Hundred Finance is a name that has been gaining considerable traction with good reason. It recently launched on Fantom Opera Network, and its TVL has skyrocketed by an additional US$146.19 million.

As with Arbitrum, HND has recently released two incentivized liquidity programs. Simply put, it is a decentralized borrowing and lending platform that has see explosive growth across the networks of Ethereum, Arbitrum, Fantom, Harmony and Moonriver.

As with any dApp, there is a need to release new products and services in additional to innovative technology to win over new investors.

Hundred Finance has been delivering this with a mission to be a preeminent multi-chain protocol, coming up with a high interest-based return and innovative tokenomics.

What exactly is Hundred Finance?

Hundred Finance is the successor to Percent Finance, a community owned fork of Compound Finance using ChainLink Oracles.

As a multichain protocol, it makes use of ChainLink Oracles to ensure market health and stability, while specialising in serving long-tail assets.

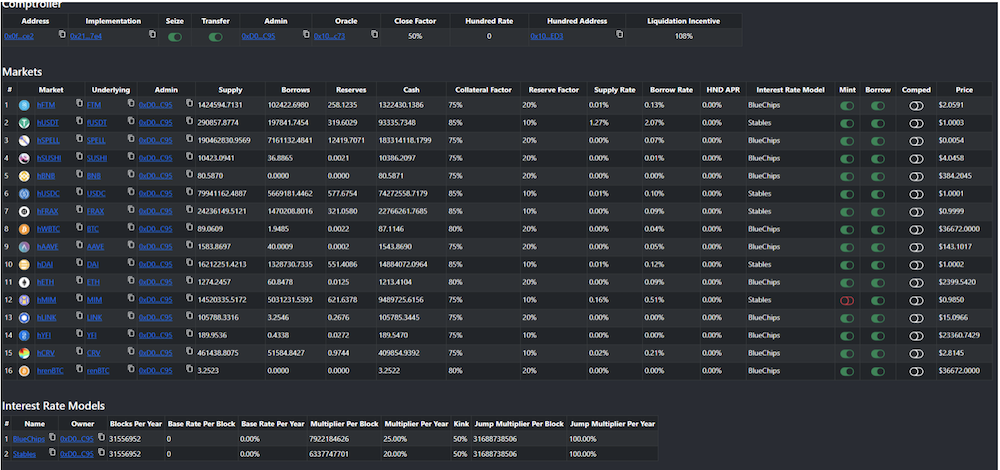

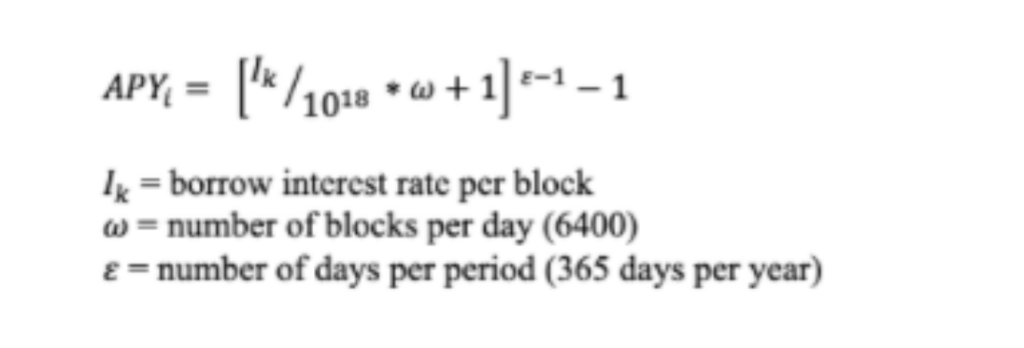

Interest rates on Hundred Finance are automatically calculated and expressed per token as an APY (Annual Percentage Yield) These rates are variable and adjust on a block-by-block basis in response to demand for a particular asset and liquidity available to supply for that demand.

However, changes in the market value of assets being borrowed and lent with the accrual of interest, may result in supplied assets insufficiently collateralizing obligations on borrowed assets.

If the collaterization of the debt falls below a certain ratio, an account on Hundred Finance is vulnerable to liquidation. This process entails its assets being claimed and a liquidation penalty by independent liquidators in return for repaying the accounts debt.

Supplying asset markets

The various HND markets can be accessed through the website’s homepage. The interest rate model contracts can be accessed using the dashboard

At a first glance this may seem extremely complicated. However, to supply a token to the platform, all the user actually has to do is:

- Select the network they want, eg. Fantom, Harmony

- Click on the asset market they wish to interact

- Approve the token and choose the amount of token they wish to supply

- Supply the token to initiate the transaction

By supplying an asset, users receive hTOKENS. These are interest bearing of the underlying asset and can be used in a number of ways.

Borrowing assets

When users lend tokens on Hundred Finance, assets supplied can act as collateral to borrow. This is known as debt-financing. The amount of value can be borrowed against an asset is set via the protocol level. It is necessary to manage risk and for all borrowed assets plus interest to be returned to redeem your collateral.

Loan to Value – An asset’s loan to value is used to determine the maximum amount a user can borrow based on their collateral. For example, if a user has supplied $1000 of USDC, the user can borrow up to $800 worth of other assets.

Values are variable and they act cumulative to allow borrowing. This could occur when assets have varying loan to value ratios.

Borrow Limit – A users borrow limit once exhausted, the liquidity of the account will reach 0. If the value of the user’s collateral decreases further, they are vulnerable to liquidation.

Liquidation will occur once an active borrowed balance exhausted all of its liquidity via its loan to value ratio and accrues further debt due to the fluctuation of assets. This mechanism helps maintain the platform health and is incentivized with a liquidation bonus that grants the users collateral at a discount.

Security of platform

The security of the contracts upon which Hundred Finance is based, received an audit provided by Chainsulting.

A Bug Bounty Program is also available to increase the smart contract security by rewarding responsible disclosures of vulnerabilities. They are classified by different levels of severity with up to $50,000.

Technical Aspects and Collaborations

Hundred Finance has collaborations with Beethoven X, B.Protocol Backstop, Chainlink Oracles, DODO, Immunefi, Olympus Pro, and SpookySwap. A few interesting ones are highlighted below:

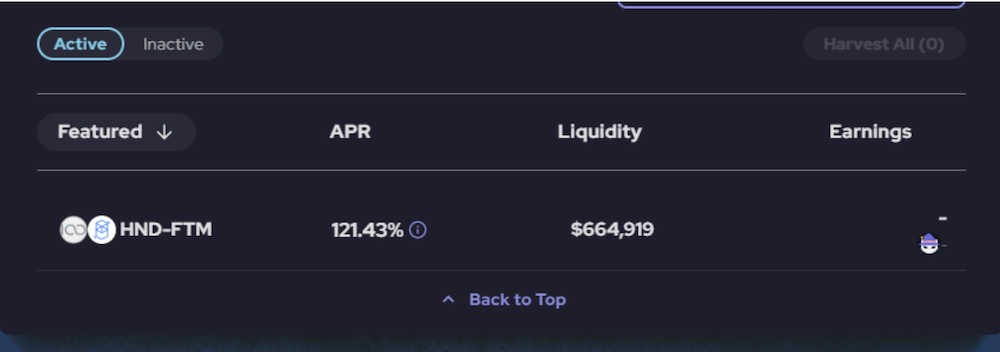

SpookySwap – For those unfamiliar with Spooky, this is the largest DEX on the Fantom Opera network. Two incentive programs are provided:

- HND/FTM LP that emits BOO tokens

- Single Sided BOO Staking Pool that emits HND

BOO Staked can be farmed or bought and placed in SpookySwap’s single-sided staking system. BOO staked receives xBOO and rewards, which are further staked to receive HND. In addition, it autocompounds by using a portion of all trading fees to buy back BOO. These means that your xBOO, BOO, and HND token holdings will all grow over time.

Olympus Pro – This partnership allows for the bonding of Beethoven X’s HND-USDC-FTM liquidity tokens on Fantom and DODO’S HND-ETH liquidity tokens on Arbitrum. Mote information can be found here. (Disclaimer: with the recent saga, please be mindful and DYOR)

This program has four interesting features:

- Significant reduction in sell pressure — Protocol-owned liquidity reduces the impact of mercenary LP carrying out short-term farming practices (farm and dump)

- Absorption of IL — Protocol-held liquidity shifts IL to the largest holder of the native token, the protocol itself

- Goal alignment between Protocol and Holders

- Generation of a Protocol Revenue Source

Interest Rates are based on an interesting APY formula

Note that the interest rate is compounded at each block. The few key numbers are

- Base Rate per year for borrowing

- Multiplier per year, the rate of increase of interest in accordance to utilization

- Kink, the point where the model follows the jump multiplier

- Jump Multiplier, rate of increase with respect to utilization after kink

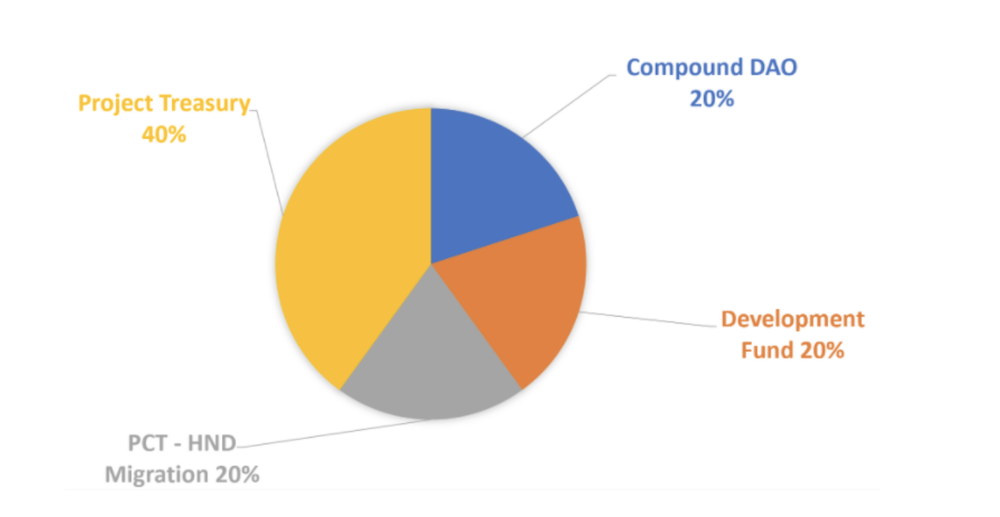

Tokenomics

40% is assigned to treasury for liquidity and partner mining

20% is allocated to development fund and operations with a four year vesting emission

20% is granted to Compound DAO

20% goes to Percent token migration

Closing thoughts

Hundred Finance has definitely piqued increase of investors with its latest developments on Fantom. The protocol is dedicated to development of these four areas:

- Multi-chain expansion

- HND Distribution

- veHND integration

- User acquisition

Two key areas to watch out for are their research and development in the areas of veHND mirroring and Cross-chain collateral. I personally am looking at the cross-chain collateral as it something very unique. While both of these are still in research phase, these two functions are planned to provide UVP (Unique Value Propositions) and contribute to their growth in 2022.

Hundred Finance is expected to provide a runway of at least four years. As with all protocols, catalysts as well as retail/institutional interest is needed for it to become a robust and exciting money market. To find out more information, you can visit their socials.