The web3 world is currently made up of digital silos. Each blockchain, an isolated island.

A series of disconnected networks, each confined within their own parameters. Trapped within their own limitations.

But just as globalisation connected nations, a similar revolution is on the horizon in the blockchain landscape.

Enter the world of cross chain technology. Its existence in the realm criticised by behemoths such as Vitalik and Jump Crypto, I believe that it is the inevitable future of the space.

And with major advantages if done right.

Let me explain why.

Also Read: Designing Better Cryptocurrencies: 7 Tokenomic Insights from a16z

Understanding Cross-Chain Technology

At its core, cross chain technology is a protocol that enables the transfer of data and assets between multiple blockchain networks. It steps in to mitigate the limitations of popular networks like Bitcoin, Ethereum, and Solana, which, while capable of supporting token trades, face scalability issues due to their isolated operations.

Crosschain technology is built on principles such as atomicity, which ensures transactions either complete entirely or not at all, and consistency, which maintains the integrity of data across all involved blockchains. It also enables distribution across different platforms, facilitating interactions without intermediaries.

The technology employs mechanisms like atomic swaps and relays to ensure interoperability. Atomic swaps enable peer-to-peer token trades across blockchains without a centralised third party, while relays monitor transactions and events on other chains, acting as a bridge between different networks.

There are clear advantages to this technology. With crosschain interoperability, we can theoretically pick and choose different aspects of different networks and combine them in a flawless-interface superchain

Imagine the speed of solana combined with the wide user base of ethereum, or being able to deposit collateral on Fantom, borrowing against it on Avalanche and using that to mint an NFT on OpenSea- the possibilities are endless.

And yet, there are warnings of major risk associated with such technology. From anti-network effects to contagion risks of 51% attacks, this is a heavily debated topic.

So why do I think it is inevitable?

One answer: The History of Power.

Looking at the History of Global Power

Consider the inception of the European Union.

In the wake of World War II, Europe was left devastated, with economies crippled and in dire need of rebuilding.

Recognizing the necessity for swift recovery, six key European powers decided to pool their major industries, laying the groundwork for a unified market among member states. This initiative culminated in the signing of the Treaty of Rome in 1957.

This triggered a substantial stride towards integration, providing member states the ability to concentrate on their unique strengths, assured that their deficiencies would be offset by their partners’ proficiencies.

Take France as an example. Blessed with abundant agricultural resources, it could focus on producing wine and cheese, exporting these commodities to other member states. Germany, on the other hand, leveraged its robust industrial base to specialise in manufacturing cars and machinery.

This strategic specialisation led to a phenomenal economic surge, heralding what is now referred to as the Golden Age of European Economic Growth.

Simultaneously in the East, the establishment of ASEAN had a strikingly parallel effect, fostering a more integrated regional economy. This integration resulted in an explosion in trade volume, escalating from $82 billion in 1993 to over $2.8 trillion in 2023.

This signifies an astounding 30-fold increase in just two decades(!!).

Throughout history we can see this trend repeat itself over and over again. Disconnected economies historically converge towards interconnectivity, as the advantages of cooperation are irresistible.

Still not convinced? Let’s turn our attention to the evolution of the internet itself.

The Cycle of Open and Closed Loops

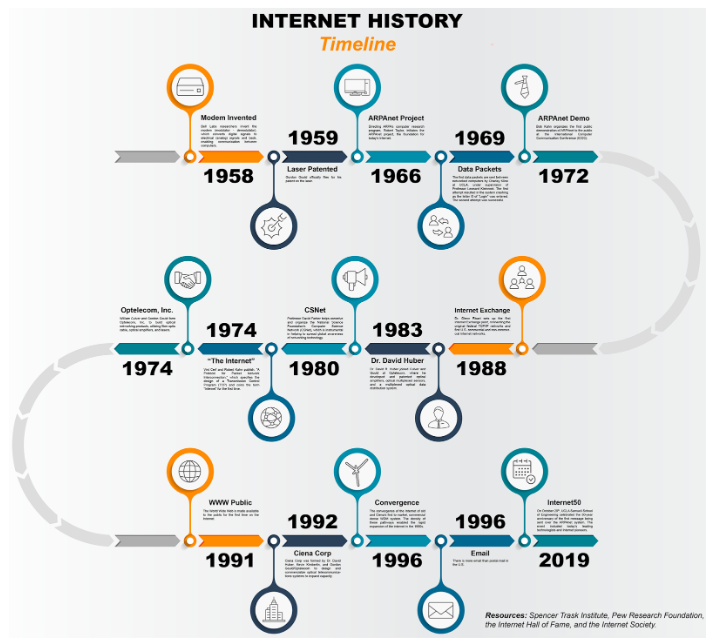

The Internet showcases how linking isolated systems can spark monumental progress by opening up avenues for information and resource sharing.

In the late 1960s, the precursor to the Internet, ARPANET (Advanced Research Projects Agency Network), was born. The initial concept was simple: four universities in the United States would have their computers connected, allowing them to share data and resources. At this early stage, each university’s computer system was a standalone entity, disconnected from the others.

However, as the potential benefits of interconnection became clear, the network grew. More universities and research institutions were added to the ARPANET, and similar networks began to appear around the world. These were still disconnected from each other, creating islands of connectivity.

The real revolution happened when these networks themselves became interconnected, forming the “network of networks” we now know as the Internet. The key to this development was the standardisation of protocols – rules for how data should be formatted and transmitted so that any computer on the network could communicate with any other.

The effect of this connectivity has been revolutionary. As of October 2021, there were 4.88 billion Internet users worldwide, representing over 62% of the global population. The Internet has transformed economies, allowing for unprecedented levels of communication, collaboration, and commerce. It has given birth to entirely new industries, such as e-commerce and social media, and has fundamentally changed existing ones, such as publishing and entertainment.

In 2019, the digital economy was worth $11.5 trillion globally, or 15.5% of global GDP.

This represents an incredible level of economic activity that simply would not be possible without the interconnection provided by the Internet.

What Crosschain Technology Will Mean for Web3

Ok, enough history lessons. Now that we understand this global trend, what will the ‘internet of blockchain’, powered by crosschain technology, actually mean for Web3?

Crosschain interoperability has the potential to not just revolutionise DeFi and Web3, but also to create a hyperscale digital economy of the future. This new frontier is characterised by increased system liquidity, asset mobility, capital efficiency, and a shift towards modular blockchain infrastructure.

Let’s explore some of the benefits:

1. Democratisation and Globalization of DeFi Access

Crosschain technology democratises and globalised access to DeFi.

Users across different blockchain networks can freely participate in the DeFi ecosystem, fostering an inclusive and diverse environment where the benefits of DeFi are not confined to users of a specific blockchain.

2. Creation of Hyperscale Markets

Interoperability and crosschain activities are key to avoiding the siloed nature of digital economies.

By enabling seamless interactions across different blockchains, crosschain technology is laying the groundwork for hyperscale markets, where trillions of dollars in market activity can be realised.

3. Overcoming Limitations of Individual Blockchains

Interoperability enables users and applications to transcend the limitations of individual blockchains, such as high transaction fees or low liquidity.

Moreover, it enables the leveraging of the unique benefits offered by different blockchains, thereby enhancing overall system efficiency.

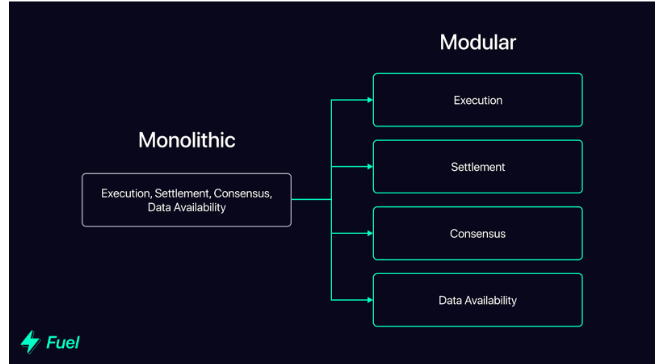

4. Modularization of Blockchain Infrastructure

Crosschain technology is driving the shift towards a modular blockchain infrastructure where different components of the blockchain technology stack can be mixed and matched as per needs.

This is crucial for the evolution of the blockchain ecosystem and for supporting a robust digitised economy in the future.

5. Rapid Integration of Emergent Networks

Bridges and interoperability solutions facilitate the rapid integration of emergent networks into the existing ecosystem, regardless of whether these are modular or monolithic.

This agility is key to maintaining the dynamism and vitality of the blockchain ecosystem.

6. Efficient Crosschain Messaging Maximising Capital Utilisation

Protocols like Wormhole and LayerZero enable efficient crosschain messaging, pushing the friction of transacting between different blockchain environments towards zero.

This significantly enhances capital utilisation, as underutilised assets can quickly move to higher value opportunities on any given chain.

7. Institutional Adoption and Compliance

Services like MetaMask Institutional (MMI) make crosschain interoperability accessible to institutional users while ensuring compliance with necessary security standards.

This bridges the gap between institutional requirements and the decentralised world.

8. Enhancing Liquidity and Efficiency with Just-in-Time Provision

Just-in-Time (JIT) liquidity provision, facilitated by crosschain interoperability, can draw on underutilised assets to address liquidity shortfalls.

This, combined with improved asset utilisation, is vital for pushing decentralised finance to a global scale.

But There are Risks

As mentioned, there are serious risks associated with a crosschain future.

The ones we will mention are outside of the inherent risks with the bridge technology itself,a very extensive discussion for a later date. However, keep in mind that these are definitely present, and have been the vulnerabilities responsible for the infamous Ronin hack of $624M.

So what other risks are there?

Notably, Vitalik Buterin is a major critic of such technology, arguing that if a blockchain gets 51% attacked, this attack would reverberate throughout the crosschain network, affecting many other systems directly as well.

An attack of this nature could potentially leave users with tokens that are devoid of backing from assets on an alternate chain. This heightens the contagion risk, especially if decentralised applications (dApps) were to be constructed atop this compromised foundation.

A bridge-based interchain is only as strong as its weakest link, and so Vitalik argues that the future should be multi-chain, rather than crosschain, and that you can’t just pick and choose a liquidity and security layer; your liquidity layer HAS to be your security layer.

My argument for why the future will be *multi-chain*, but it will not be *cross-chain*: there are fundamental limits to the security of bridges that hop across multiple "zones of sovereignty". From https://t.co/3g1GUvuA3A: pic.twitter.com/tEYz8vb59b

— vitalik.eth (@VitalikButerin) January 7, 2022

Outside of such anti-networking risks, there is also the risk of centralisation.

In an interconnected future, crosschain technologies like bridges have the potential to grow even more influential than the underlying L1 technology,having significant control of the trajectory of emerging ecosystems.

This comes from the fundamental reality that bootstrapping is incredibly difficult, especially in such a system which becomes increasingly interconnected. This would make such technologies and their governance bodies a form of a gatekeeper, or intermediary.

Despite the potential of decentralisation through token governance, crosschain bridges and technologies can harbour individual biases.

These biases may appear as preferences in fee structures, transfer volume caps, or restrictions on issuing wrapped assets.

These factors effectively become the levers influencing the difficulty level for a new L1 or chain to attract transferred assets and data. Early favourable treatment from a bridge partner could make a significant difference in an ecosystem’s success before the user onboarding process even begins.

Bridges with substantial power could exert an outsized control over the capitalization of new ecosystems, leading to a significant centralization risk in the overall power distribution.

And These Are Some Ways We Can Mitigate Them

While the potential risks of crosschain technology are significant, innovative solutions and strategic standardisation can effectively mitigate these issues.

The cornerstone of these solutions is the advent of Generalized Messaging Protocols (GMPs), an evolution from bridges that provides a secure and efficient mechanism for interoperability. GMPs represent a shift in cross-chain communication, enhancing information exchange across ecosystems in a more secure and effective manner.

Key players such as LayerZero, Axelar, and Wormhole are leading the charge in GMP growth, each bringing unique strengths.

LayerZero leverages an oracle and relayer to securely connect smart contracts across different chains. Axelar, on the other hand, operates as a proof-of-stake blockchain, supporting crosschain messaging across various ecosystems. Finally, Wormhole employs a third-party consensus mechanism, with the robust backing of 19 reputable validators, known as “Guardians”, adding a layer of reputational and economic security to the system.

As this landscape evolves, standardising functionality across bridges and GMPs is crucial to minimise potential attack surfaces. Over time, we could even witness the emergence of a super-standard, with crosschain standards like IBC being notable contenders.

Closing Thoughts – Embrace the Future or Die

It’s important to note that the race for cross-chain messaging dominance won’t be a winner-take-all scenario. Ease of developer onboarding, chain availability, and economic incentives are significant factors that will shape the future of cross-chain messaging. As with the existing web 2.0 stack, we anticipate a variety of infrastructure options to cater to the diverse applications being developed.

Unveiling @LayerZero_Labs Alpha with us!

— Polkastarter (@polkastarter) February 1, 2023

The thread covers #LAYERZERO's

• key features

• highlights of projects that implemented LayerZero

• challenges 🚀 pic.twitter.com/Ksz0QUeDrt

In conclusion, by harnessing the potential of protocols like GMPs and through strategic standardisation, we can navigate and mitigate the risks associated with crosschain technology. This approach will enable a more interconnected, efficient, and secure digital economy as we venture deeper into the era of Web 3.0.

We’ve seen it with the rise of the internet. We’ve seen it with the explosion of cryptocurrencies. And now, we might be about to see it again with crosschain technology.

The choice is ours to make.

Also Read: What Bitcoin’s Evolving Supply Distribution Tells Us About Decentralization

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

This article was written by Harry Vellios and edited by Yusoff Kim