Before we go into the details, here is a TLDR of the Huobi FUD.

🟡 SUMMARY OF #HUOBI FUD

— Rock 🪨 (@DataaRocks) January 6, 2023

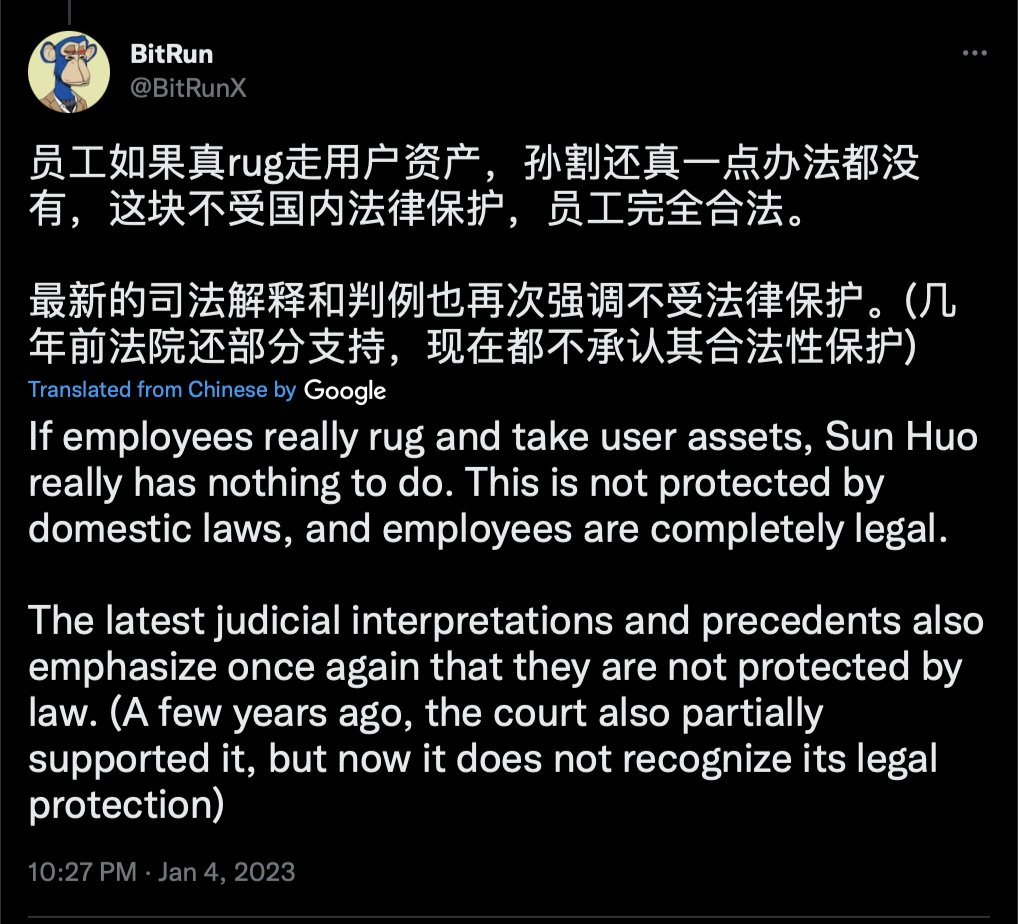

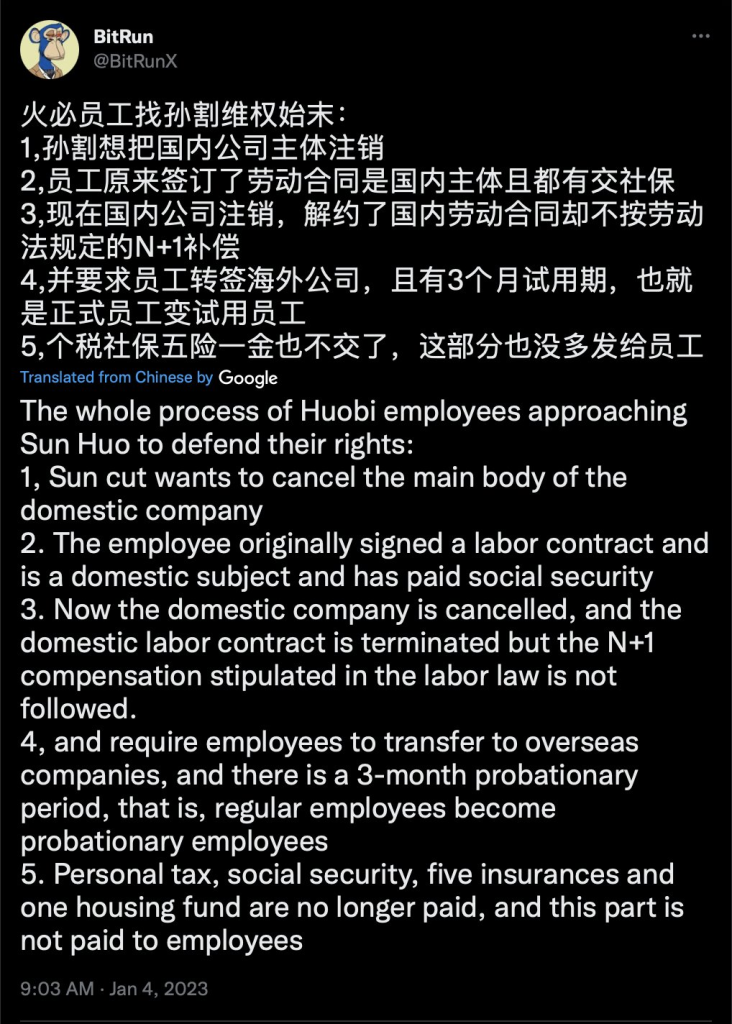

– Justin Sun to shutdown 1,100 staff Huobi China HQ

– Re-contracting all China employees to Huobi Global, Singapore

– Full-time employees become new staff with 3-Mth probation

– Revoked N+1 layoff compensation

– Revoked year-end bonus

1/🧵 cont'd pic.twitter.com/WDMbk2IQBk

After all the glitters of new year celebrations settle, has the contagion continued? This time, with another centralised exchange stealing headlines. A FUD surrounds Huobi, and I think it’s time we unpack them.

It all started with the news of Huobi cancelling all year-end bonuses for its employee and preparing a layoff of 1,200 people with a massive massacre in salary cuts of senior employees, as Wu Blockchain reports.

According to Reuters, Huobi plans to lay off about 20% of its staff, as mentioned by its CEO, his excellency Justin Sun.

This comes in a very PTSD manner, with concerns about solvency a pressing issue among various crypto exchanges after the collapse of FTX and a slew of bankruptcies in 2022.

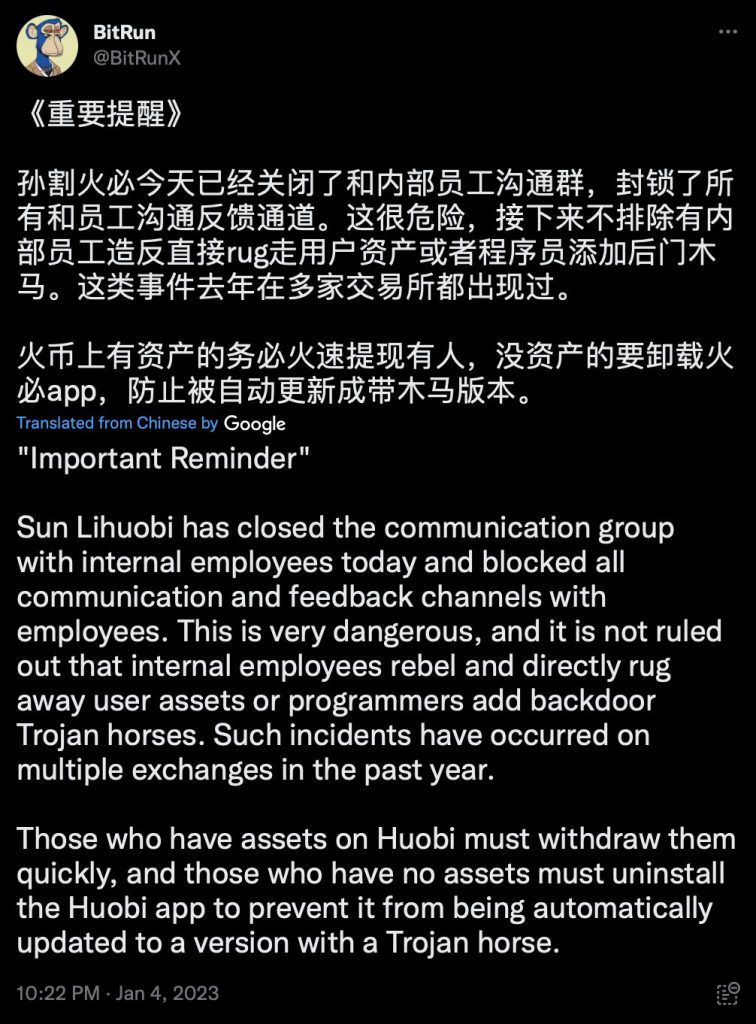

BREAKING: Huobi shut down internal employee communication groups and feedback channels.

— Garlam (@GarlamWON) January 5, 2023

What's going on at @HuobiGlobal

Reporters claim that Justin Sun closed down all company communications following attempts to dissolve the company.

And there’s more.

Then came the ultimatum. The report on Justin Sun’s HR was communicating with all Huobi employees that their salary would be changed to USDT/USDC instead of fiat currency. “Employees who cannot accept it may be dismissed.”

While payment in stablecoins may be common throughout multiple protocols and web3 companies, the sudden switch amidst the current market condition may seem unusual.

Here’s the response from his excellency.

.@HuobiGlobal is an exchange that was founded in 2013 and has since grown to become one of the most popular exchanges in the world. Huobi has a strong focus on technology and security,and it has implemented a number of measures to ensure the safety of its users and their assets.

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) January 6, 2023

TLDR of his recent tweet,

- Huobi’s strong focus on tech and security has implemented several measures to ensure the safety of users.

- It utilizes cold storage for most of its digital assets; they are stored offline in secure, physically protected locations.

- Commitment to transparency, abiding by all laws the exchange operates in.

- They have a team who is in charge of user assets safety.

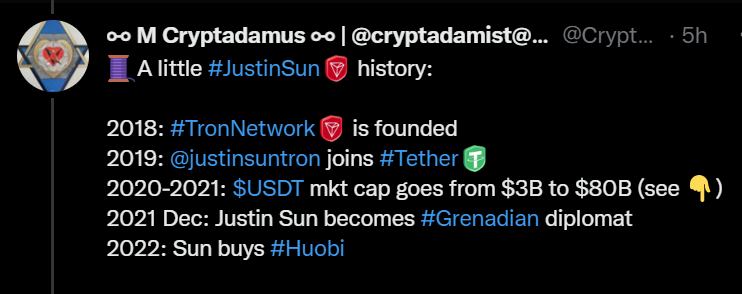

Justin Sun’s tweet above was derived after Huobi appeared to be having internal trouble. Here’s a quick recap of Justin’s history done by Cryptodamist.

Huobi performed a proof of reserves attestation a couple of months ago. Still, after several criticisms on how proof of reserves does not disclose liabilities or negative balances, Justin seems cooperative in doing a Merkle tree proof of reserves, which “reveals all” liabilities.

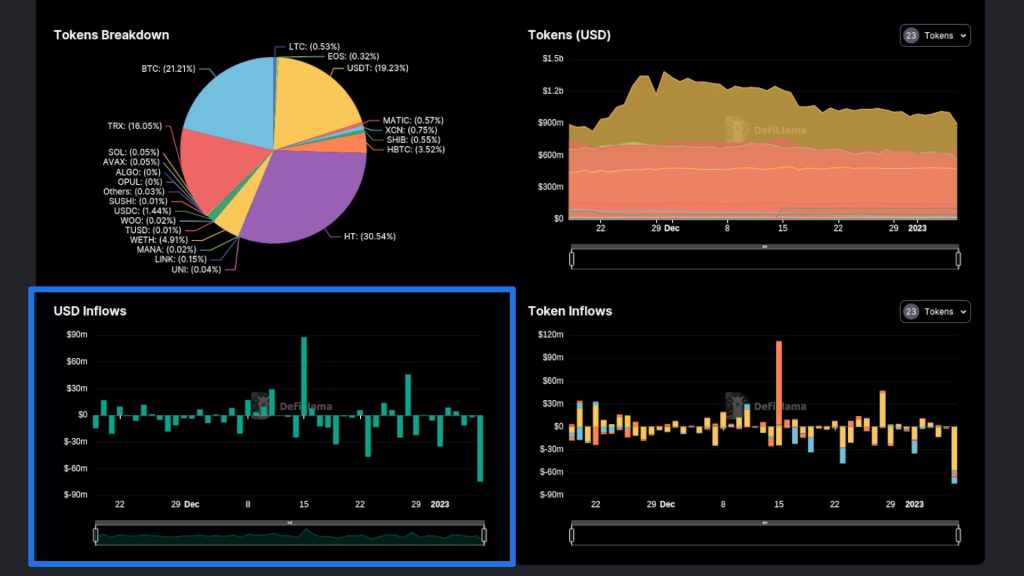

According to Nansen, exchange holdings for Huobi have fallen from $3.3B 2 months ago to currently $2.9B in the present day.

It's been ~2 months since we published the Exchange Holdings for some of the largest crypto exchanges

— Nansen 🧭 (@nansen_ai) January 5, 2023

How are they doing now?

Binance $55B (see screenshot, ⬇️from $64.3B)

Bitfinex $6.7B (⬇️$7.9B)

OKX $6.5B (⬆️$5.8B)

Huobi $2.9B (⬇️$3.3B)

KuCoin $2.5B (⬇️$2.7B) pic.twitter.com/7QPzecbWV4

DeFiLlama also talked about the inflow of ~88M to Huobi on the 15th of December and, since then, experienced over $200M in outflows, with ~$75m occurring in the last 24 hours (as of the time of writing).

Justin’s personal fortune

According to investigative research by Arkham on Twitter, less than one month ago, there was a transfer amounting to $200M in stablecoins originating from Sun’s wallet.

Although his excellency claimed to support Binance by holding his funds there, on-chain data may suggest otherwise.

Over the past 24 hours, this Paxos deposit address has seen >$200M BUSD of inflows, all from Binance.

— Arkham | Crypto Intelligence (@ArkhamIntel) December 14, 2022

This suggests that this entity is likely moving funds off of Binance, rather than on to Binance. pic.twitter.com/gAkuTl9z2C

Justin Sun has also been active on-chain. During the last few days of the year, he was spotted paying $15K in slippage to swap and bridge stablecoins rather than redeeming them directly from TRON.

It looks like Justin Sun paid ~$15k+ in slippage to swap and cash out $100M via USDC/Circle instead of simply redeeming via Tether on Tron.

— Conor (@jconorgrogan) December 25, 2022

Besides the fees, this entailed multiple transfers, a CEX deposit, and a chain swap.

Not sure why he went through the hassle 🤷 pic.twitter.com/sBWWvfT8KJ

We read from Lookonchain about Justin’s recent transactions on-chain.

Justin Sun transferred 198M $USDC to #Circle to cash out in the past 2 days.

— Lookonchain (@lookonchain) December 26, 2022

He transferred $198M $USDC to #Binance on the TRON network and withdrew $198M $USDT from #Binance to the Ethereum network yesterday.

He completed the cash out of all 198M $USDC just now. pic.twitter.com/6U2YEft3Io

Coincidence with Silvergate?

According to Cryptadamist, DOJ (department of justice) moved to seize money amounting to ~$90M in Silvergate bank. And some of that money was reported FTX‘s.

But guess who else banks with Silvergate? Huobi. This does not look well for them, especially when reports that they could not meet payroll are also made public.

1/ We learned $SI banks @HuobiGlobal, a lax-KYC offshore exchange where criminals, including North Korea's Lazarus, have laundered Billions. Huobi is now run by Justin Sun, an accused sex trafficker who FBI is reportedly investigating for money laundering. (We are short $SI). pic.twitter.com/htZEjcdgDt

— AV (@AureliusValue) December 29, 2022

Sentiments in the market are all almost negative, and there seems to be a more significant correlation between the two entities, more than we know.

With Silvergate and Signature Bank under fire… look for Huobi, Tron, and USDD to be impacted. Follow the depeg of USDD closely for signals. https://t.co/IwpBKRV3Ab

— Damon Nam (@damonnam) January 6, 2023

PI ARE SQUARED

Another FUD surrounding Justin is the rug of PI Network. Here is a complete thread to keep you up to speed.

Epic 🧵 about #JustinSun closing people's accounts when they made money trading the nonexistent $PI token launch on @HuobiGlobal.

— ⚯ M Cryptadamus ⚯ | @cryptadamist@universeodon.com (@Cryptadamist) January 6, 2023

Legendary chutzpah, legendary thievery. Their souls are so diseased with greed their minds have completely rotted.#Huobi @JustinSuntron https://t.co/STJv2CecFb pic.twitter.com/zl9mkXEuhB

TRON nose dive

Justin’s TRON $TRX has seen a plunge.

A chance for big longs and shorts

History has its way of teaching us lessons, which might be another. Based on the FTX dump due to its catastrophic news, there might be opportunities to take positions within the Huobi ecosystem chain.

Thoughts regarding this huobi news.

— JJC (@JericoJamesCada) January 6, 2023

Chance for big long and shorts

A thread pic.twitter.com/eJ5UDfDzcc

This thread may give insights into how you may navigate by taking positions during this Huobi situation. This is not financial advice.

Closing thoughts

There is more than meets the eye, and more significant threats are detrimental to the state of crypto. Besides Huobi’s internal conflicts and employee layoffs, Silvergate capital shares dumping 42%, Genesis announced a massive wave of layoffs and DCG shitting down its wealth management division. These collective events may implode the market.

⚠️⚠️Please, get your funds OFF @HuobiGlobal. There are too many red flags. https://t.co/z6enqLjiOU

— CryptoCondom (@crypto_condom) January 6, 2023

All the FUD may be true or not, but as they are not confirmed, the best thing you HAVE to consider is survival. By that, it’s better to be safe than sorry to get all your funds off centralized exchanges.

Also read: Top 3 Decentralized Platforms As An Alternative To Trade On Centralized Exchanges.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief