The famed “Uptober” for the crypto markets and Bitcoin (BTC) in particular hasn’t materialized yet. Historically, October popularly renamed Uptober by crypto enthusiasts has always been a bullish month for cryptocurrencies.

Add in the upcoming US elections with both Donald Trump and Kamala Harris leaning pro-crypto, October was poised to deliver fireworks in the crypto markets. However, Bitcoin and other leading cryptocurrencies have produced underwhelming price actions so far.

For the week starting October 6th, Bitcoin began on a bullish note, rising quickly to $64,500 by Monday, 7th October. However, the bearish pressure at the $64,700 zone saw a sharp pull back for BTC to the closest support level at $61,780.

Further selling pressure at the support level saw another dip to $60,000 with a strong 4-hour candle on Wednesday, 9th October. This dip to the $60,000 level signalled a growing bearish sentiment on the lower timeframes, although BTC’s daily and weekly timeframe remained bullish.

Sellers Can Extend Short-Term Price Correction

On the four-hour timeframe, the outflow of capital from BTC was marked by the Chaikin Money Flow (CMF) hitting a negative value of -0.06. Accompanying this capital outflow was the Relative Strength Index (RSI) continuing to stay under the neutral 50 mark.

With a lack of buying pressure along with capital outflows, sellers look favourites to extend the short term dip till the $58,000 support level. Shorts will need to book profits at this level, as the $58,000 has displayed solid bullish strength in times past.

Mixed Signals on Bitcoin ETF

On October 7, the total net inflow of Bitcoin spot ETFs was $235 million with Fidelity ETF FBTC having an inflow of $104 million, and BlackRock ETF IBIT with an inflow of $97.883 million. However, on October 8, the total net outflow of Bitcoin spot ETF was $18.663 million.

This was according to data by Sosovalue with the mixed signals in the spot ETF market signaling a cautious approach by investors in the short term.

Satoshi’s Identity Remains a Mystery

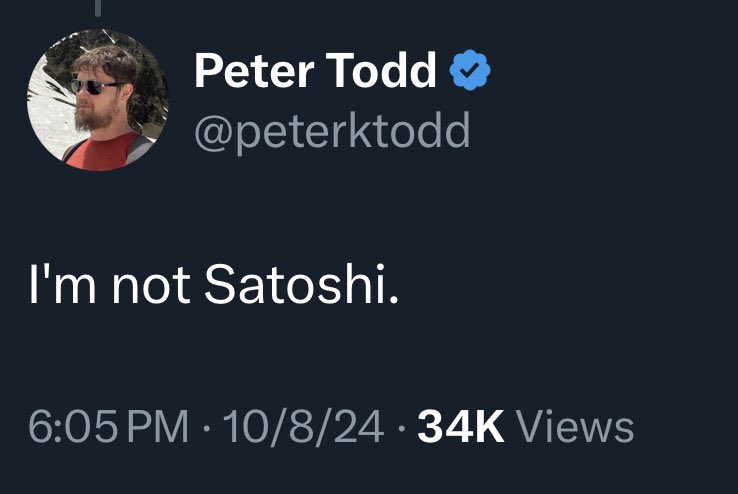

The hyped HBO documentary which was supposed to reveal the true identity of Satoshi Nakamoto fell flat. The documentary by investigative filmmaker Cullen Hoback alleged Bitcoin developer Peter Todd to be the man behind the Satoshi Nakamoto moniker. However, the evidence put forth in the documentary did little to convince the crypto community. In addition, Peter Todd denied the claim via his X handle.

Many Bitcoin enthusiasts have always leaned strongly toward having the identity of Satoshi remaining anonymous forever. Time will tell, if that will be the case or if we will see another attempt to uncover the true identity of Satoshi.