Most investors entered crypto with the hope that there will be a big reward on capital gains due to its volatility.

However, most times after they have purchased the tokens, they let them sit idle. Instead of just leaving it in your wallet, why not earn interest on them?

Earning interest on your idling crypto assets is a great way of making your money work for you. All you have to do is to allocate your assets to interest-bearing platforms.

Ways to earn passive income with crypto

Here are five ways you can earn passive income with your crypto assets:

- Lending

- Staking

- Interest-bearing digital assets

- Dividend earning tokens

- Yield farming

1) Lending

Lending is one of, if not the safest way, to generate interest on your crypto assets. It has become one of the most popular crypto services in the crypto industry.

As an investor, you can lend your digital assets to borrowers to earn an interest. There are three primary ways to lend out your crypto assets:

- Margin lending: There are plenty of traders looking to earn a quick buck in the market by amplifying their positions through borrowed funds. You could lend your crypto assets to them and earn interest upon the repayment of the loan. Crypto exchanges usually do most of the work for you so all that is required here is to make your crypto available for lending on the exchange.

- Centralised lending: There is usually a lock-up period and the interest rates here are fixed. Similar to peer-to-peer lending, you have to transfer your crypto to the lending platform to start earning interest on your assets.

- Decentralised lending: DeFi grant investors the opportunity to lending services directly on the blockchain. Unlike P2P and centralised lending, there are no intermediaries involved in DeFi lending. Instead, lenders and borrowers interact with smart contracts which autonomously set interest rates accordingly to supply and demand.

Also Read: How To Get Started With Decentralised Finance (DeFi) For Beginners

2) Staking

Proof-of-stake (PoS) is a type of blockchain consensus mechanism designed to validate crypto transactions and creating new blocks in the blockchain.

The PoS model allows owners of a crypto to stake their tokens and even create their own validator nodes should they meet the minimum requirement.

Staking is when you pledge your tokens to be used for verifying transactions. Your tokens are locked up when you stake them, but you can unstake them should you decide you want to sell them. You gain interest in return for staking your tokens to help secure the network.

Some examples of PoS blockchains are Ethereum 2.0, Cardano, Solana and Harmony.

3) Interest-bearing digital assets

Investors can take advantage of interest-bearing crypto accounts to earn a fixed interest rate on their idling crypto assets.

Just like depositing your money into a bank account, you deposit your crypto into these accounts and get rewards daily, weekly or monthly depending on the platform you choose.

Some examples are BlockFi and Nexo.

4) Dividend earning tokens

Certain tokens offer holders a fraction of the revenue of the company that issues them. All you have to do is to hold the token and you are eligible to receive a percentage of the company’s revenue.

An example is KuCoin Shares (KCS). KCS is the native token of KuCoin exchange. Users who hold at least 6 KCS can get a daily bonus, which comes from 50% of KuCoin’s daily trading fee revenue.

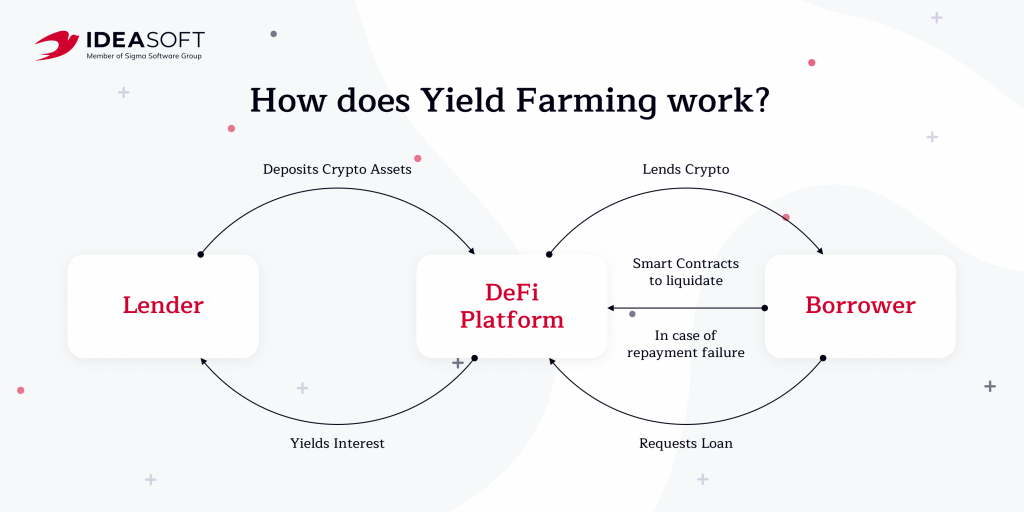

5) Yield farming

Yield farming comes with a huge amount of risk and beginners should never jump right into it without prior knowledge.

Yield farming is made possible by trading platforms where users rely on the combination of smart contracts and investors for the liquidity needed to execute trades.

By providing liquidity into a pool, users (called liquidity providers) are able to earn a percentage of the pool reward based on the amount they contributed.

Closing thoughts

There are a variety of ways where you can earn more crypto even in your sleep. Some have low risk while some require a higher risk tolerance.

Ultimately, how you decide to allocate your holdings is decided based on your risk appetite level.

Lending on a CEX is low risk but also generate low rewards. On the other hand, yield farming is very risky and subjected to smart contract risk.

So don’t let those crypto sit idle in your wallet. Let them work for you!

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Where To Farm And Earn Extra Interest On Your Ethereum