For the purposes of the 2022 annual recap, there will be no meme coins/ stablecoins included. We will only focus on five top projects and how they performed this year.

This year has been tough; we entered the year with a booming spirit, and it almost felt like 2022 was going to be the year for mass adoption. Little did we know, we were heading towards a great storm.

In hindsight, how naive were we? The up-only narrative can only be fueled for so long; we should have known it would not last forever.

“LUNA” and “FTX” are the two most triggering words you think about when you think of 2022. Go to any crypto native this year and whisper those to them; you will either be met with great hostility or disappointment, likely both.

And the macro conditions did not make anything better; inflation and the Russia-Ukraine war caused massive supply shocks to trickle backlash to the crypto markets. If you survived this year unscathed, you are a winter soldier.

1. Someone told me Bitcoin would hit 100k in 2022…

Everyone thought Bitcoin would see new levels at the start of this year, but the world always has a way of playing out the opposite. We weren’t even close.

As of 2022, Bitcoin miners are awarded 6.25 bitcoins for each block they successfully mined. This year, we saw the 3rd biggest Bitcoin miner selling. The FTX fraud also did the miners dirty, leaving them to go bust while hash rates were trending down.

While we see countries like El Salvador expanding their Bitcoins holdings this year, the “digital gold” is starting to make waves in adoption, especially in Brazil, where they recognize Bitcoin as a means of payment.

Micheal Saylor? Still bullish, and Tesla still holds Bitcoin on its balance sheet.

Bitcoin remains the “one true coin.” If anything, there are no ponzinomics or recursive token dynamics, just pure supply and demand.

2. The only thing unsuccessful about Ethereum is its price

Although Ethereum’s price action did not live up to my expectations of 2022, there are certainly few wins recorded by the 2nd largest cryptocurrency this year.

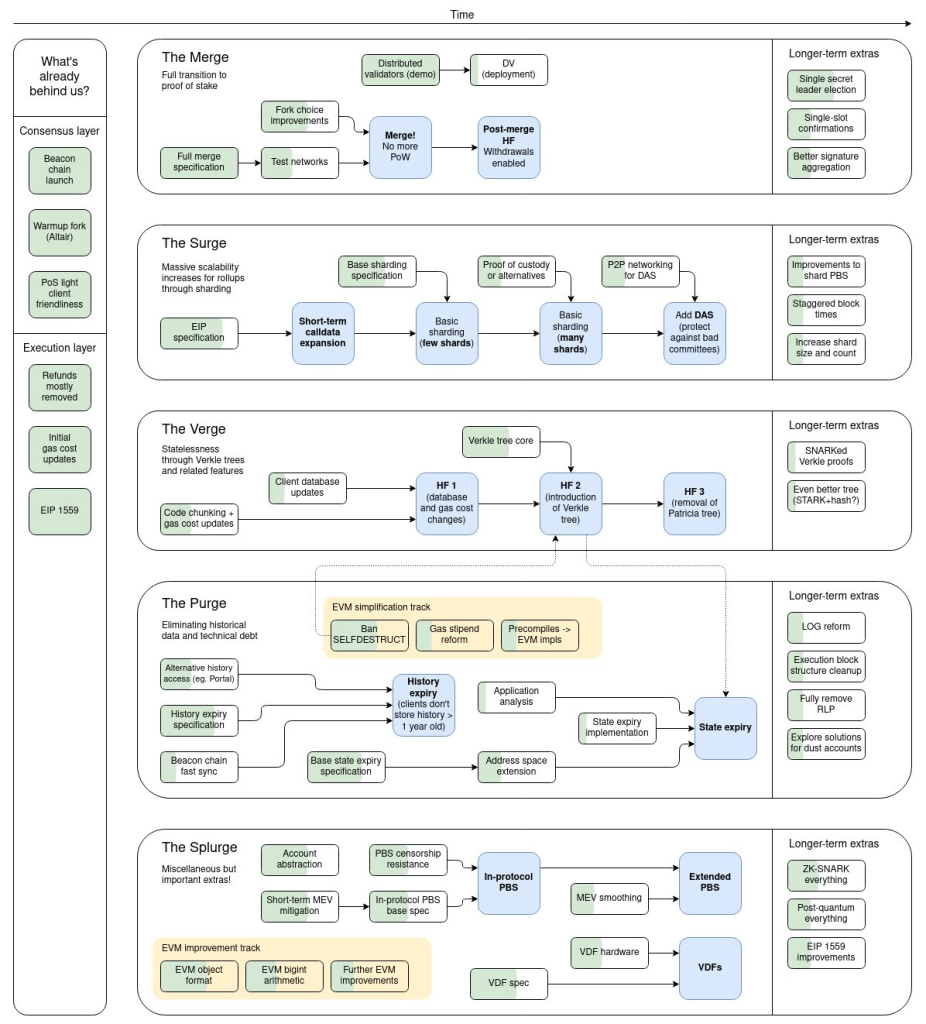

Well, let’s kick things off with the successful merge. Ethereum’s new “software upgrade” to PoS is set to slash the network’s energy consumption by 99.5%.

Chapter 1 is complete; next is the Surge.

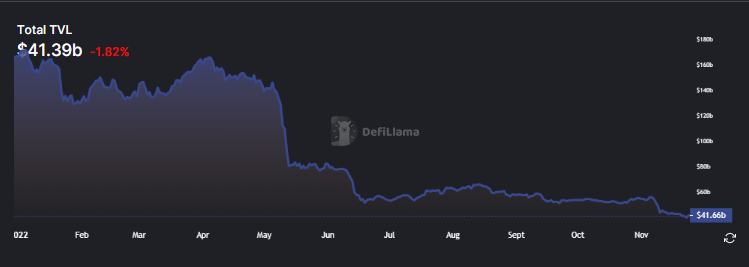

At the heart of Ethereum is DeFi. While the stats on DeFi Llama only reflect what remains of an uninterested space, at its core, development here will lay the foundation for what is to come in the next bull run.

DeFi on Ethereum continues to pursue innovations and improve existing products.

Curve, for instance, picked up the pieces of what remained within the stablecoin scene by pushing a new stablecoin, which is self-liquidating and better helps manage a portfolio passively.

Big Ethereum players like UNISWAP and AAVE pushed out V3 of their products.

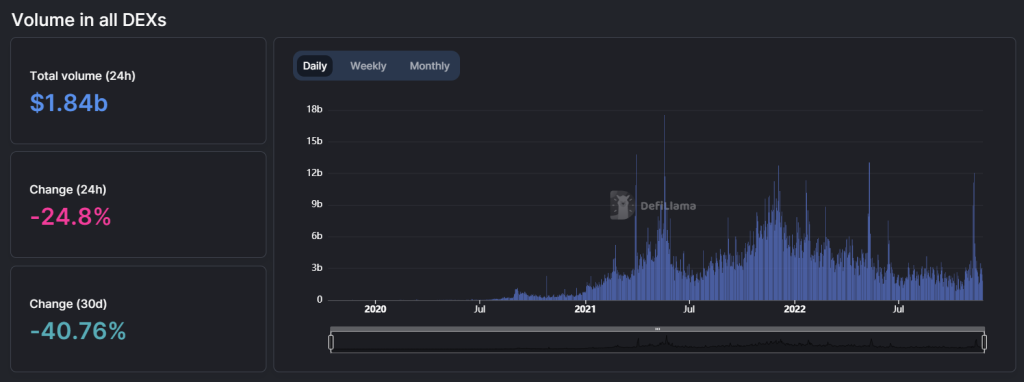

The demand for decentralized exchanges became a prevalent alternative after centralized has proven not to be trusted.

While layer2s continue to lead the charge, transactions on Arbitrum and Optimism have been increasing exponentially. Giving hope to the possibility of the flippenin coming true

Ethereum is also the home to ZK and its Optimistic roll-ups as a scalable solution to Ethereum. Technology that would indefinitely contribute to shaping the blockchain future.

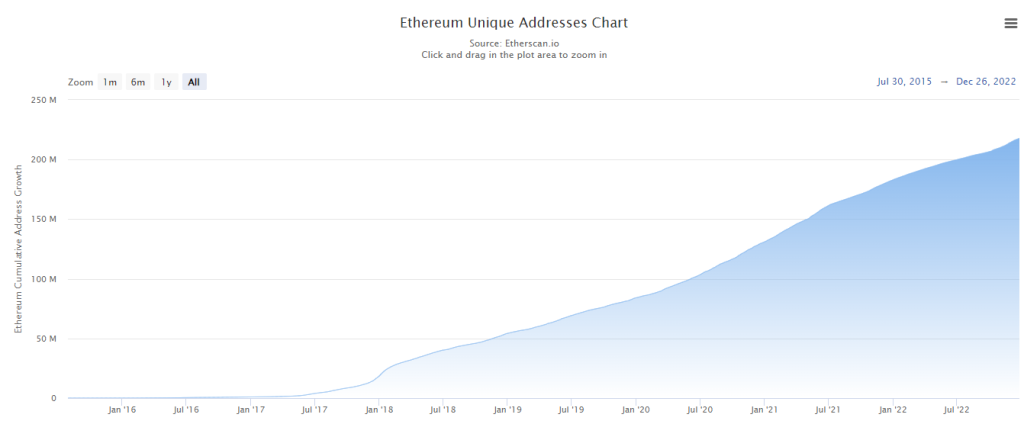

After dipping into being net deflationary for some time, Ethereum’s daily verified contracts have been increasing parabolically.

Ethereum unique addresses are also up.

Ethereum also saw its highest number of active ERC20 addresses since May 2020.

The best silver lining to the FTX fiasco is the increased decentralized trading volumes. This stat is higher than the bottom of July 2021 and any point before Feb 2021.

Also read: 3 Reasons Vitalik Is Excited For Ethereum And Why You Should Pay Close Attention.

3. The leader of BNB is the hero we need, not deserve

Not only is Binance leading the forefront in being the biggest crypto exchange in the world, but they also pride itself in being transparent, even with its reserves.

Since I last remember, they have always been at the top of the spot exchanges charts.

While Ethereum is the clear leader in DeFi TVL, BNB Chain is not far behind, currently at $4.16B. Q4 2022 also saw users on the BNB chain grow 6.6%, amounting to 1.7M new users.

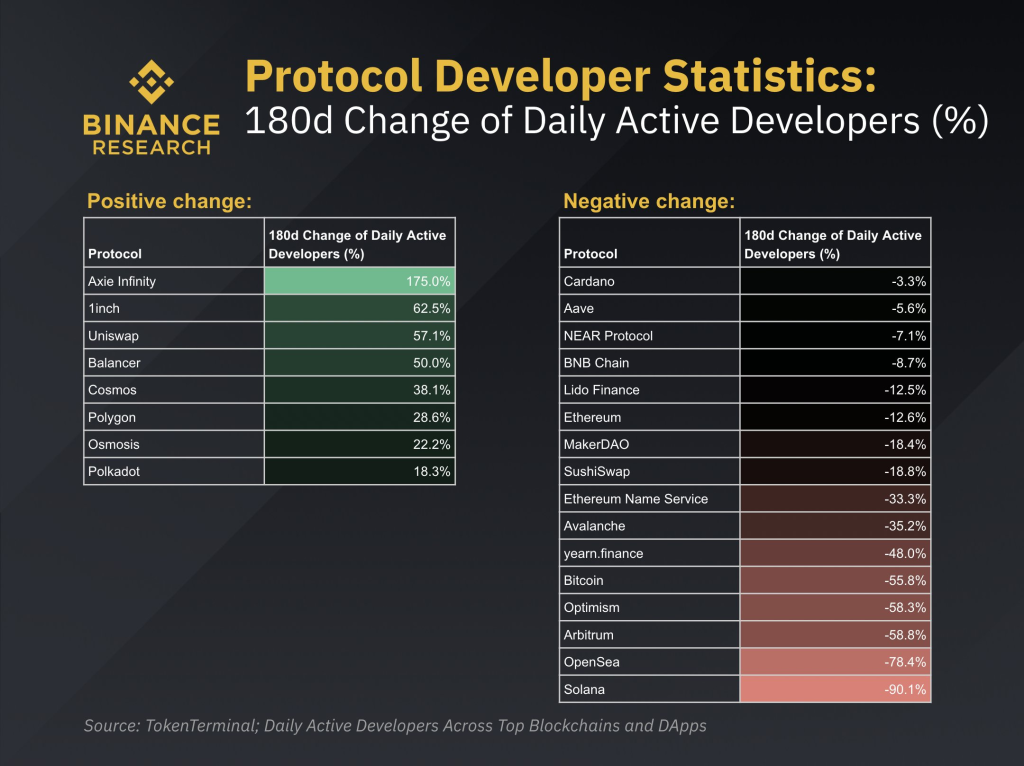

Active developers are on a steady rise and a 50% rise in trading volume over the past 30 days, averaging higher than the average of Q1 2022.

Pancakeswap clinched the third spot by revenue generated in Q3/Q4 of 2022, behind Opensea and dYdX, respectively.

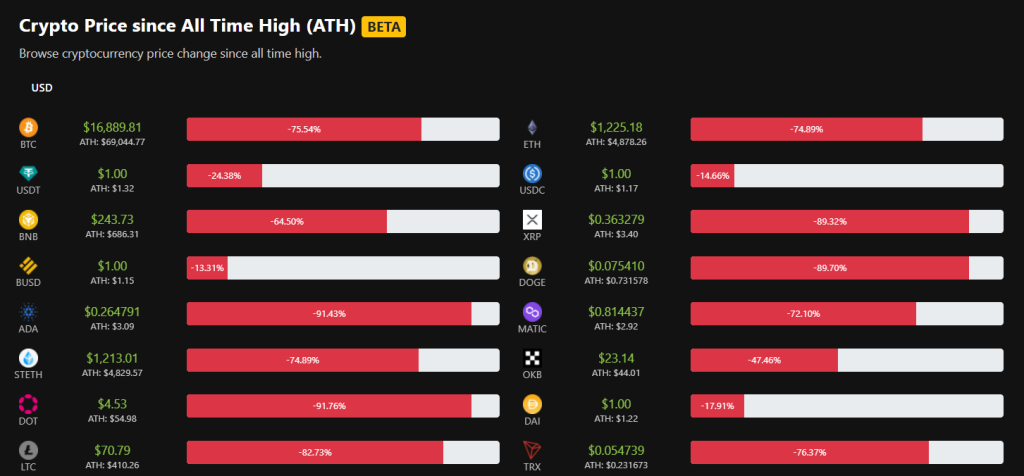

Furthermore, BNB’s relative strength, compared to the rest of the market, could be remarkable, declining 64% compared to -75% of Bitcoin, -74% of Ether, and -72% of Matic from their ATHs.

They went big with Binance academy, launched a global law enforcement training program, plans to enter Japan after acquiring JFSA Registered Sakura Exchange BitCoin and completed its 21st BNB burn, a total of 2,065,152.42 BNB burnt approximating $575M in value.

They even managed to push out Cristiano Ronaldo’s NFT collection.

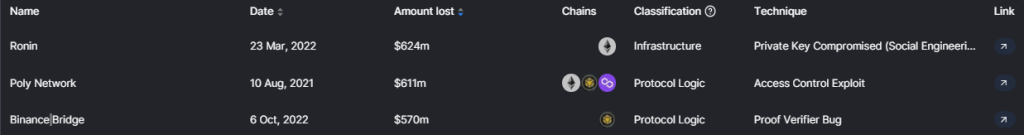

The year has not been easy; this is even applicable to Binance. According to DeFiLlama’s data, the hack on the Binance bridge on the 6th of October 2022 saw it being the 3rd most significant exploit in the history of crypto; stolen funds amounted to $570M.

In the last quarter of 2022, though, things got interesting. BNB’s main involvement came from the CEO’s decision on Twitter to dump FTX’s native token, $FTT, after the leak of Alameda research’s balance sheet revealed a not so ‘clean reserve.’

Read more on the Signs The FTX Crash Was Bound To Happen.

While this cascaded to one of the biggest selling events in crypto this year, many rumours are circulating that Binance could also find itself in murky waters, too, insolvency.

We took two approaches wearing a pair of unbiased lenses. The first was to tap on on-chain data to all the FUD surrounding them.

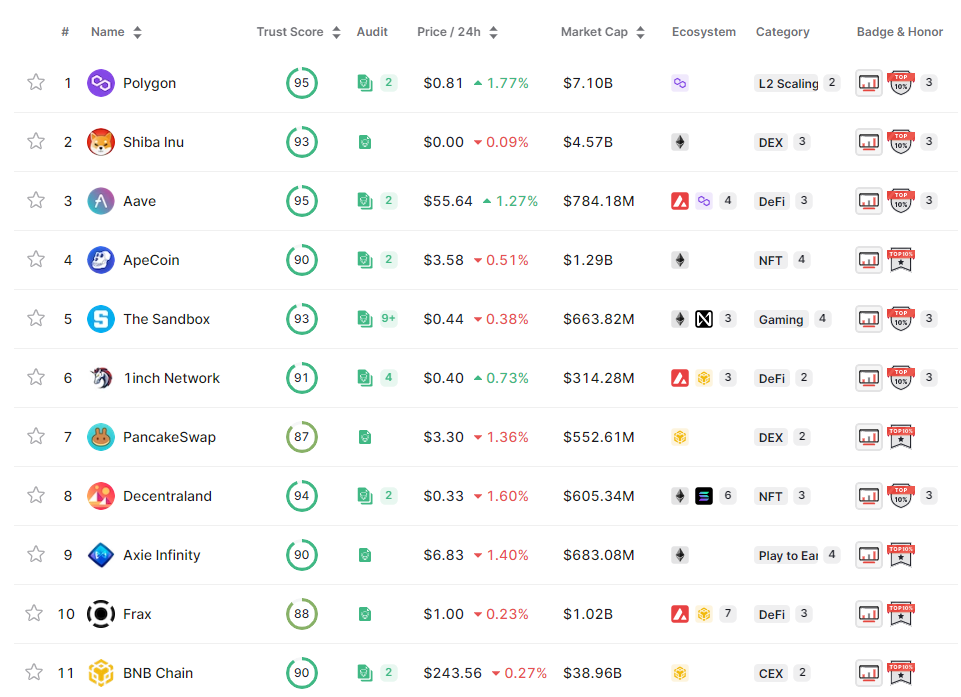

According to Certik’s Web3 leaderboard ranking, BNB Chain ranks 11th, with a trust score of 90.

Betting on BNB is also a direct bet on lord supreme CZ. In a way, BNB grants you exposure to both the exchange and the L1 itself; getting into BNB will bring value accrual to you in two ways. With CZ seemingly at the forefront of global adoption and his diligent approach to security and regulation, BNB may be one to watch in the coming year.

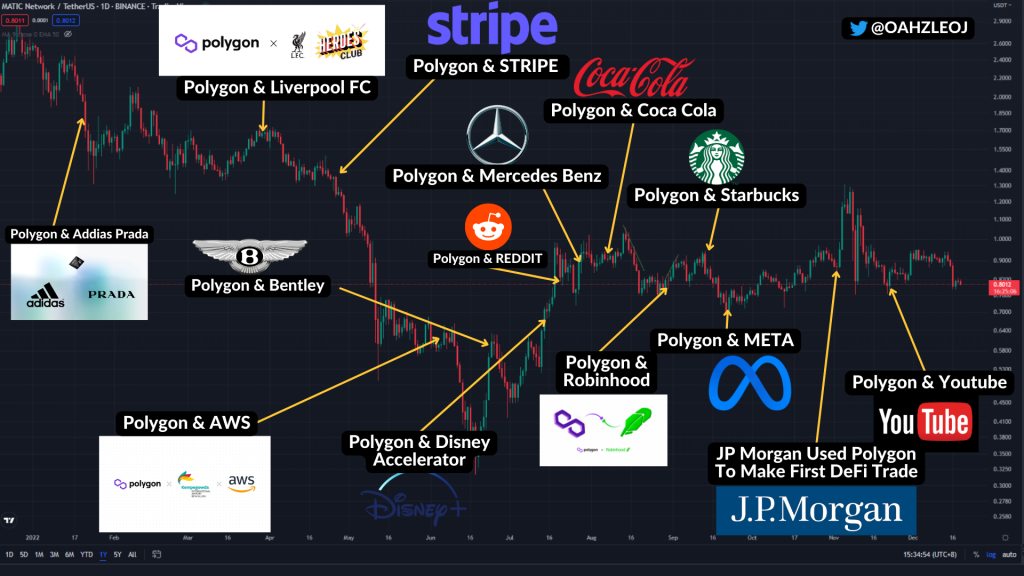

4. Polygon’s business development team needs a pay raise

We covered Polygon in our Weekly Newsletter sometime ago, be sure to subscribe to get the latest scoop into protocol deep dives.

Polygon Matic has reached a critical tipping point in mainstream brand awareness. It has also been accepted as an industry standard for web3 integration.

You may ask, what does this mean? Simply put, it will accelerate network demand, and the price of MATIC should appreciate accordingly.

The partnerships above add additional value to the polygon network in two ways.

Firstly, network participants. More participants will lead to more participants and increase demand for MATIC. They are citing Metcalf’s law and increase in network value.

Secondly, brand awareness. While many quickly think about Bitcoin and Ethereum when the word crypto is thrown around, I guess that polygon will likely be next. Partnerships build credibility, and with that, Polygon is positioning itself as the “go-to” blockchain for any interested web2 company.

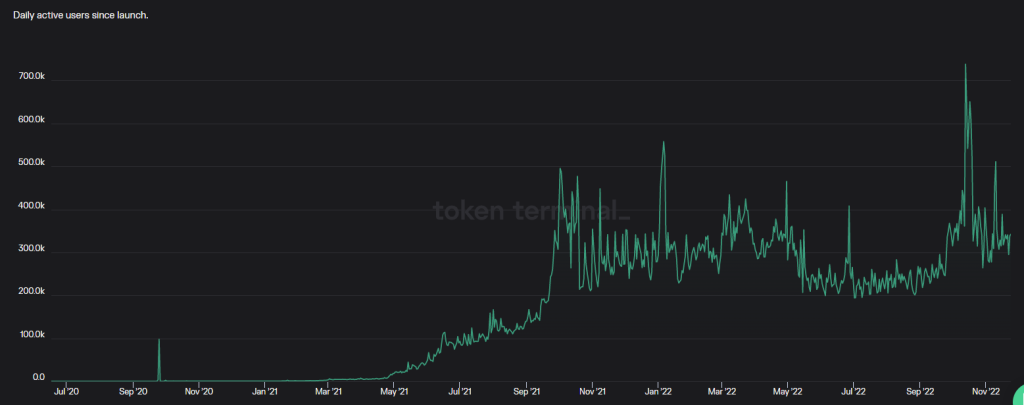

This will likely see this chart below go parabolic.

Although this may be a project crypto natives are familiar with, their immense positioning in the market makes them, in my opinion, severely undervalued.

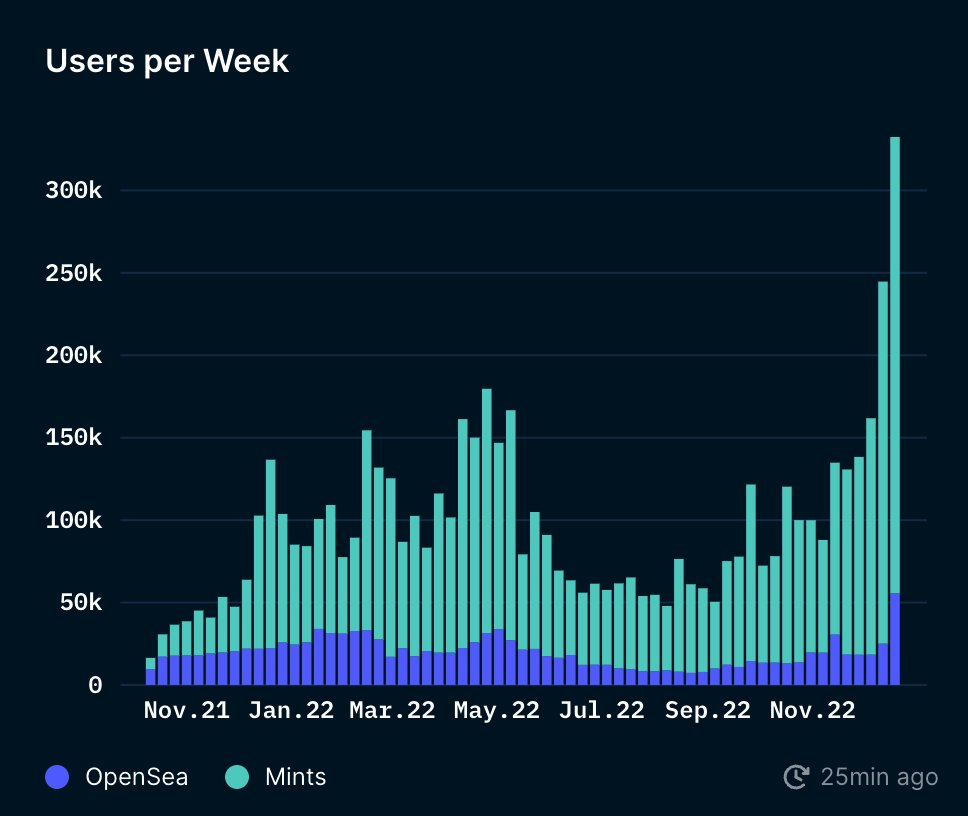

For Gaming and NFTs, they have an arm called Polygon Studios that solely focuses on onboarding and incubating Metaverse projects.

According to Nansen, 332,000+ users minted or traded NFTs on Polygon.

For funds, they have an ecosystem fund and a Polygon DAO used to advance and boost the web3 space by supporting ventures, developers and projects.

Calling all #DeScientists 🔬

— Polygon DAO 💜 (@0xPolygonDAO) November 29, 2022

The #DeSci contest is wrapping up in less than 24 hours! Don't miss out on getting your submissions in and possibly winning some USDC and recognition for your work 👀

👉 https://t.co/fN4OFaPHUX

More details 👇https://t.co/IhW7m384Ap pic.twitter.com/frfweZpXXV

For sustainability, they have a program which helped them go carbon negative. Green investing narratives? Sure to attract a specific die-hard crowd.

For institutions, their solutions for enterprise growth utilise side-chains, off-chains and, most importantly, zero-knowledge-proof technology.

They are more than a layer 2 scalability for ETH; instead, they act as a highway for transactions and will soon become a platform for devs and companies to access an entire suite of tools compatible with Ethereum.

47/ If you wish to learn more about $MATIC's tokenomics, check out @Messari's Polygon profile:https://t.co/waewu1vZI6

— Miles Deutscher (@milesdeutscher) July 19, 2022

Furthermore, MATIC’s deflationary burn function enables Polygon to remove MATIC from the total supply, making each token more valuable as the day goes by.

While they might not have the best tech and might not be the most decentralized, their critical success factor lies in their ease of integration with web2 businesses.

5. Solana suffered 8 outages; the 8th was because of FTX

After the FTX fiasco, I still question if Solana’s initial growth was organic or artificially dictated in its early days. There is no doubt SBF’s played an integral role within the Solana ecosystem, but when that piece fell, it caused a massive landslide for Solana’s price action.

Did the @FTX_Official collapse force @solana devs out of the ecosystem?

— Messari (@MessariCrypto) December 18, 2022

Examining some developer stats, the number of @github developer repos and the number of daily unique programs are both up ~2.5x year-over-year despite $SOL prices dropping -95% over the same time period. pic.twitter.com/x3YvvV5Edr

If you thought Solana was fast, it is about to get faster.

Solana was designed to scale with Moore’s law. Moore’s law says that technology will move so fast that the “power and speed of computers double every two years” while cost decreases.

Firedancer is the name to remember; with the help of Jump Crypto, an entity which builds crypto infrastructure, they are making a Solana on steroids.

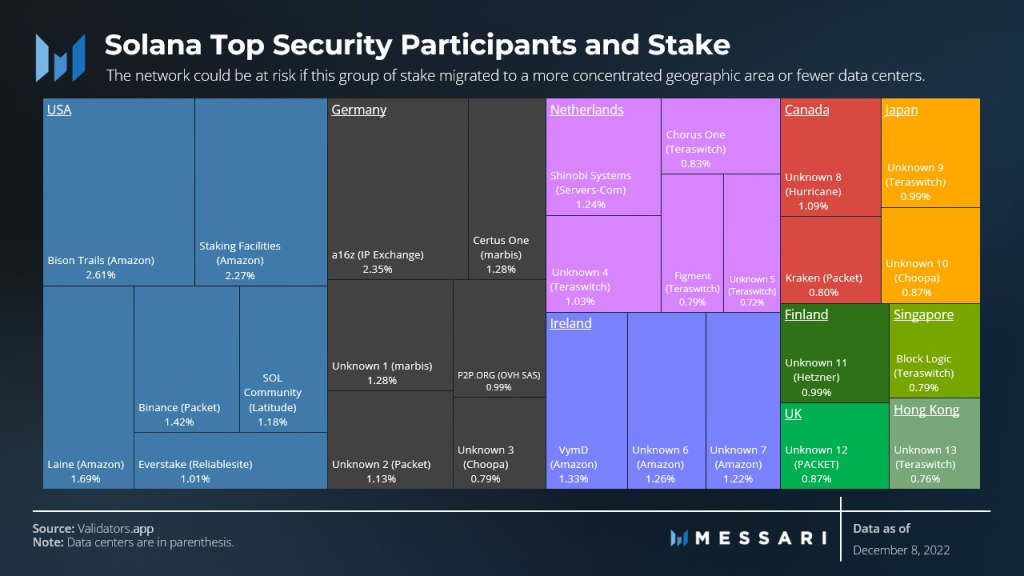

The blockchain trilemma has always been governed by three pillars, decentralization, security and scalability. If any blockchain, it seems Solana has the best bet to solve this.

Now you would think with this increased boost in speed, they will compromise on decentralization, and if not decentralized, why even exist, right? But Solana is highly decentralized, with nearly 1900 validators on the mainnet.

With the ability to scale and its proven decentralized nature, Solana’s Achilles heel is security, with several outages recorded this year.

But why are outages occurring so frequently? Here are some insights.

fun, aka hard, engineering problems to fix with the solana protocol

— toly 🇺🇸 (@aeyakovenko) October 24, 2022

1. asynchronous block production – bankless leaders. no need to execute transactions to pack blocks. Cuts latency to send a transaction out, leader can be a separate box focus on making best blocks.

🧵

Most common failures come from above, but this may be part and parcel of something big in the future.

On a positive note, having outages has its merits; for one, it forces the team to come out with an SOP in reaction to an event, something other blockchains may have oversight on. Secondly, being “battle-tested” may build the ecosystem into a stronger one, one more robust after filling the gaps of its flaws.

Solana also plans to tackle the MEV scene. Partnering with Jito, they are actively transforming Solana’s MEV scene and launching products that bring new incentives to users.

1/ @jito_labs has recently decided to:

— Solscan🔍 (@solscanofficial) November 20, 2022

▶️ open source Jito Solana MEV-boosted validator client for Solana &

▶️ launch JitoSOL-a MEV-powered staking derivative.

Jito is actively transforming the Solana’s MEV scene & launching products that bring incentives to users too

🧵👇 pic.twitter.com/nywxfVVi5d

Regarding network health, there are validators distributed across more than 35 geographic locations with over 135 data centres. Decentralization scored via the Nakamoto coefficient is relatively high compared to other L1s.

The developer landscape has been booming as well. A recent survey showed that rumours of mass Solana developer exodus and FTX contagion might be overstated. Survey methods won’t get exactly get anyone into Science magazine, but data is data.

Primary Research on Solana Developer Sentiment👇

— Ali 🥐🧁 (🦇🔊) (@analyticalali) November 23, 2022

"It's a capital mistake to theorize before one has data"-Sherlock Holmes

Lots of commentary on Solana devs the past week so decided to go direct to the source and ask Sol devs how they're feeling, data collected from devs (n=107)

In regards to DeFi, Solana has, to say the least, been decapitated.

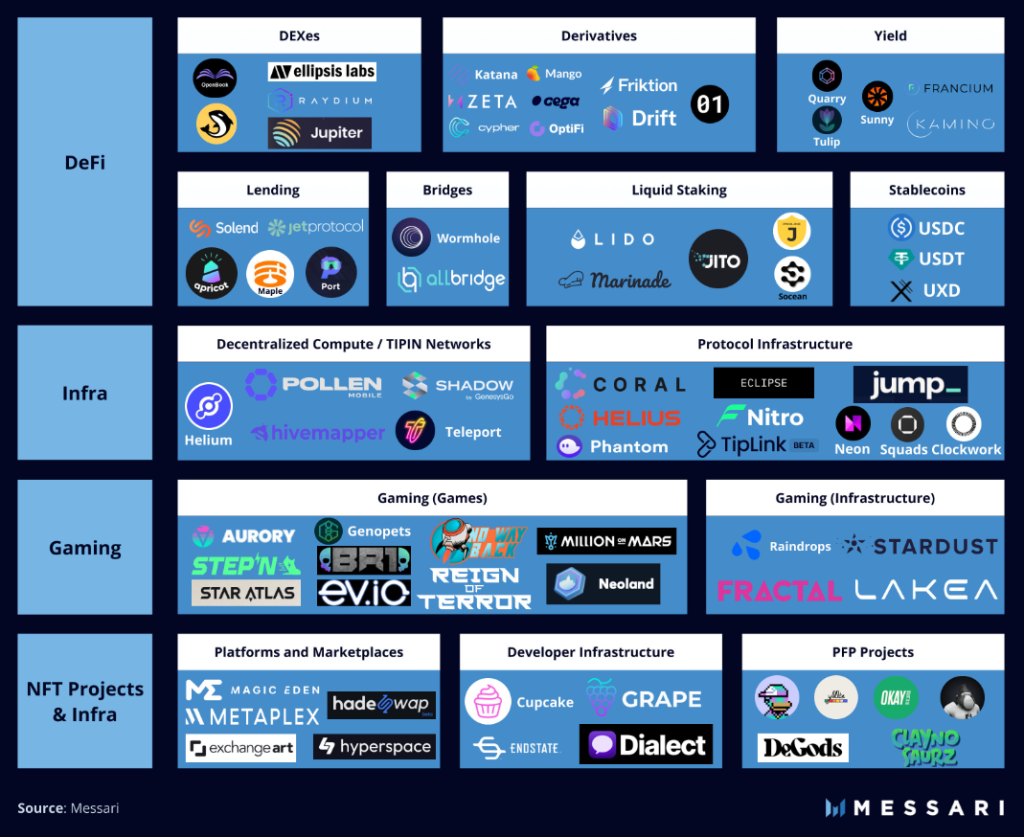

However, the ecosystem is still resilient. Even with a $115M Mango markets hack, quality teams are trying to solve existing issues. These include Friktion and Zeta for derivatives, Tulip for yield, Solend for lending and Jito for liquid staking, all potentially re-igniting its on-chain growth.

In addition, their $150M funds this year to boost the network’s gaming ecosystem have also attracted several investment funds, sparking traction in gaming.

Solana’s ecosystem is still far from complete. Its tech has not seen its full potential yet, the ecosystem is not without promise, and technical upgrades are in sight in the coming year.

Closing thoughts

The 2022 season will end, and we look back thinking, how did we do it? While this question may linger in the back of our minds distastefully, there is more to look out for in 2023. Though the five projects on this l percentage contribute a significant portion of the entire crypto space, there will be projects which rise the ranks in the coming year.

We don’t need a bull market for the space to grow, although it determines the pace of it. Any step towards widespread adoption, innovation and use cases will indefinitely alleviate more significant global issues. Someone needs to start the ball rolling.

If anything, 2022 taught me that there is no one, no entity, too big to fail. With this as a guiding star for 2023, you’ll be privy to the information you consume and cognizant of the responsibility you undertake participating in this space.

Also Read: I Used DeFiLlama To Track 10 Projects Who Raised Millions In The Bear Market

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief