If you have been involved with cryptocurrencies, chances are you would have heard of the term stablecoin. What exactly are stablecoins? Here’s a quick article to help you understand the cryptocurrency class.

What are stablecoins?

As cryptocurrencies don’t require an intermediary institution for payment transactions, it can be used by anyone anywhere in the world.

However, unlike the government-issued fiat money such as U.S. Dollars, or gold, cryptocurrencies come with the drawback that prices can fluctuate frequently and drastically, making it challenging for everyday use. For example, bitcoin can be priced at $30,000 today and goes up to $33,000 tomorrow, a 10% change in just 1 day.

Stablecoins try to tackle price fluctuations by tying the value of cryptocurrencies to other more stable assets – usually fiat currencies.

Being supported by assets outside the cryptocurrency landscape, the prices of stablecoins are typically “stable” hence the term, therefore reducing potential financial risk. Stablecoins that are backed by fiat currencies for example the US Dollars, basically encounter the same risk as the backing asset. There are almost 200 stablecoins in the world today. They offer fast transactions, privacy and security of cryptocurrency payments while also ensuring volatility-free stability, especially for risk-averse investors.

Types of stablecoins

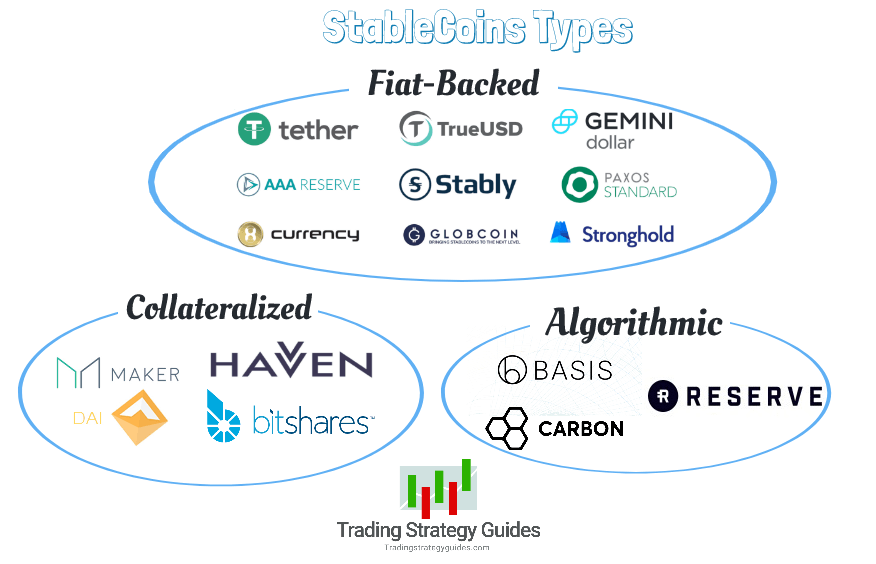

Stablecoins can be classified according to the different types of assets backing it, mainly – fiat currency, commodity, crypto assets, and Seigniorage or non-collaterialised stablecoins.

This reflection of the various types of stablecoins offer insight into the stability of the stablecoin price. As volatility is reduced with the stability provided by stablecoins, once shaky market participants might now find it easier to enter the cryptocurrency market.

1. Fiat-backed stablecoins

Various currencies, for example the U.S. Dollar or Chinese Yuan, are used as collateral to back stablecoins. This is the most commonly accessed backing. Stablecoins can be pegged to a 1:1 ratio to the fiat currency.

For example, an equivalent sum of cold hard cash, backing the same amount of digital stablecoins, is stored securely in a “reserve” such as a physical bank. The money serving as collateral can be withdrawn from the reserve to cash out tokens as a form of exchange.

An example of a fiat-backed stablecoin is Tether (USDT) which was the first stablecoin in the market. Fiat-backed stablecoins offer the most stability. The value of 1 USDT will be the same as the value of 1 US Dollars, and you can use USDT to buy any cryptocurrency.

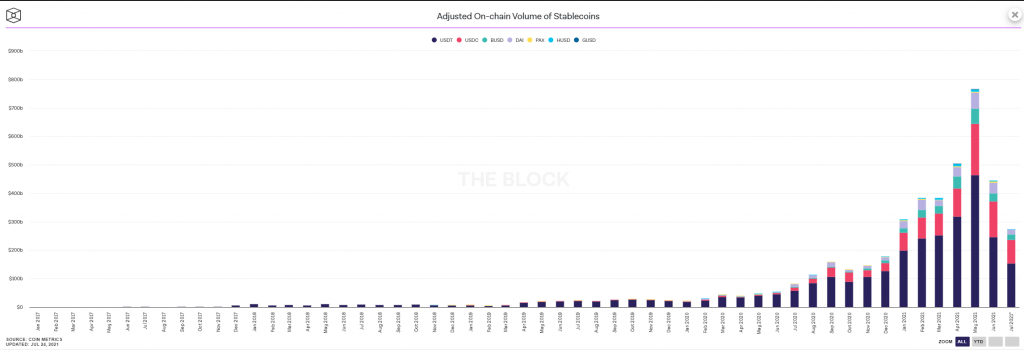

Currently, the amount of stablecoin in circulation is at $275 billion, with USDT being the most dominant stablecoin.

2. Cryptocurrency-backed stablecoins

Another way of pegging stablecoins to assets is through the use of other cryptocurrencies, for example, Ether, instead of a fiat currency. Cryptocurrency-backed stablecoins are decentralised without a single person or entity being in control of the funds.

It is the most complex form of stablecoins as backing is usually through multiple cryptocurrencies to better distribute potential risk. One example of such a stablecoin is the popular DAI by MakerDAO, which is pegged against the U.S. Dollar and has a basket of crypto assets as reserve.

3. Commodity-backed stablecoins

This includes the use of hard assets such as precious metals, like gold (most commonly used) and silver, real estate, or oil. Stability is provided as the stablecoins are tied to the value of these precious metals.

4 Non-collateralised stablecoins

This process doesn’t involve the use of reserve or assets and instead takes place through an algorithm by implementing a smart contract in an independent manner.

Coins are created or destroyed by the algorithm to match the value of its target price. For example, if the target price drops, coins would be burned to increase the stablecoin’s price, similar to how banks would print notes to maintain price valuation for fiat currencies.

Stablecoin Comparison

Most fiat-backed stablecoins are used interchangably, for example, 1 USDT is almost the same value as 1 USDC or 1 BUSD. They are all backed by the US Dollars, and they only differs in the issuing party.

How to use stablecoins

Stablecoins can be used to buy goods and services. Think of it as the digital US Dollars, where 1 stablecoin (USDT or USDC) equals to 1 US Dollars. You can buy stablecoins directly from popular exchanges.

They are effective for global money transfers and payments which are fast and cheap, between a fiat and cryptocurrency exchange. The growth of decentralized finance, or DeFi, has also boosted the use of stablecoins.

Crypto users are able to send money across the world almost instantaneously within seconds. Its stability also makes transactions smooth and secure. In the case of large price movements, money can be moved into stablecoins until the market calms and stabilises, offering a less-volatile option to investors. Stablecoins can also be easily exchanged into fiat currencies or other cryptocurrencies, making them highly tradable.