Following a somewhat catastrophic year-end in 2022, the cryptocurrency industry has enjoyed a promising start in 2023, which is expected to continue.

According to data from CoinGecko, the crypto market tallied a 48.9% market cap increase (approximately $406 billion in money terms) in the first quarter of 2023. Particularly, Bitcoin was the best-performing asset in Q1, outperforming assets such as the NASDAQ index and gold.

With the crypto ecosystem constantly shifting, there’s no telling what the 2023 Q2 report would look like. However, as a trader looking to be profitable in the constantly-evolving market, it is essential to stay atop the latest and developing stories.

In this article, we’ll take an in-depth look at the five most interesting crypto narratives that have potential to produce massive returns in the coming weeks and months.

Also Read: 8 Tokens To Watch Out For in 2023

1. DeFi: Decentralized Exchanges

In early February, Crypto giant Kraken was forced to shut down its staking service, while also paying a $30 million fine to the U.S. Securities and Exchange Commission (SEC). Only a few days ago, the same SEC charged crypto trading platform Bittrex “for operating an unregistered national securities exchange, broker and clearing agency.” Such has been the strict nature of regulation that most centralized exchanges have had to face in recent times.

It's important to mention that 70% of the $ETH awaiting withdrawal originates from @Kraken exchanges, as they are discontinuing their staking service after paying a $30 million fine to the SEC.https://t.co/C5eoCpPXQc

— Diversitas (@Diversitas_LTD) April 14, 2023

As a result, decentralized exchanges – and decentralized finance as an entity – are beginning to gain a lot more traction. For instance, the collapse of FTX saw many people lose faith in centralized exchanges – and some in cryptocurrency. However, this unfortunate event welcomed a shift, which saw decentralized exchanges tally a 93% month-over-month increase in November 2022 – the month of the FTX implosion.

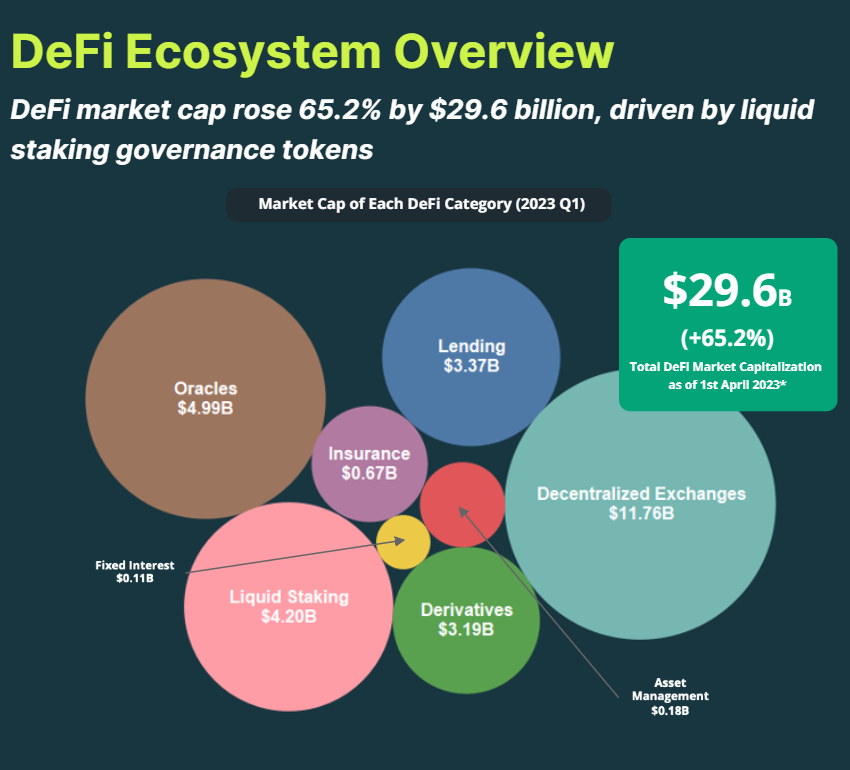

According to CoinGecko’s first quarter report, the decentralized finance industry recorded a whopping 65.2% market cap increase (approximately $29.6 billion) in the Q1 of 2023. Although DEX governance tokens continue to lose market share, decentralized exchanges tallied a 44.3% market cap increase in 2023 Q1. At a minimum, we are going to see more crypto enthusiasts adopt decentralized exchanges and platforms as this year advances.

But that’s not all – more traditional financial institutions are expected to make a foray into the DeFi space. J.P. Morgan, a global financial institution, already made the first step in 2022 when it executed a cross-border transaction – the first of its kind – using DeFi on a public blockchain.

2. Liquid Staking Derivatives

Following the implementation of the highly-anticipated Shapella upgrade, several crypto natives are willing to bet on the success of liquid staking derivatives (LSD) protocols. With the recent possibility of withdrawing locked ether tokens from the Beacon Chain, ETH staking has become an even more attractive activity.

Liquid staking derivatives are one of the most significant innovations in the DeFi industry. They offer an alternative route to generate yield and interest on your digital assets, particularly Ethereum. LSDs allow users to enjoy the benefits of staking while also retaining access to their assets for other profitable activities.

Even before the launch of the Shapella upgrade on April 12, the liquid staking sector has been on a swashbuckling run. CoinGecko reported that liquid staking governance tokens saw a staggering 210% market cap increase in the first quarter of 2023. This made liquid staking protocols the third-largest sector in decentralized finance.

While it can be said that Lido Finance is the pacesetter in the liquid staking industry, the implementation of the Shapella upgrade will open up more opportunities in the market. Now, several protocols with liquid staking tokens (LSTs) can lay a claim to Lido’s throne.

Besides Lido (LDO), other LSD tokens that we expect to gain more market share and provide lucrative returns during this rally include Frax Share (FXS), Rocket Pool (RPL), Ankr (ANKR), Stader (SD), and so on.

3. Artificial Intelligence; AI Coins

Over the last few years, artificial intelligence has been making waves and garnering attention in the crypto industry. From ChatGPT taking over the internet to the launch of Google’s chatbot Bard, there have been several exciting storylines surrounding artificial intelligence in recent times. What’s more, the rise of AI coins has amplified the excitement surrounding this cutting edge technology.

AI coins are cryptocurrencies specifically designed to facilitate or power AI blockchain projects, applications, and services. These digital assets enable users to access these AI-powered platforms. Some of the crypto projects that are driven by AI tokens include decentralized AI marketplaces, AI-based trading algorithms, AI-powered decentralized autonomous organizations, etc.

Quite frankly, the growth of artificial intelligence has been a key factor in driving the interest in AI coins. As a result, these digital currencies have been steadily increasing in value, with their prices showing an upward trend. CoinGecko’s data reveals that the market capitalization of AI cryptocurrencies has reached an impressive $3.05 billion, with a recent rise of 1.30% over the last 24 hours.

Some of the AI coins to watch out for during this crypto rally include Render (RNDR), Fetch.ai (FET), SingularityBET (AGIX), OriginTrail (TRAC), and Ocean Protocol (OCEAN).

4. Layer 2s: Zero-Knowledge Rollups

Large smart contract blockchains, like Ethereum, often have processing limitations, typically resulting in expensive – yet slow – transactions. To tackle this issue, layer 2 systems such as rollups were developed. Rollups are a type of layer 2 scaling solutions, which simply make a slow blockchain faster and cheaper.

There are two primary types of rollups, namely Optimistic and Zero-Knowledge (ZK) rollups. As its name suggests, an Optimistic rollup hopefully assumes that all transactions on a network are valid. Zero-Knowledge rollups, on the other hand, process transactions in batches and utilize a complex piece of cryptography to determine whether a transaction is valid.

While ZK rollups have their own downsides, like complexity, these protocols hold a number of advantages over their Optimistic counterparts. For instance, ZK rollups are relatively more secure and fast than Optimistic rollups. Interestingly, several ZK protocols are beginning to launch their zkEVMs (Zero-Knowledge Ethereum Virtual Machine), which operate similarly to the Ethereum mainnet.

🌟 The Security Of ZK Rollups: A Deep Dive 🌟

— ETH Vietnam 🇻🇳 (@eth_vietnam) April 18, 2023

ZK Rollup is an improvement that addresses a number of key weaknesses

(Continue below 👇🏻🧵) pic.twitter.com/4bkfIDOXR3

Some of the ZK rollups that we think everyone should pay attention to during this crypto rally include Polygon zkEVM, Linea, zkSync, Starkware, and Scroll.

5. China

The United States continues to clamp down on various crypto organizations with its strict regulations. China, on the other hand, seems to be softening its stance on cryptocurrencies – despite the country’s total ban on crypto and crypto-related activities. At the moment, every crypto enthusiast should be paying attention to the moves being made by the East Asian giant.

On February 17, the People’s Bank of China injected 632 billion yuan (approximately $92 billion into the Chinese economy, according to a Bloomberg report. This act, recorded as the largest single-day liquidity injection in Chinese history, was a measure to boost the Chinese economy following the end of the zero-Covid policy. It is understood that this liquidity injection caused the value of some China-related assets to soar.

Furthermore, Hong Kong has announced its plans to ease restrictions around crypto-related activities. While this doesn’t mean that crypto trading is going to be available to everyone in Hong Kong, it is a big step towards achieving global adoption of cryptocurrencies. Interestingly, mainland China’s body language has been positive towards Hong Kong’s ambition to become a crypto hub.

With the positive and optimistic news coming from East Asia, Chinese-associated assets seem to be positioned for tremendous profits during this rally. Some of the coins to look out for are Conflux (CFX), Vechain (VET), Filecoin (FIL), Linear Finance (Lina), etc.

Final thoughts

As a crypto investor or trader, staying informed and on top of the latest trends gives you an edge to be successful in the market. By following strong crypto narratives, you will always find yourself ahead of the curve and in the most profitable trades.

That said, we don’t expect all the narratives mentioned in this article to unfold at the same time. While some of these stories may seemingly have already run its course, you should endeavor to monitor each situation, as you might eventually discover an untapped potential.

Also Read: A Full Guide on Linea: The New Layer 2 Launched By Consensys, MetaMask’s Parent Company

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Opeyemi Sule and edited by Yusoff Kim