In 2021, Ethereum has enjoyed a tremendous run up in their coin price as it hits a high of over $500 billion in market cap before retracing to the current market cap of $392 billion at the time of the writing.

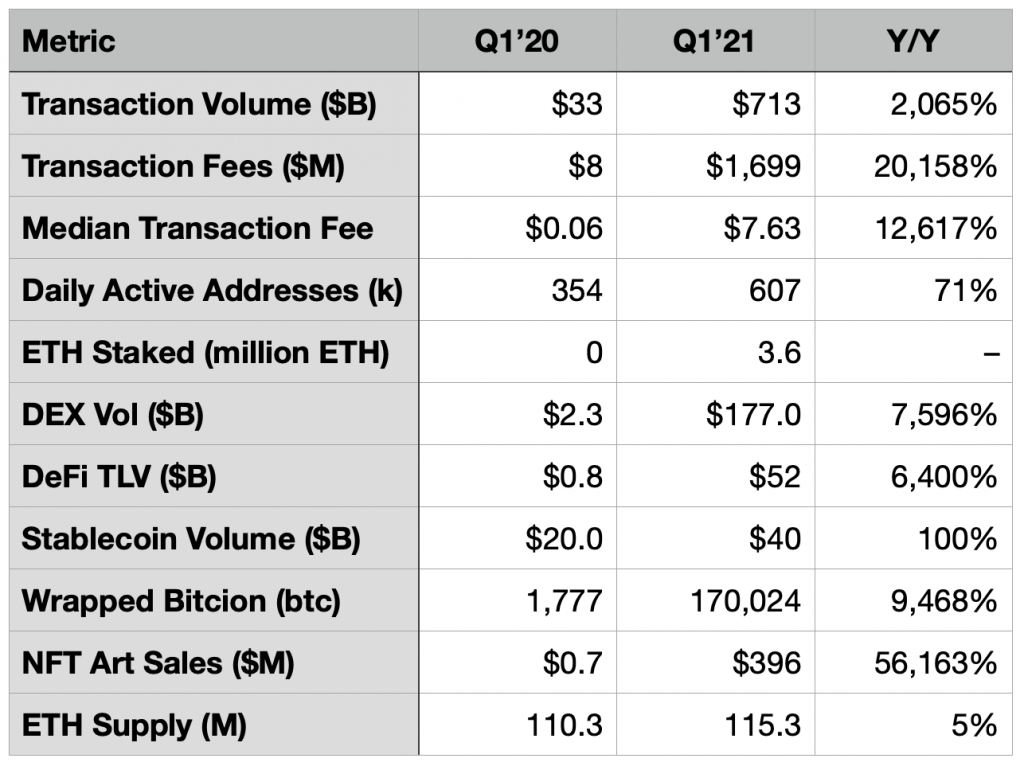

As an open source project, the Ethereum Foundation has shared some key financial data of how the cryptocurrency has performed in the first quarter of 2021. Here are some highlights:

Revenue and transaction volume

Total transaction fees, also known as , compared with just $8 million in Q1 2020. For the month of April, Ethereum generated annualized revenue run rate of $8.6 billion—comparable to Amazon Web Services in 2015.

Total transaction volume on Ethereum increased 20x to $713 billion in Q1 2021, compared with $33 billion in Q1 2020.

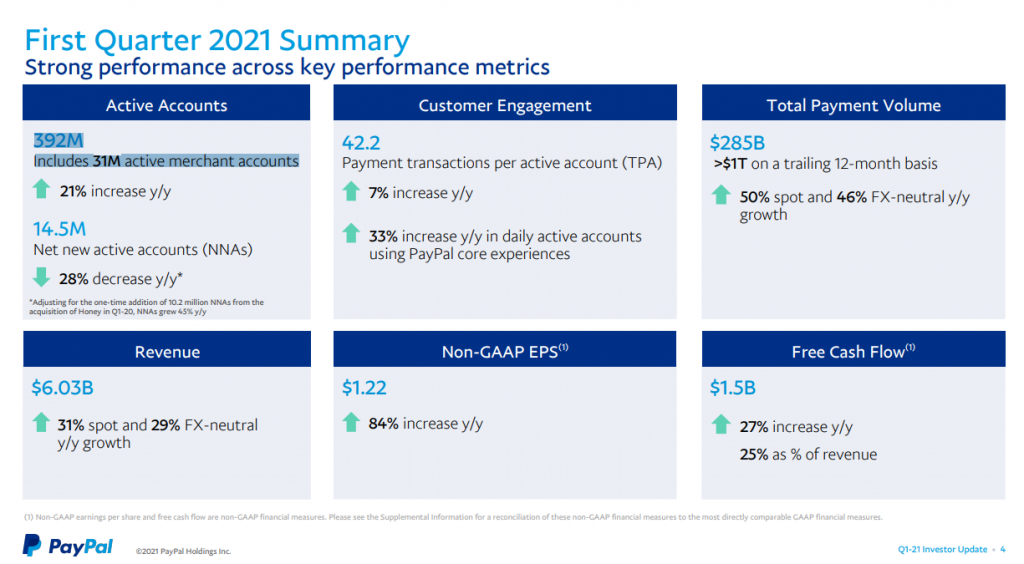

For comparison, PayPal, which is valued at $285 billion market cap now, generated $6.03 billion in revenue in Q1 2021, but only processed a transaction volume of $285 billion in Q1 of 2021.

| Ethereum | PayPal | |

| Price per share/coin | $3370 | $243 |

| Market Cap | $391 billion | $285 billion |

| Q1 2021 Revenue | $1.7 billion | $6.03 billion |

| Total transaction volume | $713 billion | $285 billion |

Daily active addresses

For its daily active addresses, a proxy for daily active users, Ethereum saw and increase of 71% to 607k total active addresses in Q1 2021, compared to just 364k in Q1 2020.

PayPal on the other hand, reported 392 million active addresses in Q1 2021, a growth of 21% as compared to its active addresses in 2020.

Other key developments in the Ethereum Network

Here are some other key developments in the Ethereum Network.

Ecosystem Results

- Decentralized exchange (DEX) volume increased 76x to $177 billion in Q1 2021, compared with $2.3 billion in Q1 2020.

- Decentralized Finance (DeFi) total value locked increased 64x to 52 billion in Q1 2021, compared with $0.8 billion in Q1 2020.

- Stablecoin volume increased 100% to $40 billion in Q1 2021, compared with $20 billion in Q1 2020.

- Wrapped BTC volume increased 95x to 170k BTC in Q1 2021, compared with 1.8k BTC in Q1 2020. Approximately 1% of bitcoin supply is wrapped as ERC-20 tokens and traded on top of Ethereum.

- NFT art sales increased 560x to $396 million in Q1 2021, compared with $0.7 million in Q1 2020.

- Metamask—the popular Ethereum wallet for desktop and mobile—reached 4 million monthly active users (MAUs) in Q1 and crossed 5 million MAUs in April

From the results shown above, it is clear that Ethereum has grown tremendously in this quarter, and in certain aspects, has shown more percentage growth than PayPal, the largest digital payment network in the world.

Ethereum is now powering thousands of decentralized finance applications, and has definitely proved that it is more than just a speculative cryptocurrency.

Source: James Wang

Also Read: An Introduction To Ethereum Layer 2 Scaling Solutions

Editor’s Note: Chain Debrief provides the latest industry news and on chain analysis for major cryptocurrencies in the world. We are looking for contributors and team members to join us. Do write in to admin@chaindebrief.com to find out more.