In 2021, Stader launched its all-in-one staking service. Its aim was simple: to simplify the staking process while making reward claiming more efficient.

Its presence has undeniably improved the standard of staking and they have gone on to introduce new products over time. It is now 2022, and we have the launch of Aperture Finance.

Similar to Stader, Aperture aims to simplify complex yield farming strategies for the average DeFi user, starting with users of the Terra ecosystem.

The aim is to truncate the setup of such strategies into a near one-click experience. In this article, we will explore their main mission and the merits of having such a protocol.

Read also: Staking LUNA? How Stader Labs Simplifies The Staking Experience For Terra Users

What is it?

According to its Telegram announcement group, Aperture touts itself as a cross-chain marketplace for strategies, connecting investment opportunities from various blockchain networks into one product. Therefore, offering a one-stop solution to DeFi users, and bridging the gap between chains.

While DeFi does not care about one’s social or economic background, it is still highly prohibitive because of the nascent technology that comes with it.

Aperture believes that the current technical landscape limits the rate of adoption and that new users should not have to deal with such complexities.

As a result, it will be introducing two main solutions that will drastically simplify complex yield farming strategies.

Firstly, an integrated bridge solution where users will be able to route assets from one chain to another for the lowest fee and in the quickest time based on their algorithm’s recommendation.

Secondly, the creation of a marketplace where users will be able to participate in complex yield farming strategies with just a (or a couple of) click of a button.

This builds on the integrated bridge solution where investors will be able to invest and capitalize on opportunities across all supported chains.

For the V1 launch of Aperture, it has debuted the delta-neutral farming strategy on Mirror. A summary of how the strategy works can be seen in the screenshot below.

For someone new to DeFi, this might be very intimidating as there are multiple steps to set up this strategy and funds can be lost at any point of the way if mistakes are made.

However, Aperture has simplified the setup of this process and now, anyone will be able to do it.

What products will be available?

According to their website, Aperture will have two main products: Aperture Invest+ and Aperture Invest.

The first will focus on complex yield farming strategies such as the one mentioned in the paragraph above while the second will focus on the usual liquidity pools.

But what is the point if I can LP by myself? Aperture’s key aim is to bring convenience to the investors by allowing them to invest in LPs outside of the chain their assets are currently in.

For example, an investor with his assets in Terra need not bridge to Solana to LP in the pools below. They would only need to deposit assets in the Aperture protocol, on Terra, to reap the benefits.

How does it work?

Wwhen I first started out farming on Terra, I remember taking weeks to fully understand what the delta-neutral strategy entails and how to go about setting it up.

I was so worried that I would make a misstep while setting up the multi-step strategy, losing funds in the process.

However, with Aperture in the picture, all it takes are a few clicks for the strategy to be set up. The only portion that cannot be streamlined is the part where investors have to get a basic understanding of how the strategy works and its risks.

This can be done by reading its Medium or Twitter posts or simply watching Youtube videos.

Also Read: Back To Basics: Why Mirror Protocol Is Still My Favourite Yield Farm On Terra

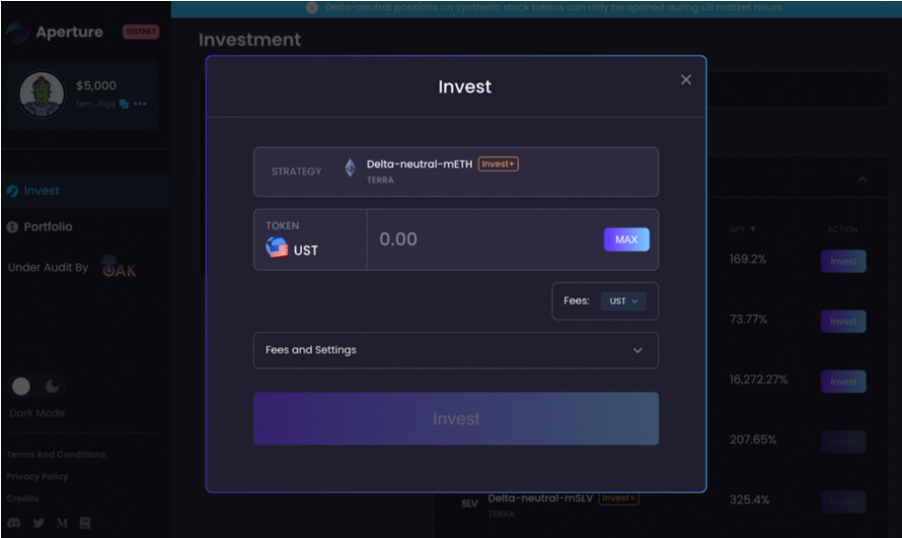

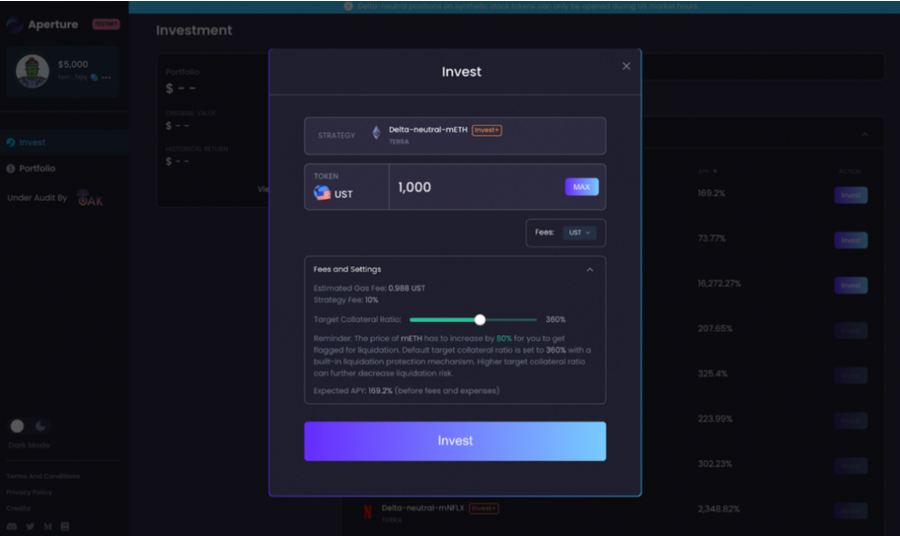

These are the three steps in setting up this strategy when using Aperture:

- Choose an mAsset

2. Decide on the amount to invest

3. Toggle Target Collateral Ratio (TCR) to your comfort. Do note that it is not necessary to go with the default TCR since Aperture’s algorithm rebalances every five minutes.

However, it would be prudent to set it slightly higher than the lowest TCR to protect against abnormal short-term volatility.

When all three steps are done, the investor can sit back and relax while the profits roll in. More details can be found in their medium post here.

Currently, Aperture is in Private Beta with about only 400 users having access to these services. However, the public release should be announced soon according to one of the community managers on Discord.

Why would you use it?

As the DeFi landscape becomes increasingly sophisticated, generating alpha becomes harder as well. Therefore, strategies have become progressively more complicated as investors look to stay ahead of the curve.

However, these strategies could be considerably intimidating to newer investors and may turn them away. This is where Aperture comes in to bridge the gap and assists the investor in setting up such strategies.

Furthermore, it is really for convenience that one would use Aperture. In an increasingly multi-chain environment, users often have to bridge funds from chain to chain.

This can be quite intimidating for new users or just plain troublesome for veterans. Aperture takes care of all that and there is no need to worry about careless mistakes anymore.

Icing on the cake

Aperture is one of the few projects that is going live in recent times with a working product before selling their tokens first.

To me, it is a breath of fresh air that emphasis is placed on a working product. Additionally, decisions by the team will not be swayed by the price action of a token since there is none currently.

I also like that the core team is fully doxed as seen in the screenshot below. This adds an element of trust to the project.

Finally, while Aperture has been largely unheard of until recently, it announced on 10 February that they closed a US$5.3 million seed funding round boasting some big names from both VCs and Angel investors.

Closing thoughts

While they are starting out with only a delta-neutral strategy, I believe there will be more use cases in the future as yield farming strategies become increasingly complex.

One should also be aware that returns for these strategies will fall linearly as the amount of investments into them increases. Also, investors will assume an additional layer of smart contract risks when interacting with Aperture. Hence, investors need to consider both the pros and cons.

As always, never invest more than you can afford to lose!

Featured Image Credit: Aperture Finance

Also Read: Growing Your Bag Of LUNA: Here’s A Guide To Yield Farming In The Terra Ecosystem