Over the past few months, one of the most popular cryptocurrency being discussed is definitely Polygon.

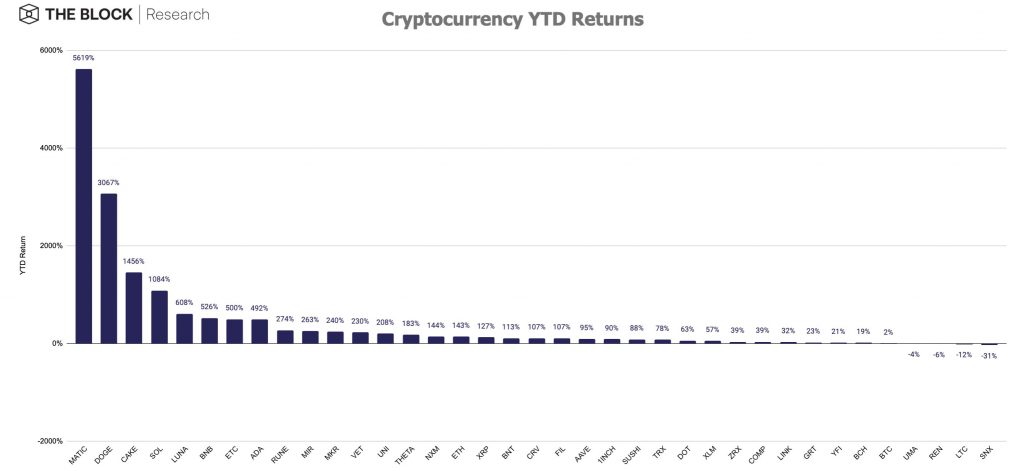

Polygon is a Ethereum scaling solution and year to date, has been the highest performer in terms of traction and market capitalization growth.

While the cryptocurrency market is seeing an overall retracement now, Polygon (previously known as Matic) is still growing at a huge clip. Here’s a look at what makes Polygon successful and some of the key metrics of Polygon.

Previously known as Matic, Polygon first launched its initial token offering on the Binance launchpad back in April 2019. 1 matic coin was launched at USD0.00263 per coin, and at today’s price of USD1.18, this represents a growth of almost 45000% since the initial token offering.

Its total value locked has also grown from just under $1 billion back in March to currently $8.5 billion.

The polygon mainnet featured an EVM-compatible plasma chain which runs parallel to the Ethereum network, allowing users to easily bridge their assets from the Ethereum network over to the Polygon network to enjoy much lower transaction fees as compared to the Ethereum gas fees.

On top of that, the Polygon mainnet also uses proof of stake staking mechanism to optimize for scalability and decentralization.

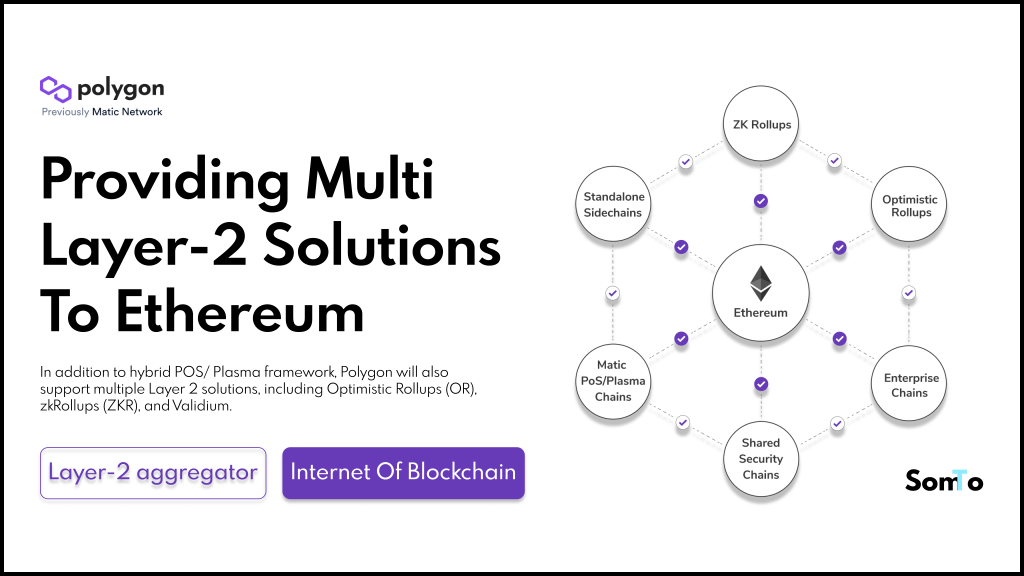

The term Matic and Polygon is used interchangably now, as the original project, which was launched as Matic, rebranded earlier this year to Polygon Network with a whole new vision – to become Ethereum’s internet of blockchains.

The new vision better represents what Polygon can do, as it can now connect multiple scaling solutions with one another instead of just connecting to the Ethereum blockchain.

The network Polygon network supports two types of Ethereum compatible blockchain networks:

- Secured networks: Maintained by Polygon/Ethereum validators. Highly secure but lack flexibility.

- Standalone networks: Maintained by own set of validators. Highly flexible but lacks security.

Additionally, the Polygon network architecture consists of 4 essential layers:

- Ethereum layer – Consists of smart contracts built on Ethereum network.

- Security layer – A validator as a service to provide additional security for a fee.

- Polygon network layer – The base layer of the network with a collection of sovereign blockchain networks that serve each other.

- Execution layer – A mandatory EVM compatible layer needed to execute smart contracts.

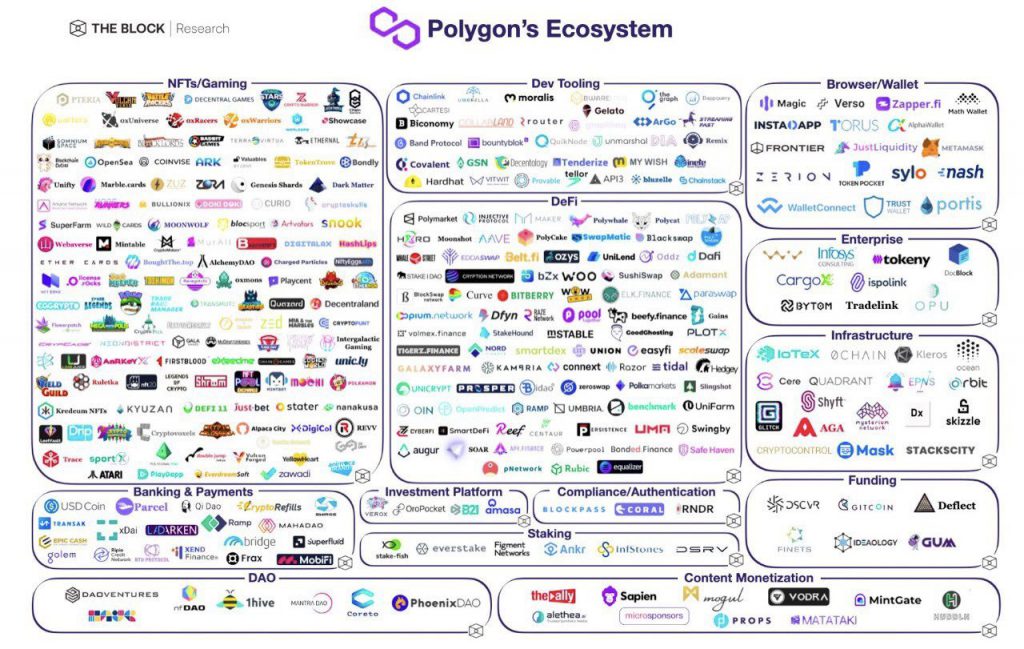

The layers are customizable, and protocols can opt for scaling solutions that fit their needs while being a part of an interoperable ecosystem. This is one of the crucial reasons for the rise of decentralized finance on the Polygon Network.

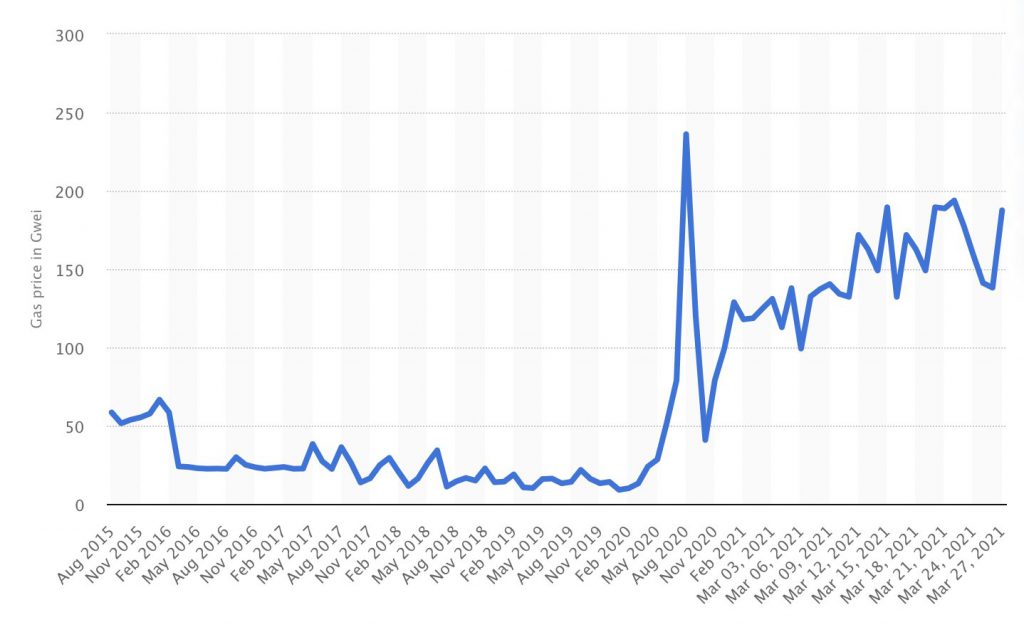

Other reasons catalyzing the growth of the Polygon network include increasing users from developing countries entering the DeFi ecosystem and existing users migrating out of the Ethereum blockchain due to its high gas fees.

Since May this year, several decentralized finance protocols such as Aave, Sushiswap, Curve and others, have also jumped onto the Polygon blockchain and have found success and huge traction. Here are some data:

2/ Users are the primary driver of revenue.@0xPolygon's user growth has been astronomical, posting it's fifth consecutive week of double digit growth.

— Raphael (@RaphaelSignal) June 16, 2021

Week 19: 35.06%

Week 20: 17.48%

Week 21: 14.75%

Week 22: 33.51%

Week 23: 21.49%

Soon, $MATIC will have > 100k daily users! pic.twitter.com/E1uPL5mSkM

4/ As a consequence, we continue to see Polygon's daily active users climb relative to Ethereum.

— Raphael (@RaphaelSignal) June 16, 2021

Polygon now has 17.42% of Ethereum's daily active users.

And the rate of change is quickening. This week $MATIC went from 12.6% to 17.42% of ETH's dau. pic.twitter.com/rRQcT5lNdU

6/ Contrast with Polygon, which has seen tx increase 372% month over month!

— Raphael (@RaphaelSignal) June 16, 2021

As $MATIC continues to onboard users, polygon becomes more desirable for dapps to deploy on, which in turn attracts more users.

Both user + dapp growth => tx growth. pic.twitter.com/44fHG7r1Tj

8/ With these numbers, we would expect Polygon's revenue to surge, multiplying the growth of both users and transactions over the last month.

— Raphael (@RaphaelSignal) June 16, 2021

That didn't happen. Instead, we see oscillating rev. in $MATIC terms until a break out in week 23.

Why is this? pic.twitter.com/TKrrdCdIMx

10/ However, cost per gas has dropped. And dropped a lot. Until this week, cost per gas decreased weekly

— Raphael (@RaphaelSignal) June 16, 2021

Week 18: -49.07%

Week 19: -28.86%

Week 20: 3.78%

Week 21: -33.21%

Week 22: – 19.33% pic.twitter.com/CPhZWIKGYp

12/ And, as $MATIC token has appreciated in price, revenue in $ terms is even more staggering, growing 396% in 7 weeks.

— Raphael (@RaphaelSignal) June 16, 2021

Average daily revenue ($) is nearly $8k. pic.twitter.com/dcN2Fb8J8R

According to Raphael, Polygon is growing its revenue while decreasing the transaction cost, and this is not something you see with other blockchains such as the Ethereum main blockchain.

As new users and other Dapps continue to build on the Polygon network, we expect revenue and active users to continue growing for the Polygon network over the next few years.

Of course, there are risks with regards to the Polygon network.

As with all scaling solutions, Polygon faces competition from other solutions such as Loopring, Omise, and newly launched Arbitrum.

New users and native applications continue to build on the platform at a rapid pace. The team is exploring innovative solutions and earlier this month released their findings and the way forward.

There are also debates that scaling solutions are just short term solutions addressing the inefficiencies of the Ethereum network. When ETH2.0 finally rolls out, that will render all scaling solutions such as Polygon obsolete.

However, according to Sandeep Nailwal, cofounder of Polygon, Layer 2 scaling solutions are here to stay.

“Ethereum 2.0 is supposed to have 64 shards, each one is going to be similar to what Ethereum is today. Let’s say after you add proof-of-stake to the current, single Ethereum chain, it’s able to process 50 tps (transactions per second), up from 13 tps today. Multiply that 64 shards: 3,200 tps. Do you think if Ethereum is going to become the fundamental settlement layer of the world that even 3,200 tps is a good enough scalability?” Sandeep told Coindesk in an interview.

“No, absolutely not. Let’s think of it as the supply of scalability. At the moment it goes up on Ethereum, the demand is already there. It will grow immediately and you will end up with the same bottlenecks,” added Sandeep.

Sandeep also shared that this is precisely why Ethereum cofounder Vitalik published a layer 2-centric roadmap for Ethereum, where he says ETH2.0 will only have data availability shards, meaning they will only have the data of the applications, but the execution happens on layer 2.

“Ethereum 2.0 will become 64 times more scalable than Ethereum is now, but the demand is 1,000x than where we are. You will need L2 scalability.”

Also Read: The Full List Of Yield Farms On The Polygon Network