A futures contract is a legal agreement to buy or sell financial security at a predetermined price at a specified time. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange.

The buyer of a futures contract is taking on the obligation to buy and receive the underlying asset when the futures contract expires.

The seller of the futures contract is taking on the obligation to provide and deliver the underlying asset at the expiration date.

Why is it called a futures contract?

A futures contract gets its name from the fact that the buyer and seller of the agreement are agreeing to a price today for an asset or security to be delivered in the future.

Understanding futures contract

Futures are derivative contracts that obligate the parties to transact financial security at a predetermined future date and price. The buyer must purchase, or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date.

Futures contracts detail the quantity of the underlying asset and are standardized to facilitate trading on a futures exchange. Futures can be used as a form of hedging or trade speculation.

Examples of a futures contract

Futures contracts are mainly utilized by two market participants – hedgers and speculators.

Producers (or purchasers) of an underlying asset hedge (or guarantee) the price at which the commodity is sold (or purchased).

Portfolio managers and traders may also bet on an underlying asset’s price movements using futures.

For example, an oil producer needs to sell its oil. They may use futures contracts to do it. This way, they can lock in a price they will sell and then deliver the oil to the buyer when the futures contract expires.

Similarly, a manufacturing company may need oil to make widgets. Since they like to plan ahead and always have oil coming in each month, they, too, may use futures contracts. This way, they know in advance the price they will pay for oil, which is the futures contract price, and they know they will be delivering the oil once the contract expires.

Futures are available on many different types of assets. There are futures contracts on cryptocurrencies, stock exchange indexes and commodities.

Who uses futures contracts?

Speculators use futures contracts to bet on the future price of an asset or security.

Hedgers use futures to lock in a price today to reduce market uncertainty between now and the time that good is to be delivered.

Arbitrageurs trade futures contracts in or across related markets, taking advantage of any theoretical mispricings that may exist temporarily to profit off it.

What is leverage

Leverage is using debt (borrowed capital) to undertake an investment.

Investors use leverage with the hope of significantly increasing the returns provided on their investments. They leverage their assets using various instruments, including options, futures, and margin accounts.

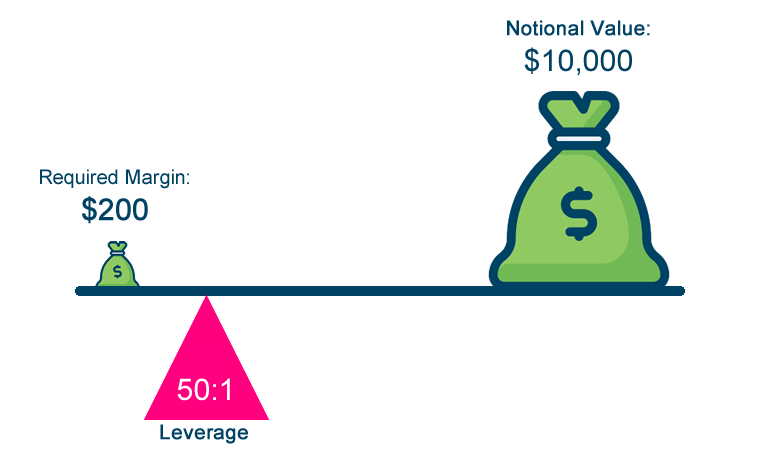

Example of leverage

With a 50x power, a trader only requires a margin of $200 to open a trade worth $10k.

Advantages of leverage

1. Maximize profits

With margin trading, you can enter the market with a more prominent position, which means more significant gains on successful trades than just your existing funds. Assuming that your margin trade is booming, high leverage ratios can help you maximize your returns.

2. Convenience in trading

Margin trading allows you to enter positions quickly without depositing more funds to acquire the same position size. This also allows you to save time and act quickly if you are timing the market.

3. Portfolio diversification tool

With borrowed funds from margin trading, traders can open multiple positions with relatively smaller amounts of capital without compromising position size. This allows traders to diversify and hedge, reducing the risk of significant losses by preventing traders from putting all their proverbial eggs in the same basket.

Disadvantage of leverage

High risks usually accompany high returns. While returns are amplified with leverage, losses are multiplied if the investment does not pan out.

For example, a mere 2% move in the opposite direction will liquidate a 50x leverage trade position. In the crypto market, a few per cent movement is typical and can happen in a matter of minutes.

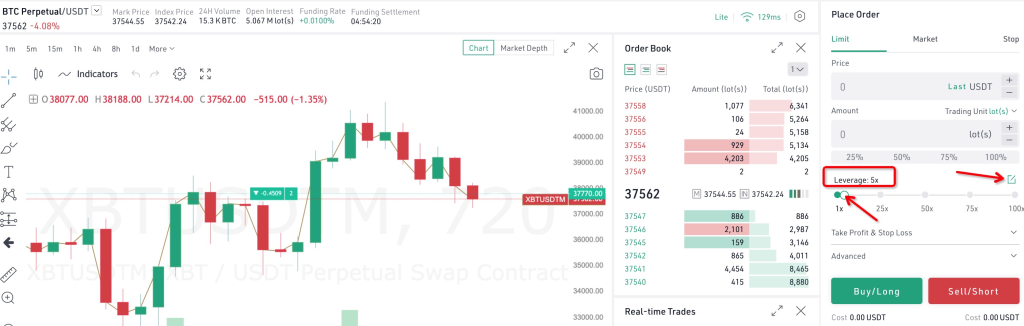

How to set your leverage on KuCoin

Option 1: Drag the slider to select the leverage you prefer (only supports whole numbers).

Option 2: Click the edit button to input your preferred leverage times (supports decimals).

When should I leverage?

1. When you want to increase your buying power

Suppose you are restricted by your current capital but hope to capitalize further on a potential trade. In that case, leverage trading can allow you to increase your position in the market for magnified returns. For example, if you are interested in purchasing $1000 of bitcoin but only have $500, you can use margin trading.

2. When you want to diversify and hedge

If you consider diversifying your portfolio into another crypto but only have a small capital, you can use margin trading to increase your buying power. Using margin trading to enter a hedged position against the crypto market can also help protect against significant market downturns.

3. When you understand your potential losses

Because of the high risk involved, it is not recommended for beginners who do not understand the potential losses. Experienced traders who understand the risks and want to attempt margin trading can do so with proper risk management strategies like stop-limit orders. If you’re exploring margin trading, check out these additional resources regarding Margin Trading before starting.

Conclusion

The use of futures contracts can be rewarding should one know how to hedge market uncertainty or arbitrage from temporary mispricing.

With leverage, you can obtain more significant gains on successful trades than just your existing funds. However, you incur more considerable losses on unsuccessful transactions, so always have an exit strategy and do not ape into a single trade with all your funds.

Always take note of the pertinent risk in leverage trading, it is not for everyone, and you don’t need to learn this the hard way.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief

Read More: Profiting During A Crypto Crash; A Beginner’s Guide To Short Bitcoin On FTX Pro (Mobile)