There is no doubt that bear markets in crypto pose the best opportunity to build your wealth. It is also the time for builders to continue building and investors to keep their eyes peeled for the next big thing during the next bull cycle.

The previous bull run showcased DeFi and NFTs leading the charge in innovation, adoption and inflow of capital into the markets.

It’s been a difficult season, but “we are in it for the tech right?” I don’t blame you if that doesn’t resonate with you, it is tough to see assets which are fundamentally sound reflect opposing price action.

So what’s next?

No one can predict the future but here are some ideas/narratives to ponder about for the next bull run. There is no guarantee this will make you a crypto billionaire but something worth pondering.

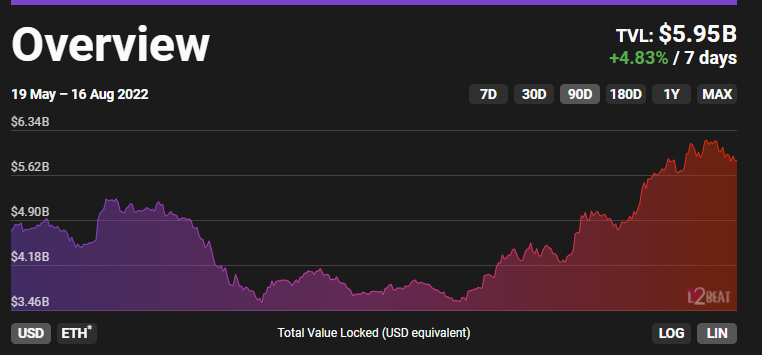

1. Layer2s Adoption

If you are invested in layer1s, there is a high chance you would have heard of the blockchain trilemma. The trilemma comprises scalability, decentralization and security and is widely believed that public blockchains can only provide two out of the three at any given time.

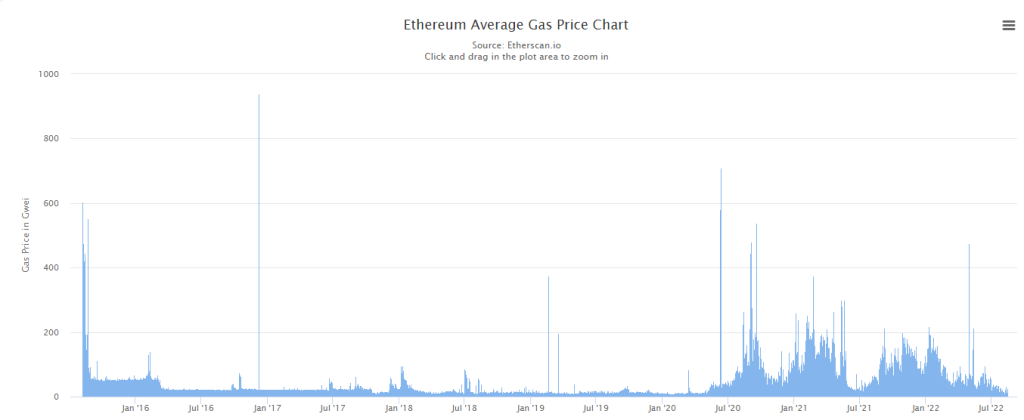

Take Ethereum as an example, which shows strength in its decentralized nature and security, however compromising on the scalability end of the triangle.

The issue of scalability in Ethereum is clearly reflected in its gas prices, the more congested the more expensive the gas fees will be. Especially with the DeFi boom and NFT surge, we saw gas prices surge especially from July 2020 to the present day.

So how can we solve this? That is where layer2s come into play. Layer2s offer the ability to increase the throughput and scale the blockchain while inheriting the same level of security and decentralization.

Layer2 solutions bundle thousands of transactions into one and post it to Ethereum’s main chain. This significantly lowers the cost per transaction and reduces the overall congestion that the main network can handle.

In my opinion, Layer2s offers solutions to existing layer1s and reveals they’re true potential. This goes beyond Ethereum, think of your favourite layer1s, basically what they lack will be what layer2 will solve.

How do you then envision layer3s to be? I’ll give you an answer in 5 years.

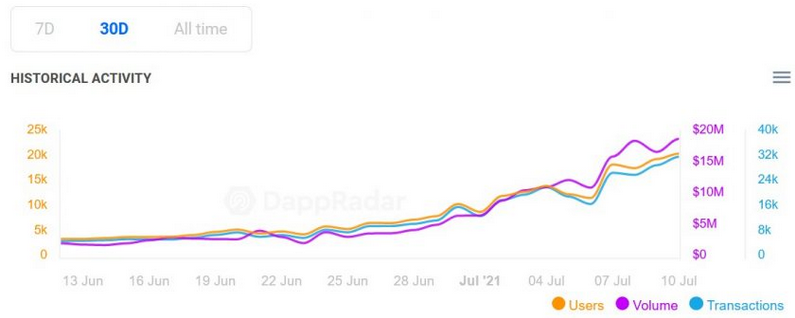

2. DeFi and NFTs

We saw glimpses of mass adoption between these two. The influx was rapid and exponential during the bull market. But the bear market cooled the overheated space, revealing areas for builders to continue building foundation blocks.

Everyone can agree though, that they are still in their infancy stage. DeFi as a financial system enables anyone, anywhere with any amount to participate while the true digital ownership of NFTs is not as simple as “right-click-save”.

Financial innovation sums up DeFi perfectly. For one, DeFi is basically a trustless and transparent system which opens up opportunities for all, even for the underbanked.

DeFi potential introduces new utility, and clarity of access for those who can borrow, make or even lend money without a middleman but it has yet to be truly battle tested. While I don’t think DeFi will overthrow the current TradFi industry completely, co-existing wouldn’t hurt.

Beyond pixelated art that you see your friends have on their telegram profile, it formulates as the baseline to basic digital ownership. It may not have a direct impact on you right now, but its potential to impact facets of industries and the way of life is never clearer.

It is a force to reckon with especially disrupting industries like gaming, music or even the educational sector as digital certificates. The innovation in this space is one to watch out for, they just need to get it to fruition.

3. GameFi

This multi-billion dollar industry is not one to overlook. Gaming was the reason why I begged my parents to buy me, my first game boy. It is the reason why I skipped soccer trainings just to improve my virtual status in rank. And I think this very effect applies to the majority out there.

This is crucial, the crypto space needs to get this right, and mass adoption will be imminent. In the current gaming environment, games are either free to play or paid. Regardless, of what you do in the game, every item you own isn’t really yours. It only is yours just as much as you play it.

In hindsight, maybe because I am older now, the hours I dedicated to the game are the sunken cost of time. I put the majority of my teenage hours into something I am not able to capitalize on.

There’s always a result, for exams, if you put in the hard work and effort, the likelihood of you achieving a good grade will likely be represented in your final result. When I ponder about gaming, I did not gain anything. GameFi will dispute this.

In my opinion, the market is ripe for disruption. Allowing players to take ownership of their time and money sunk into games powered by the blockchain with verifiably owned NFTs will create opportunities for all.

Can you imagine, the phrase “why are you wasting so much time on your games?”, usually said by my parents, will not be applicable.

But the technology is not ready. Not yet.

As soon as there is a shift, the adoption of GameFi will be exponential.

Closing thoughts

I don’t know as much as you do, maybe even less. But one thing is for sure and highly probable, crypto’s use case in the coming years, especially in the bull. Disruption will come but with that, gives birth to a more efficient economy with the adoption of crypto tools in various existing industries of the world.

Well, that could be an optimistic mindset, but there will be hurdles along the way which is almost inevitable. Perhaps this could be something we could work towards, and build the foundations of the future.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief

Also Read: We Asked Crypto Banter Host Miles Deutscher About Crypto Hacks, L1s, And His Biggest Degen Story