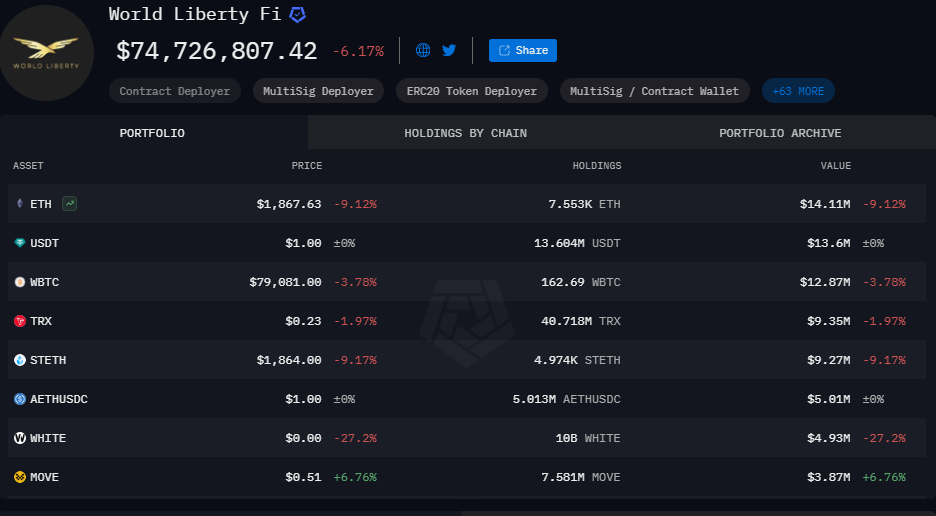

World Liberty Financial (WLFI) has seen its portfolio significantly decrease in value. Currently, the total value of its holdings stands at approximately $74.7 million, marking a 6.17% decline. The platform holds a range of cryptocurrencies, including Ethereum (ETH), Wrapped Bitcoin (WBTC), and TRON (TRX), with some assets seeing substantial losses.

The portfolio’s largest asset, Ethereum (ETH), has experienced a sharp drop of 9.12%, with a current value of $14.11 million. Similarly, its holdings in stETH are down by 9.17%, totaling $9.27 million. The platform has also faced a loss in Wrapped Bitcoin (WBTC), which dropped by 3.78%, now valued at $12.87 million.

Despite these losses, WLFI continues to hold other assets such as USDT and MOVE, which have remained stable or shown positive growth. USDT has not changed, while MOVE has increased by 6.76%, now valued at $3.87 million.

You can also read this Trump’s Impact on Cryptocurrency Regulations Explained

WLFI’s Strategic Shifts Amid Losses

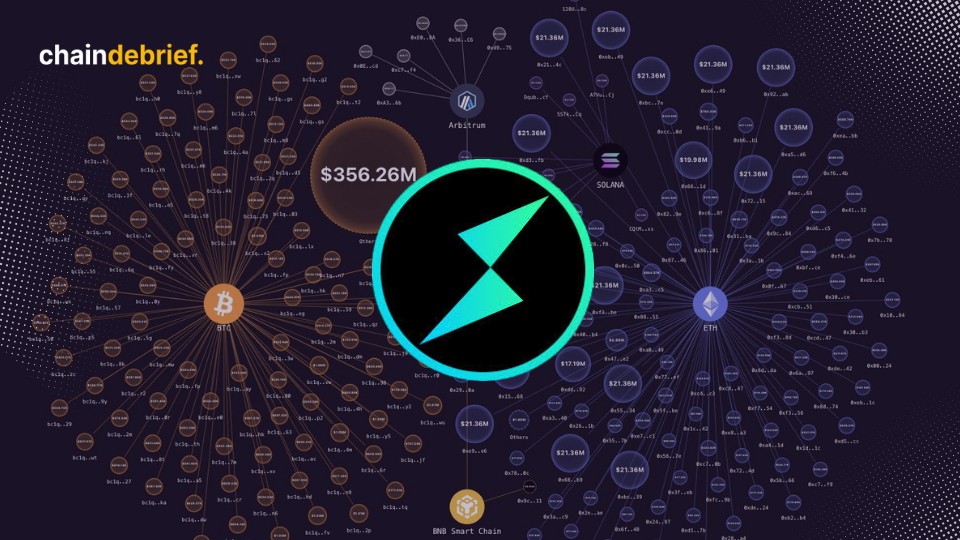

Despite these losses, WLFI continues to bolster its portfolio. On March 6, the platform acquired $21.5 million worth of Ethereum, Wrapped Bitcoin (WBTC), and Movement Network tokens. This demonstrates WLFI’s continued confidence in its investment strategy, despite the downturn.

The platform has also formed a strategic partnership with Sui, a blockchain project founded by former Meta developers, to explore decentralized finance (DeFi) opportunities. This partnership could help WLFI diversify its investments and expand its influence in the DeFi space.

WLFI has also seen some success with its token presale, attracting retail investors. However, it remains $2 million short of its target for the second presale phase. WLFI tokens are primarily being purchased using Ethereum and USDC, indicating growing interest from smaller investors.

You can also read this ThorChain, A Tool for Laundering Stolen Assets

Future Outlook and Strategic Moves

Looking ahead, WLFI is positioning itself for long-term growth. The platform is preparing to launch its own version of an Aave vault, allowing users to earn passive income through crypto lending. This is part of its broader strategy to enhance its DeFi offerings.

Despite the current losses, WLFI remains a significant player in the DeFi space. The platform’s aggressive expansion into Ethereum and other blockchain ecosystems, along with its partnership with Sui, may provide a solid foundation for future success.

However, WLFI’s involvement in the cryptocurrency market raises concerns about potential conflicts of interest, especially considering its leadership. Nevertheless, the platform’s ongoing presales and strategic investments suggest it is still positioning itself for potential growth in the future.

You can also read this Pump.fun X Account Hacked to Promote Fake $PUMP Token

Editor’s Note: This article does not represent financial advice. Please conduct your own research before investing.