Dedicated crypto research team

The Bank of America, the second-largest bank in the United States, will reportedly establishing a team devoted entirely to researching on cryptocurrencies.

This marks Wall Street’s latest push to capitalise on investors’ frenzy for digital assets.

According to an internal memo seen by Bloomberg, Alkesh Shah from Bank of America’s data and innovation strategy group will be leading a team looking into digital assets.

Bank of America has created a team dedicated to researching #Bitcoin & cryptocurrencies ? pic.twitter.com/WoEbD0idn8

— Bitcoin Magazine (@BitcoinMagazine) July 8, 2021

Alkesh Shah, Mamta Jain, and Andrew Moss of Bank of America Merrill Lynch’s digital innovation group will be reporting to Michael Maras, who reportedly oversees global currencies and commodities research.

“We are uniquely positioned to provide thought leadership due to our strong industry research analysis, market-leading global payments platform and our blockchain expertise,” Candace Browning, head of global research for Bank of America, said in the memo.

Some Bank of America analysts have criticised cryptocurrencies like Bitcoin (BTC) for their volatility in the past. However, the team seems to be taking steps headed towards the direction of crypto adoption.

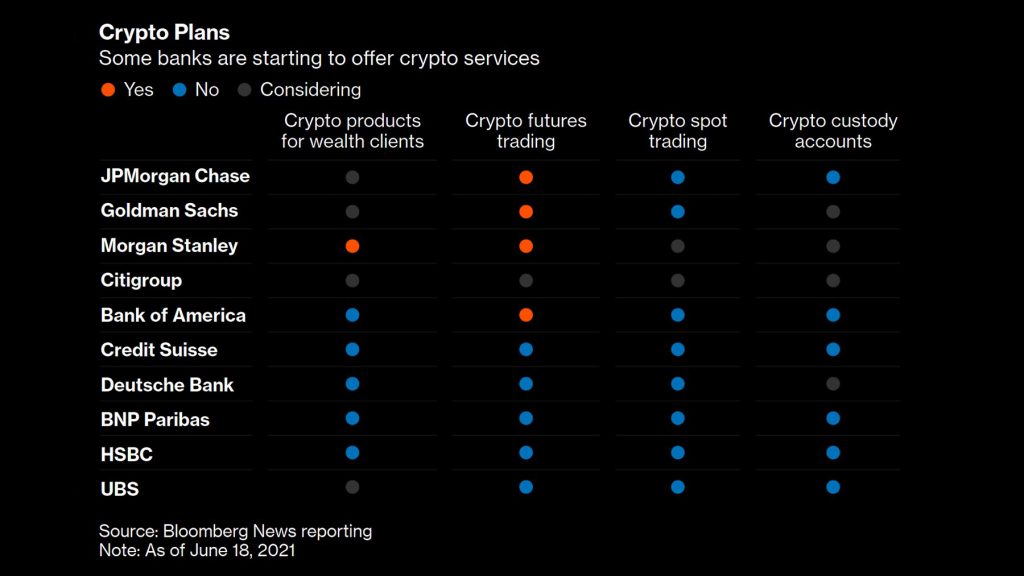

Bank of America joins the slew of banks around the world who are capitalising on the cryptocurrency asset class. Some banks, including JPMorgan Chase & Co. and Goldman Sachs Group Inc., have begun offering crypto-futures trading.

Bloomberg, recently published an informative table showing how the biggest banks in the United States are involved with Bitcoin and what products were already announced by each of them.

Here’s a look at the table by Bloomberg:

In a massive news pushing for cryptocurrency adoption, Germany has recently passed a new law called the Fund Location Act allowing all specialized investment funds to invest up to 20% of their assets in cryptocurrency such as Bitcoin.

Also Read: Adoption News: New Law Allowing Crypto Investment In Germany Takes Effect