2022 might be the year for Fantom. In January alone, Fantom had two major achievements that shocked the crypto community.

First, it surpassed Binance Smart Chain (BSC) to be the third-largest DeFi network by total value locked (TVL). Next, for the first time ever, it processed more transactions in a single day compared to Ethereum.

These two achievements are clear indicators that the Fantom ecosystem is growing rapidly and is a force to be reckoned with.

If you’re new to the fantom ecosystem, you can check out this crash course done by Chain Debrief, where we gave a comprehensive rundown on the fantom ecosystem and also dived into three key protocols on fantom — SpookySwap, Geist Finance and Tomb Finance.

SpookySwap ($BOO)

SpookySwap is the first and largest decentralised exchange (DEX) on the Fantom network. It uses the traditional automated market model (AMM) popularised by Uniswap.

Like most DEXs, SpookSwap also charges a base fee of 0.2% for a normal swap and 0.22% if it’s a limit order. 75% of the revenue is then distributed to the liquidity providers and the rest would go to the $xBOO holders.

SPOOKYSWAP METRICS REPORT IN JANUARY 2022

— Fantom Hub (@FantomHub) January 27, 2022

🔹 Total Revenue: $23.32M +105.72%

🔹 TVL: $1.08B

🔹 ATH Price: $39.97

🔹 P/S = 1.59

🔹 P/E = 10.58

Are you investing in @SpookySwap?#Fantom #FTM #SpookySwap $BOO pic.twitter.com/dQJ355KT6f

$BOO is the native governance token of SpookySwap. Investors can stake $BOO to get $xBOO and earn a share of the trading revenue produced by the protocol. $BOO holders can also vote on proposals and shape the future of the project.

SpookySwap also released its very own NFT — the Magicats. The 5,000 highly anticipated genesis NFTs were sold out within five minutes of the launch. With over US$1 million in trading volume, it is currently ranked first on PaintSwap NFT marketplaces.

SpiritSwap ($SPIRIT)

SpiritSwap is one of the first AMM DEX on the Fantom ecosystem. It is a partial fork of the leading DEX on Binance Smart Chain (BSC), PancakeSwap.

Similar to SpookySwap, it allows users to swap tokens on its platform without any centralised governance.

Trading on SpiritSwap would incur a higher trading fee of 0.3% compared to SpookySwap’s 0.2% trading fee.

About 83% of the trading revenue goes to liquidity providers and the rest would be distributed to the protocol vault and native token holders.

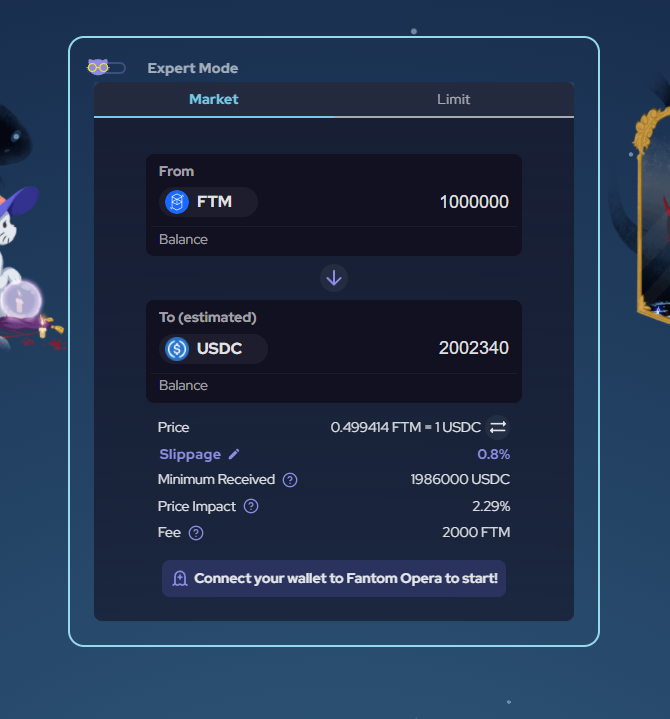

Recently it just released the long-awaited Ape mode. It collaborated with Abracadabra to integrate leverage trading or the Ape mode into its ecosystem. With just a click of a button, users can trade up to 3x leverage.

If we look at the currently planned roadmap, the team is very ambitious and plan to roll out lots of extra features. One of the notable planned features is to improve capital efficiency by partnering with Abracadabra. This would allow Abracadabra to accept Spirit’s LP token as collateral to borrow $MIM.

So which is better?

Both protocols are very similar in nature but there are distinct differences that make one DEX better than the other.

To determine which DEX is better, we will look into two important metrics:

- Total Value Locked (TVL)

- Trading Volume

1. Total Value Locked (TVL)

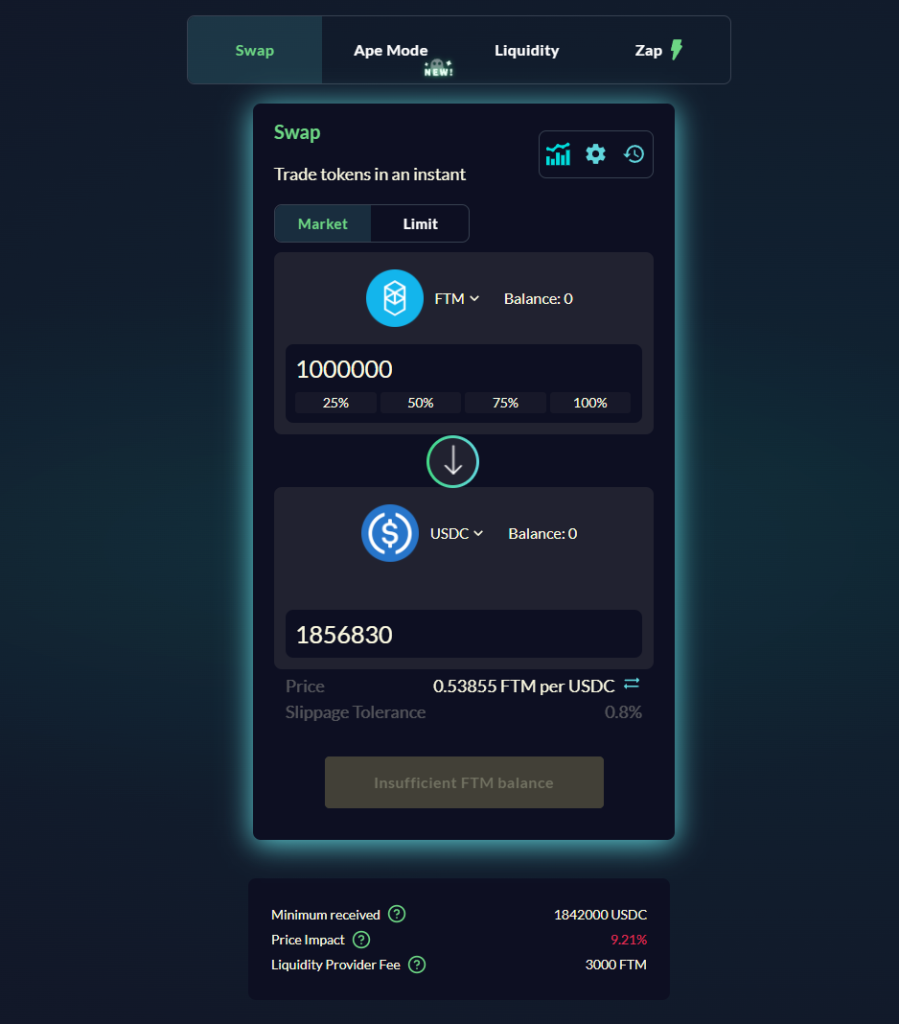

TVL is one of the most important metrics used to evaluate an automated market model DEX because it directly affects price slippage.

Due to the way the AMM formula works, swapping an asset on an AMM DEX would inherently cause price slippage. The higher the TVL of the DEX, the lower the price slippage is.

At the time of writing, the current TVL for SpookySwap is over US$1.3 billion and for SpiritSwap is over US$346 million.

If we do a side to side comparison of both DEX, we can see that SpookySwap incur lesser slippage because it has a higher TVL.

Besides that, it also charges a lower fee compared to SpiritSwap. This would indubitably attract more users, especially whales to use SpookySwap rather than SpiritSwap.

2. Trading volume

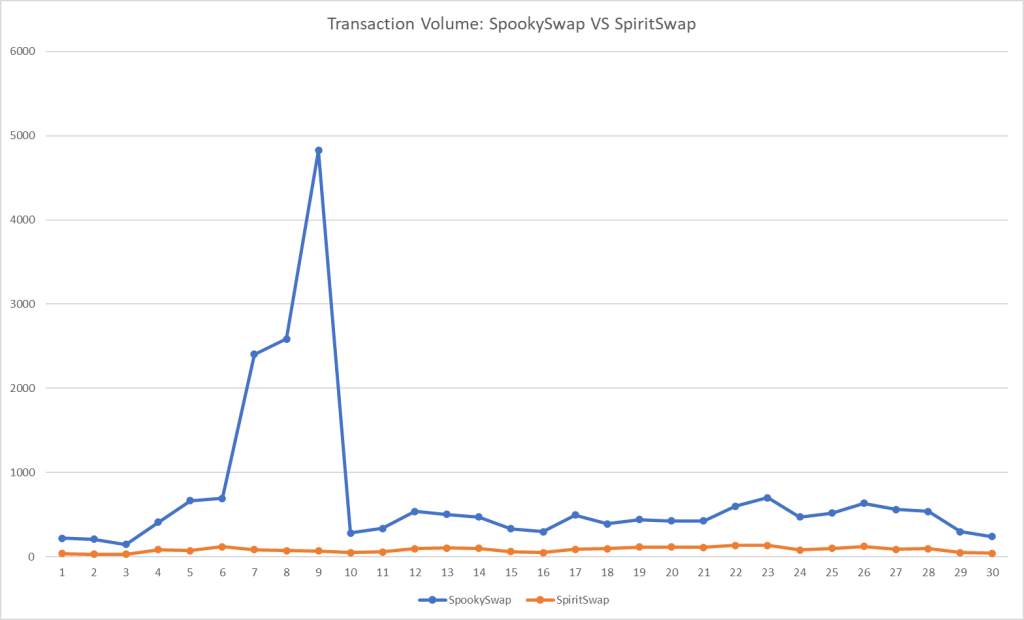

Now let’s look at the second metric which is the transaction volume. Transaction volume is important to an investor as the higher the transaction volume, the more revenue is generated for the investor.

If we look at the numbers, SpookySwap is doing significantly better than SpiritSwap. In January alone, it generated over US$ 1.4 million in trading revenue compared to SpiritSwap of about US$ 250,000 only.

We can see that there is a spike in trading volume on Spookyswap from 4 to 9 January peaking at 4 billion trading volume in a single day. Even if we label those as outliers and removed them from the data, revenue generated from SpookySwap is still more than double that of SpiritSwap at US$ 840,000.

Conclusion

SpookySwap is leap and bounds ahead of SpiritSwap in terms of TVL and transaction volume. There’s no argument that SpookySwap is currently leading the race but SpiritSwap is also rolling out new functions every other day.

If SpookySwap doesn’t innovate fast enough, we might see a shift in interest and it might lose its crown to SpiritSwap. All in all, SpookySwap is currently dominating the market but SpiritSwap is a close second and one day it might overtake SpookSwap and be the number one DeFi hub and DEX.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image: ChainDebrief

Also Read: From SpookySwap To Tomb Finance: Here’s A Guide To Yield Farming Opportunities On Fantom