What is Tokenomics?

Tokenomics or Token Economics is a method of valuing a token’s ecosystem and other factors that could affect its price. The quality of a token determines its ability to appreciate in price and being able to differentiate good or bad tokenomics can make or break an investor.

These Tokenomics can be further differentiated between various types of cryptos, mainly Layer 1s and Layer 2s, with Layer 1 projects usually being cryptocurrencies used as currencies such as Ethereum, Bitcoin or Binance BNB coin.

Layer 2s instead are tokens that provide some sort of utility and are built on top of Layer 1s for various applications.

Why Tokenomics matters

With newer investors especially, not understanding Tokenomics can cause them to make bad investments.

For example, while Ripple’s $XRP at US$1.07 may look cheaper to purchase and seem like it has a higher price ceiling than $AVAX at US$63.7, the former actually has four times the market capitalization of the latter.

Given a US$50 billion inflow into both tokens, $XRP would only see a 2x while $AVAX would see a 4x. Furthermore, this gap could be widened by various supply factors.

I bet you understand now why $TITAN charts have no bounce, it's straight down all the way. Each time $TITAN tried to consolidate and bounce, $IRON redemptions would inflate the supply of $TITAN. Its straight to $0.

— Finance Geek (0/0/0) (@FinGeekCo) June 17, 2021

16/22 pic.twitter.com/JguT3GuYDe

Being able to identify good Tokenomics in a project can also prevent you from rug pulls, which even billionaire investor Mark Cuban fell for.

Rug pulls are devastating events similar to pump and dumps, and can cause your whole portfolio to go to zero in under a few minutes.

(Also Read: I Got Rug Pulled and Scammed By A NFT Project, Here’s What I Learnt)

Tokenomics is also the reason many investors are so bearish on meme coins, which usually have insane vesting schedules or have a few wallets that hold a large supply of coins.

If they were to dump the supply on the market, the price could be deflated instantly and leave retail investors left holding the bag.

Vesting schedules

The first thing you should look at in determining a token’s possible price increase is its vesting schedule. Cryptocurrencies are usually created and distributed through fair launch or based on a specific schedule by its developers via pre-mine.

Fair launches occur when a cryptocurrency is mined, earned, governed and owned by the entire community without early access for specific investors.

Good examples of this are $BTC, $SUSHI and even $DOGE. Pre-mined tokens on the other hand have their some or the entire supply minted before launch and have a predetermined vesting schedule which sometimes can be changed.

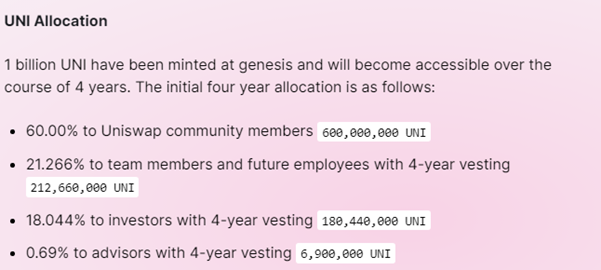

These days, most tokens are pre-mined as they can be then sold to accredited investors for fundraising purposes or to attract early adopters to the space.

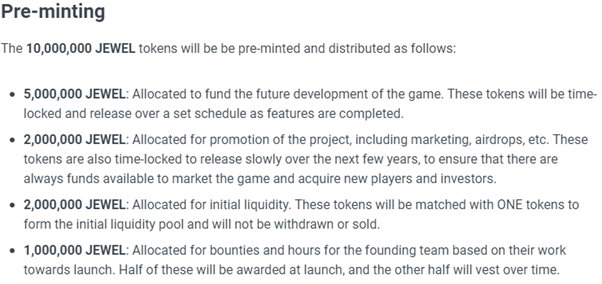

For example DeFi Kingdoms, the top Dapp on the Harmony One Blockchain by TVL, pre-mined 10 million tokens for various purposes, such as rewarding their game developers and providing liquidity.

Though it can be easy to be worried that the developers can sell all their tokens at a peak, deflating token price, their vesting schedules can help you make a better-informed decision.

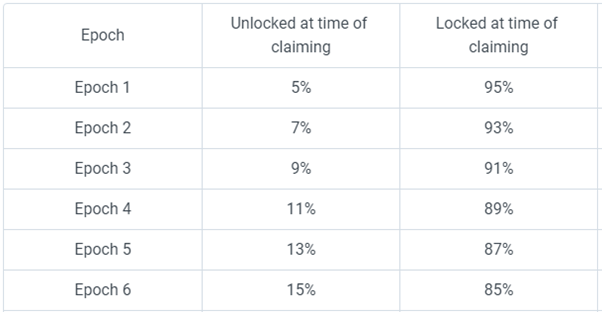

DeFi Kingdoms has a solid vesting schedule, only allowing liquidity providers to unlock a certain amount of their farmed tokens each Epoch, which lasts about a week each.

This assures that supply is not aggressively increased with respect to demand and allows token prices to remain stable.

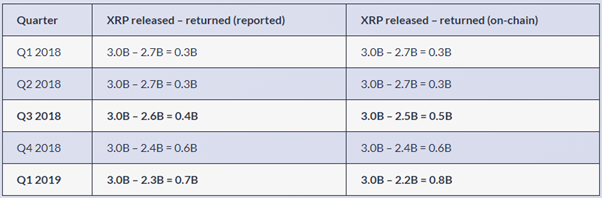

Compared to this, $XRP’s vesting schedule releases an immense number of tokens into the open market constantly, deflating its prices despite a growing market capitalization.

Furthermore, poor management of their vesting schedule has led to discrepancies in the reported amount of $XRP released into the open market.

Though the project may be sound, Tokenomics means that from an investor perspective, these tokens have a lot of opportunity cost to hold.

Inflationary / deflationary tactics

Inflation occurs when the supply of tokens increases, causing your token to be worth less and vice versa for deflation.

Though most tokens will constantly increase in supply, their developers can apply deflationary tactics to cut the total circulating supply in order to reward those who hold their token.

For example, some projects allocate a percentage of tokens to be “burned” as gas fees during every transaction to counter supply inflows.

6174 ($18M @ ~2915) with 273 ETH burned in the last hour 🔥🔥

— The # of ETH burned is: (@ethereumburn) August 6, 2021

Avg Burn Rate (24H): ~167 ETH/hr

The most notable recent example of this is EIP-1559, a hard fork which causes parts of the transaction fee for $ETH to be burnt.

Though miners can still earn $ETH and add to open market supply, burning the cryptocurrency will eventually allow $ETH to become deflationary and allow its price to rise respectively.

Projects can also go the TVL (Total Value Locked) route, where they incentivize users to lock their tokens up in order to take them out of circulating supply.

For example, while $AAVE has large supply inflows into the market thanks to liquidity mining protocols, $19 Billion in the token has been locked in its various apps thanks to these same incentives, keeping its price attractive to investors.

However, even if supply controls are effective, there is still the risk of a project failing if its ecosystem doesn’t exist. There must be demand for the tokens and being able to spot whether users will purchase tokens to participate in a network is important.

This can be for various reasons like DeFi with $AAVE, governance with $DOT or even staking with many exchange’s native tokens.

Finding tokenomics

Thanks to the beauty of blockchain, most projects have a whitepaper or roadmap released to inform possible investors on their tokenomics.

For more opaque blockchains, on-chain data can usually help, and supply increases can be tracked via websites such as coinmarketcap, where you can see the circulating supply vs total max supply.

Featured Image Credit: Chain Debrief

Also Read: Looking For The Next 10x? Why You Should Consider Investing In An Initial Dex Offering (IDO)