Bybit, one of the largest crypto exchanges, was hit by a massive hack on February 21, 2024, losing $1.4 billion in $ETH. But Bybit didn’t waste any time. CEO Ben Zhou quickly announced that the exchange had already bought back $742 million worth of $ETH within two days, according to Lookonchain.

Zhou reassured users that Bybit’s assets are fully backed and promised a new proof-of-reserve audit, showing that everything is secure and 1:1. The exchange’s prompt action and transparency helped rebuild trust, especially after such a huge breach.

Latest Update: Bybit has already fully closed the ETH gap, new audited POR report will be published very soon to show that Bybit is again Back to 100% 1:1 on client assets through merkle tree, Stay tuned. https://t.co/QLa1vOujM6

— Ben Zhou (@benbybit) February 24, 2025

This rapid response proved Bybit’s commitment to protecting its users. Despite the breach, the platform kept running smoothly, and the support from the wider crypto community demonstrated just how resilient Bybit truly is.

Bybit’s Quick Actions Restore Confidence

After the hack, Bybit’s $ETH reserves plummeted from 439,000 to just 61,000 $ETH. But in less than a week, Bybit managed to restore over 446,000 $ETH—most of it coming from OTC trades. This swift recovery proves Bybit’s ability to bounce back from even the biggest setbacks.

Since being hacked, #Bybit has received ~446,870 $ETH($1.23B) through loans, whale deposits, and ETH purchases.#Bybit has nearly closed the gap. pic.twitter.com/0oz3ytLi4X

— Lookonchain (@lookonchain) February 24, 2025

Industry giants like Binance and Bitget also jumped in to help, sending 100,000 $ETH to Bybit in emergency liquidity. This support made it clear that the crypto world is united when it comes to protecting platforms and their users.

Binance and Bitget just deposited 50k+ ETH directly into Bybit's cold wallets. Bitget's deposits are especially interesting; its 1/4 of all of the exchange's ETH! (that I can see)

— Conor (@jconorgrogan) February 21, 2025

Since they skipped a deposit address, these funds were coordinated directly by Bybit themselves pic.twitter.com/yimpcYpLx7

Bybit’s fast recovery and transparency have earned them serious respect. Withdrawals quickly surged, showing users still have faith in the exchange. Thanks to its quick response, Bybit has proven that it’s ready to handle any challenge.

Lazarus Group’s Stolen $ETH: What’s Their Next Move?

The Lazarus Group, a North Korean hacker group, is suspected of orchestrating the $1.4 billion hack. Experts think the stolen $ETH might not hit the market anytime soon. Instead, Lazarus may sit on it for a while, keeping it out of circulation to avoid causing a crash in $ETH prices.

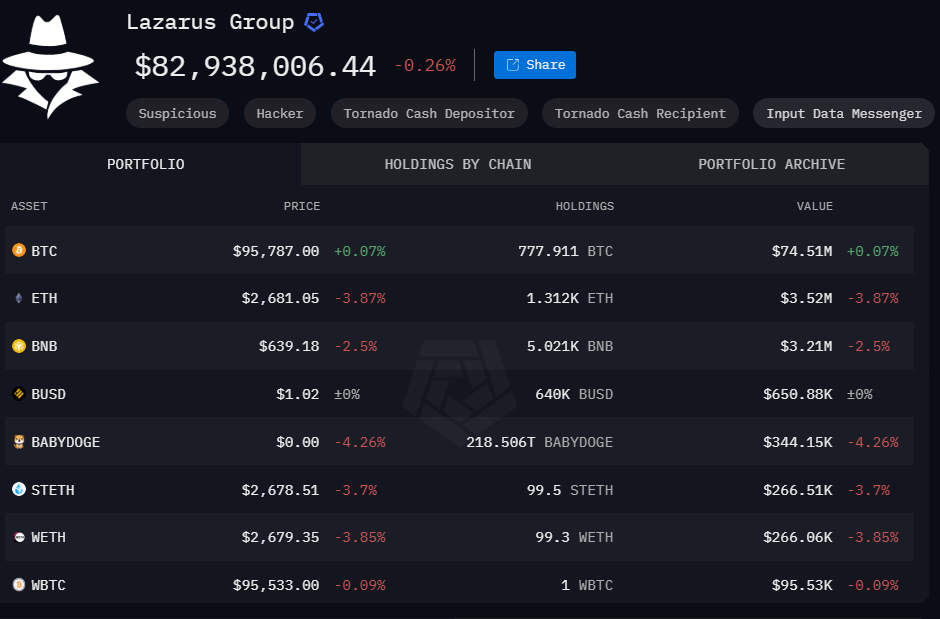

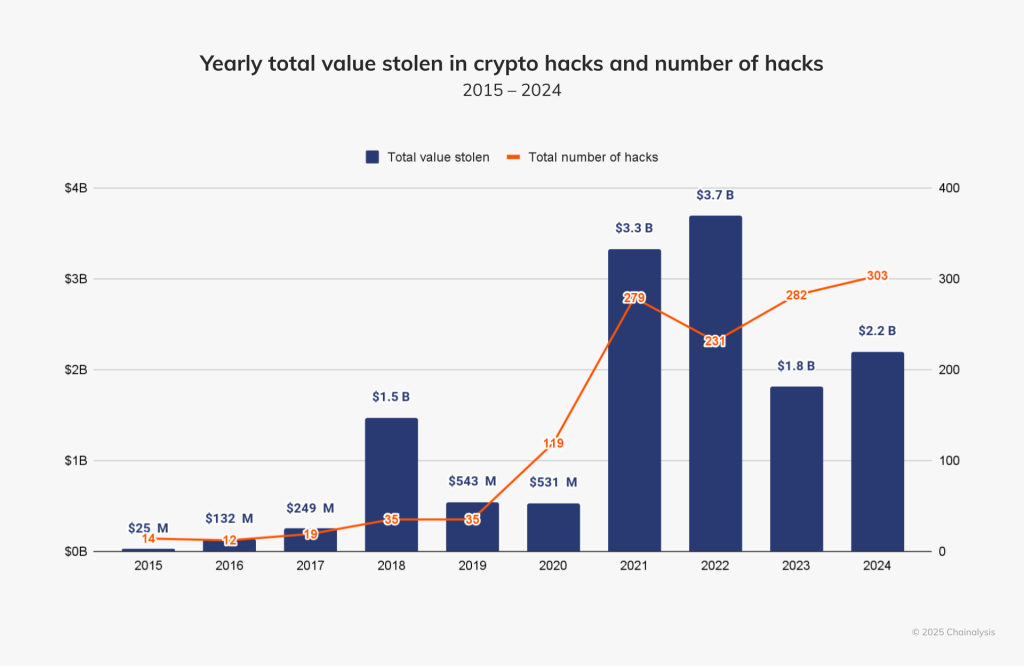

Lazarus’ public wallet currently holds over $82 million in crypto, including $3.52 million in $ETH. However, this is just a small fraction of the $1.34 billion they’re estimated to have stolen last year. According to Chainalysis, Lazarus was responsible for over 60% of the crypto stolen in 2024.

Given Lazarus’ history, it’s likely that they’ll hold onto the stolen $ETH for the long term. This strategy would prevent a flood of stolen assets from hitting the market all at once, keeping $ETH prices from dropping further.

What’s Next for $ETH and Bybit?

Although the hack caused $ETH to dip by 7%, the coin has bounced back to $2,765. Bybit’s continued $ETH purchases, including $295 million worth from OTC trades, have played a key role in this recovery.

To fully reverse its recent downtrend, $ETH needs to push past the $3,000 mark. The $2,700 to $3,000 range is the key resistance point, but growing institutional interest and a shrinking supply of $ETH on exchanges could help fuel a rally.

If $ETH manages to break through this resistance, it could spark a major price surge. The crypto world is watching closely, and the momentum is building to push $ETH even higher.

You can also read this XRP Sheds “Stablecoin” Label and Surpasses Solana’s Market Cap

Looking Ahead for Bybit and $ETH

Bybit’s quick recovery and $ETH’s rising price are great signs for both. Bybit has proven it can handle tough situations and bounce back stronger, while $ETH’s solid fundamentals make it a top contender for future growth.

With the swift recovery of both Bybit and $ETH, the future is looking bright. As these two continue to grow and evolve, we can expect even more positive momentum. The road ahead is filled with promise for both.

Editor’s Note: This article does not represent financial advice. Please do your own research before investing.