While the native tokens of blockchains such as Ethereum and Solana have enjoyed significant popular interest, the Terra ecosystem has received comparatively less attention, although its recent growth and expansion has certainly been notable.

Popularly known by its reserve token Luna — the Terra ecosystem comprises of a number of key components which challenge the existing paradigm of stablecoins in cryptocurrency.

What is Terra?

Terra was founded in January 2018 by Daniel Shin and Do Kwon in Korea, and conceived as a project to create a price-stable and growth-driven cryptocurrency to push popular blockchain adoption.

One of the key pain-points in the cryptocurrency space has been the challenge of creating and maintaining a stablecoin to enable mass adoption of cryptocurrency — even today, the most popular centralized stablecoins such as Tether and Circle continue to be pegged to more conventional currencies such as the US dollar via cash and cash equivalents.

This involves the injection of fiat currency and fiat-backed assets to maintain the value and peg of stablecoins, which are collateralized via these assets.

In contrast, the Terra blockchain maintains a decentralized stablecoin (TerraUSD, or UST) which utilizes an algorithm and its associated reserve token, Luna, to maintain the balancing act of a 1:1 peg of UST to the US dollar. Terra markets itself as ‘programmable money for the internet’, according to its home page.

The decentralized stablecoin UST is the basis of the Terra payments ecosystem, which has the ambition of powering an end-to-end digital financial system with mass adoption.

Terra claims to have over 2m+ active payment users and over USD1bn in transaction volume per annum at present, and is crucially partnered with the Chai online payment service, which has grown in popularity in South Korea.

Why is Terra relevant?

Terra is seen as the key challenger to Dai, which is currently the most widely used decentralized stablecoin in the Ethereum blockchain.

However, Dai has experienced issues with scaling, due to supply-demand mismatch issues in its monetary policy. In practice, Dai is supplied by users looking to gain leveraged exposure to Ethereum and other ERC-20 assets, while Dai demand is driven by users looking to gain access to USD-denominated store of value on-chain. The supply and demand of Dai rests on two different dynamics which has often led to Dai trading at a premium to the USD.

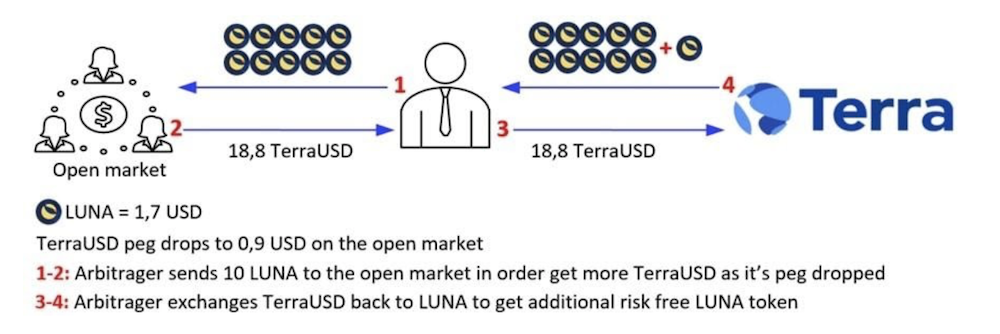

UST maintains its peg via an algorithmic balancing, where the minting of 1 UST requires 1 USD worth of Terra’s reserve asset, Luna, to be burned. Based on this, Terra claims that UST is infinitely scalable without restrictions.

What is Luna?

Luna functions as the governance and staking token of the Terra blockchain, and is utilized to maintain the peg of UST through the algorithmic burning mechanism.

Luna holders receive a percentage of transaction fees from the Terra payment network, with Luna serving as a collateral base for the entire Terra network and ecosystem.

All unstaked Luna can be freely traded, with the token listed on multiple popular exchanges such as Binance, Huobi, and OKEx.

Luna has garnered increasing attention from investors over time. Based on the 1-year price chart, Luna recently hit an ATH of USD37, with its value jumping significantly from the ~30 cents range a year ago.

Is Luna worth investing in?

1/ Before we begin, it’s important to realise what Terra is

— José Maria Macedo (@ZeMariaMacedo) September 8, 2021

Terra’s product is often misunderstood as an L1

In reality, Terra’s only product is $UST. Everything else, including the L1, simply exists to help make $UST the most useful and decentralised form of money there is

5/ The ultimate goal is “closing the loop” such that a user never has to leave $UST. This requires highly developed investment and spending ecosystems

— José Maria Macedo (@ZeMariaMacedo) September 8, 2021

The next few months leading up to and following Columbus 5 will unleash massive progress in both of these areas

9/ Once Columbus 5 goes live, the real fun begins, with @astroport_fi, @mars_protocol and @nebula_protocol all hitting the scene

— José Maria Macedo (@ZeMariaMacedo) September 8, 2021

Terra’s state of the art AMM @astroport_fi will kickstart #TerraAutumn in earnest with double incentives on mAsset farming ( $ASTRO + $MIR) pic.twitter.com/Fd7vMdeU0J

17/ Gradually then suddenly, Terra will have created a complete DeFi ecosystem, including strong primitives for synthetic assets, exchange, leveraged farming / trading, and asset management

— José Maria Macedo (@ZeMariaMacedo) September 8, 2021

All with an actual decentralised stablecoin at the heart of it

Given that Luna underpins the entire Terra blockchain and payments ecosystem, the attractiveness of Luna as an investment would be centrally dependent on the growth of Terra’s ecosystem in the future.

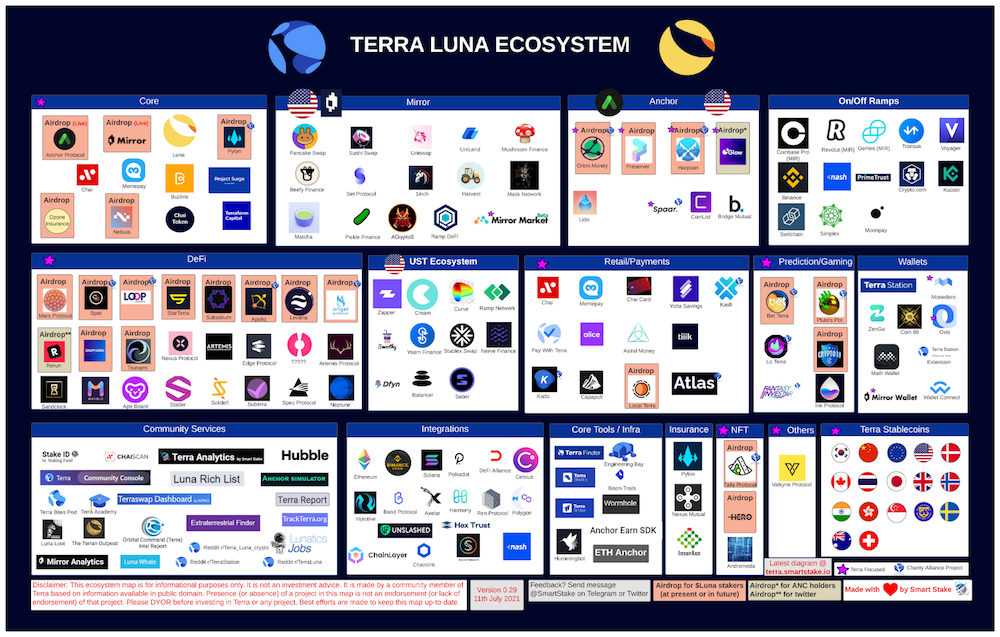

Aside from payments (Chai), other Terra ecosystem protocols include Anchor (money markets) and Mirror (synthetic assets).

It is important to note that transaction volume and adoption of Terra has been centered on the payments space so far via the blockchain’s partnership with Chai, which continues to be South Korea-centric.

Daniel Shin, the co-founder of Terra, currently serves as the CEO of Chai, which itself raised USD60m in a round led by Hanhwa and SoftBank Ventures Asia in Dec-20.

The broader Terra ecosystem is summarized in the infographic below:

In July 2021, Terraform Labs, the holding company behind the Terra blockchain, announced a USD150m ecosystem fund commitment from major investors such as Arrington Capital, BlockTower Capital, Delphi Digital, Lightspeed Ventures, Pantera Capital, and SkyVision Capital to grow its ecosystem of DeFi applications.

With the recent financial backing from marquee investors, Terra seems well poised to expand its ecosystem across the entire DeFi spectrum in the near future. A key area to watch would be how Terra scales transaction volume in its blockchain outside of Chai (and South Korea), which has played a key role in its growth thus far.

Featured Image Credit: BitNova

Also Read: All You Need To Know About TrueFi: The DeFi Protocol For Uncollaterized Lending