With all the negative associations led by the series of unfortunate events in 2022, many stepped away and even more lost faith in what used to be a promise of financial freedom. While there are some who continue to hold on to that dream tightly, a particular vertical within crypto continues to innovate and build. In recent times, platforms like OpenEden have been doing so by utilizing real-world assets.

This is not to undermine the innovation of new L1 projects or the recent developments in the NFT market, but DeFi remains the core engine in the space. When this driving force in crypto merges with the idea of physical assets being tokenized and represented on-chain gives birth, a new asset class could catalyse cryptocurrency’s mainstream adoption.

Crypto tokens are volatile, there is no doubt. But what if we replace this volatile token with something of a AAA credit score rating, it being ‘risk-free’ and is backed by one of the biggest treasuries in the world?

T-Bills. Going on-chain.

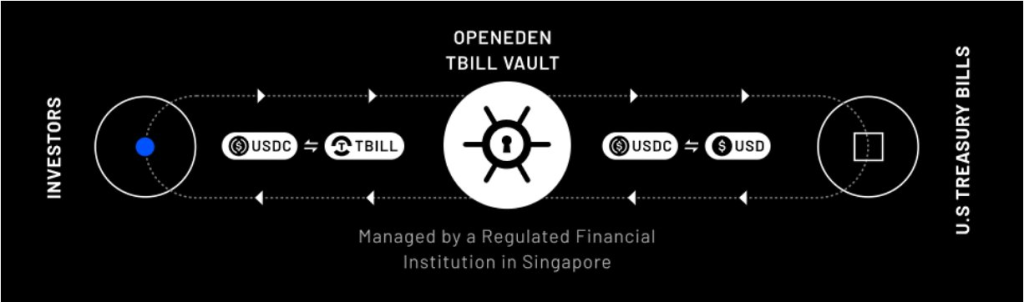

OpenEden has recently unveiled the first smart contract vault managed by a regulated financial institution to offer 24/7 direct access to US Treasuries. Their on-chain vault poses a natural product-market fit to existing crypto treasuries, DAOs and DeFi protocols today.

This will change how institutions and retail users in crypto would do with their sidelined capital.

Also Read: How Web3 is Changing The World: 6 Key Insights from a16z’s State of Crypto Report

OpenEden’s T-Bill Vault

To put things into perspective, “$TBILL to $USDT is the same as $ETH to $stETH.”

Even the biggest fund is only giving out 0.01% in deposit rates. T-Bills today earn you 4%, now can someone calculate how much more that is?

JPM's "Too Biggest To Never Fail" subsidy: if it paid 4% on its $2.3 trillion in deposits, it would pay out $90BN per year. Instead it pays nothing to fund its assets thanks to 0.01% deposit rates pic.twitter.com/w7D4oCZ2HN

— zerohedge (@zerohedge) April 25, 2023

Anyone who wants in, only needs these two prerequisites before they start earning.

- 15 mins of time

- USDC ready for deployment

Digital onboarding will get KYC in 15mins, thereafter, users then deposits their USDC into OpenEden’s TBILL vault to mint TBILL tokens immediately.

Putting things into perspective again, there is currently ~130B of stablecoins sitting idle and not “working” for you. Imagine all of that tapping into OpenEden’s offering.

While the concept may sounds simple, the exectuion was a whole another story especially when work is needed for the tech, legal and licensing sides of things.

According to OpenEden’s founder, Eugene Ng, his TBILLS will allow for more transparent, yet compliant tokens which will run 24/7 on-chain so minting and redemption can be done at anytime.

Not only will the gates of institutional grade defi for institutional players be swung open, but also allows for more use cases for TBILL tokens. OpenEden will also utilize Chainlink’s Proof of Reserves to crosscheck any underlying T-Bills held at a regulated custodian in real time. This custodian will be regulated for accoutning purposes with an independent auditor conducting monthly attestations of the vault’s assets.

Furthermore, “the issuer of TBILL tokens is a professional fund regulated by the British Virgin Islands Financial Services Commission, and the Vault’s assets are managed by OpenEden Pte Ltd, a financial institution regulated by the Monetary Authority of Singapore.”

Closing thoughts

TBILL could only be the start. The beginning of a journey to bridge real world assets on-chain.

Yes, it will not be fully decentralized. Yes, it might not be accessible to everyone in the world. Yes, KYC and all that stuff will be involved. But that will surely take a swing in pushing Defi forward. In fact, while some may ask why T-BILLS need to be on-chain, the simple answer I could give is transparency.

This path will put OpenEden in a position more transparent than their tradFi counterparts and likely bring a greater inflow of capital into the crypto ecosystem as a whole.

Also Read: Real World Assets On-Chain: What Are They & What Risks Do They Have?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief