In the world of prediction betting, one well-timed decision can make all the difference. This was certainly the case for “zxgngl”, a whale on Polymarket, who scored an impressive profit by betting on Donald Trump’s victory in the 2024 U.S. presidential election.

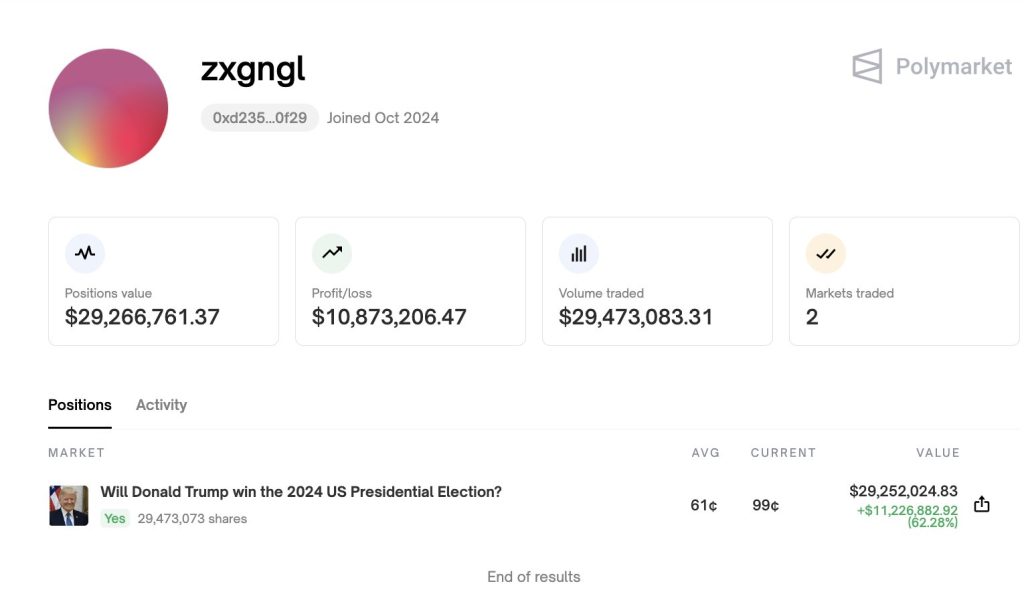

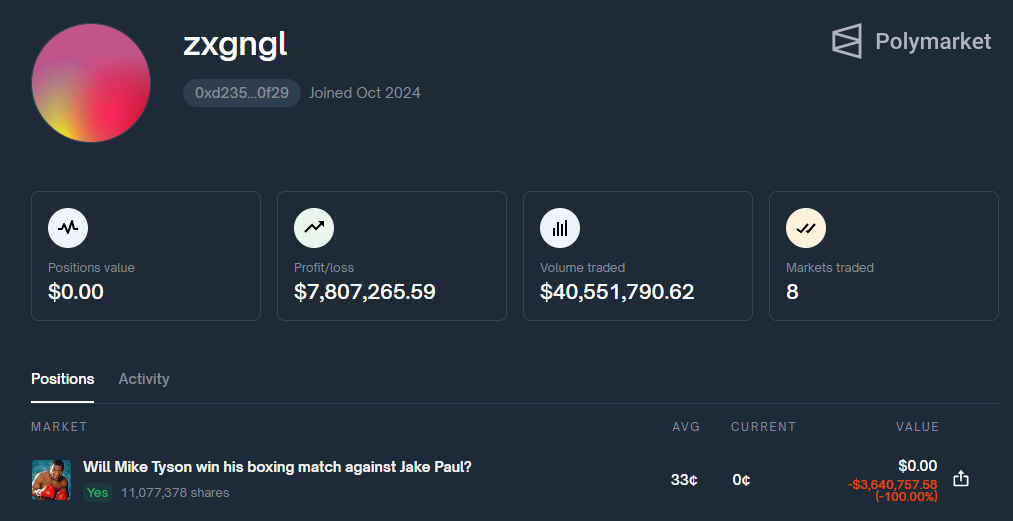

Profit of “zxgngl” in the U.S. Election Bet | Source: Polymarket

By buying Trump shares at an average price of 61¢ and later selling them at 99¢, zxgngl walked away with a remarkable gain of $11,226,887.92, or about 62.28%.

🇺🇸 JUST IN: Polymarket user "zxgngl" has bet $18 million on Trump, with a potential payout of $29.5 million.

— Cointelegraph (@Cointelegraph) November 5, 2024

Currently, this is the largest Trump wager on the platform. pic.twitter.com/DCoxTNBvZl

This win wasn’t just luck; it was a calculated move based on smart strategy and timing. The success placed zxgngl firmly in the spotlight within the Polymarket community. In a competitive environment where every decision counts, zxgngl demonstrated boldness and a sharp eye for opportunity amid the political uncertainty surrounding the election.

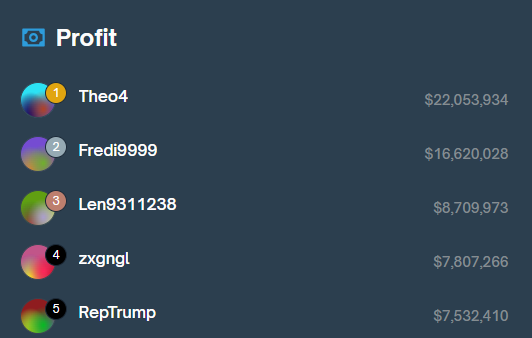

In the leaderboard of Polymarket’s top traders, zxgngl currently holds the fourth spot, with an impressive profit total of $7.8 million. Though not the highest—behind other notable figures like Theo4 at $22 million and Fredi9999 at $16.6 million and zxgngl’s success has cemented their position among the top players. This substantial gain underscores their skill in navigating Polymarket’s complex prediction markets..

Optimism on the Tyson vs. Paul Fight

The odds have hardly moved since this fight started.

— Polymarket (@Polymarket) November 16, 2024

Who you got? pic.twitter.com/kVSAL8kLLm

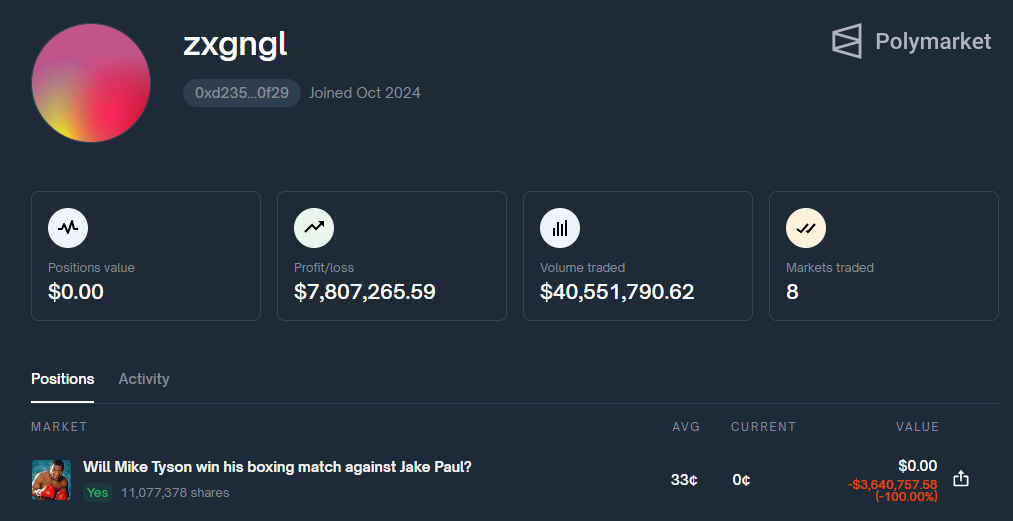

After scoring big on the Trump bet, zxgngl decided to go all-in again, this time betting on Mike Tyson in his highly anticipated match against Jake Paul. Confident in Tyson’s abilities, zxgngl placed a hefty $3.6 million wager on Tyson, purchasing over 11 million shares at an average price of 33¢ each.

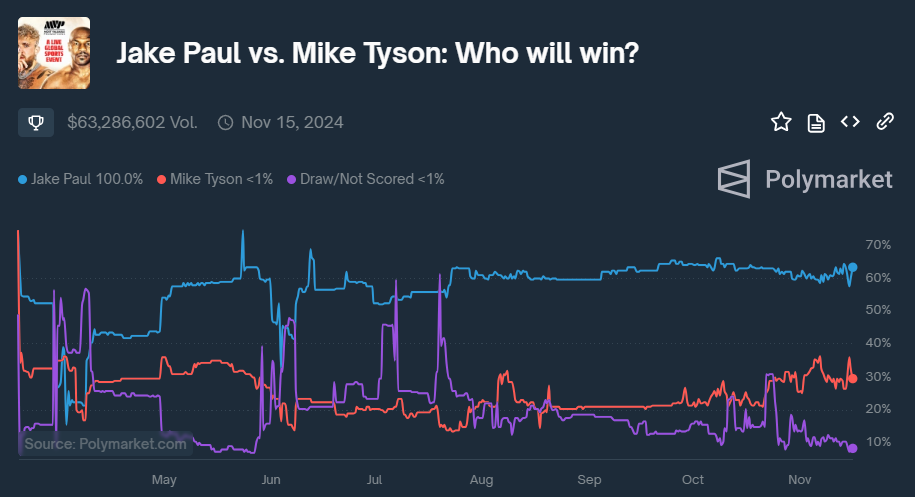

Looking at Polymarket data, the market leaned toward Jake Paul before the fight. Prediction charts showed Paul’s odds of winning hovering around 63.5%, while Tyson’s odds stayed below 30%.

The prediction market saw over $63 million in trading volume, highlighting the intense interest in this match. Despite the odds favoring Paul, zxgngl remained optimistic, willing to take a significant risk against the dominant market sentiment that leaned heavily toward Paul.

This trader now has $3.7 million on Mike Tyson.

— Polymarket (@Polymarket) November 16, 2024

He won't stop buying.

What does he know? pic.twitter.com/sdtJHCeDDF

Related 2024 US elections: Trump elected US president for a second time

Tyson’s Defeat and a Big Loss

Unfortunately, zxgngl’s massive bet on Tyson didn’t pay off. In the eight-round fight, Jake Paul emerged victorious with a unanimous decision from the judges, while Tyson appeared fatigued in the later rounds.

The $3.6 million zxgngl wagered on Tyson ended in a total loss, erasing almost a third of the profits previously gained from the Trump bet.

According to transaction data, zxgngl made multiple purchases of Tyson shares at various prices and volumes, showing a high level of confidence despite the unfavorable odds. Some of the major purchases included 60,988 shares at 48¢ for $26,123.20 and 39,935 shares at 65¢ for $29,574.35.

Jake Paul wins, as Polymarket forecasted.

— Polymarket (@Polymarket) November 16, 2024

The crowd's not happy. pic.twitter.com/JUMbitfJPQ

In the end, all these shares were wiped out after Tyson’s defeat, underscoring the substantial risk involved in prediction betting, where even experienced traders like zxgngl can face significant losses on a single event.

Related Polymarket ‘whale’ earned $85M on Donald Trump win

The Big Winner on This Bet

While zxgngl faced a major setback, another whale on Polymarket managed to come out on top with a well-placed bet on Jake Paul’s victory.

User “thatdawg” placed a significant wager on Jake Paul winning the fight against Tyson, and this choice proved highly profitable. Thatdawg acquired Paul’s shares at different prices and amounts, demonstrating confidence in Paul’s abilities.

Data reveals that thatdawg purchased shares at 59¢ in multiple large transactions, such as 13,000 shares worth $7,670.00 and 176 shares worth $104.11. Other smaller purchases included 99 shares for $58.40 and 150 shares for $88.50. In total, thatdawg secured a profit of $78,635.45, with a final position value of $109,682.58, marking him as one of the biggest winners in this prediction market.

With a trading volume exceeding $290,000, thatdawg cemented his status as a savvy and strategic player on Polymarket, taking substantial gains from a carefully calculated bet on the younger and more favored fighter.

You can also read this : DOGE Gains Coinbase CEO’s Backing as a Path to U.S. Economic Freedom

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief