GND Protocol has two main products, which focus on yield-bearing and revenue-generating sources. With its recent successful launch on Arbitrum with the GMD launchpad, GND surpassed $21M in TVL. It might not seem much, but accomplishing this within two weeks has garnered some eyeballs, especially from gem hunters.

$21,000,000 TOTAL VALUE LOCKED 🍀🤑

— GND Protocol (@GNDProtocol) May 8, 2023

After 2 weeks of launch, @GNDProtocol have successfully surpassed 21m in TVL.

Thank you so much for your early support 🫡🚀 pic.twitter.com/0EiAMhdQ4N

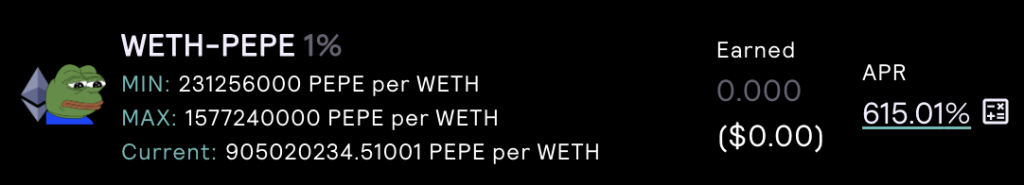

Since its launch, the protocol has featured more than 25 farms, almost like bringing any Arbitrum DeFi farmer to their favourite seafood buffet. They even have a $PEPE vault which gives you 615% in rewards broken down into 153% in $GND and 461% in $xGND.

The yield-bearing Algo-stable, how does it work?

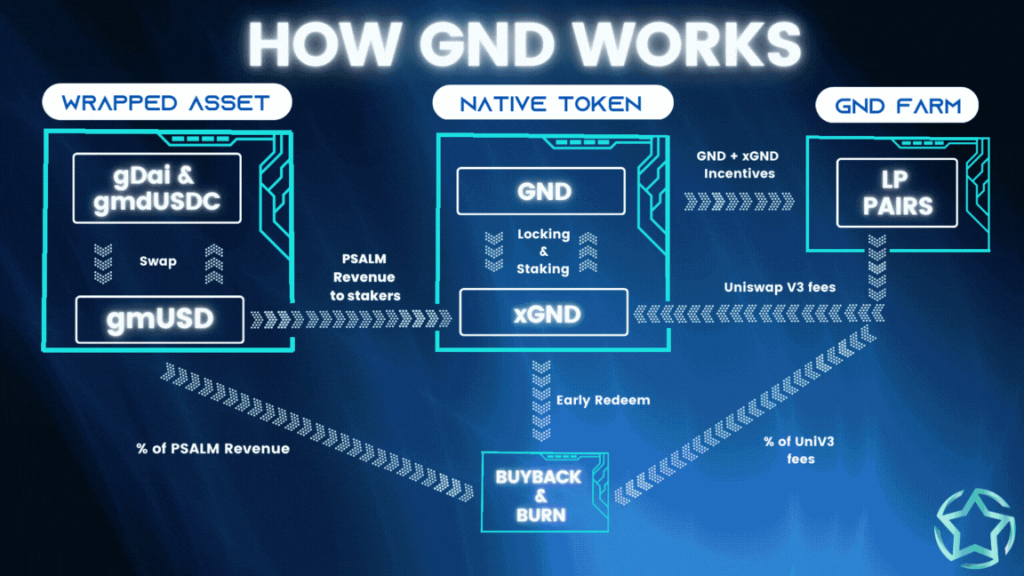

At the core of GND is their algorithmic stablecoin, $gmUSD. Now while the sound of the words “algo stable” may bring remembrance and a bucket load of PTSD to the once great but fallen $UST, the team at GND has plans to do things differently.

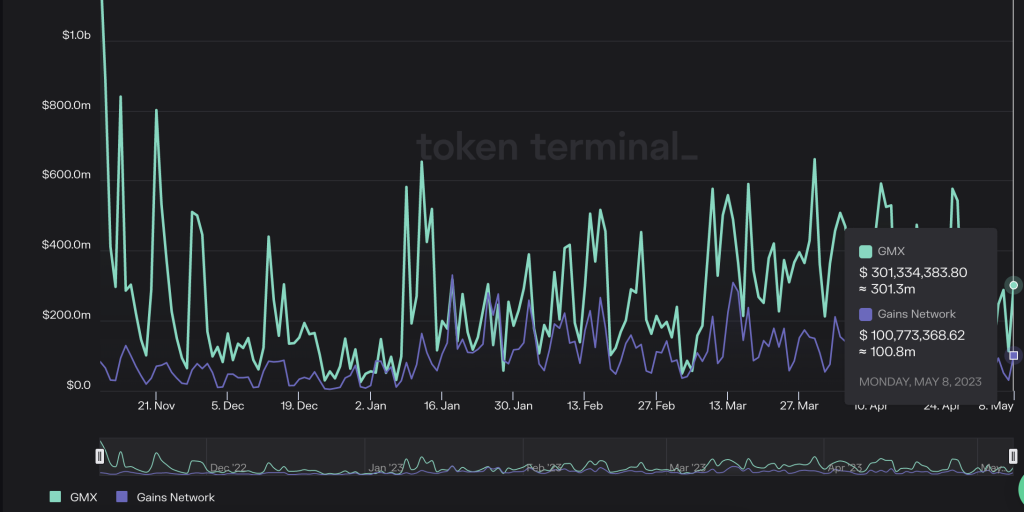

The $gmUSD is fully backed by $gDAI and $gmdUSDC; if those names sound familiar, it is because they are. $gDAI is actually a receipt token for gTrade’s DAI vault on the Gains Network platform, while $gmdUSDC is GMD’ protocol USDC vault built on top of the GLP receipt token, the LP from GMX.

Being backed by two coins which derive their value from two of the most popular decentralized perps platform, GMX and GNS, the yield that GND generates does not come from some hyperinflated (3,3) crazy APY mechanism; instead, backed by solid revenue-generating protocols.

This stablecoin will be suitable for those looking for sustainable yield, as you combine the best of both worlds. As of the time of writing, $gmUSD is expected to yield 15%-25% annually.

Revenue streams of GND

Before we explore $GND’s revenue stream, we have to wonder, where does the algorithmic mechanism come into play?

The $gmUSD maintains its peg with PSALM; essentially, if $gmUSD goes to $1.05, the protocol mint $gmUSD for $1 with $gDAI and $gmUSDC and sell for $0.05 profits.

Similarly, when $gmUSD goes to $0.95, the protocol buys $gmUSD back and redeems $gDAI and $gmUSDC. This means that the protocol does not have to compete with MEV because GND is the only entity allowed for minting and redeeming $gmUSD, ensuring arbitrage trades will always be profitable for the protocol before any third party.

So profits from this arbitrage mechanism serve as one revenue stream for the $gmUSD and $GND stakers, but there’s another, which I already name-dropped in the paragraphs above – GND farms, aka Uniswap v3 trading fees.

Ponzi tokenomics?

Now you would think such a deal would surely come with Ponzi tokenomics, maybe one with hyperinflationary emissions, which is often unsustainable. However, their put massive priority into burning.

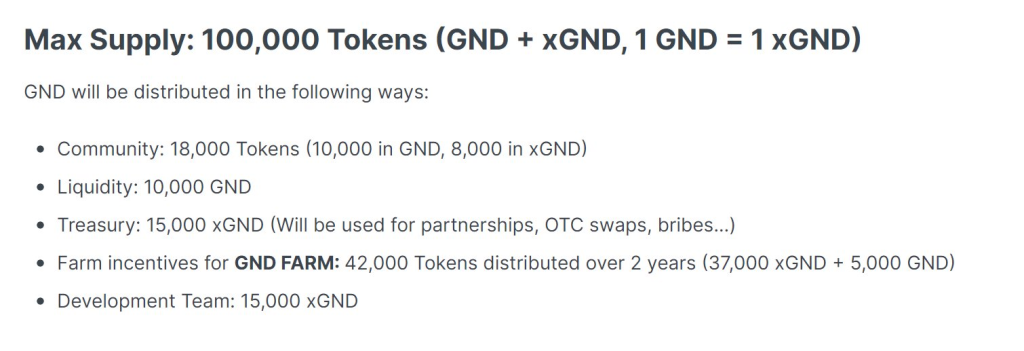

They utilize similar mechanics to how Camelot does with $GRAIL for vestings and token emissions. With a hard cap of only 100K tokens, the $GND token is divided between $GND and $xGND. This is a green flag if you ask me.

Additionally, the team has implemented several mechanisms that will make $GND extremely deflationary. They are deflating in three different ways; the first, 60-80% of the protocol earnings will go towards buying back $GND and burning. Imagine getting a portion of yield in the form of stables or ETH and the other portion being used to deflate your real yield token; it well deserves another green flag to me.

Secondly, when the vesting duration is not the maximum when a user is converting their $xGND to $GND, the xGND:GND ratio will be lowered to as low as 1:0.5.

For instance, if a user redeems 1000 xGND with the 20 days vesting duration, he will obtain a 1:0.5 ratio and receive 500 GND in the end. That means 1000 – 500 = 500 GND will be burned during the process.

Lastly, whenever $xGND is staked, a deposit tax will be applied, ~2%. This tax will essentially be burned as well.

Now, crazy Amazonian forest burning deflation + hard cap on tokens = up only ?? economics 101 tells me yes, but we shall see.

Closing Thoughts

Backed by the two most popular real yield perp dexes, GND finds its place quickly among the greatest. This innovative way of algorithmic stablecoin’s revenues could see a more sustainable defi project in the current times. If you think about it, $xGND stakers dumping will lead to more $GND burn and staking $xGND in itself will lead to a tax which again, will lead to the burn of $GND.

Also Read: Which Arbitrum Projects Received the Largest $ARB Airdrops and Why Does it Matter?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief