Previously we wrote about Decentralised Finance (DeFi) yield farming and the tokenomics of DeFI yield farms.

The innate issue of DeFi yield farms is that the yield is highly dependent on the price of the native token. Once the market turns bearish and starts dumping the token, the token price would collapse and yield gets eroded.

On the other hand, DeFi options vaults adopt a more sustainable model and does not rely on a reward token for base yield.

To understand how DOVs work, we must first begin with options, the core product of DOVs.

What are options?

An Option is a financial contract that gives the user the right, but not the obligation, to buy or sell an asset at a predetermined price on or before a certain date.

Investors who wish to purchase an option contract would have to pay an option premium to the other party.

The most common type of options are call options and put options. A call option gives the contract holder the right to buy the underlying asset at the predetermined price before the contract expiry date.

Whereas put option gives the contract holder the right to sell the underlying asset at the predetermined price before the contract expiry date.

Options are primarily used to hedge against the underlying risk of the asset.

If an investor is bearish on an asset but does not want to sell the asset, the investor can hedge by buying a put option on the asset.

If the price of the asset declines, the investor can exercise the contract and sell the asset at the predetermined price to limit the losses.

Value proposition of DOVs

One of the most lucrative ways to earn yield is through options strategies. Most people do not utilize options strategies as it is accompanied by the cumbersome process of employing the strategies.

What makes DOVs shine is the simplicity of it. DOVs allow users to bypass the hassle of options strategies and only have to simply stake their assets into vaults. The protocol would automatically deploy the staked assets into specified options strategies through the use of smart contract.

Users would then earn yield from the premiums paid by the options buyers. Furthermore, users are rewarded with native tokens which further increase the total yield. Certain protocol allow users to stake the native token and effectively creating three sources of yield in a single vault.

As the base yield is obtained from the payment of option premiums rather than reward token, the yield would be sustainable in the long run no matter if it is a bull or bear market.

Strategies used

At the time of writing, DOVs utilize simple covered calls and covered puts strategies.

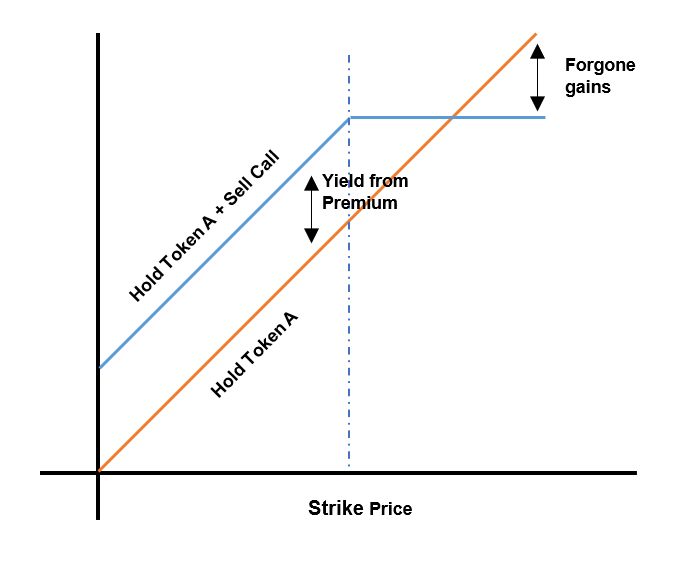

The covered call strategy can be broken down into two parts. The first part is when DOVs holds a long position in the token.

The second part is when the vault sells call option on the same token. Essentially what this does is that the call option is covered by the long position held by the vault, hence the term ‘covered’ call.

As there is no such thing as a free lunch, this strategy does come with its own risk. In the event that the token price starts appreciating greatly and hit the strike price, the option would be exercised and the token would be sold.

User of DOVs has a choice to choose either covered call or covered put strategy. If the user feels bearish, he can opt-in for the covered call position and earn yield as the market goes down. Vice versa for user who feels bullish, he can opt for the covered put option to earn yield.

In the future, DOVs may start introducing more sophisticated options strategies that would use the collateral effectively and amplify the base yield.

Where to begin

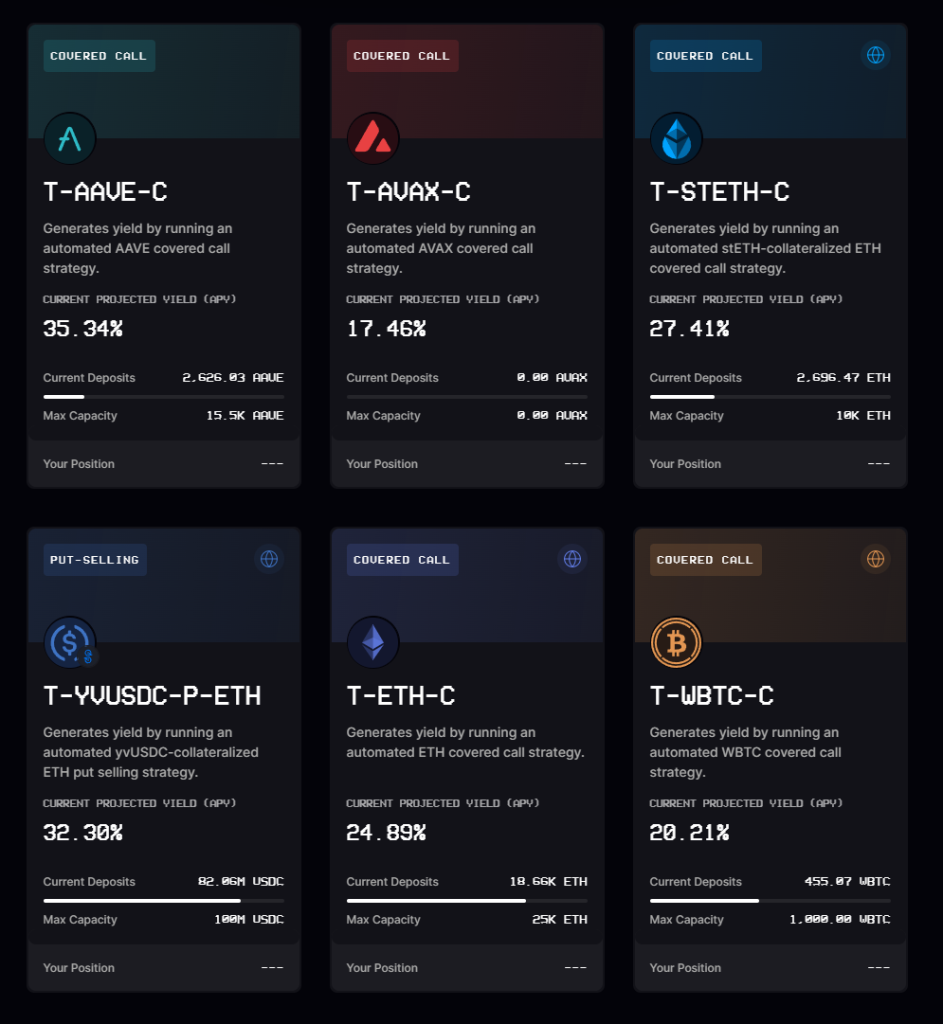

Ribbon Finance is a battle-tested pioneer protocol in the DOV space. The Ethereum on-chain vault launched on February 13, 2020, helped simplify option trading with the use of smart contracts.

At the time of writing, Ribbon Finance has over US$190 million TVL mostly in ETH. The protocol also offers AAVE, WBTC, and STETH.

Users simply have to deposit their ETH into the vault and the vault would automatically deploy the strategy. The current projected yield would earn the user 24.89% APY. If the call option sold is not exercised, the ETH would be returned back to Ribbon vault.

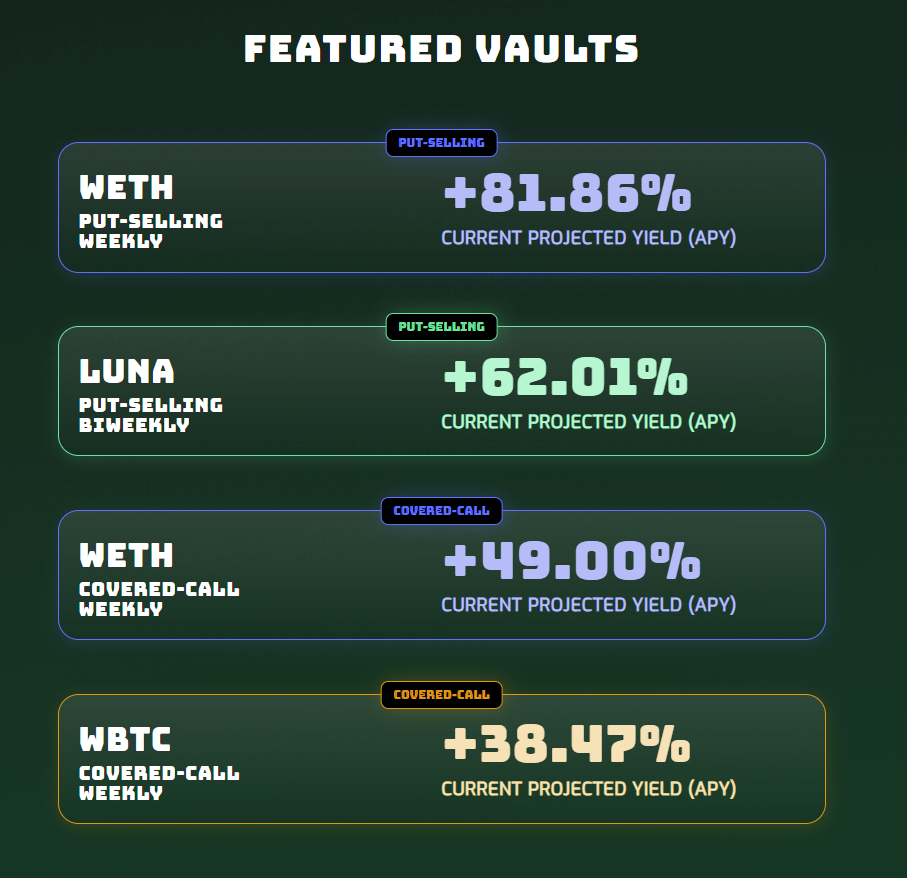

Thetanuts Finance is a multi-chain protocol currently deployed on Ethereum, Binance Smart Chain, Polygon, Fantom, and Avalanche with many more chains launching soon.

Its goal is to fill the demand gap for Altcoins options. With over US$42 Million in TVL, it currently offers WBTC, ETH, LUNA, ALGO, ADA, and BCH vault.

Similar to Ribbon Finance, Thetanuts is also a hassle-free DOV. Currently, Thetanuts covered call projected yield for WEth is much higher at 49% than Ribbon Finance Eth at 24.89%.

Other notable DOVs

Frikition Finance – Powered by Solana, Frikition Finance currently offers BTC, SOL, and ETH vaults. With upcoming vault that helps liquidity providers hedge against impermanent loss.

Arrow Markets – Backed by notable investors (Alameda Ventures, Delphi Digital), Arrow Markets is the next generation of options market.

Conclusion

To sum up, yield farming on DeFi option vault is revolutionary and worth considering. Especially when the base yield is derived from options premium and not relative to the token price. Keep in mind that while it is unlikely, there is a risk that the option contract get exercised.

Always do your own due diligence and be mindful of the risks before diving headfirst.

Featured Image Credit: NewsBTC

Also Read: https://chaindebrief.com/synthetix-leading-derivatives-protocol-in-defi/