What is Terra?

Terraform Labs (TFL) was founded by Do Kwon and Daniel Shin in January 2018. This company is the one behind Terra which is a blockchain powered by Proof-of-Stake (PoS) concept. Blockchains normally seek to do better in two main areas: cheaper fees and faster transactions. This is evident from Polygon, an L2 solution to Ethereum and various other L1s.

What is Terra’s aim?

Terra has a different focus compared to most other blockchains. Their main goal is to make a better kind of money and to build practical products for the masses to utilise. Some initial projects include partnering with payments services firms and creating a high yielding savings account. On its home page, Terra markets itself as ‘programmable money for the internet’.

What is Terra’s plan?

One of the key pain-points in the cryptocurrency space has been the challenge of creating and maintaining a stablecoin to enable mass adoption of cryptocurrency — even today, the most popular centralized stablecoins such as Tether and Circle continue to be pegged to more conventional currencies such as the US dollar via cash and cash equivalents.

This involves the injection of fiat currency and fiat-backed assets to maintain the value and peg of stablecoins, which are collateralized via these assets.

In contrast, the Terra blockchain maintains a decentralized stablecoin (TerraUSD, or UST) which utilizes an algorithm and its associated reserve token, LUNA, to maintain the balancing act of a 1:1 peg of UST to the US dollar.

The decentralized stablecoin UST is the basis of the Terra payments ecosystem, which has the ambition of powering an end-to-end digital financial system with mass adoption.

What are stablecoins?

Stablecoins are a type of cryptocurrency that is designed to be stable in price. It achieves this by pegging its value to a commodity, currency, or having its supply regulated by an algorithm. They are essential because it allows a user to move from volatile cryptocurrencies to a stable digital asset without having to convert to fiat.

What is UST?

A decentralised, algorithmic stablecoin pegged to the USD. A common misconception is that it is backed by LUNA. However, it is not. It is the algorithm that maintains the peg of UST.

What is LUNA?

LUNA is the native token of the Terra ecosystem. It is used for staking (validating transactions which secures the ecosystem) and governance (voting on changes to be made within the ecosystem). LUNA is also the other half of the equation that helps UST maintain its peg.

Relationship between UST and LUNA

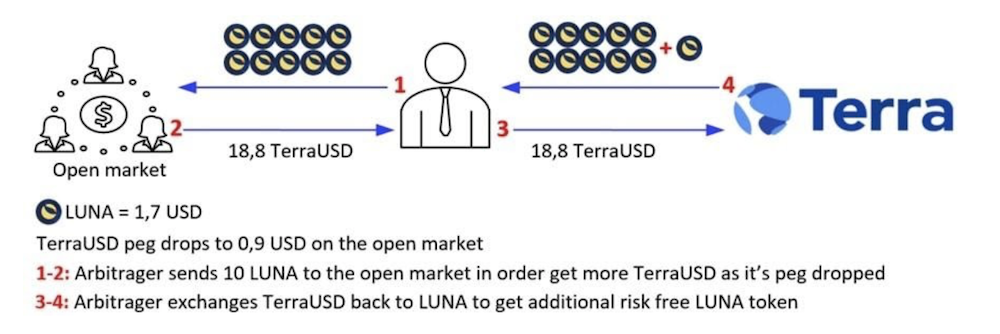

Based on Terra protocol’s market module, 1 UST can always be exchanged for 1 USD worth of LUNA. Even then, the price of UST may fluctuate due to macroeconomic factors such as demand and supply thereby deviating from its peg occasionally. However, a user will always be able to swap 1 UST for 1 USD worth of LUNA and vice versa. This gives rise to the practice of arbitraging when UST deviates from its peg and that is how the peg is maintained.

Assuming 1 UST rises in value to 1.1USD, an opportunity for arbitrage presents itself. Demand for UST will increase as people are incentivised to burn LUNA and mint more UST, capitalising on this 10% profit. Supply of UST increases allowing the price of UST to drop back to equilibrium. On the flip side of the equation, the supply of LUNA decreases which increases the price of LUNA, ceteris paribus. The opposite happens when UST is worth less than USD. Thus, the protocol ensures the supply and demand of Terra is always balanced, leading to a stable price.

Seigniorage is the value of a coin minus the cost of its production. In the Terra protocol, the cost of minting is very small. While seigniorage can create enormous value, it also creates inflation in the system. All seigniorage in the Terra protocol is burned, making Luna deflationary in nature.

Overview of the Terra Ecosystem

Just like the natural ecosystem we see in the world today, every aspect of nature has its part to play in maintaining a vibrant ecosystem. Similarly for Terra, every protocol has its own use and together, it helps the ecosystem to function better.

Given that LUNA underpins the entire Terra blockchain and payments ecosystem, the attractiveness of LUNA as an investment would be centrally dependent on the growth of Terra’s ecosystem in the future.

The following is a summary of the various protocols that serve to address the different needs and investment appetites of the institutional and retail markets.

The bottom line is that these protocols together increase demand for UST. Consequently, LUNA must be burned and this decreased supply means a higher LUNA price all else equal.