seem daunting at first, it actually lends to a multitude of additional features other platforms may not offer.

What’s the best exchange for me?

Every CEX has its pros and cons, and therefore different use cases. It is probably best to go for one recognized by the Malaysian Securities Exchange to guarantee the safety of your funds.

Making a decision should be mostly based on fees and user experience. Trying them out one by one is, of course, still the best way to understand which is best for you. Using multiple exchanges may also be good, given how uncertain regulation is in the crypto space.

Also Read: Investing In Crypto? Here Are 5 Exchanges To Buy Crypto From In Singapore In 2022