There is always chatter about when the next mass adoption will be. Although there may be a correlation between adoption and the sentiment of the market, bull or bear, one thing is for sure, we are slowly inching towards new innovation and technology.

While we saw glimpse of how DeFi garnered significant adoption in the past year, we are not completely there yet. With minor tweaks that still need to take place, DeFi could be a serious competitor in how the next generation earns.

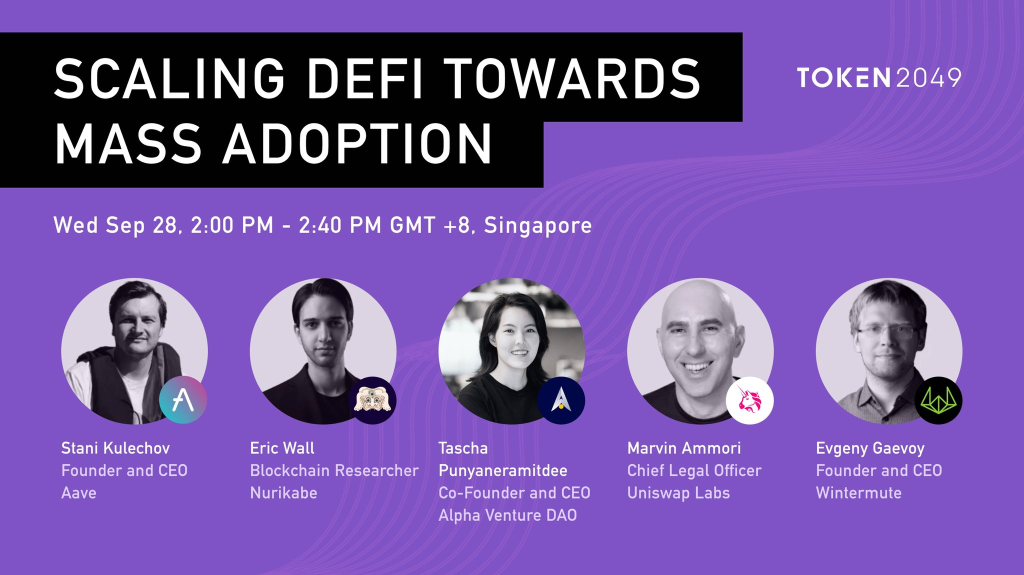

CEO and Founder of Aave, Stani Kulechov, Blockchain Researcher Eric Wall, CEO and Founder of Wintermute Evgeny Gaevoy, Chief Legal Officier of Uniswap Labs Marvin Ammori and CEO and Co-Founder of Alpha Venture DAO, Tascha Punyaneramitdee (Moderator) took the Token2049 stage to talk about Scaling DeFi Towards Mass Adoption.

The current DeFi landscape

“The markets are different than they used to be,” while one of the drivers in DeFi is yield, Stani also raised awareness on how it has to be sustainable.

One beauty about DeFi is its monetary accessibility. Regardless of where you are in the world, with an internet connection, you are able tap on the vast features of products.

Especially in developing nations, DeFi might be the key to push them onto a level playing field. It helps the local communities fight against inflation and serves as an avenue for a store of value over time, particularly with the use of stablecoins.

So what will kickstart the next DeFi wave?

To put it simply,

The beautiful things is that we don’t know, if you ask me a year ago what the most popular use case in Ethereum would be, I wouldn’t think it be of monkey pictures.”

Eric Wall

Athough the bear market usually encourages builders to focus on building new innovation, it still is difficult to identify what can kickstart the next wave. When narratives comes and go quickly, it may be difficult to filter the stones from the gems.

However, there are other benefits of DeFi which may be obvious. This comes in the form of complete transparency on the blockchain and smart contract execution where it you can trust the software will work in a particular way.

While “the tradFi industry has not been evolving that much,” DeFi is consistently pushing the forefront of innovation, especially with new products surfacing especially in the department of derivatives.

Getting the masses onboard, easily

In a space where onboarding may pose as a challenging task for the new users, one aspect in driving adoption is improving the ease of use. While yield attracts the masses, complexities will steer them away, and this has been an ongoing problem in crypto for the longest time.

Also read: Web3Connect: A Quick Recap On How DeFi Will Change The Way You Earn

For a lot of people, traditional finance is much easier. The average folk do not have to deal with private keys or self custody and instead is provided with a straightforward UI/UX to interact with. Marvin Ammori added on how “we NEED to improve on user interface in a way anyone can use crypto without knowing they are using crypto.”

Highly probable, GameFi

“The next wave might come with gamefi”

Evgeny Gaevoy

He referenced this not from the early web3 games in the market, but new ones which does not focus on buying and farming tokens but on the aspect of ownership.

So why is ownerships important? Especially in games, ownership might bolster the trading and lending apsect within a game to be executed. This might also improve user retention but Tascha added it will take time as there are still “a lot of hoops we have to jump over.”

The over arching umbrella

“Crypto is driven by macro and looks like it will continue for some time.” CEO of Wintermute, Evgeny reminded us that even with all of the above in place, the right market condition is still needed to see significant adoption.

While the crypto market is slowly building the foundation blocks in becoming an asset class of its own, it would be a foolish to ignore the macro effects.

I don’t know who wants to hear this, but looking at prices, graphs, rainbows, previous halvings etc is all, very obviously, astrology for men

— wishful cynic (@EvgenyGaevoy) June 19, 2022

Ultimately it all comes down to macro and belief

Why does yield need to be sustainable in the future?

“Getting yield on your assets is important but bigger enemy is inflation.”

Stani Kulechov

While yields on top of rising inflation is great to have, the bigger opportunity that arise is building more opportunity to finance areas traditional finance cannot.

Stani reflection on how he is “31 years old and I still have not received a bank loan after applying every 3 to 4 years.” While this could be due to how banks view crypto in a stricter stance, the immutable and verified data system blockchain solves could create a trust network to empower finance.

He added that it is “not financing everyday lives but infrastructure on a larger scale,” creating more demand and a flywheel for liquidity.

Should we put our faith in the long term of DeFi?

Marvin thinks there is a real future of DeFi. “We built innovation traditional finance was not able to built… you can’t centrally plan innovation.”

He added the way innovation works is very unpredictable with an analogy of “letting a thousand flowers bloom and one or two of them will be the uniwap and Aave.”

The fact that anyone can build on top of one another will continue to spur innovation in DeFi, in rapid and exponential growth.

1/3 Been meeting founders & VCs here in SG 🇸🇬 before @token2049

— Tascha | Alpha (@tascha_panpan) September 27, 2022

1 thing that stands out is many are expanding to build an ecosystem

My take on this is don’t scale too fast and spend a lot of time sharpening your edge

Speed was key in last cycle. Edge will be key in the next…

While certain countries take a paternalistic approach with regulators controlling almost everything, Evgeny says “crypto is completely the opposite, it is all about personal responsibility and being in full control of your capital.”

“I am very excited about everything that has been built so far.” With the current infrastructure, Stani mentioned that we are likely ready to build the auto parts for the future of onchain finance to even using on chain liquidity in real life. Till then, it is up to “you to decide the future of DeFi.”

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief