Web3 is not just a new financial system, it’s an evolution of the internet. And amidst all the negativity, it is back, stronger than ever before.

That’s the main message of a16z’s State of Crypto 2023 report.

With over $35B in assets under management and having invested in behemoths like Airbnb, Coinbase, Facebook, GitHub, Lyft, Pinterest, Slack, and Stripe, a16z is one of the most influential VC’s in the tech space.

Their report, which spans over 60 pages of data-driven insights, covers everything from the macro outlook of crypto markets, to the development of layer 1 blockchains, to the rise of DeFi and NFTs, and more.

Let’s dive into the 6 biggest insights this incredible report has to offer.

Also Read: Blockchains With The Highest Developers Count In 2023

1. The Cycle Which Powers Growth in the Industry

The crypto market seems to develop in a weirdly concrete and predictable cycle.

This is a fundamental insight a16z provides, which helps understand the market better, disconnect yourself from the emotionally driven market chaos and look at the bigger picture from a bird’s-eye view.

It’s called the Price-Innovation cycle, and here’s how it works:

- As prices rise, attention and interest is magnetised, which leads to investment and people jumping in to the action

- This leads to more ideas, activity, and innovation from entrepreneurs and developers who want to create new products and services using crypto.

- This leads to further value creation, as well as increased adoption from users who actually want to start using these new services

- This leads to more demand and appreciation for crypto assets, which pushes their prices up even further.

- The cycle repeats

This positive feedback loop has been the engine that has propelled the industry through four distinct waves since Bitcoin’s inception in 2009:

- The first wave (2009-2013) was driven by Bitcoin’s emergence as a new form of digital money that was decentralised, censorship-resistant, and scarce.

- The second wave (2013-2016) was driven by Ethereum’s launch as a platform for smart contracts and decentralised applications that enabled new use cases beyond money.

- The third wave (2016-2020) was driven by DeFi’s growth as a set of protocols and platforms that offered alternative financial services such as lending, borrowing, trading, and saving using crypto.

- The fourth wave (2020-present) was triggered by NFTs’ explosion as a new way of looking at digital assets and collectables.

Currently, we are in the midst of the fourth wave, the largest and most exciting one yet.

Here is the proof:

- Market capitalization of crypto assets reached an all-time high of over $2.5 trillion in May 2021

- Active addresses hit an all time high last month at 15M- more than doubling over the past 2 years

- Total transaction value across various blockchains exploded from $4 trillion in 2020 to over $15 trillion in 2021.

- Total developers building publicly in crypto grew from 9,000 in January 2019 to over 30,000 in March 2023

- Academic publications related to crypto tripled from 1,000 in 2018 to over 3,000 in 2021.

These numbers show that crypto is not only growing fast but also becoming more diverse and mature as an industry.

Great times seem to be coming.

2. The Creator Space Revolution

“You know something is profoundly wrong with our economy when Big Tech has a higher take rate than the mafia”

If this doesn’t tell you something is wrong with the tech space’s hierarchy, I don’t know what will.

Excluding primary sales, NFT creators have earned over $2B in secondary sales royalties from marketplaces in the past 2 years. Compare this to the $1B Meta earmarked for all its user base in the same time period.

Now remember that Meta has over 3.74B users, whilst marketplaces range in the tens of millions. Do the calculation to see the average earn per user, and you suddenly understand how criminal this difference is.

It’s also worth noting that take rates in web3 are trending downwards if anything.

Traditional platforms are not only taking a huge share of the value created by creators, but also limiting their creative freedom and ownership.

Web3 platforms offer a better alternative, enabling creators to capture more value from their work and fans, whilst giving them full control and ownership over their content and data.

Here are some takeaways of how this offer materialises:

- In 2021, primary sales of Ethereum-based NFTs (ERC-721 and ERC-1155), plus the royalties paid to creators from secondary sales on OpenSea, yielded a total of $3.9 billion. That’s quadruple the $1 billion – less than 1% of revenues – that Meta has earmarked for creators through 2022.

- In 2021, over 1,000 DAOs were created on Ethereum, with a total value locked (TVL) of over $10 billion. That’s more than the market capitalization of some of the largest web2 companies, such as Twitter, Snap, and Spotify.

- In 2021, over 500 social tokens were launched on platforms such as Rally, Roll, and Zora, with a total market capitalization of over $300 million. That’s more than the annual revenue of some of the most popular web2 platforms for creators, such as Patreon, Substack, and OnlyFans.

Web3 is tiny but mighty. As time goes on, expect to see more artists and musicians transition into this realm of technology, taking their fanbase with them.

3. Scaling and Zero Knowledge Tech Will Accelerate

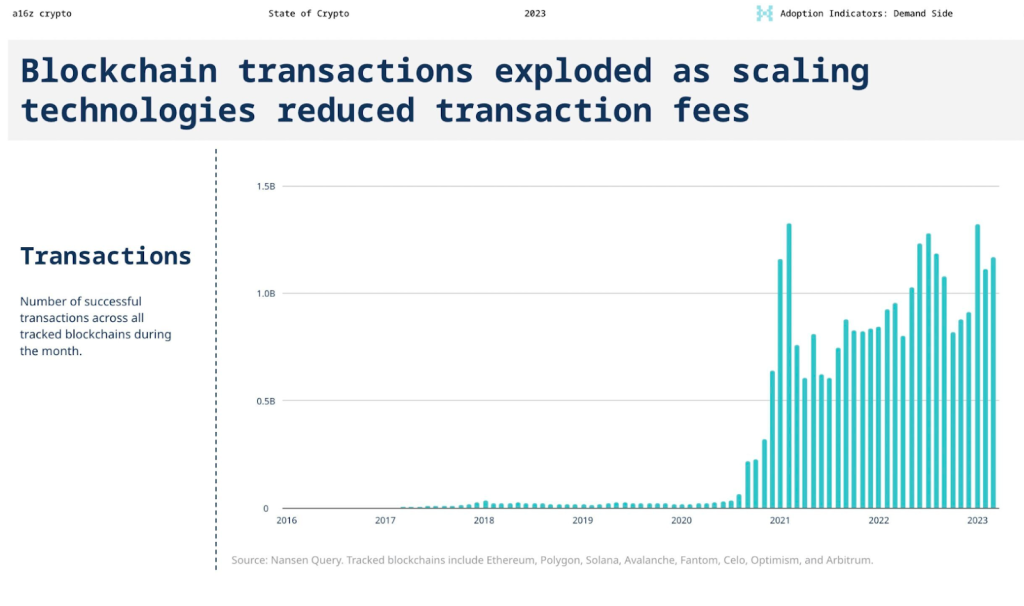

Scaling solutions are a massively growing sector of the industry.

With a plethora of different technologies and solution approaches, scaling solutions open doors to more blockspace, faster transactions with rapidly decreasing fees, more security, more interoperability and many other much needed upgrades.

Around 7% of all Ethereum gas fees are paid by L2 rollups, up from under 1.5% last year.

With a rapidly increasing vault of educational resources combined with reduced hardware prices, previously infeasible technologies like ZK Proofs are now becoming realistically applicable on a commercial scale.

Post-merge, ethereum has now become incredibly cheap, further amplifying these effects.

All of this is great news for the industry, as it means that a backlog of infrastructure is available to handle massive traffic in the near future(even though it is currently underused). This opens doors to both new users to interact with the technology, but also to a more widespread, interoperable and connected industry.

4. DeFi and NFTs are Back on the Rise

After the hype-crazy heights and crash of 2021-22, NFTs and DeFi seem to be back on the rise.

This time around, growth seems to be a lot more organic and use case focused.With over 66% of HNWI’s (high network individuals) pleading for less speculation and more utility for the space (according to this art basel x ubs report), this is great news.

The past 3 months have seen continuous growth for the first time since the crash. With uniswap seeing a larger trading volume than coinbase for the first time, combined with a trend towards lower take rates and more interoperability, it seems like the vision of nft’s and decentralised finance endures.

5. Community is Everything

The power that web3 provides when combined with a strong community is many times understated.

Web3 allows communities to become self-sustaining, generating incentive for growth both for the individual and the collective, through tokenization and decentralised governance amongst a heavily interpersonal and interconnected experience never seen before in the world.

Many big brands are seeing this, and are quickly adopting this tech to supercharge their fanbase.

DAOs are also evolving, with overall participation growing and new and more intricate forms of community governance being experimented with.

With sub industries such as gaming posing the perfect springboard for a wave of new and very profitable community adoption, this will be a very interesting space to watch.

6. The United States is Losing its Place

The US of A is having a rough couple of years. Maybe amidst the threats to the dollar’s global dominance, its loss in the web3 space is secondary, but it adds to the soup of mess the world’s most powerful nation is creating for itself.

In the past three years, there has been over a 20% reduction in US developers and over a 30% reduction in traffic on US-based crypto websites.

With increasing regulatory and policy pressure, many US based companies such as coinbase, kraken and gemini are facing unprecedented threats.

This is a very important inflection point for the US, and how their government deals with it will determine whether they can stay on top of technological innovation or irreversibly fall behind.

Final Thoughts

It feels like we say this over and over again, but it is worth repeating. It is still very, very early days for the web3 space.

Web2 didn’t really take off until 2005 where it reached around 1B users and behemoths like facebook and google emerged.

Web3 is estimated to be between 20 and 120M users right now. There is still a lot of time.

If you are reading this article right now, you are special. Use it.

If there is one thing that you should take away from this article is that the space is complex, intricate and exciting. Providing revolutionary use cases is priority number one; this is what is going to take the industry to the 1B user mark.

Day trade less. Build more.

PS-a16z also released a ‘state of crypto’ index, which tracks many innovation and adoption metrics related to web3. It is amazing, check it out here

Also Read: Arthur Hayes’ Stablecoin is Revolutionary – We Just Don’t Understand it yet

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief

This article was written by Harry Vellios and edited by Yusoff Kim