Kadena is a proof-of-work platform that combines both a Layer 1 public chain protocol with a Layer 2 network to provide high throughput while maintaining security and scalability.

The platform aims to use the blockchain for real-world use cases, with tools and services ready for widespread adoption

Meet the team

Even in a space filled with brilliant minds, Kadena has put together a team of experts that simply manages to astonish.

The project was founded by Stuart Popejoy and Will Martino, who were leading JPMorgan’s Blockchain group and the SEC’s Cryptocurrency Steering Committee respectively.

Together, they built JPMorgan’s first blockchain, now known as JPM Coin and eventually moved on to start Kadena.

The project also features members who worked at Microsoft, Google and Disney. Most notably though, their team includes Dr. Stuart Haber, the co-inventor of blockchain, whose studies were cited multiple times in the Bitcoin White Paper itself.

While the sheer expertise present in the team already presents a bullish case for the protocol, co-founder Will Martino’s expertise in the SEC (America’s Securities and Exchange Commission) is especially important.

Given that the SEC has been stepping up cryptocurrency-related regulations, knowing how to work with them may be the most important factor in securing the project’s future.

What is Kadena?

Kadena aims to provide blockchain solutions for enterprises and entrepreneurs, providing the security of Bitcoin, virtually free gas fees, and high throughput.

Furthermore, it uses the smart contract language PACT, which is supposed to be more accessible to the layman than other coding languages.

In a world where every cryptocurrency is seemingly moving to Proof-Of-Stake to process transactions on their blockchain, Kadena is instead going back to Proof-Of-Work, which it believes is the safest method of securing their blockchain.

However, this comes with scalability issues, best seen by Bitcoin and Ethereum, which both have expensive transactions, and are slow compared to newer blockchains.

To solve this, Kadena uses a “chainweb”, which essentially “shards” transactions. Sharding is a process where transactions are broken up into smaller blocks, allowing them to be processed faster and cheaper, something Ethereum is also trying to do with it’s upgrade to Ethereum 2.0.

Chainweb also allows Kadena’s Proof-Of-Work system to remain energy efficient even when scaling, unlike Bitcoin and Ethereum, allowing it to be adopted with less resistance.

Kadena’s Layer 2 private blockchain “Kuros” builds on this by allowing enterprise users to leverage its layer 1’s scalability and throughput to process and automate workflow via smart contracts.

\A simple use case for Kuros is data transaction for insurance providers. In fact, Kadena has already performed a proof of concept for its enterprise use case.

The protocol is currently working with Rymedi, a start-up that develops healthcare applications on the blockchain, to collect real-world data on healthcare products using blockchain technology and with USCF (US Commodities Fund Investments) to provide next-generation ETFs (Exchange-Traded Funds).

Tokenomics

In November, Kadena’s native token, $KDA, skyrocketed by 1400% from just October. Thanks to positive news and various exchange listings, it peaked at US$28.25 before a sharp correction.

It is now treading at around US$11.75 at the time of writing.

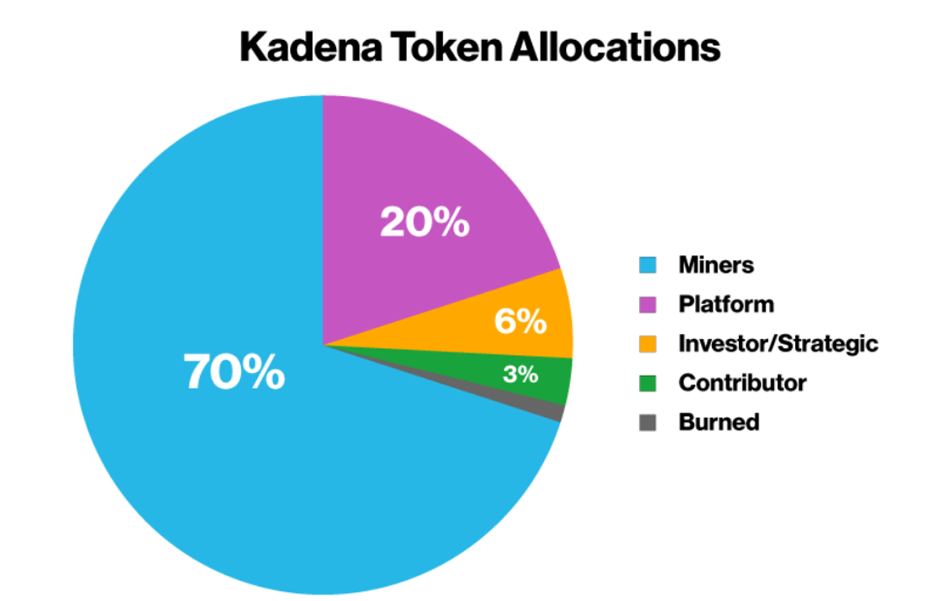

A majority of $KDA is mainly reserved for miners as rewards for facilitating transactions on its blockchain. According to Kadena’s block explorer, there are currently 157.7 million $KDA circulating and the estimated emission rate of $KDA is 48 Million tokens per year.

Mining rewards will also face a “halving” every year, where the amount of tokens awarded to miners per block decreases by half.

This system models itself after Bitcoin, which has a halving event about every four years and is designed to eventually make the token deflationary.

However, token emissions schedules can be manually adjusted by Kadena and maybe eventually by a DAO (Decentralized Autonomous Organisation). Investor/contributor allocations will also be fully vested in 2022, but no clear dates are given.

KDA Staking officially reopened!!

— CoinMetro (@CoinMetro) November 3, 2021

We just filled 730,000 $KDA capacity in 20 minutes!

That is $5,800,000+ worth of KDA Rocket

Proud to be supporting @kadena_io LFG! https://t.co/74AAgbX4rT#Staking #CoinMetro #Kadena #DeFi

Another reason for its price spike may be that $KDA can now be staked on cryptocurrency exchange CoinMetro for up to 18% APY.

With US$5.8 million worth of the tokens staked in 20 minutes, it shows a strong community mindset behind DeFi (Decentralized Finance) and yield farming amongst the Kadena community, which would help increase demand of the token.

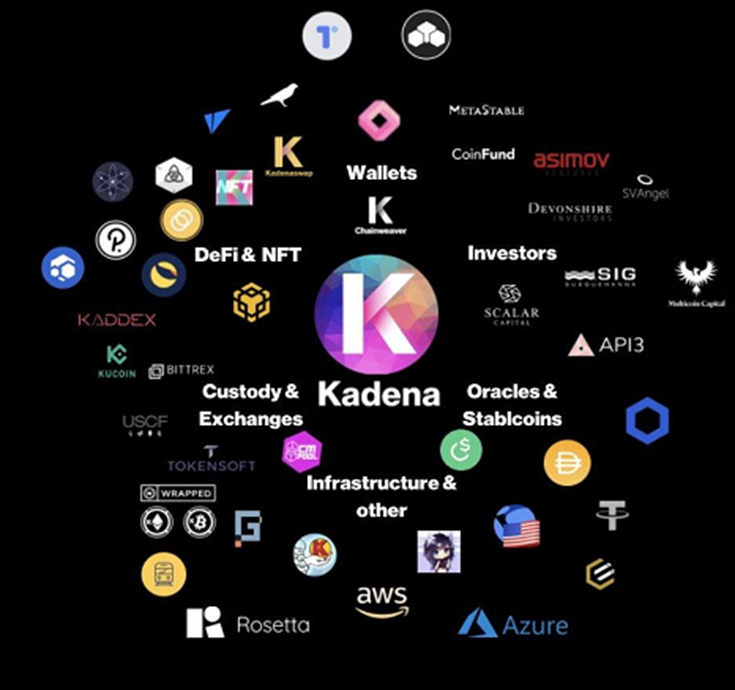

Kadena’s partnerships and plans

Recently, Kadena bridged to the Ethereum Mainnet, allowing $KDA to be wrapped as an ERC-20 token. Bridging cross-chain with not only Ethereum, but other Layer 1s such as Terra and Polkadot will also allow unlock liquidity that can be used on the Kadena network.

Furthermore, the Kadena network allows for “gas stations”, where transaction fees can be refunded from a community pool. Not having to transact in the native token allows further ease of use and onboard new parties onto the network.

Wrapped Kadena, $wKDA, has been submitted to @ethplorer!

— Kadena (@kadena_io) November 6, 2021

Soon you'll find Wrapped $KDA on an Ethereum-based #DEX near you!

Along with bridging to #ETH, @kadena_io is committed to expanding to other layer-1 protocols such as @terra_money, @Polkadot, @CeloOrg, @cosmos, & more! https://t.co/xCExLkLcX5

The protocol has also been expanding rapidly to target the latest trends. This includes DeFi, Kadena as a DAO, which will give its token further use in governance, and NFTs. Play-to-Earn games, the latest trend in the crypto space, are al so coming to the network.

Their list of partners goes all the way from big name companies like Amazon to the latest yield farming protocols such as Terra.

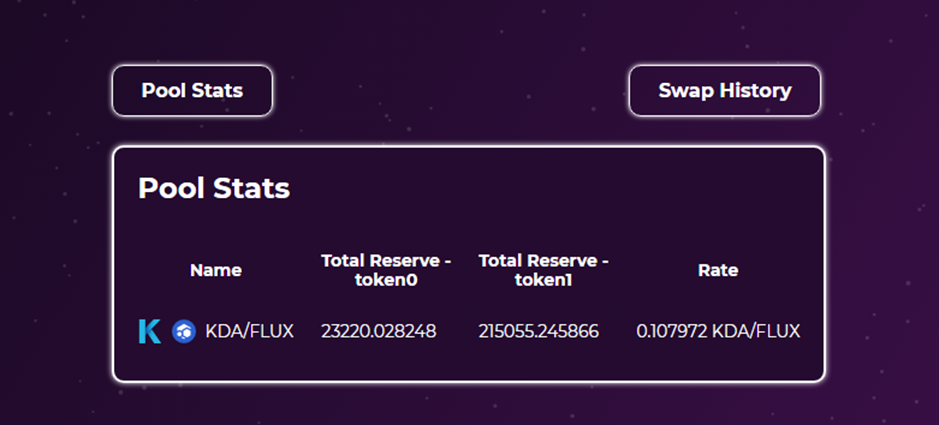

Currently, the only major project available for retail users is its decentralized exchange and liquidity pool, and only between the $KDA and $FLUX pair.

However, with the Kadena protocol granting grants up to US$50,000 to help develop initiatives and hot new projects, there still remains a lot of potential for this network.

Featured Image Credit: Crypto Ninjas

Also Read: A Look At The Sandbox: Is It The Next Big Metaverse Project?