Jerome Jerome Jerome…

Ahead of the FOMC meeting held earlier today, most of the market sentiment was leading towards an expectation of a 25bps rate hike. On the opposing camp, the market expected a 0% rate hike after one of the biggest investment banks, Goldman Sachs, stated that the FEDs would not rate hikes.

This FOMC meeting was one of the most monumental. For one, it goes down as the biggest FED decision in US history and greatly affects Bitcoin’s price and the future of money and fiscal policy.

The FED faced a very difficult decision: they could keep hiking rates but run the risk of breaking banking systems, or they could not cut rates, which backs down from their stance to curb inflation back to 2%.

FOMC crypto cheat sheet:

— Miles Deutscher (@milesdeutscher) March 22, 2023

0 bps: Pump

+25 bps: Flat. Pay attention to Powell’s statement + dot plot.

+50 bps: Dump

Jerome spoke, and the decision was clear, a 25 bps rate hike which showed he is standing strong in the fight against inflation even with the banking turmoil. Furthermore, his hawkish stance on future decisions stumbled the crypto market, with an expectation that there will unlikely be rate cuts in the future.

Bitcoin took a 7% plunge, and so did many other cryptocurrencies. Good time to buy, or is it a foreshadowing or a bad thing to come? Regardless, all possibilities of Bitcoin hitting $1M are starting to look a little bleak right now.

Also Read: Can Bitcoin Hit $1 Million In 90 Days?

A war on crypto

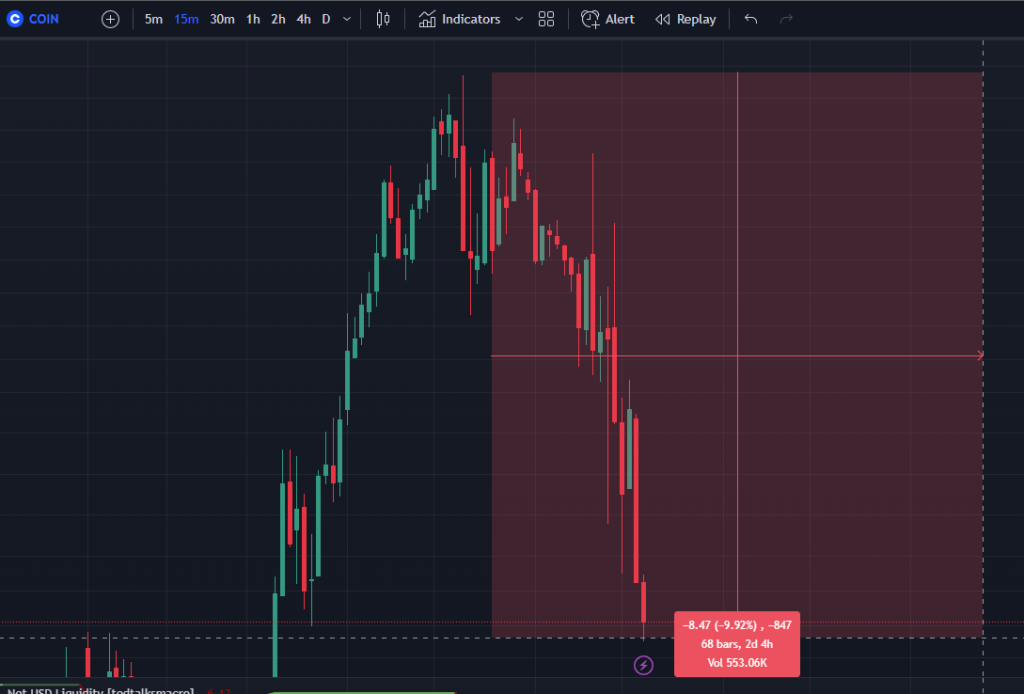

The second blow to the market came from a Wells notice served to Coinbase from the SEC. This came after the many regulatory stances in the US made the crypto environment unfavourable for builders, traders and investors.

1/ Today Coinbase received a Wells notice from the SEC focused on staking and asset listings. A Wells notice typically precedes an enforcement action.

— Brian Armstrong (@brian_armstrong) March 22, 2023

After years of asking for reasonable crypto rules, the final boss crypto faces are here. In a must-win battle, Coinbase seems to go full swing if they do choose to take SEC to court. As the revolution begins, many await at the sidelines for better clarity and certainty of crypto’s relationship with regulations in the US.

Some caveat, the SEC is seemingly going after staking the staking services Coinbase provides in their Earn, Prime and wallet products, declaring staking as a security. Regardless, it seems like Coinbase has the resources and is willing to fight for its products in court.

This news also saw Coinbase’s stock tumble more than 10% after trading hours.

Remember, the SEC doesn’t make the law, only allegations, which ultimately must be tested in the courts. Is Bitcoin still king then?

You can only manipulate for so long Justin…

Today we charged crypto entrepreneur Justin Sun and three of his wholly-owned companies for the unregistered offer and sale of crypto asset securities Tronix and BitTorrent.

— U.S. Securities and Exchange Commission (@SECGov) March 22, 2023

Read more:https://t.co/4tXgKNof6Q

After the announcement of the SEC cracking down on Coinbase, they extended their invitation to charge Justin Sun for market manipulation.

Justin Sun is the man behind Huobi and is involved in the stablecoin scene (USDD and TUSD), and with that power, he is in a position to manipulate the market easily. But the truth is yet to be told, we have to wait and see how this allegation plays out.

Just one week ago, TrueUSD’s operator Archblock moved over $1B in reserves to the Bahamas recently, following the shutdown of Signature, which is forcing many crypto companies to consider new banking partners offshore. The timing of this might be more than coincidental…

Justin’s response.

The SEC’s civil complaint earlier today is just the latest example of actions it has taken against well known players in the blockchain and crypto space. We believe the complaint lacks merit, and in the meantime will continue building the most decentralized financial system.

— H.E. Justin Sun 孙宇晨 (@justinsuntron) March 23, 2023

TRX’s token response, nuketown.

However, the move from the regulators seems to have a strong ripple effect on other exchanges, Binance changed the 0 fees to trades on BTC/USDT spot market to BTC/TUSD. Is this change of perks suspicious?

2hrs ago Binance made a pretty big change to it's BTC spot trading market structure:

— Mike van Rossum (@mikevanrossum) March 22, 2023

For the last few months Binance charged 0 fees for anyone trading on their BTC/USDT spot market, they just swapped that to BTC/TUSD – which is currently a dead market pic.twitter.com/zbmDNxlzUA

Will Justin dump his bags or buy the dip? As reported by Wu Blockchain, Justin just transferred $100M USDT from AAVE to Binance. Stablecoin movement to exchanges is usually a sign of either a mass asset purchase or off-ramping his funds.

Just In: The address marked Justin Sun (0x3ddfa8ec3052539b6c9549f12cea2c295cff5296) transferred $100 million USDT from Aave to Binance. @PeckShieldAlert reported it first. https://t.co/7w0QxWcwKT

— Wu Blockchain (@WuBlockchain) May 11, 2022

His portfolio, consisting mostly of his Stablecoins, is expected to see more movement in the coming days, with a few altcoins such as $AAVE, $COMP and $MATIC to be susceptible to price swings.

We write quite a bit about Justin. Read more in our him below.

Closing thought

With no rate cuts in 2023, inflation remains one of the biggest macro factors affecting the crypto market. Within, regulatory pressures continue to pile up as the battle between crypto entities and the SEC continues to heat up. But all that is just another day in crypto innit?

Also Read: Whales Begin To Dump as Crypto Fear and Greed Reaches Yearly high

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief