The market cap of cryptocurrencies continued to decline as we move into a bear market. As of the time of writing, the crypto market cap is at 1.3 trillion dollars, and the price of bitcoin is hovering around $31,700, far from its high of $63,730 back in April.

Here’s a look at the some data from market intelligence platform Glassnode.

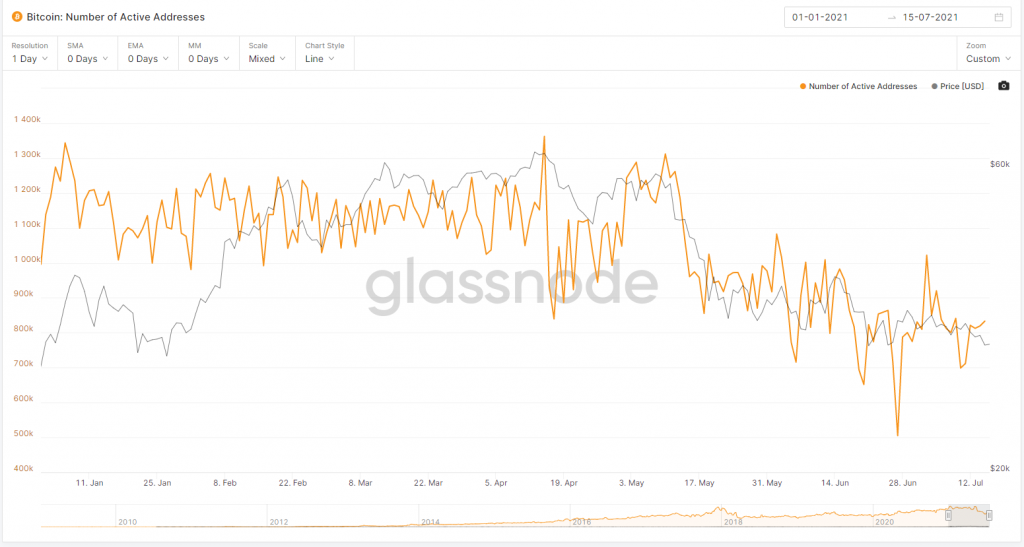

Bitcoin active addresses decline

Bitcoin onchain analysis shows that the number of active addresses continue to decline over the past few months.

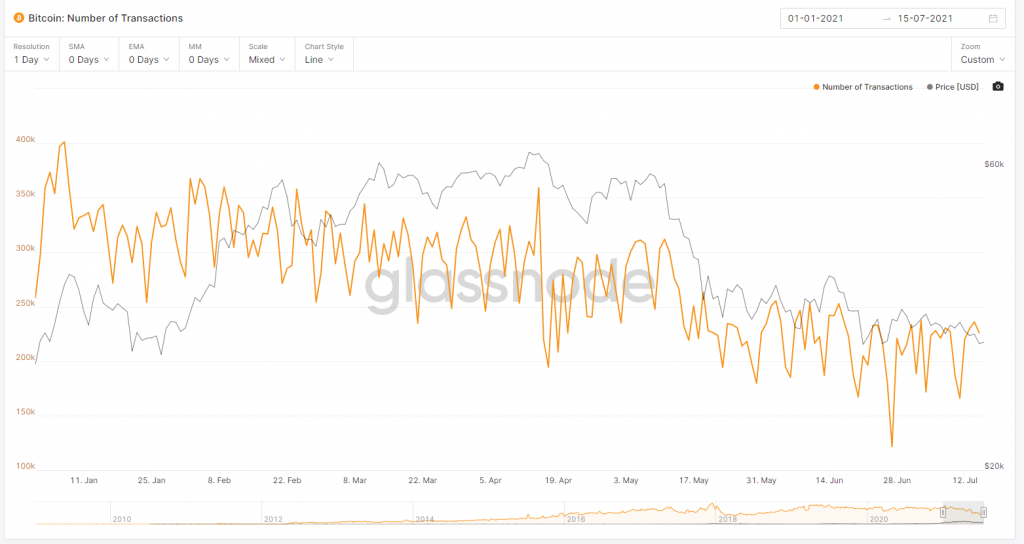

Bitcoin transaction volume and fees decline

The total number of transaction fees on the Bitcoin network also dropped to a one year low in correspondence with the decline in the total number of transactions on the Bitcoin network.

In terms of Bitcoin exchanges inflows, earlier yesterday, Binance saw an inflow of 14,550.78 bitcoins, of which 4,518.4 BTCs flowed in between 17:00 and 18:00. This is Binance’s largest single-hour inflow of bitcoins since May 20, which coincided with a large bitcoin downwards price pressure.

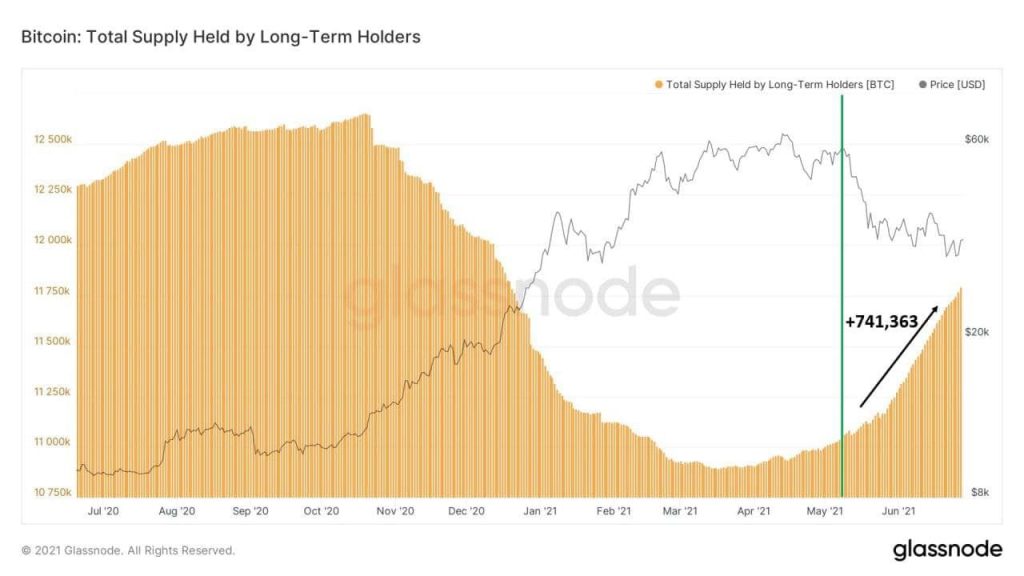

In May, while Binance saw a large inflow of Bitcoin, which coincide with the retracement of Bitcoin prices since May, what Glassnode is showing us is that the total supply held by long term holders started to increase in the middle of May, and is still steadily increasing.

These data seems to suggest that while there are a lot of selling pressures and transaction volume on the Bitcoin network has declined, long term holders are using this as an opportunity to buy up Bitcoin when the prices have been falling.

Also Read: 20 Fundamental Reasons Why Bitcoin Is Here To Stay For The Long Run