One of the most hotly contested topics in the crypto space is the choice of trading platforms or exchanges.

Is it better to trade crypto assets using a Centralised Exchange (CEX) or a Decentralised Exchange (DEX)?

This article will compare the different aspects between the two, to help you make a better choice when selecting your crypto exchange.

What is a CEX?

A CEX is a cryptocurrency exchange that is operated by a company that owns it in a centralized manner.

Order book refers to an electronic list of buy and sell orders organized by price level. An order book lists the quantity being bid on or offered at each price point. CEXs are online trading platforms that match buyers and sellers via an order book.

They are the most common method that investors use to buy and sell cryptocurrency holdings.

Pros and Cons of a CEX

Pros

- Trading Volume: CEXs are highly liquid. As you can see, Binance records over US$15 billion in daily trading volume. This is much more than the rest of the Top 5 combined.

- Fiat-to-Crypto and Crypto-to-Fiat Conversions: The top CEXs typically support fiat to crypto on and off-ramps, meaning that they allow you to buy bitcoin with US dollars, for example.

Also Read: Here Are The Top 3 Exchanges To Off-Ramp With Little To No Fees - Ease of use: One captivating qualities of most CEXs are their user interfaces. With the consideration that most investors are new and unfamiliar with crypto, CEXs do a great job funneling users into the crypto space. Binance, for example, has a lite version for investors looking to make basic trades.

- Other features: Apart from the vast array of digital assets that CEXs support, they also offer other features such as staking your idle assets on the exchange itself, leveraged trading, lending, borrowing, and many others.

Cons

- Rigid know-your-customer (KYC) policies: Majority CEXs subject users to strict KYC policies. They require you to upload a photo of your face and a valid identity card to buy and sell crypto or make withdrawals. CEXs are not the go-to for users who would like to maintain privacy.

- Not Your Keys, Not Your Coins: I’m sure many have heard of this before. Your assets are in the custody of the exchange should you choose to leave it there. There are times where Binance has halted the withdrawal of certain crypto tokens and this can cause quite the hoo-ha should you like to transfer it out at that point in time.

What is a DEX?

A DEX is a cryptocurrency exchange that allows the exchange of cryptocurrencies based on functionality programmed on the blockchain (i.e. in smart contracts).

The trading is done online securely via direct peer-to-peer transactions or between pools of liquidity without the need for an intermediary.

Also Read: What Are Decentralised Exchanges (DEXs) And Why Slippage Occurs

Pros and Cons of a DEX

Pros

- Privacy and anonymity: The top reason why DEXs attract users is because of the concealment of identity. DEXs only require you to connect your wallet and there is no identity verification process needed before being able to use them.

- Security: DEXs are generally more secure than CEXs because there is no identity checks and they are non-custodial.

- Decentralised finance (DeFi): DEXs are the leading space for DeFi. DEXs allow users to access the world of smart contracts and DApps that provide financial services; including lending, borrowing and savings products with attractive rates as there is no intermediary involved.

Cons

- Speed: Trading on a DEX is usually significantly slower than on a CEX. While this varies from DEX to DEX, each transaction must be validated by miners which will take time before being confirmed. This can lead to unfavorable trading conditions.

- Trading options: The functionality of DEXs are still pretty limited. Unlike CEX, limit orders, margin trades, or stop losses are widely unavailable.

- Ease Of Use: If this is your first time navigating a DEX, the user interface can be quite confusing as it is more sophisticated as compared to a CEX.

Top CEXs and DEXs

The top CEXs based on trading volume are Binance, Coinbase, Kraken, and KuCoin.

There is no one CEX that has everything. For example, you may find smaller market cap tokens on KuCoin but not on Binance.

However, Binance has the largest trading volume and liquidity among all crypto exchanges. So, there is really no best platform amongst the top few but rather which suit your needs the most.

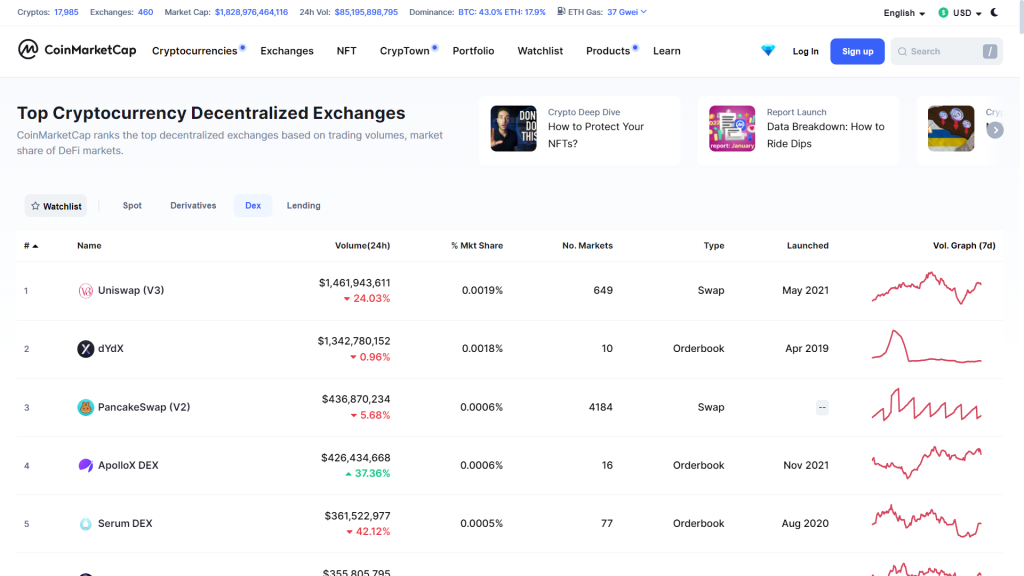

The top DEXs based on trading volume are Uniswap (V3), dYdX, PancakeSwap (V2), ApolloX, and Serum.

Like CEX, you may be able to find tokens on the Serum DEX but not on Uniswap simply because it is not an ERC-20 token.

Hence, there is no best DEX as well but rather which DEX has the token you want to acquire and what is the available liquidity.

Which should you choose?

Both types of crypto exchanges allow users to buy and sell crypto.

For new users joining the crypto space, CEXs provide a simple and fast way to trade.

DEXs, on the other hand, are more suited for intermediate to experienced traders looking for privacy and complete control over their digital funds as well as earning yield in the DeFi world.

Closing thoughts

The approach you should take in deciding which crypto exchange is better for you is to weigh out the different factors. Here are some questions that can aid you in your decision-making process:

- Which crypto tokens would you like to trade?

- What trading options would you like to have access to?

- How do you want ownership of your assets to be controlled?

- How important is decentralization and security to you?

Another practice is to not limit yourself to a singular platform (CEX or DEX). To minimize risks, it is better to spread your assets out to a few different platforms that you trust. In the event that there is a hack and your funds are stolen, the bright side is that it is not your entire crypto portfolio.

Lastly, you should never limit yourself to a specific option. It is possible that you may find an interesting exchange today that may become irrelevant in a few months’ time. Thus, always be prepared for changes and do your own research before investing any of your funds.

Featured Image Credit: AAX Exchange

Also Read: Interest Rate Hikes: Here’s How Interest Rates Affect The Crypto Market