Crypto has always been known to be a market of massive swings and hypersensitive volatility. With that, comes a market with over 12,000 different cryptocurrencies accounting for a $1.1T space. While the dawn of tokenization saw the rise of many verticals within crypto such as DeFi, Gaming and even stablecoins, Alongside is currently building something the traditional markets are very familiar with, an index.

Think of it like the S&P500 and the Dow Jones, which are indexes that tracks the top US companies but for the crypto market. Not only does this offers diversity in a broad range of cryptocurrencies across various sectors, but it also ease of investment in crypto as a whole.

The team behind Alongside

Among their core founders, CEO Austin Diamond, COO Gauthier Le Meur, Head of Engineering Jun Ho Hong and CTO Ratan Rai Sur is a team with talent in finance, marketplace growth, Ethereum core development and product design. Solid stuff.

How does Alongside work?

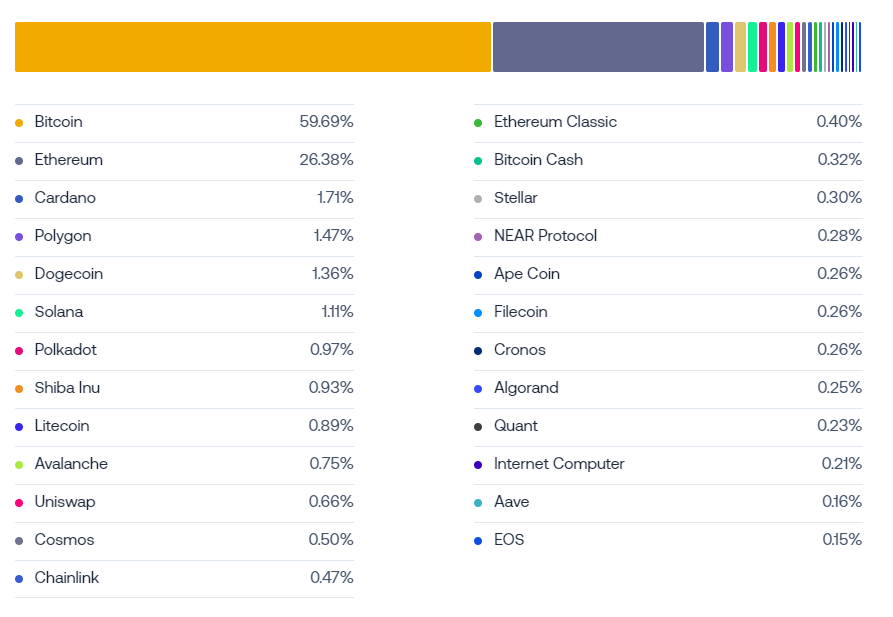

So by buying their index, $AMKT, you will get exposure to a market cap-weighted basket of 25 assets which are rebalanced monthly and reconstituted quarterly. (Not available to US residents)

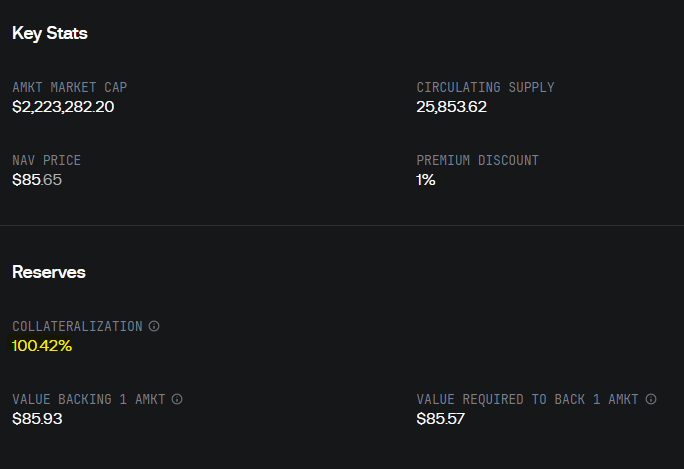

Each $AMKT is backed 1:1 by its underlying assets and can be viewed in real time in their $AMKT reserves dashboard. These assets are securely held by Coinbase Custody, and they hold insurance for a digital asset held across their storage systems against losses from theft, and cybersecurity breaches.

Screening through the weightings of the index above, you will realize this index is meant to be passive. Buying the $AMKT token not only grants you the tokens above but also gives you votes under the AMKT DAO, where token holders get to vote on asset inclusion changes.

AMKT also uses a fixed token supply inflation rate to capture an expense ratio. This means that by holding the $AMKT token itself, AMKT will collect a fee from holders using an inflationary mechanism.

Each quarter, new assets are included and old ones are removed to match the top 25. Currently, they have more than 50 $BTC and 300 $ETH and other crypto assets stored in hot and cold wallets, amounting to a total value of $2.2M. Find out all the exact denominations of the collateral units within $AMKT here.

Recently, Alongside announced their $11M round led by a16z, one of the biggest crypto VCs. This round also included another notable name, Coinbase ventures which is their asset custodian, the platform which holds all their collateral.

Closing thoughts

Index products have saved people billions in fees and served as a simple gateway for millions of regular people to invest. I anticipate newer index products in the future, for one, an Ethereum Index could constitute L2s projects etc, or even a DeFi index where a collection of DeFi blue chips would reside in.

This will make investing easier, simpler and much more straightforward by holding a basket of assets. Furthermore, I would love to see how AMKT would be used in DeFi (or even in options) as a means for further yield generation and collateral, all of these of which are unchartered territories, nothing traditional finance has seen.

Also Read: 3 Key Takeaways From CoinMarketCap 2023 Crypto Playbook

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief