When you hear about Curve, you will immediately reference its DeFi presence in the entire space. For a long time coming, Curve boasted innovation and continuously pushed the boundaries of DeFi.

In its rise to glory, Curve has been the perfect place for swapping tokens with similar value; it allowed trades with very low slippage. Its also popularity increased after the launch of veCRV.

Here, 50% of fees are given to CRV lockers in addition to veCRV holders to be able to vote on pool emissions, while the other 50% of fees go towards LPs. That gave birth to Curve wars as participants bribe to get a larger incentive share; find out more of that here.

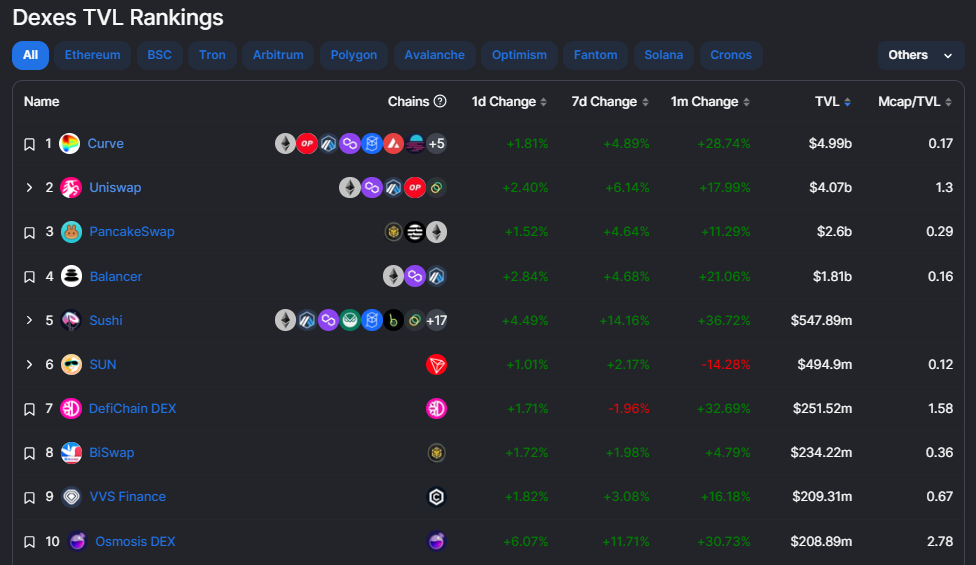

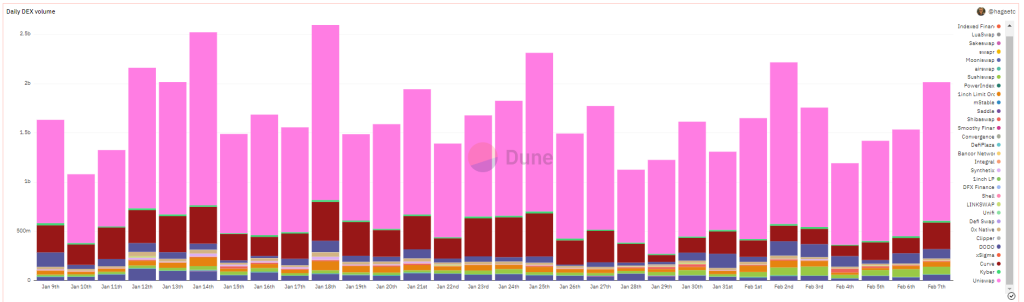

Despite having the biggest TVL at $4.99B among all DEXES, Curve (in maroon) is way behind Uniswap (in pink) in terms of volume, causing some to think, why?

Efficient swaps but when the price falls…

You should also know for Curve to perform efficient swaps, they require liquidity. The genesis of the CRV token is used as a farming incentive to build that liquidity. But that came with a 27.42% inflation rate (We’ll get to that later).

So the main question will revolve around sustainability. When the CRV emissions > Curve revenue + bribes, it seems dark days will be ahead of the protocol.

Furthermore, when trading volume goes down, so will the fees generated. This would mean CRV would become less attractive, bringing down the TVL.

With a decreasing TVL, liquidity swaps will be less efficient. You know how that story ends.

Since its all-time highs, Curve is down 94.1%, a tragic story. But this book has other chapters, other DeFi “blue chips” average being down 94.5% from their all-time highs.

Check out this guy’s portfolio, IYKYK.

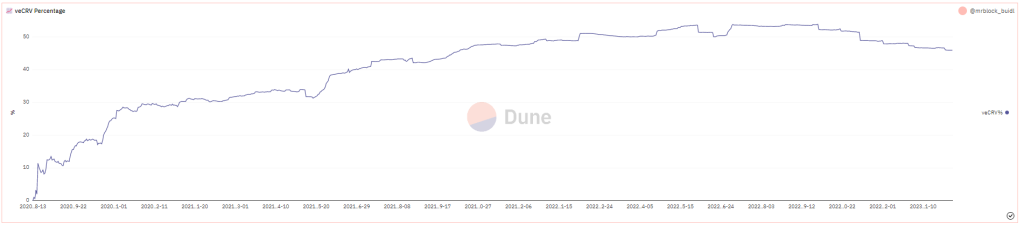

Currently, the veCRV ratio reached the pick in September with 53.9% supply being locked and slowly falling to ~46% of $CRV being locked as veCRV.

If 35% of the 2023 ~400 million $CRV inflation is locked as $veCRV, it will result in a 22% increase in $veCRV supply. This means that the yield and rewards for $veCRV will decrease by 22% if the trading volume and rewards remain unchanged.

Their four-year locking period, for veCRV offloads its sell pressure to participating LPs such as Convex and Yearn, by propping up the value of CRV with their protocol native tokens. Yes, it brings in the capital and TVL numbers, but is it an indication of sustainability and resilience?

That is where liquid wrappers came into play by allowing users to exit their positions while having most of the $veCRV benefits.

The same holds for $CRV. When emissions decrease or run out, trading fees will be the remaining incentives. This means that the incentives for LPs to maintain liquidity and protocols to compete within the Curve ecosystem will diminish.

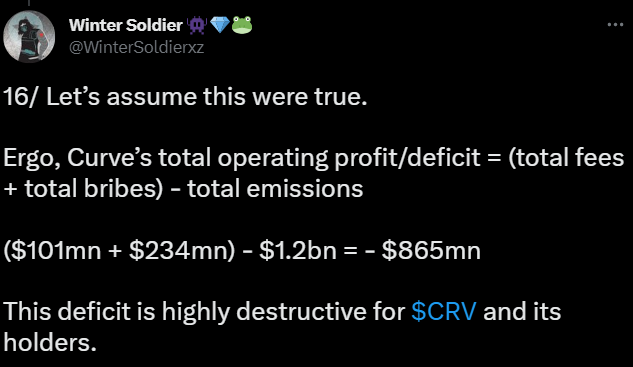

The cost of emitting $CRV to access liquidity on Curve is significantly greater than the combined value of the revenue and rewards generated by the rented liquidity, leading to significant operating losses for the protocol.

To put things simply, the emissions of CRV have been “prepaid” by the protocols mentioned above to secure the on-chain liquidity by offsetting the CRV inflationary pressure. The math done below.

Winter Soldier also on Twitter also talked about how “the cost of emitting $CRV to “rent” liquidity on Curve far outweighs the value of revenue AND bribes pertaining to the rented liquidity, resulting in significant operating deficits for the protocol.”

Curve is rented

Their ve-model is a precarious structure where protocols rent liquidity from Curve (receiving bribes in $CRV), Curve rents liquidity from LPs ($CRV in exchange for liquidity), and LPs mint liquidity from protocols (receiving $CRV for providing liquidity).

Stablecoin for revival?

With rising competition in the space + bear market shenanigans, Curve faces the tall task of sustaining its demand and volume. They try an solve this by creating demand around a stablecoin to bring more TVL to the platform to compensate for the heavy dilution of stakers over this and the following year.

Some may argue creating their very own stablecoin is free money for protocols; it allows users to borrow against their own or external positions and charge interest annually in minting or repayment fee. AAVE also joined this stablecoin race with its very own $GHO.

Will Curve’s stablecoin salvage the dire remains of decreasing demand? I could, but it will unlikely change anything when TVL continues to drop.

Find out more about how Curve’s stablecoin mechanism compares to Uniswap v3.

Introduction to $crvUSD

— DeFi Made Here (@DeFi_Made_Here) November 25, 2022

Part 1

Curve problems in comparison to Uniswap v3.

Thread 🧵 pic.twitter.com/3jkX0Ekyga

The saving grace, though, is that from August 2024, its inflation will be significantly lower, and the fees and bribes will likely cover it.

Closing thoughts

There is no doubt Curve’s utility and value proposition is of extreme importance for crypto, DeFi and Ethereum. Its innovation in the department of veCRV tokenomics spawned gauges, bribes and curve wars that are all unparalleled in other protocols.

With the entire Curve ecosystem hinging on CRV and its bribe revenue, the falling prices and TVL will not help the cause; instead, they create a falling house of cards. As we wait for the introduction of crvUSD to bring more volume and incentivize the locking of CRV, we will have a better picture how this will play out.

Innovation is what drives DeFi forward, but sustainability is what makes DeFi stay.

Also Read: GMX Up 83% In a Month But…

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief