While blue chips like Bitcoin and Ethereum have proven their staying power, many crypto tokens are likely to outperform during the next bull market.

By using metrics such as whale accumulation, TVL, and protocols fees, we may just be able to identify some cryptocurrencies with strong upside for 2023. With that said, let’s dive into some crypto tokens you should be keeping an eye on this year, based on your risk profile.

Also Read: How To Build a Better Crypto Portfolio (With Examples!)

Least risky

Ethereum (ETH)

Ethereum has rolled out the much anticipated Shapella hard fork earlier on 12 April and this has been a pivotal moment in garnering institutional interest in ETH.

Institutional investors have a preference for regulated products such as CME futures where they can gain exposure to digital assets such as ETH without actually owning them.

The surge in open interest alongside a rise in ETH’s price indicates an inflow of money into the market and ETH’s price has risen approximately 8% since the Shapella Upgrade.

ETH’s deflationary tokenomics has also been a strong narrative for its eventual rise this and next cycle.

Solana (SOL)

While 2022 proved to be a particularly challenging year for Solana, it survived. From hacker attempts to multiple outages and its exposure to the now-defunct FTX, Solana has truly weathered multiple storms and headwinds.

Its resilience can be attributed to its focus on low costs, high speed and scalability.

SOL’s token price has more than doubled from its December 2022 lows of USD 9.75, a testament to its staying power.

SOL is expected to wean off its association with FTX and Alameda and emerge stronger, similar to how ETH rose from the 2018 bear market.

Saga is the phone that keeps giving. The Solana dApp Store offers an experience like no other app store.

— Solana Mobile 🌱 (@solanamobile) April 17, 2023

Alongside Saga, we are also launching a device-bound Saga genesis token, which will be your key to the Saga Rewards program.

Let's get into the details 🧵 pic.twitter.com/VGN0dIm3wu

The new Solana mobile, which aims to make digital asset custody safer and more reliable, could also be a key factor for mass adoption.

Polygon (MATIC)

Polygon not only has a comprehensive DeFi ecosystem, it has several partnerships with global brands such as MasterCard and Samsung.

These partnerships provide Polygon with both visibility and credibility in bringing real-world utility. Reddit has also launched NFTs on MATIC, capitalizing on its low fees and high transaction speeds.

.@Reddit NFT Marketplace 🔥🔥#Powered by @0xPolygon https://t.co/qCMmUg86i9

— Sandeep Nailwal | sandeep. polygon 💜 (@sandeepnailwal) March 22, 2023

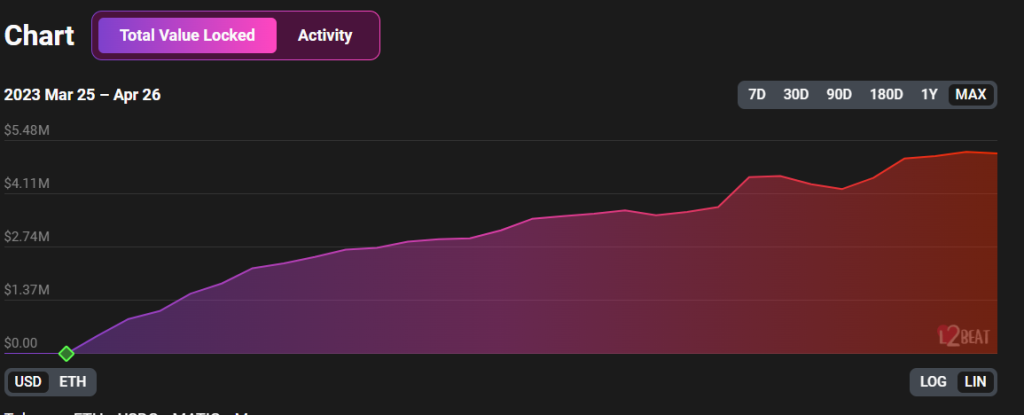

Beyond that, Polygon’s zkEVM has already attracted USD 3.9M in TVL since completing its beta mainnet launch on 27 March 2023, this is bullish for MATIC.

Medium Risk

Lido Finance (LDO)

Lido Finance needs no further introduction, it is expected to outperform Ethereum (ETH) as it offers a significantly higher 6% APY for staking ETH tokens as compared to staking ETH direct.

Ahead of the planned Shapella Upgrade, there has already been a surge in popularity around ETH staking and Lido has been one of the main beneficiaries of such a trend.

Lido has a strong community that is committed to growing the platform and remains one of the leading players in the liquid staking space.

LDO is already up almost 150% this year and is expected to continue to outperform.

Rocket Pool (RPL)

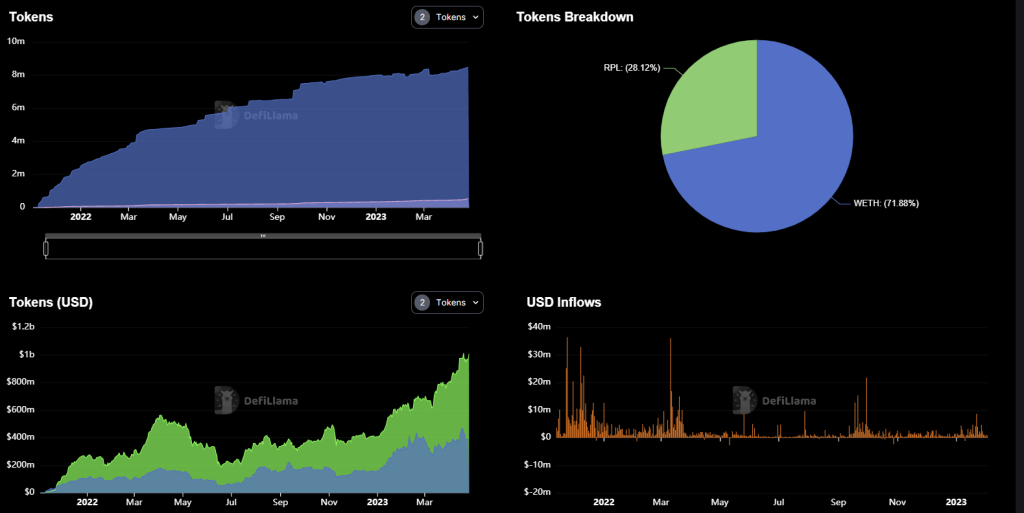

As a competitor of Lido, Rocket Pool’s TVL increased by more than 20% and currently stands at USD 1.37B. This makes it the third largest liquid staking platform, behind only Lido and Coinbase.

For five consecutive days following Ethereum’s Shapella Upgrade, RPL rallied more than 48% to hit a high of USD 61.21.

Most recently, Rocket Pool has also rolled out a major upgrade that grants node operators instant access to their staking rewards and lower barriers of entry to their minipools.

The node operators now accept ETH stakes of as little as 8 ETH, compared to 16 ETH in the past.

Similar to Lido, Rocket Pool users can stake any amount of ETH and receive a liquid staking derivative token called rETH.

As such, these minipools and rETH provide opportunities for users with lesser capital to join in and earn rewards that would otherwise not be possible.

Immutable X (IMX)

Immutable X has gained recognition as a leading L2 platform for Web 3 games. Based on-chain data from Santiment, IMX whales have been relentlessly accumulating the token since November 2022.

This accumulation is primarily driven by two key narratives, Web 3 gaming and ZK rollups. Immutable X has teamed up with StarkWare to utilize ZK technology to super-charge the network.

🐳 Whale addresses holding between 1M to 100M $IMX tokens have increased their holdings by more than 58% since November, 2022. Read our community member's short take on #ImmutableX , #ZeroKnowledgeProof, and why you should be paying attention to these. https://t.co/FJNC2kARmh pic.twitter.com/2swLWbNJw6

— Santiment (@santimentfeed) February 2, 2023

In terms of tokenomics, the circulating supply has been designed to incentivize long-term growth and sustainability. The 2B $IMX tokens will be progressively unlocked for different user groups.

Highest Risk

Conflux (CFX)

Conflux is the only regulatory-compliant public L1 blockchain in China that has partnered with global brands such as China Telecom, McDonalds China and Oreo on blockchain and metaverse initiatives.

The Chinese app called the Little Red Book, the Chinese equivalent of Instagram, has integrated its blockchain network to enable users to mint NFTs that can serve as their PFPs.

More recently, Conflux has plans to bring Uniswap V3 and Curve to China’s public blockchain.

Conflux has been expanding its use cases and partnerships with the blessing from the Chinese government. Along with the bullish Chinese AI narrative, the price of CFX is set for a sustained increase this year.

CFX is one of the best-performing crypto tokens this year, the project’s foundation has burnt close to 500M CFX tokens to make it less inflationary as well.

Also Read: Could Conflux (CFX) Still Be The Best Trade of 2023?

Level Finance (LVL)

Level Finance is a decentralized and non-custodial perpetual exchange on the BNB chain with superior risk management and liquidity solution.

Although this microcap has a low TVL, it has consistently generated top revenue and achieved a high level of success in its reward incentives despite the bear market, definitely one to watch out for!

Closing Thoughts

In past bull rallies, most altcoins saw tremendous growth as both crypto and stocks continued to break new all-time highs. However, the macroeconomic conditions we face in this upcoming cycle are vastly different from 2021/22.

Therefore, it may be wise to not be overly exposed to riskier investments such as small-cap cryptocurrencies, but instead opt for battle-tested crypto tokens. Furthermore, the nascency of Web3.0 means that there are very few “blue-chips”.

Instead of going all out into alt-coins taking the time to do your own research and identify hidden gems which you feel secure accumulating could be the difference between a good and an amazing return for the next few cycles.

Also Read: How Web3 is Changing The World: 6 Key Insights from a16z’s State of Crypto Report

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Clarence Lee and edited by Yusoff Kim