Bitcoin (BTC) maintained its dominance as the leading asset class for 2024. While the broader market took a beating in Q3, Bitcoin managed to cling to its crown as the best-performing asset class year-to-date. However, its lead has shrunk significantly, marking a sharp stark contrast to the bullish sentiment that prevailed earlier in the year.

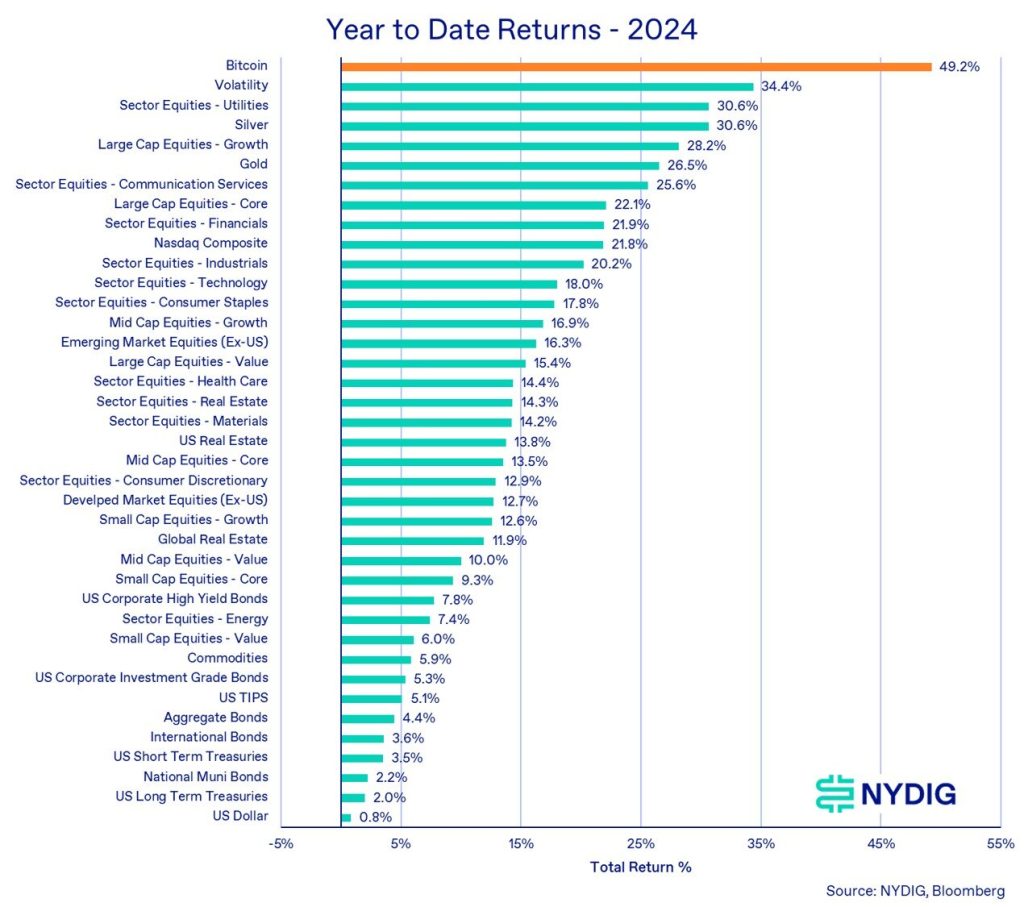

According to a recent report by NYDIG, Bitcoin has gained a respectable 49.2% so far in 2024. While that may seem impressive on its own, the third quarter of 2024 was a particularly challenging period for Bitcoin.

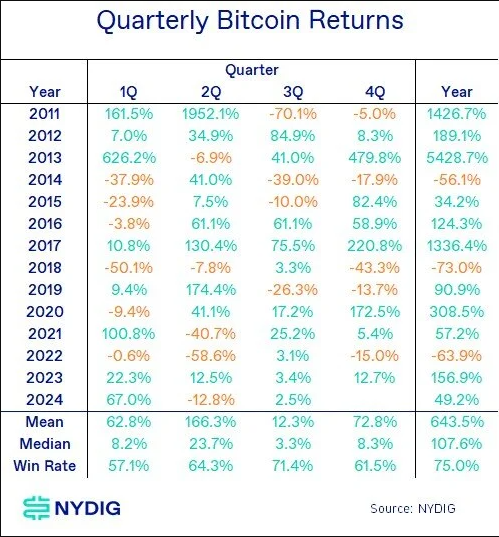

Despite a slight uptick in September, the cryptocurrency’s overall performance was lacklustre, with gains of just 2.5%. This stands in stark contrast to the previous quarter, when Bitcoin experienced a significant decline.

Several factors contributed to Bitcoin’s underwhelming performance. The distribution of funds from the Mt. Gox and Genesis bankruptcies, totalling nearly $13.5 billion, created a significant selling pressure. Additionally, large-scale sell-offs by governments, such as those in the United States and Germany, further dampened the market.

Moreover, the growing correlation between Bitcoin and US stocks has raised concerns about its diversification potential. As the US economy faces uncertainties, Bitcoin’s performance may become more closely tied to the broader market, reducing its appeal as a safe-haven asset.

Corporate Investors Remain Bullish on Bitcoin

Despite these challenges, Bitcoin has continued to attract interest from corporate investors. Companies like MicroStrategy and Marathon Digital have increased their holdings of Bitcoin, demonstrating their confidence in the long-term prospects of the cryptocurrency.

The political landscape has also played a role in shaping Bitcoin’s trajectory. The unexpected embrace of the crypto industry by former US President Donald Trump has boosted investor sentiment. Additionally, global monetary easing measures, including rate cuts by the Federal Reserve and stimulus initiatives by China’s central bank, have provided a favorable environment for risk-on assets like Bitcoin.

Looking ahead, the upcoming US presidential election in November could have a significant impact on Bitcoin’s performance. If Donald Trump wins, his pro-crypto stance is expected to fuel further gains for the cryptocurrency. Conversely, a Kamala-Harris administration may adopt a more cautious approach, potentially limiting Bitcoin’s upside.

Overall, while Bitcoin remains a dominant force in the cryptocurrency market, its recent performance has been mixed. The challenges posed by geopolitical events, regulatory uncertainties, and market volatility have tempered the enthusiasm around the asset. As we head into the fourth quarter, it remains to be seen whether Bitcoin can defy the negative sentiment and deliver a strong bullish run to end 2024 and solidify its position as a leading investment.