Have you ever wondered what tokens Whales are buying? With their large bags, Whales will impact the markets, with their buying and selling decisions influencing the prices of various digital assets. In this article, we’ll take a closer look at seven tokens that have caught the attention of crypto whales and explore what makes them so attractive to these big players in crypto.

1. Lido, $LDO

The first token whales are bag-holding is Lido. Understandably, the Lido token and other liquid staking derivatives grew in value ahead of the upcoming Ethereum Shanghai upgrade set to drop in March.

Since the start of the year, not only has $LDO been trending upwards in price, but the number of $LDO token-holders has also been increasing. A collective of retail investors and whales with large holdings contributes to this increase. When I say large, I really do mean it.

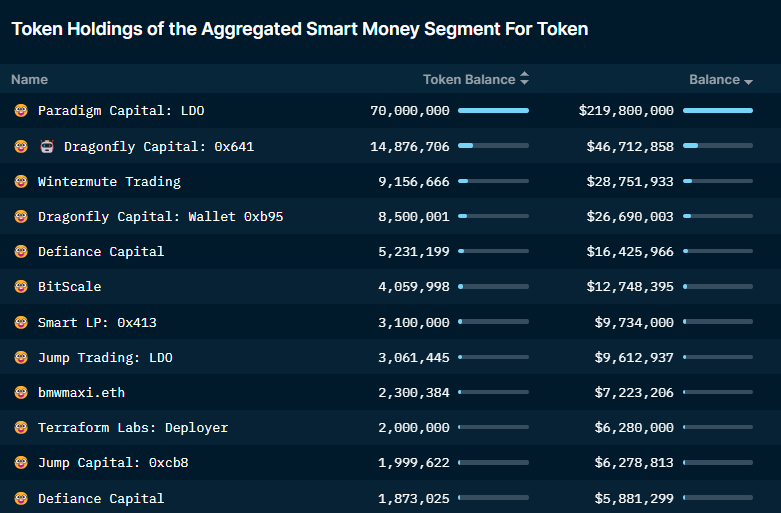

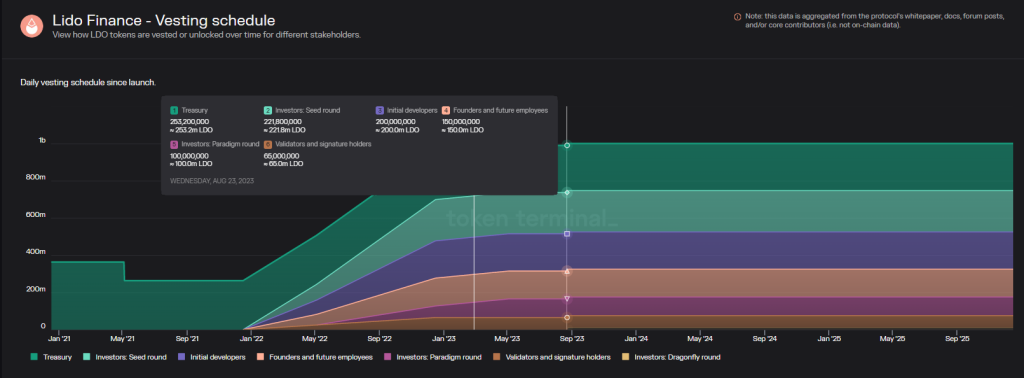

According to TokenTerminal, Lido’s vesting schedule is set to see a massive unlock on the 25th of Aug this year. We also can expect Paradigm’s 100M LDO vesting to finish in May 2023 and Dragonfly capital 10M unlock of $LDO tokens on the 25th of Aug 2023.

Paradigm Capital, the biggest believer in $LDO of 70M tokens, is now worth ~$218M. Interestingly enough, these 70M at $1.1 per token were received on the 5th of May 2021, and they have been holding it since.

Looking at the largest staking transactions on Lido also reveal Justin Sun, founder of Tron, being the largest contributor. Wait a minute, three arrows capital????

2. GMX $GMX

GMX has been on a tear lately by breaking its all-time highs amidst the bear market. The decentralized perpetual exchange is one of the biggest successes among other DEXES and the leading protocol in terms of TVL on Arbitrum.

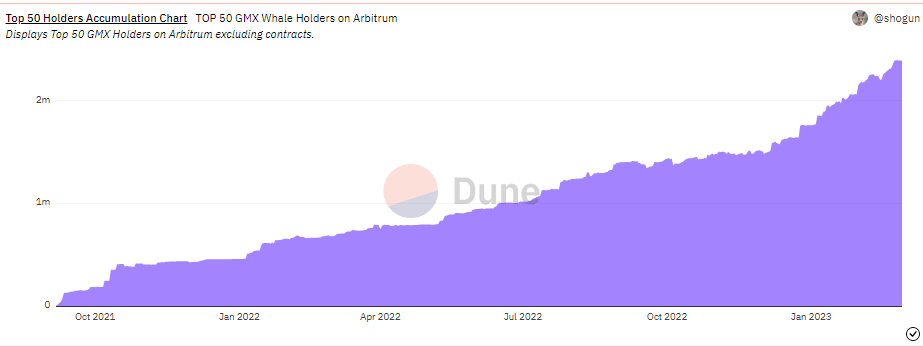

According to Shogun on Dune Analytics, we also see the top 50 holders of $GMX on a rising trend. Whales are certainly bullish, are you too?

At the top of the $GMX holder list is Bitfinex founder Arthur Hayes, the biggest individual holder of $GMX with over 200.5k $GMX worth ~$15.5M. Arthur also bought most of his $GMX in early 2022 at a price range of $20-30 per $GMX.

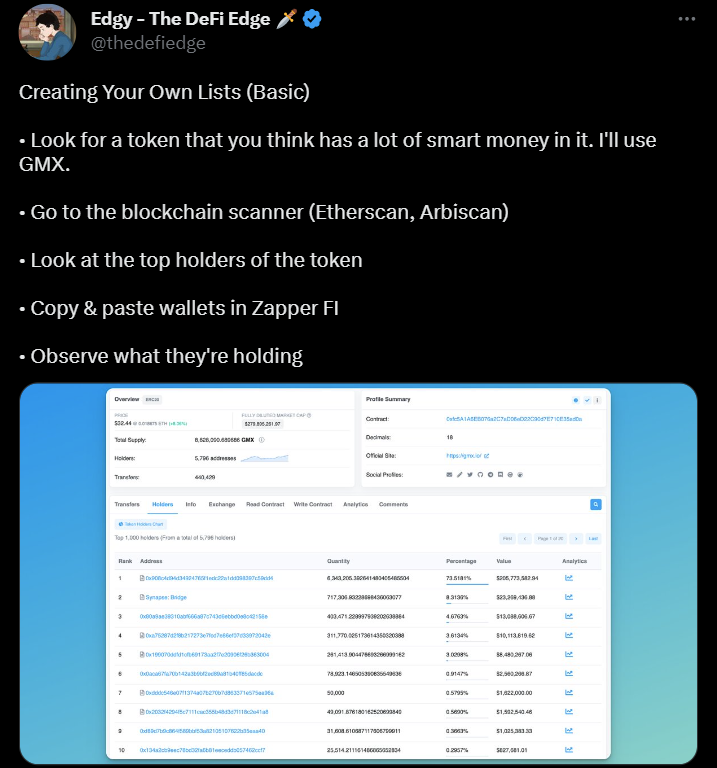

Alternatively, DeFi Edge also did a quick and simple rundown of the top token holders of any specific coins on Etherscan. You do not need any paid platform for this, just a few minutes of your time.

3. Rocketpool $RPL

Also riding on the liquid staking derivative narrative, Rocketpool has seen significant adoption in recent months. It’s price action, similar to $LDO, saw a run-up from $18 to a high of $54 since the start of the year.

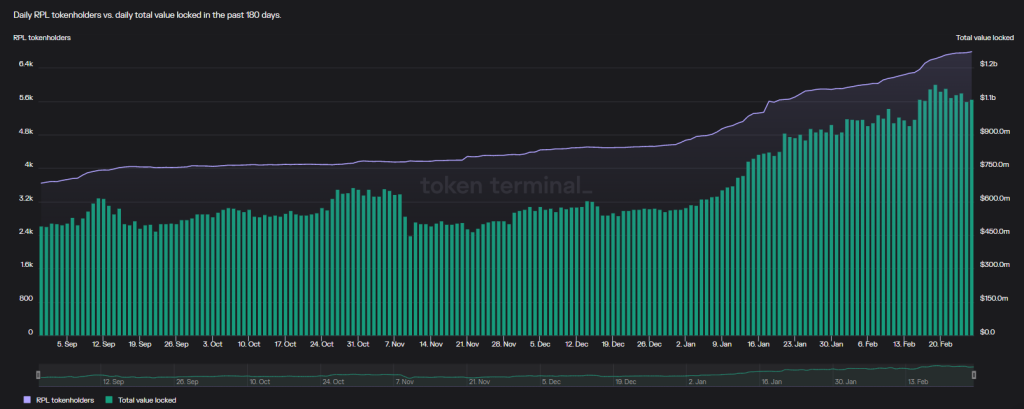

According to TokenTerminal, with the steady price increase, $RPL is also seeing increasing adoption with an increased number of token-holders. While these holders likely come from ETH holders looking to maximize their yield with liquid staking platforms, we see similar strides in total value locked as well, significantly correlated.

How are whales looking at $RPL, though?

With the help of Nansen’s smart money, I got a glimpse of the top token holders. The only question I have right now is, who is Patricio Worthalter?

Upon inspection, Patricio Worthalter is the founder of POAPs and is now recognized as the pioneer of NFT attendance taking and the biggest individual holder of $RPL. Most of his $RPL (old) tokens were acquired in 2018 and have since been seen taking profits in the image below.

Nansen also showed us his $RPL (new) token balance over time. At one point, he was holding ~3.5M in $RPL tokens and reaping the benefits of being an early adopter right now.

The 2nd biggest $RPL holder is an investment firm canned 1kx. This $RPL whale currently holds $17.6M in $RPL; that is mostly what they hold (or at least with what my research is limited to). They have been buying $RPL since 2021 and have likely cashed out in bite sizes along the way.

4. FRAX $FXS

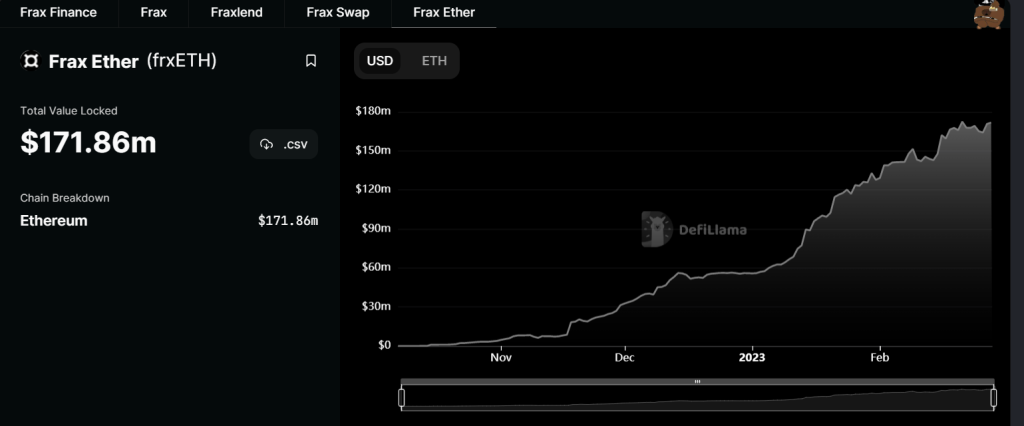

FRAX is another liquid staking derivative that gained significant attention before the Ethereum Shanghai upgrade. Their current returns are almost double competitors, bringing a 207.72% increase in their TVL.

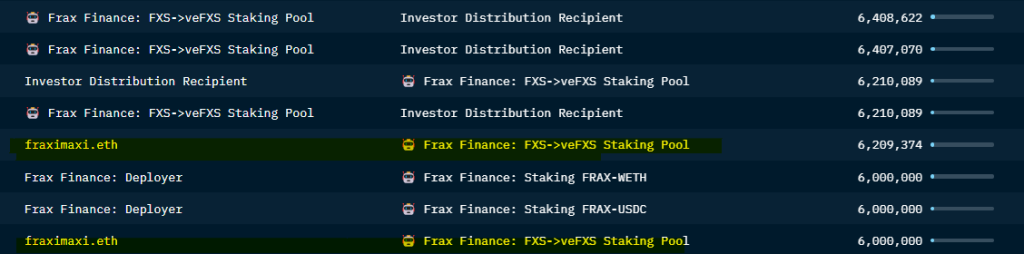

Undoubtedly, those with bags of $ETH will use these solutions to maximize their gains. Dragonfly capital and the biggest $FXS holder, fraximaxi.eth receives $FXS once a month from an address labelled “Private sale distribution”, being early investors in FRAX.

Here are other investors and backers of FRAX.

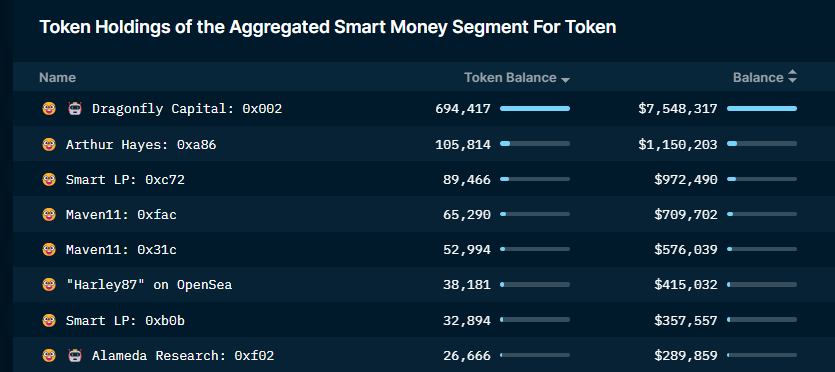

Here are the top whales holding $FXS. Notable names are Arthur Hayes and Alameda Research (they are still alive???). However, other wallets are tagged as “fraximaxi. eth”, “fraxcetacean.eth” and “frax-ape.eth” all big FRAX whales but have been seen dedicating their tokens to the FRAX staking pools.

5. Curve $CRV

Curve has often been viewed as an essential piece in DeFi. The salt to the pepper, the peanut to the butter. Being the AMM that offers a highly efficient way to exchange tokens while maintaining low fees and low slippage by only accommodating liquidity pools was the main contributor to their popularity.

As DeFi became a crucial pillar in crypto, its value proposition also attracted whales. On top of the whales you see below, the biggest wallet of $CRV is labelled ‘Founder wallets #2-4’ with over 396M CRV valued at $467M.

Additionally, the CEO of Curve finance, Michael Egorov, holds over 340M CRV valued at $401M. Most of the CRV held by the founders are either vesting for the next couple of years or locked as veCRV. Further, a large amount of CRV vesting in ‘Investor wallets’.

Genesis trading, which recently came under scrutiny over the FTX contagion, is the biggest holder of $CRV of ~$2.88M in value. They first accumulated their $CRV in March of 2021 and, ever since, have been trading the token in the ups and downs of the market.

6. dYdX $dYdX

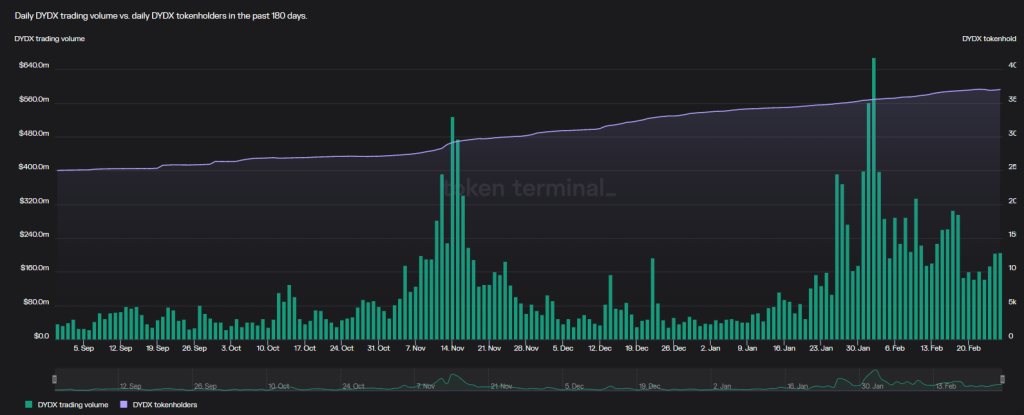

dYdX was one of the few decentralized exchanges which greatly benefitted from the fall of the centralized exchange, FTX. Its adoption saw the department of trading volume and token-holders surging in adoption. Even with a great product market fit, the thing worrying about the protocol is their emission rates, categorizing the $dYdX token as one of the highest inflation rates.

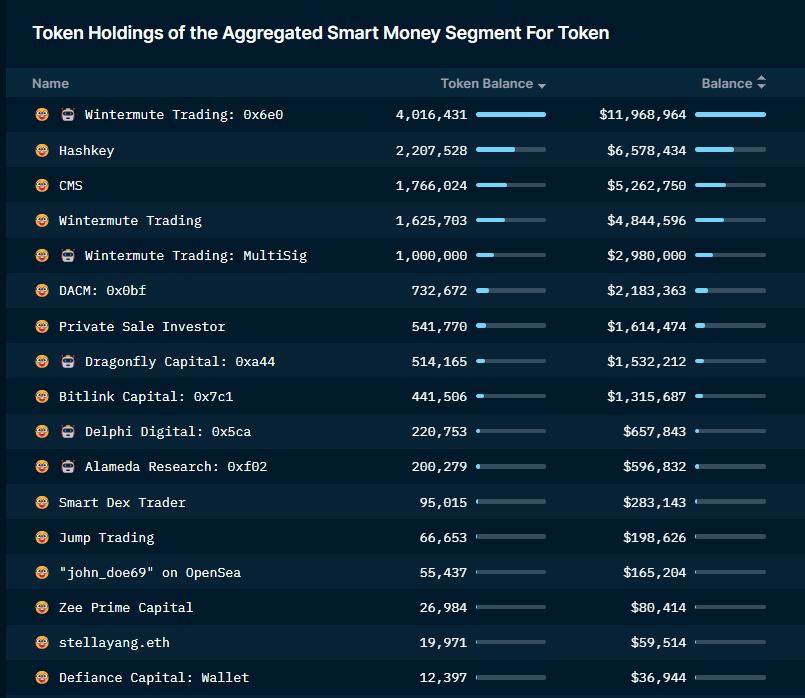

They have huge backers too. Among their top $dYdX token holders are VCs such as Wintermute, Hashkey, Dragonfly Capital, Jump trading and DeFiance capital.

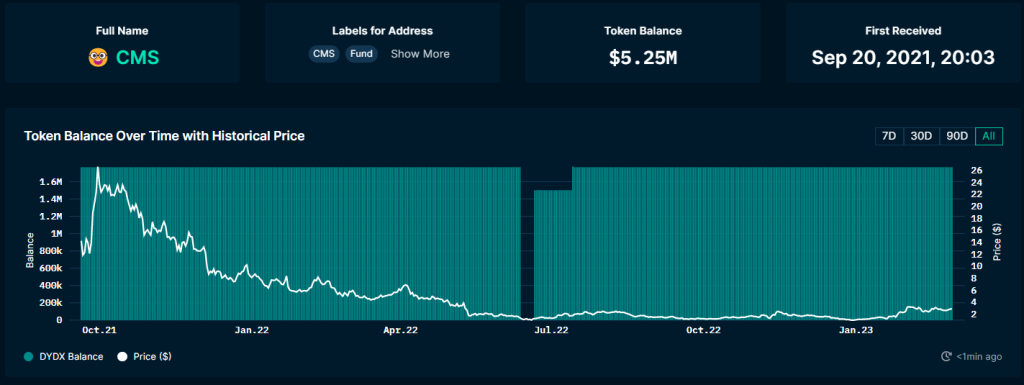

CMS, a crypto investment firm in particular, first received ~1.7M $dYdX tokens on the 20th of September 2021 for $1.73 and now is the third biggest $dYdX token holder valued at $5.2M.

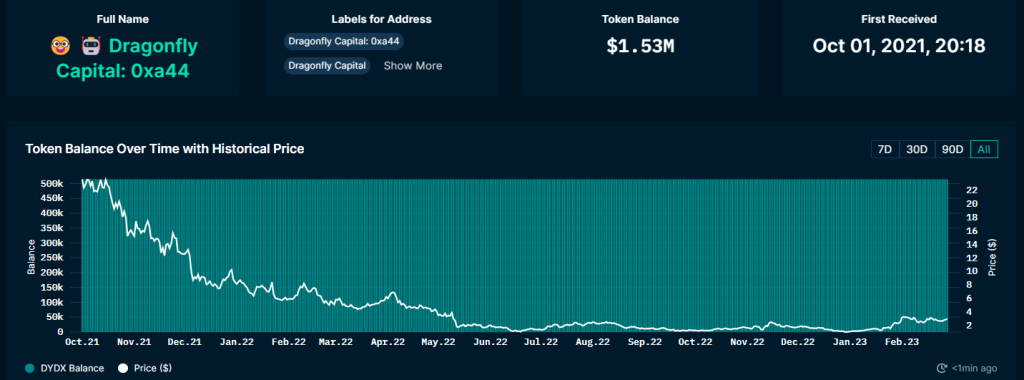

Another crypto VC, Dragonfly Capital, received their $dYdX token first on the 1st of October 2021 and has not sold since.

7. Polygon $MATIC

Regarding business development, Polygon is the leading protocol to chair this department; no other protocols do it better. Their presence in NFTs, web2 collaborations and zero-knowledge products brought attention to their project, even amongst the whales.

If anyone deserves a big fat bonus this year, it'll be @0xPolygon's business development team🔥#MATIC #Polygon #PolygonVillage pic.twitter.com/HQYXvuvVVv

— Joel Zhao (@oahzleoj) December 19, 2022

Whales include the biggest VCs in crypto, such as Republic Capital, Alameda research, Dragonfly capital and Jump trading.

Dragonfly capital received over 8.3M $MATIC at $0.7 from a Binance account in July last year, and they are still holding. Currently, their wallet is valued at $10.2M.

The biggest holder of $MATIC, Republic Capital, first acquired $MATIC on the 24th of August 2022 but has seen accumulating over 24M $MATIC tokens earlier this year valued at $0.99. There have not been any transactions in the sale, while $MATIC prices increase to a local high of $1.52 on the 18th of February, 2023.

Closing thoughts

Whales are bullish on $ETH. When three of the seven tokens listed here are liquid staking derivatives, whales seem to see these projects as an alternative to earn with their $ETH bags. Call it coincidence, but looking at the entry dates, the positions these whales enter all seem to be “pre-pump” periods. They catch the waves instead of chasing them, and following early trades they make might be a viable alpha.

Each protocol on this list is also related to Ethereum in one way or another. The flipping will happen.

Secondly, Nansen as a tool. Most of the information in this article is captured with Nasnen’s dashboard. While they have different tiers with subscription plans, their most basic allows access to all you’ve read above. We have no referral but one of the better entry-level data analytics platforms.

My "How-To-Nansen" Guide

— NEL 🎅🏼🐧 (@nellimkopi) March 15, 2022

Chapters 👇🏼

Thirdly, the shift to DeFi and its products is inevitable. Whales are looking at dYdX as a decentralised exchange with a selected few holding $CRV, which signals the belief it will succeed. Whether or not they are ready for the world is another question up for debate. As these products and many more continue to innovate, DeFi, in particular, is something I am most excited about, and looking at VC holdings could give me an idea of what to look at next.

Also read Comparing Arbitrum And Optimism, Which Is Better?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief