With the crypto market dipping, many are asking themselves if now is the time to be stocking up on more tokens.

If your answer is yes, this article is a must-read with KlimaDAO pondering at all-time lows. This article serves as a brief, overview of KlimaDAO.

What is Klima DAO?

KlimaDAO aims to fight climate change by accumulating carbon-backed assets and locking them in its treasury. This is done by pegging every KLIMA token to 1 tonne of carbon offsets.

By also being a fork of Olympus DAO, they effectively use Web3.0 as its channel to build a sustainable community and KLIMA token.

Every KLIMA token is fungible, backed by 1 tonne of verified carbon offsets, and gives holders the ability to vote on varying KlimaDAO policies.

The DAO serves the role of a “de-central” bank, governing the monetary policy of this new carbon-backed currency, just as a central bank governs the monetary policy of a fiat currency. Over time, an economy will be built around KLIMA by driving adoption and unlocking the growth of the crypto-carbon economy.

Why buy KLIMA?

The amount of carbon in our treasury is equivalent to the emissions of over 1 trillion smartphone charges. pic.twitter.com/BdVfhlvuzv

— Klima DAO (🎄,🎄) (@KlimaDAO) November 8, 2021

1. Value is not derived by financials but being a key player in fighting climate change

It is a decentralized autonomous organization created for change. It creates organizational incentives to solve critical issues of the carbon markets, fluidity, opacity and disorganization.

It concentrates on climate change and makes low-carbon technologies and carbon-removal projects more profitable. It will be the single largest disruptor of the carbon markets for setting a new monetary system financed by carbon.

Using KlimaDAO’s Coin will enhance value creation for its community and create a worthy cycle of growth. Ultimately, the KLIMA Token will function as a truly supportable asset and medium-of-exchange with real global value.

2. It rewards long-term holders well

Staking is designed to incentivize the longer-term holding of KLIMA and to give market participants exposure to the climbing price of carbon.

The longer participants HODL and stake, the more they compound and the more KLIMA tokens they will have when they unstake.

3. The community and founders

Having been in the Klima community since its launch on 18th October, I have had the privilege to be in one of the friendliest and most consistent communities I have seen so far.

In the Klima Community, many truly believe in the power of decentralization and you can constantly observe members with key roles in the carbon industry offering to contribute and help the project.

Many times when key decisions are being made and certain instructions are hard to understand, members that do are keen to help others out as well.

How do I participate in KLIMA?

You might be looking to get into KLIMA but its whitepaper makes you giddy, so here are three key ways you can participate in the Klima Ecosystem.

1. Buying

As KLIMA is on the polygon network, to buy KLIMA you will need tokens on the Polygon Network specifically. After obtaining tokens on the Polygon Network, you can then swap to KLIMA on SushiSwap.

You can choose to hold KLIMA without staking it, but I highly encourage staking! I don’t see why you wouldn’t take extra KLIMA.

2. Staking

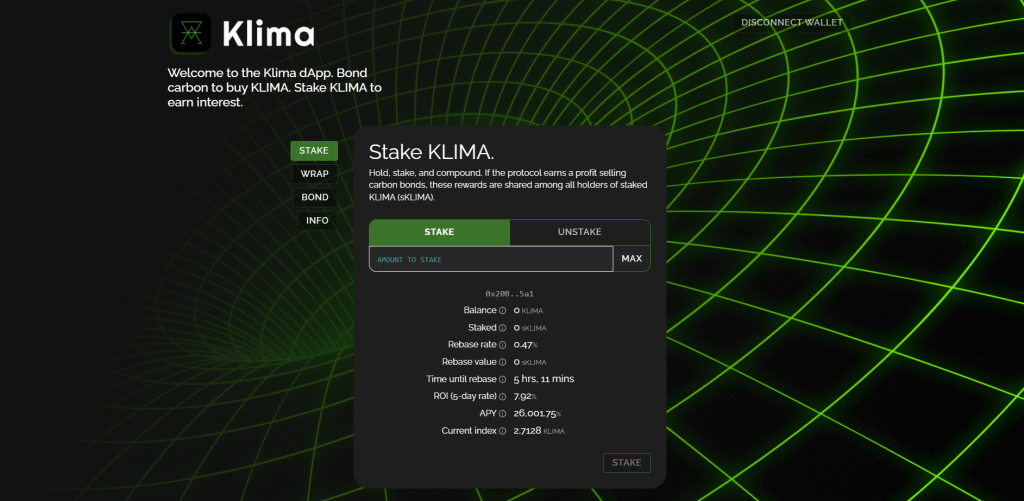

When KLIMA is staked via the staking contract, you receive sKLIMA, which stands for Staked KLIMA, on a 1:1 basis. sKLIMA automatically compounds via rebase operations, but it is illiquid and not officially listed on any DEX.

sKLIMA can, however, be transferred between wallets. For example, you can move your sKLIMA from a hot wallet to a cold wallet. When you unstake, you will always receive KLIMA on a 1:1 basis for your sKLIMA holdings.

KLIMA can be staked on Klima’s dAPP.

Rebase operations happen every 8 hours, and a rebase is basically adjusting circulating capacity, for example, a decrease by burning out the tokens or an increase by adding tokens to supply, including all holder’s and LP’s holding tokens count.

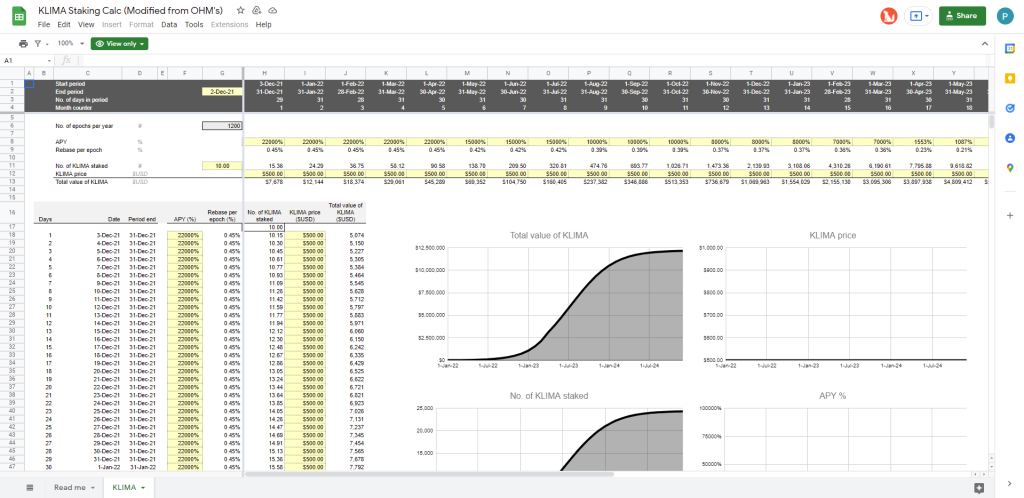

You can visualize your estimated staking rewards by using a rebase calculator that looks like this:

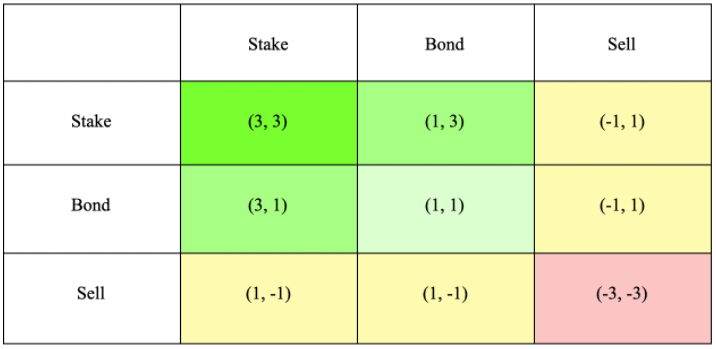

If you have been in crypto for a while you might have heard people talking about (3,3) or (9,9). The table below is what they are referring to! Participants who (3,3) are favoured as by staking, they support the project directly.

While (9,9) is not in this included table, we can imply that it might also be a viable strategy you want to implore. (9,9) is the form of leveraging on your investment, by lending your KLIMA as collateral, you are entitled to borrow a limit of stable coins that you can then use to buy more of your initial investment which in this case is KLIMA.

You can do this as many times as you want until your limit is hit, depending on the risk you are looking to take! In another perspective, (9,9) is a form of increasing your APY on your initial investment as well, as more capital would lead to more returns compounded over each rebase.

You can use a site like this: https://polygon.market.xyz/

3. Bonding

Lastly, bonding is the process of trading a Liquidity Pool (LP) share to the protocol for KLIMA. The protocol will quote an amount of KLIMA, a discount, and a vesting period for the trade. Bonding will reward the participant with a discount on the market price of KLIMA.

This enables the treasury to collateralize with more than just BCTs and increase its purchasing power (for BCTs), thereby increasing supply. Think of bonding as a way for Klima to accumulate more carbon-backed assets!

Currently, the protocol takes in:

- Reserve Assets: BCT (Base Carbon Tonnes)

- Liquidity Assets: KLIMA/BCT and BCT/USDC SushiSwap LP pairs.

Bonding is more catered towards participants that already have a hold of those assets, or participants that are expecting certain price movements.

Wrapping Up

By creating a sustainable project that directly supports the carbon industry and combating climate change, I believe Klima DAO has a chance in playing a key role in the carbon industry which will create value for KLIMA tokens and their holders.

This will subsequently lead to onboarding more people into the Klima ecosystem which will potentially bring about a reversal in the damage of our earth.

Featured Image Credit: KlimaDAO

Also Read: Elrond ($EGLD): The Business Model Behind The First Blockchain To Coin The Term DeFi 2.0