In our previous articles, we introduced two crypto-derivatives exchange platforms Kucoin and FTX, both of which offer Futures Trading.

Incorporating futures trading as part of your portfolio can be a way to increase your profits while at the same time destroying your portfolio.

But what are crypto futures, and how can beginners learn the trading basics?

What are futures?

Futures is a contract that sets a predetermined price for an asset between a seller and buyer to be carried out in the future regardless of its spot price. The contract will determine the price and size of the assets that is being traded. Contracts typically expire at the end of every month.

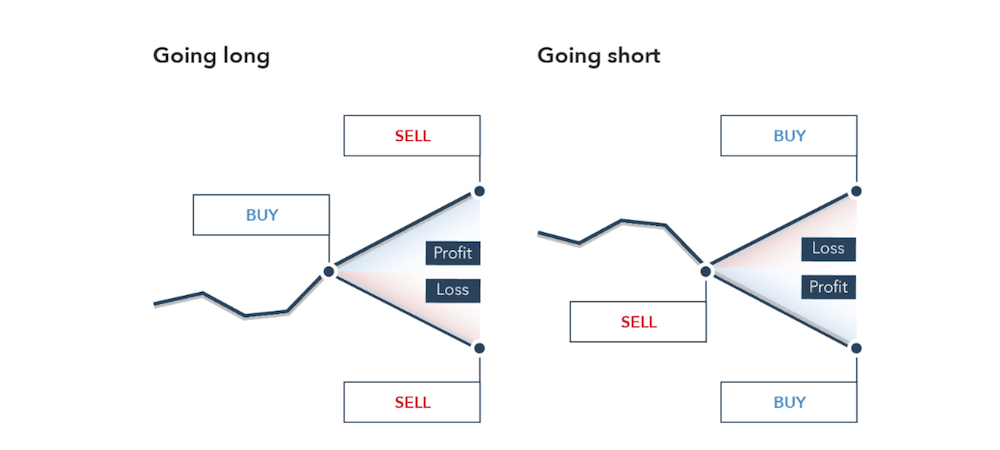

In futures, investors are allowed to go Long (Buy) or Short (Sell) on an asset, as compared to spot trading where you can usually only Buy and Hold an asset.

You’d go long if you believed that the underlying market price will rise, and you’d go short if you believed it will fall.

Upon expiry, the buyer or seller must buy/sell the underlying asset at the predetermined price regardless of the spot price on the expiry date.

Why invest in futures?

Futures like other crypto-derivatives products have many different uses and benefits. Below are a few reasons why you might want to engage in crypto futures trading:

- Position Hedging: Typically used by miners, as they have an influx of tokens to sell on a regular basis. If they feel that the token price would drop the following month, they would open a short position to sell at a high price. Once their mined tokens are in, they would sell them at the predetermined price on expiry.

- Leveraged Trading: Trading in futures typically involves leverage. Leverage is typically being able to trade more than what you have. Depending on exchanges, it can range up to 125x.

- Higher Profit Margins: With leveraged trading, you can increase your profits. However the opposite is true as well, and losing more than what you have put in the trade is also possible.

- Short Positions: In futures, traders are allowed to short an asset which typical spot traders cannot. This allows profit even when the asset price is falling.

Example of futures on an exchange

Let’s look at a real example of futures on FTX Exchange and how their prices can defer from time to time.

BTC-1231 means that the contract will expire on 31 December, in a MM/DD format.

As you can see, although the screenshots are only less than a minute apart, the differences in prices between futures and spot is about 1000 USD.

This is because futures uses an index price from a few exchanges, unlike spot trading. It essentially measures the prices of BTC on different exchanges and calculates a price for the future contract, allowing for a more fair price to be shown.

There can be a lot of reasons between such discrepancies and the differences can actually share some insights on the market.

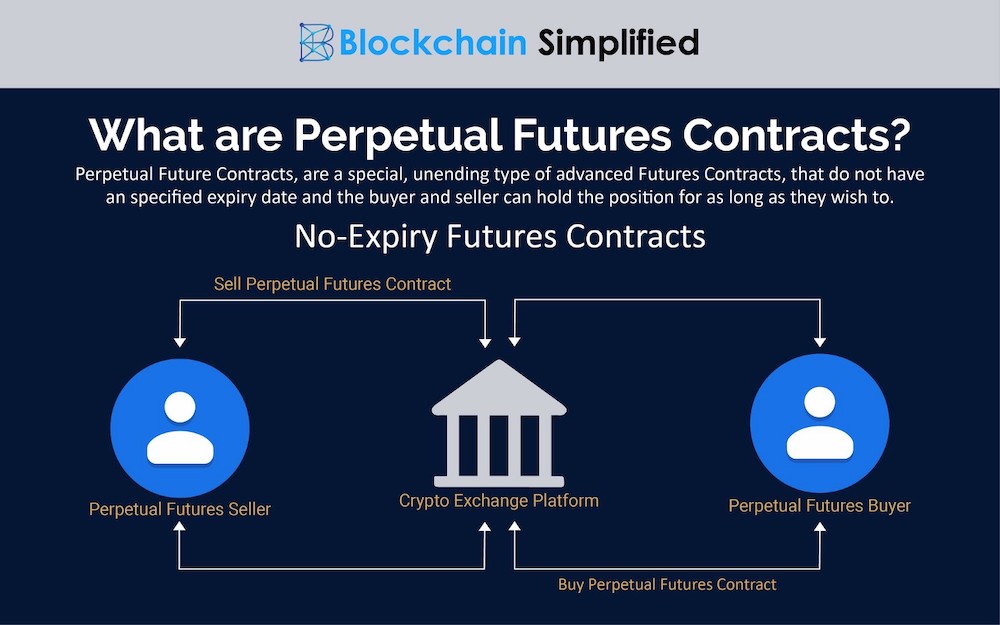

Perpetual futures

Perpetual futures are futures contract that do not have an expiry, and are essentially positions that you can hold on forever.

Perpetual contracts bring the idea of funding rates which can be paid either on an hourly basis like on FTX or at a pre-set schedule by the exchange.

Funding basically uses a formula to try and ensure that the futures contract pricing is in equilibrium with the spot market. Should there be more longs than shorts in the market, the longs will pay the shorts a predetermined fee based on a formula, vice-versa.

Tickers for Perpetual Futures are BTC/PERP, ETH/PERP, SHIB/PERP.

Terminologies of futures trading

Here is a list of terminologies in futures that you might find useful in whilst trading it.

- Initial Margin: An initial margin is basically the amount of collateral required to hold your leveraged position. Assuming you open 10,000 USD position with a leverage of 10x. You will require to hold 1,000USD as initial margin in the exchange.

- Margin Call: When margin falls below a certain threshold determined by the exchange, you are required to top-up collateral in the exchange in order to bring your up or risk liquidation.

- Liquidation: Every traders nightmare, liquidation happens when your losses reduced your margin below the minimum maintenance margin. All positions are automatically closed and you would have realised all losses on your trade.

- PnL: Stands for profit and loss. It gives a trader the overview of his position if the trade is profitable or in a loss.

Risk of futures trading

Trading with futures and leverage gives traders the ability to make more money on a smaller movement in the market. At the same time, traders typically leverage their trades and when the trades go the opposite of what you speculated, traders typically lose more than normal.

Consider the following the scenario, having 100 USD and using 5x leverage on an exchange will give you a position size of 500 USD:

- You go long on Token X at $1 and long 500 units (Position Size is 500USD)

- An hour later Token X price drops to $0.80. Your position size is now 400 USD ($0.80 x 500 units)

- 400 USD (Current Position Size) – 500 USD (Initial Position) = -100 USD (Loss)

Having only 100 USD in your account would have immediately been liquidated as a further drop in price will typically cause you to lose more than what you have.

A typical 20% movement on the assets would immediately liquidate your position on a 5x Leverage.

To somewhat understand how much an asset move would cause you to be liquidated, take 100% divided by your leverage (assuming a full size position was taken).

For 20x Leverage, 100 / 20 = 5%. A 5% move on an asset would cause you to be liquidated.

So before you go ahead and take that 100x Leveraged Position, consider that a 1% price movement would liquidate you.

Example of a perpetual futures trade

Let’s have a look at an exchanges future’s interface and how you can open a trade. For this example, we would open a trade on FTX Exchange.

Go ahead and look at ETH-PERP Contracts below:

In the comparison above, you can see see the difference between buying and selling on the exchange. In this example, the leverage is set as 5x and I have 100USD as collateral.

Set a price a buy or sell price as required and the trade size you would like to buy. Go ahead and click buy once you are happy with your order.

Scroll down on the same page and you will see an overview of your position. The comparison above shows different size of trades.

You can see that on the bigger trade size of 250USD, the Est.(Estimated) Liquidation Price is now active. Should ETH price drop to that price, my position will automatically be closed.

You can also see that the PnL is US$0.05. However, as I was busy screenshotting this, ETH price dropped to 4310 and I closed the trade at at US$0.50 Loss instead.

To close the trade, you can either click Market Close to close at the current price or Open an Opposing Order at a price to close at. In general:

- When closing a Long, you would want to close it at a price above your buy price to be profitable.

- When closing a Short, you would want to close it at a price below your sell price to be profitable.

Conclusion

Futures trading allow traders to explore different strategies and also expose themselves to larger profits compared to spot trading.

However, not arming yourself with proper knowledge and having proper risk management can also cut short your dreams of being a full time trader.

It is best to fully understand the risk of futures trading before plunging all your money into futures. Invest Safe!

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: News 18 / Chain Debrief

Also Read: Here’s What To Look Out For If You Want To Lend And Borrow On Decentralised Applications