Key Takeaways

✔️ The combination of Asia’s strong market growth and the Casual/MMORPG-centric gaming market provides great potential for blockchain games.

✔️ Two main reasons why Web2 game companies are entering the blockchain space: 1) Securing the new growth engines, and 2) Raising new funds via tokens.

✔️ Strategy 1. Starting with Wemix, which has experienced the success of Mir 4 Global, companies such as Com2us are building their own blockchain ecosystem from base layer-1s and striving to maximize the added value generated across the ecosystem.

✔️ Strategy 2. Supported by the AAA IPs, main players in the gaming industry are more conservative towards blockchain adoption—with the most noticeable experiments being tokenization of the game components, such as turning items into NFTs.

✔️ 2023 stands to mark a renaissance of blockchain games, given an array of lineups set to be released by Web2 companies. This will, in turn, expedite the mass adoption of blockchain games.

Section 1. Asia, A Global Leader in Gaming

A Big & Fast-Growing Market

Asia’s gaming market is promising. It is not only the largest market in the world but brimming with growth potential. The 1.7B players in this region make up 55% of the world’s total gamers, generating $72B, or 52% of the world’s annual gaming revenue in 2019.(Source: Newzoo, IDC) Its salient per capita GDP growth will accelerate in-game purchasing power, further driving up the market share in the global games market. All these explain why Asia is widely considered the driving force to propel the global gaming industry forward for the coming decades.

Three East Asian countries are leading the gaming industry

The Asian gaming market is dominated by the three East Asian countries of China, Japan, and South Korea. Of the top 100 gaming companies in the world by market capitalization, 62 are from these three countries. In China, the game industry is dominated by large platform companies such as Tencent, and in Korea and Japan, the game industry is dominated by developers and publishers that produce their own games. In particular, the interest in blockchain technology is so high that game companies are working on blockchain projects, except for those in China, where cryptocurrencies are banned. We will explain how each game company is incorporating blockchain into their game IP in later sections.

Hardware has been at the heart of the progress. South Korea and Japan, the two leaders in Asia’s gaming market, initially sowed seeds to hatch a new industry with arcade games in the 1980s. They later prospered with PC and console games in the 2000s and mobile games in the 2010s, to eventually become the world’s largest gaming market of today. Southeast Asia joined the market later, where more accessible mobile games used to trump PC games in this part of Asia. The market share, however, has reversed recently with PC games overtaking mobile games.

The Asia market favors RPG(Role Playing Games) compared with the US market, where Strategy & Action games prevail. The RPG is more suitable to adopt blockchain technology compared with the Action or Strategy Games – we’ll discuss why in the next Section using a few examples. This is also why Asia drives the blockchain gaming market in terms of growth and innovation.

Section 2. Blockchain Gaming Is Blooming in Asia

Genres suitable for blockchain: RPG & casual games

1) MMORPG knows the value of ownership—and so does blockchain

In MMORPG(Massively Multiplayer Online Role-Playing Game), users create their own characters and own the items. Enabling ownership of digital assets constitutes the backbone of the whole notion of blockchain, and NFTs in the games will allow the assets, items, and characters to be transferred to the users so that ownership is fully acknowledged. MMORPGs are games where users get to expand and complete the content by playing and interacting with a large number of other players in a virtual world.. This is the difference from other game genres where users consume the content unilaterally provided by the companies. In this context, blockchain technology and Web3 philosophy are also applicable to the in-game reward system to compensate users proportionally for their contribution to the ecosystem.

Take Kakao Games’ MMORPG ArcheWorld for example. Using blockchain technology, NFTs are enabling ownership of assets, items, and characters for the users. Users produce content through housing, farming, and trading, interact with other users, and get rewards for expanding the game. This indicates that the game recognizes the users as contributors or constituents of the ecosystem deserving of a fair share of rewards, rather than mere consumers. This way, ArcheWorld seeks to promote participation in the ecosystem and improve the game experience.

2) Casual games are light enough to run on blockchains

Casual games are a genre where sessions are short and controls are simple—like, most prominently, Candy Crush and Anipang. With the overall hardware specs being relatively low, Asia has historically favored casual games. Hero Blaze: Three Kingdoms, the game that sparked unexpected hype around P2E in South Korea in 2021, is also a casual RPG game. The low spec requirement of casual games is well suited to the blockchain environment where scalability remains an issue. The current level of scalability capacity does not allow L1 and L2 blockchains to fully onboard on-chain blockchain games that are supposed to handle tens of millions of transactions. Compared to other genres, casual games, which are designed to be simple, require relatively fewer transactions and can be onboarded to the blockchain.

The high percentage of in-app ads in casual games’ revenue is another trait that works well with blockchain. In-app ads appear when an app is launched or during the game in the form of a banner at the top or bottom of the screen. While RPGs look to solicit in-game spending from users, casual games try to attract as many people as they can to have them exposed to ads and collect fees from advertisers—hence, the more the game is played, the greater the revenue from ads. The combination of in-app ads and blockchain games that are quick to build a significant user base in Asia can create a powerful synergy, as has been showcased by Axie Infinity, Hero Blaze: Three Kingdoms, and MIR4 Global.

Securing a New Growth Engine and Raising New Funds via Tokens

In a more practical sense, the gaming companies mentioned above are entering the blockchain game market mainly for two reasons:

i) to secure a new growth engine and;ii) to raise funds from new sources via tokens. (The suitability of blockchains for games has been mentioned earlier in section 1.)

Tapping into the emerging market of blockchain games would have been an incredibly appealing alternative for small-to-medium gaming companies in need of securing new growth engines, unlike large-scale brand-name game companies with steadily upward revenue based on their unique and established IPs. Moreover, it would probably be less of a burden for these small-to-medium companies to infuse blockchain elements into their existing IPs rather than producing AAA games, which takes massive resources, time and cost – from as much as over USD 100 million.

Even from the perspective of raising new funds, blockchain games would have worked as an alternative way to attract additional funds for Web2 gaming companies who used to rely on the stock IPOs for their first source of fundraising in the past. Gaming companies have been raising funds by directly selling their tokens in the public market or attracting private investments just before the token launch. Namely, Wemade, Com2uS, and Neowiz raised USD 250 million, USD 25 million, and USD 12 million respectively, through their tokens. The funds raised were used toward setting up the teams of blockchain developers, building their Layer 1s, and securing new content IPs.

Strategy 1. Build a Blockchain Ecosystem from A to Z

Possibilities of Blockchain Games Spotted in MIR4 Global

Although many P2E projects perished after their short-lived cycles, they successfully attracted a massive number of users and demonstrated the potential of blockchain games. This was enough to entice various companies to start building games with blockchain elements, mainly led by small-to-medium Web2 gaming companies in need of a new growth engine to break away from their stagnant sales. A major example of such a move was by Wemade in Korea. In Q3 2021, Wemade launched a new game with P2E elements based on their existing intellectual property (IP) pertaining to MIR, MIR4 Global, which boosted Wemade’s sales for the 4Q up to close to a two-fold growth from the previous quarter. It became a success story that nudged other Web2 gaming companies, such as Netmarble, Com2uS, and Neowiz, to enter the blockchain gaming industry.

1) Wemade: a Korean blockchain gaming leader

Founded in 2000, Wemade is a Korean game company with a market cap of $2B that owns the popular game IP “The Legend of Mir.” WeMade has achieved an average annual revenue of $100 million from 2015 to 2020. In 2021, the company grew significantly to $300 million due to the success of its blockchain game “Mir 4 Global”, which is based on the blockchain project “Wemix”. Similar to Axie Infinity, “Mir 4 Global” has strong P2E (play-to-earn) characteristics and has gained popularity among users in emerging countries in Asia, such as The Philippines and Thailand. The game set a record of 1.4 million concurrent users and 6.2 million MAUs, contributing to WeMade’s growth.

Mir4 Global’s success can be attributed to several factors:

- Leveraging the popular game IP, “The Legend of Mir”

- Introducing play-to-earn (P2E) mechanics during the crypto bull market

- Providing a user-friendly service with low transaction fees

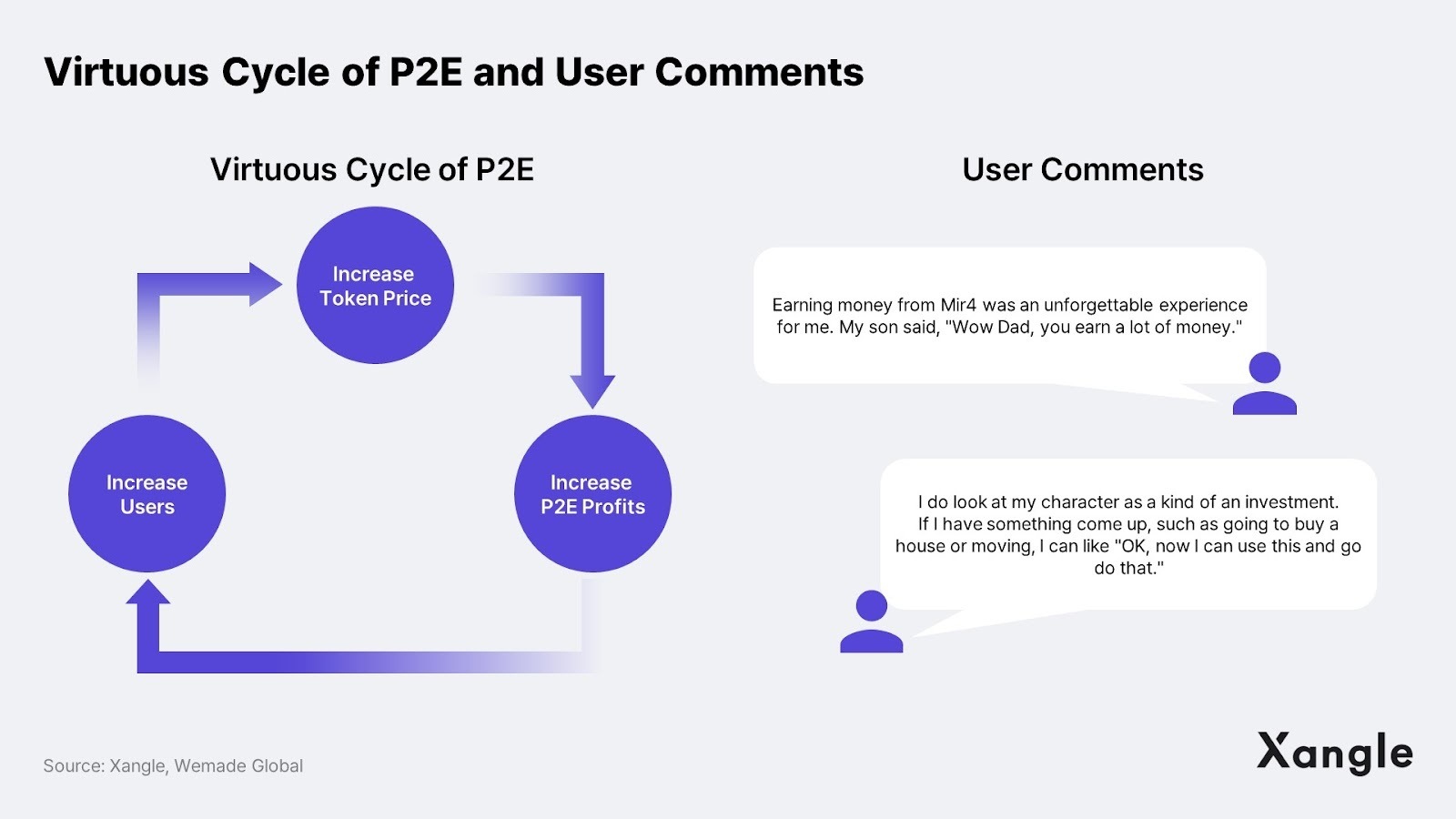

By using “The Legend of Mir” IP, Mir4 Global was able to offer a game with competitive elements such as storyline and graphics compared to existing Web3 native blockchain games. The release of the game during the crypto bull market also provided a favorable environment for Mir4 Global and Wemix, resulting in a cycle of rising token prices, increasing P2E profits, more users, and ultimately higher token prices. Additionally, the decision to utilize Klaytn’s sidechain to allow users to utilize the blockchain infrastructure at a lower fee was meaningful to users who had grown tired of high fees. Wemix was able to avoid the high fees that Axie had experienced in the past.

Similar to other P2E games, such as Axie Infinity, Mir4 Global’s game cycle started to decline as the price of its governance token, WEMIX, peaked and began to drop. In response, WeMade shifted its strategy from being solely a dApp game developer to launching its own Layer 1 blockchain called “WEMIX Chain,” which is forked from Ethereum and building an entire blockchain ecosystem. The company now plans to onboard its other major game IPs, such as “AniPang,” “Mir M,” and “Icarus M” onto its own chain, creating a WEMIX blockchain ecosystem rather than developing blockchain games in a sidechain format on Klaytn Layer 1.

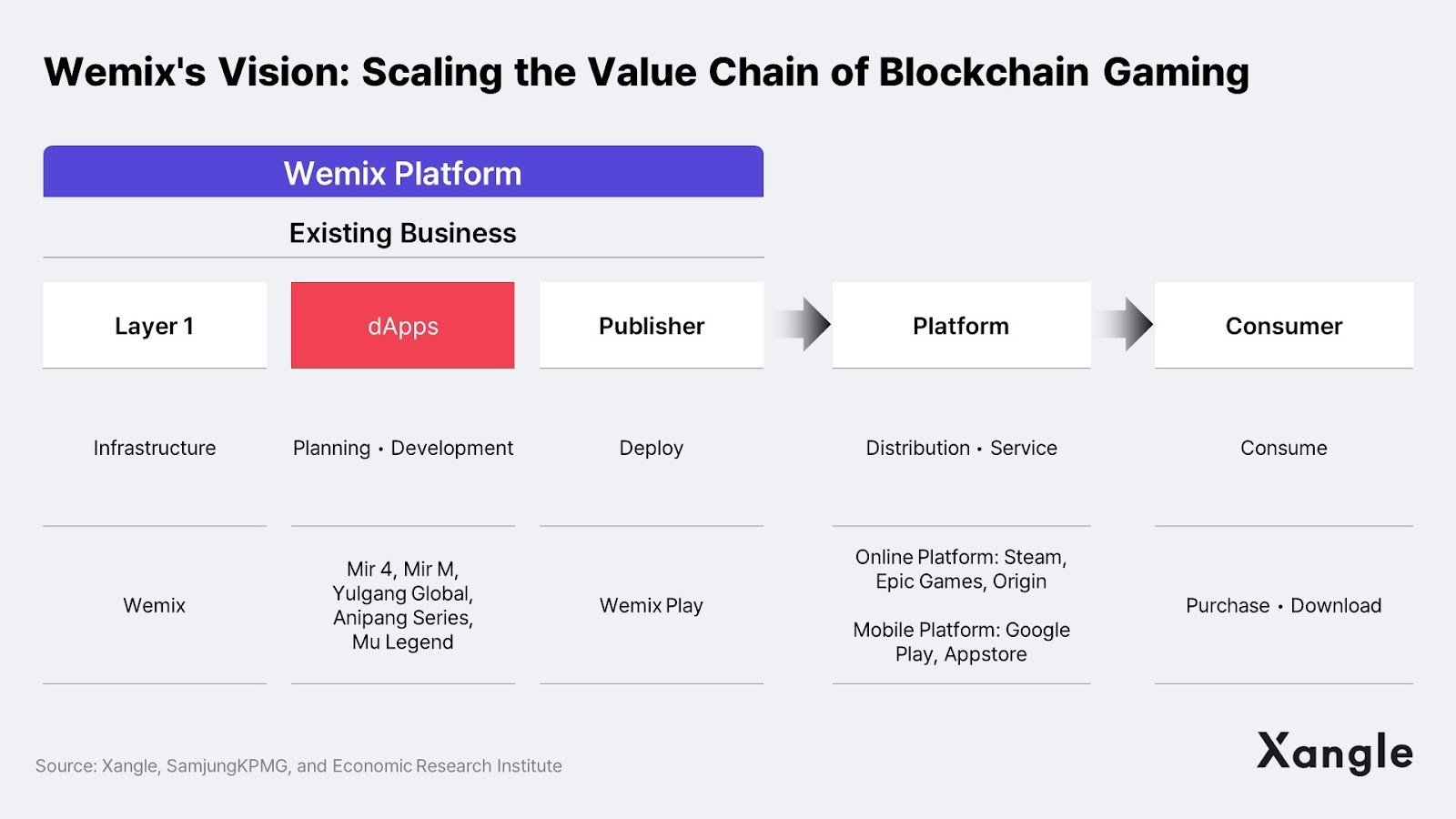

There are several reasons for WeMade to launch its own chain, but the most important is maximizing the added value generated across the blockchain. When using the Klaytn L1 infrastructure, blockchain fees had to be paid to Klaytn, and fee revenue generated during transactions such as token exchanges had to be paid to other DEXs and NFT marketplaces. However, with the launch of “WEMIX Chain” (Layer 1), “Wemix Play” (game platform), “Wemix.Fi” (DeFi service), and “Wemix Dollar” (stablecoin), Wemix can now directly operate and expand its value chain across its entire blockchain ecosystem.

WeMix Play currently offers 23 games, including Mir 4 Global and Mir M, which are based on “The Legend of Mir.” These games currently have 300,000 and 150,000 concurrent users, respectively, a significant number compared to Web3 native games. Although the number of games planned for release is 34, which falls short of the initial target of 100 onboardings, WeMix is preparing to release popular IPs from Web2, such as “Anipang,” “Mu Legends,” and “Icarus M.” The release of these games are expected to further strengthen WeMix’s position as a blockchain gaming platform.

2) Netmarble integrates blockchain technology into its core IP

Netmarble is a major South Korean game company founded in 2000 with a market cap of $4B. The company holds popular game IPs such as “Seven Knights” and “Let’s Get Rich.” As part of its new growth strategy, Netmarble has selected blockchain as a new growth engine and entered the blockchain market with a two-track approach through the Klaytn-based (soon to be expanded into multiple chain starting with BNB chain) GameFi-oriented platform Marblex and the BSC-based entertainment-oriented platform FNCY. Marblex launched three blockchain games in 2022 and set a remarkable record of 13M users and 22.5M game downloads. The platform is set to take another leap forward in 2023 with the launch of a game utilizing its core IP, “Let’s Get Rich.”

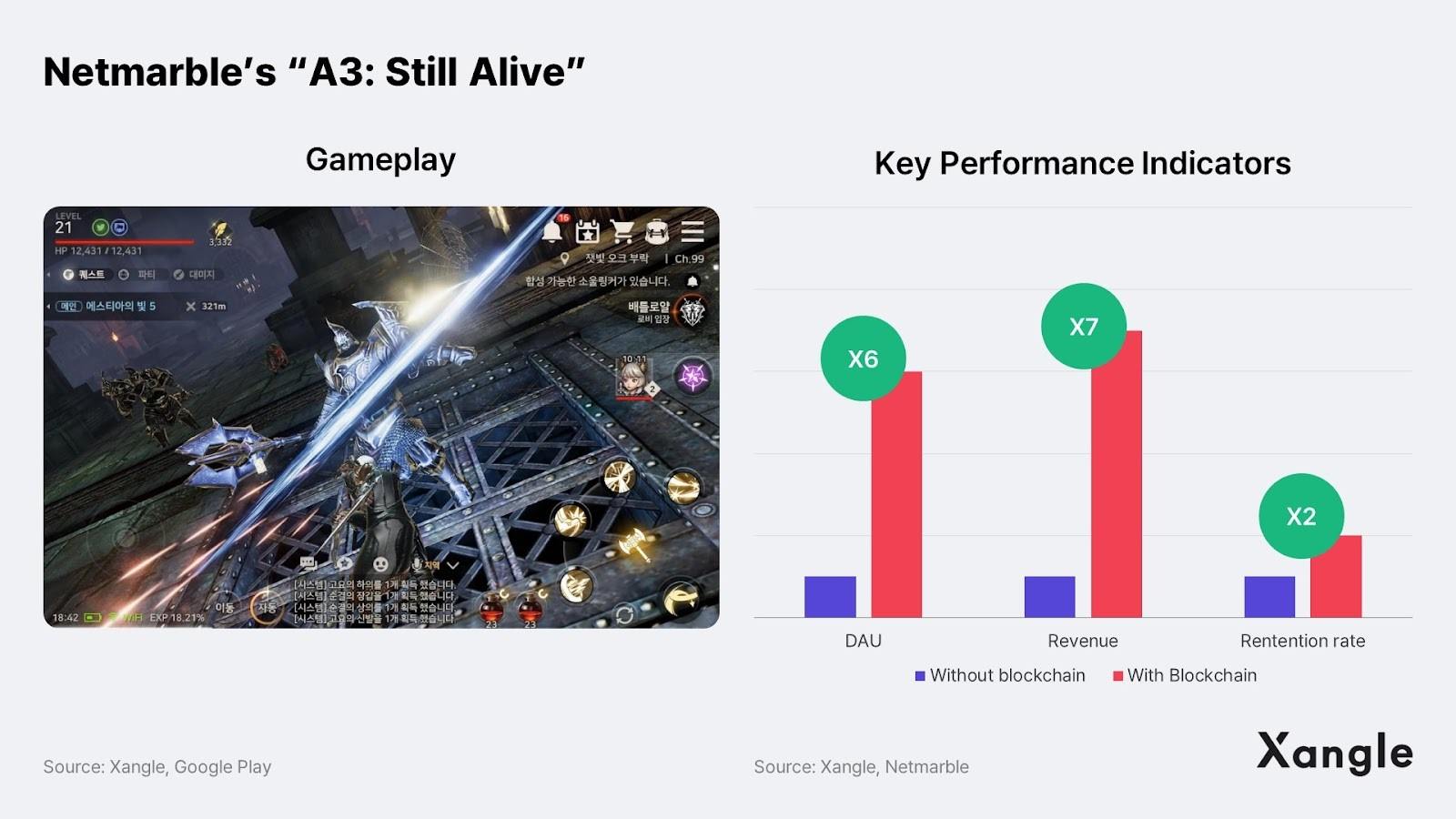

In 2022, Netmarble launched three blockchain games that utilized its IPs, namely “A3: Still Alive,” “Ni no Kuni: Cross Worlds,” and “The King of Fighters: Arena.” “A3,” an MMORPG, saw a seven-fold increase in revenue, a six-fold increase in DAUs, and more than a two-fold increase in retention after adopting blockchain. This was achieved by providing users with incentives to mine MBX tokens through gameplay, which is a unique feature that only blockchain games can offer.

“Ni no Kuni,” another MMORPG, was the highest-grossing mobile blockchain game last year, surpassing “Mir4 Global” by reaching the top 10 in both app markets in 27 countries, including the U.S. It also showed an improved 30-day retention rate (+4%) and maintained a stable token price, with an in-game burn rate of 95% compared to the number of game tokens mined. “Ni no Kuni” showcased the potential sustainability of blockchain games by offering a solution to the unsustainable tokenomics problem that has been identified as a constraint of first-generation blockchain games. This was accomplished by combining solid game content with a token sink that can only be implemented in blockchain games.

Netmarble is set to release “Meta World: My City” in Q2, which utilizes the “Let’s Get Rich” IP with 150M cumulative downloads globally. The game combines a board game with a real estate metaverse where players can trade land and buildings as NFTs and receive dividends in the form of game tokens through real estate investments, similar to Blue Marble. “Meta World” is poised to be successful as it is based on an IP that has built global recognition, and it provides unique content, unlike existing Web3 real estate games that only allow users to purchase real estate.

While some other major game companies are hesitant about integrating blockchain technology for fear of damaging their IPs, Netmarble is taking a distinct approach by leveraging its core IP. Netmarble has already experienced positive results with its three blockchain games released last year. Netmarble intends to expand its presence as a blockchain game publisher by releasing third-party games. Given Netmarble’s strong publishing capabilities, there are high expectations for this aspect of their business. Netmarble’s experimentation with bold attempts and trial-and-error to develop its own blockchain game design know-how and formula for success positions it as a potential leading company in the blockchain game market.

3) XPLA – building XPLA, the killer contents candidate for Cosmos ecosystem

XPLA is a PoS blockchain utilizing the Cosmos SDK and developed by Korean mid-sized game company Com2uS. Founded in 2007, Com2uS was a company that mainly developed casual mobile games, but as the mobile game industry grew significantly with the advent of smartphones in the 2010s, it grew into a medium-sized game company. In particular, the game IP of the mobile game “Summoner’s War” released in 2014 was such a mega hit worldwide, lifting the company’s sales to $500M and market cap to $1B.

Given that Com2us has a stellar track record of staying ahead of the curve when a pivotal shift to mobile devices took place in the gaming industry, the company seems to have spotted an opportunity in the current transition to blockchain and Web3. Among the many elements of blockchain, Com2us has focused on the transfer of “ownership” to users. It is only natural in this sense that its top pick game genres for blockchain incorporation are i) RPGs, where users have inventories in the game, and ii) casual games, where the game economy is relatively easy to build.

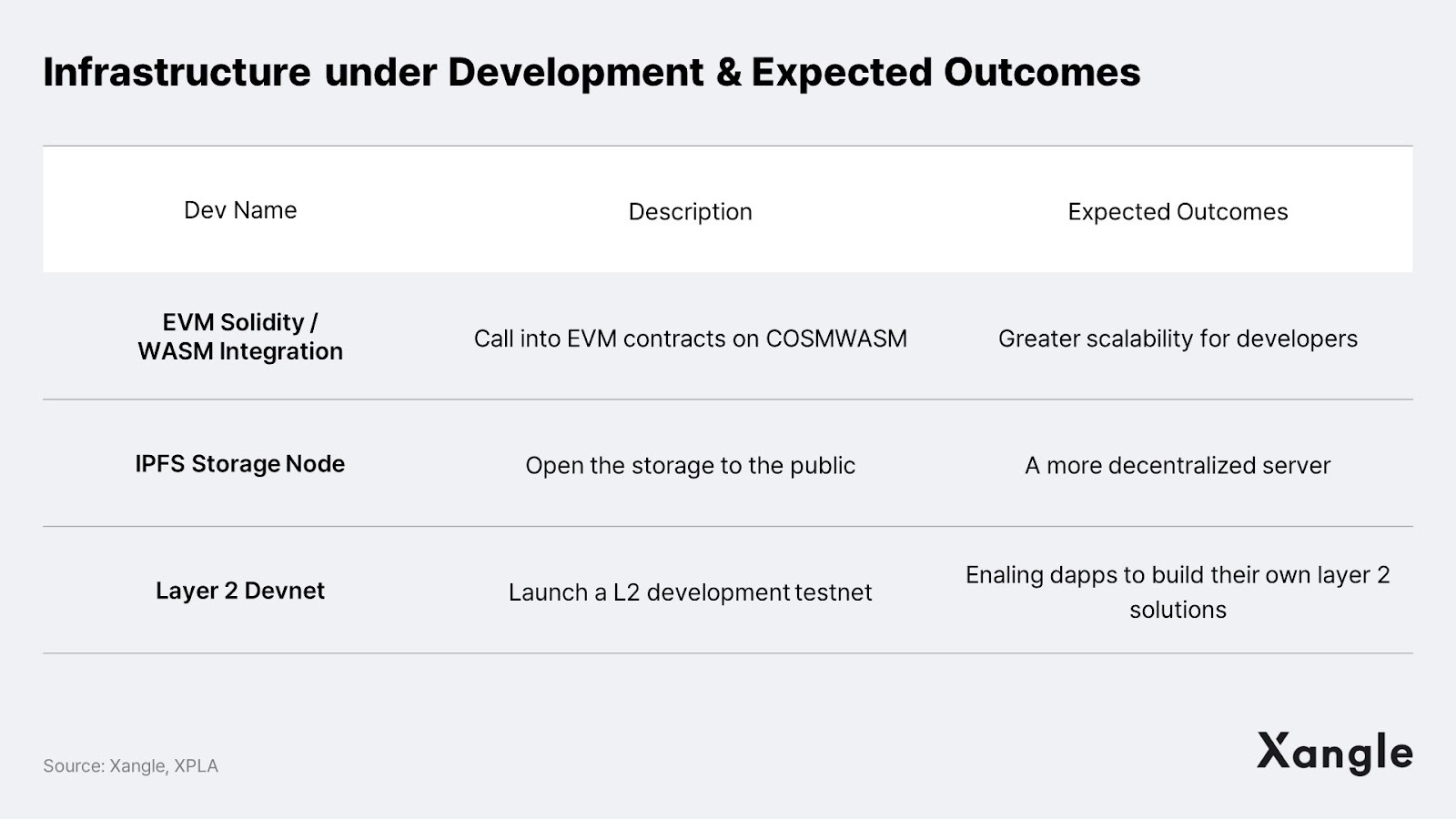

Com2us’ Web3 strategy can be divided into two parts: driving the growth of the Cosmos-based Layer 1 ecosystem and incorporating its own content into XPLA. Though the former part of the strategy suffered a delay in the overall roadmap timeline in the wake of the downfall of Terra and FTX last year, the infrastructure for developers (e.g., EVM compatibility, Solidity-CosmWasm integration, and Layer2 solution development) is expected to be completed by the end of this year.

As to the latter part of the strategy, the lineup of dApps to be onboarded to XPLA this year has already been outlined to a certain extent. We believe that this will potentially establish it as a killer game content platform in the Cosmos ecosystem that is significantly short of content. In particular, a blockchain version of Chronicle—one of the Summoners War IPs that has generated $3 billion in cumulative revenue over the past eight years—is scheduled to launch in Q3 of this year, and 3-4 casual games, such as Minigame Heaven, are expected to be onboarded in the front half of the year. In a bid to survive the intensifying Layer 1 competition, the company plans to maximize its own IP content, and is mapping out a roadmap for the infrastructure required for external dApp onboarding (e.g., XATP introduction, enhanced EVM compatibility, IPFS storage nodes, Layer 2 support).

Yet, choosing the Cosmos ecosystem when Ethereum L2 has become the mainstream choice for development comes with a challenge. The Cosmos ecosystem may require significantly more infrastructure development than the Ethereum ecosystem, posing a risk of fragmentation of resource pools. In addition, XPLA may find it difficult to satisfy the needs of developers wishing to develop services on native rollups or chains, further upping the ante in securing the infrastructure. Moreover, the lack of a tangible outcome of the adoption of blockchain technology remains a task at hand for the projects set to launch on the network this year.

Strategy 2. Test Blockchain on Selected Game IPs

While mid-to-large gaming companies are vigorously leading the formation of the blockchain game ecosystem in Korea, large-scale Web2 gaming companies have adopted a more cautious approach towards the integration of blockchain technology. It has been pointed out that this reticence is attributed to two main reasons: i) the size of the blockchain market is much smaller compared to the large gaming companies’ sales and ii) their key game IPs may be compromised through the implementation of blockchain technology.

1) NEXON – Making MapleStory a 30-year game with blockchain

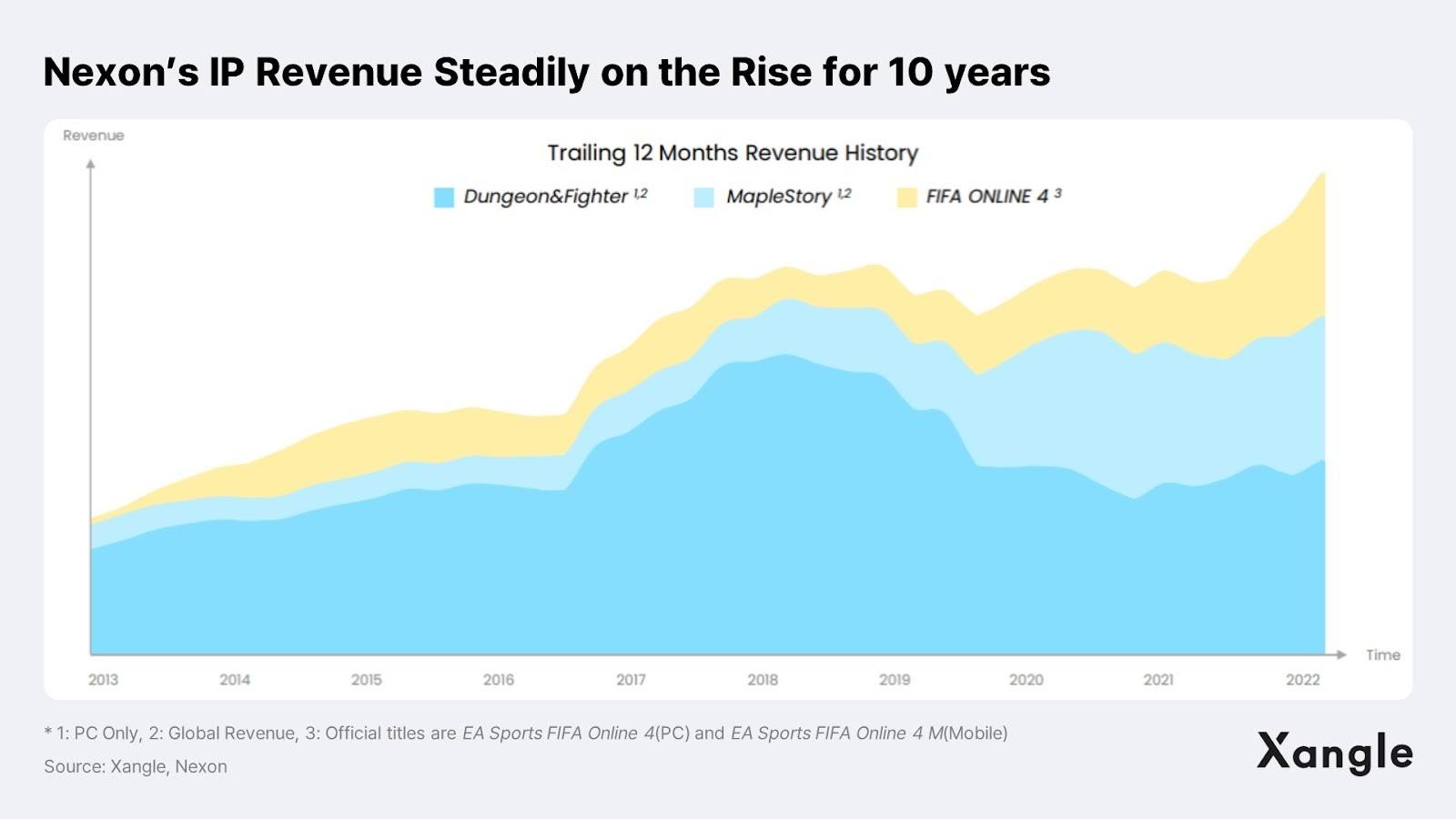

Speaking at the first session of the Xangle Adoption conference last summer, Nexon COO Kang Dae-hyun began his presentation by describing Nexon as “a company that has made unsustainable games sustainable.” Indeed, Nexon’s game IPs, Dungeon & Fighter and MapleStory, which together account for nearly 50% of the company’s $3B in annual revenue, are 17 and 20 years old, respectively, and have seen steady revenue growth. Nexon surely seems to be a gaming heavyweight that specializes in creating sustainable and long-standing games.

Nexon’s blockchain strategy is to experiment with incorporating blockchain technology into services to an extent that would not have an enterprise-wide repercussions. The company will test whether this will increase the number of users or longevity of the game. In particular, MapleStory N World, which Nexon plans to launch with blockchain elements, is a project with a clear goal of “making successful games more sustainable.” To this end, the company has decided to let go of areas that it once tried to have a control over. Most notably, it plans to decentralize various game elements like “quests” to build a game creator ecosystem and enable an environment where users get to play with the content generated natively within the blockchain ecosystem.

The blockchain technology (particularly, NFTs) and tokenomics will be utilized as a means to support the formation of this self-sustaining ecosystem. MapleStory N is reportedly targeted to launch sometime in 2023. If MapleStory’s adoption of blockchain helps create an ecosystem of creators in the game, which in turn increases the lifespan and revenue of the game, it will lead game companies that have been hesitant to adopt blockchain in their games as well.

2) BORA – Cautiously onboarding IPs on BORA

Kakao Games is a $3B market cap gaming arm of South Korean tech giant Kakao. Kakao Games initially achieved high-volume growth by leveraging i) KakaoTalk, Kakao’s mobile messaging app with a staggering 95% market share, as a platform and ii) casual mobile games featuring popular Kakao Friends characters. Today, the company has successfully expanded into multiple genres, such as MMORPGs and simulations, generating $900M in annual revenue.

As part of its new business portfolio, Kakao Games operates BORA, a cross chain-based blockchain gaming platform. In 2022, BORA launched “ArcheWorld,” an MMORPG featuring ArcheAge IPs and “Birdie Shot,” a casual sports game featuring Kakao Friends IPs. After testing the application of blockchain technology to two very different game genres, BORA concluded that casual games, in which game economy is relatively easy to design and modify, have better synergy with blockchain. Starting with the launch of a hyper casual game in 2Q 2023, BORA is set to roll out various types of casual games, including puzzle, sports and social casino over 2H 2023 to 1H 2024.

For Kakao Games, 2023 will be marked as a year of introducing and testing various tokenomics in casual games to ultimately identify a successful tokenomics model. Only by finding its own way and proving a sustainable model will Kakao Games be able to more actively and boldly apply blockchain to its large IPs.

3) Square Enix – The first blockchain game ‘Symbiogenesis’ is coming soon

Square Enix is a leading Japanese game company whose core IPs most prominently include “Final Fantasy” and “Dragon Quest.” Unlike in the past when the company used to leverage its core IPs to churn out console game series, it has successfully transitioned to mobile—as illustrated by its mobile games revenue that now represent more than half of its gaming revenue. Following the successful shift to mobile, Square Enix has recently proposed blockchain games as a mid- to long-term growth strategy. In his New Year’s speech in 2023, Square Enix CEO Yosuke Matsuda highlighted the growth potential of blockchain games that depart from a dynamic where games are unilaterally provided by game companies and facilitate user-driven growth within games.

“Symbiogenesis,” which is currently under development, reflects the vision and is expected to be the first new blockchain game to be released by Square Enix. While details are still scant, Symbiogenesis will be launched on the Polygon blockchain and will be an NFT game with its own universe based on 10,000 NFTs. Although deployment of blockchain in its flagship IPs “Final Fantasy” and “Dragon Quest” has not been nailed down yet, the New Year’s message appears to signal possible development and release of more blockchain games to come starting with Symbiogenesis.

Korea in the Lead, Followed by Japanese Gaming Companies

Among the global top 100 gaming companies, around 70% are Asia based. We looked into these companies to analyze their blockchain adoption plan. The result showcased that Korean gaming companies are at the forefront of developing blockchain games. (Refer to the table below.)

Although the gaming companies in Japan may have been late to start, their stance towards embracing blockchain technology is not much different than that of the Korean companies. While no gaming company is solely pursuing the Layer 1 business, many major brands in the Japanese gaming industry, including SEGA and Bandai Namco, have entered into the Layer 1 business indirectly by participating as validators for the Oasys. Bandai Namco, has also declared its plans to connect its unique IP with its fans by investing in blockchain startups. As the first step into that journey, Bandai Namco invested in Gangbusters Ltd., a blockchain game developer.

The Reasons Other Big companies Hesitate to Choose Blockchain

Still too small a market and concerns over potential damage to IPs

In fact, the revenue generated by the blockchain gaming market is miniscule in comparison to the annual earnings of the large gaming companies. According to Newzoo, the global gaming market reached USD 175 billion in 2021. Leading game makers, such as Nintendo (USD 14.9 billion), Activision Blizzard (USD 8.8 billion), Electronic Arts (USD 5.6 billion), and Nexon (USD 2.5 billion), all reported their record-high performances during the COVID-19 pandemic. In comparison, the revenue generated by the blockchain market is insignificantly small. The cumulative sales for 2021 and 2022 of Axie Infinity, the game that practically represented the whole blockchain gaming market, fell short at USD 1.3 billion, which dropped even further to a monthly revenue of approximately USD 1 million today. Similarly, Wemade’s MIR4 Global also recorded cumulative sales of a mere USD 140 million for the same period, which is not substantial compared to the sales figures the large gaming companies are used to seeing. All in all, the blockchain game market is simply too small to be on the radar of traditional Web2 gaming companies.

Another consideration for large gaming companies is the potential negative impact that the integration of blockchain and tokenomics could have on their valuable IPs. This is especially so if these game IPs are the main source of revenue for these companies and have been something of a cash cow, consistently generating substantial profits over an extended period. Having witnessed the extremely short-lived P2E game cases, such as Axie Infinity and STEPN, it would not have been an easy call to introduce P2E elements to their existing games. For example, Krafton, a Korean gaming company with a market cap of USD 7.0 billion, is heavily reliant on its megahit shooting game, PUBG: BATTLEGROUNDS, for most of its sales. However, it is understood that the company currently has no plans to integrate blockchain technology to this IP.

Testing the waters by adopting blockchain partially

Even so, there are some large Web2 game makers carefully seeking to introduce blockchain against these odds. Nexon, a Korean gaming company listed in Japan, plans to release MapleStory N by applying blockchain elements such as NFTs to its MapleStory IPs that make up about 25% of Nexon’s revenue. NCSOFT in Korea is also planning to enter the North American and European markets by infusing blockchain elements into the IP of its representative game, Lineage. One thing these companies have in common is that their strategy is to test the waters by experimenting with blockchain technology on services that are not large enough to make any company-wide impacts. They are expected to test whether the elements introduced will cause the number of users or the game’s lifespan to increase.

In particular, Nexon’s MapleStory N is one of the highly anticipated IPs as it is a project rooted in the attempt to “make a successful game even more sustainable.” Nexon stated that it is introducing blockchain to make this game, which has been in service for over two decades, to be an even more lasting game. It defined its Web3 elements as the decentralization of MapleStory IPs to enable and support various community-driven games within the ecosystem voluntarily generated by the users themselves. Blockchain technology (including NFTs) and tokenomics are used as means to support them. Suppose the introduction of blockchain to games would contribute toward building ecosystems of creators, eventually leading to an increase in the games’ lifespans and sales; in that case, it is expected to be the wind of change for the gaming companies who have been reluctant to adopt blockchain for their games.

Conclusion

In 2023, the blockchain gaming sector is expected to grow even stronger, with Web2 sectors releasing more Web3 gaming, starting with Wemade’s MIR M, which was released in January 2023. Netmarble’s Meta World and Com2uS’ Summoners War are scheduled to be released in 2Q 2023 and 3Q 2023, respectively, while Nexon’s MapleStory N and Square Enix’s Symbiogenesis are expected to be launched within this year. Blockchain games will take game quality to the next level compared to the previously released P2E games that reported incomplete success, potentially driving mass adoption of Web3 gaming.

Many game makers in Asia are developing blockchain games with different strategies and approaches powered by blockchain. They saw the potential synergy between games and blockchain technology, which gives users ownership over their data and allows them to trade it. Another possible opportunity factor is the fact that Chinese game makers, which are rapidly emerging and becoming more competitive, are unable to enter the blockchain market due to regulations. Although the blockchain gaming industry has been relatively slow in mass adoption since the launch of STEPN in 1H 2022, we hope the launch of blockchain games by traditional Web2 gaming companies, which have the development capabilities and resources, will bring synergy effects in the crypto asset industry.

Disclaimer

This content was produced independently by the author(s) and did not necessarily reflect the opinions of CrossAngle Pte. Ltd. The content is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

This report contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of CoinMarketCap, and CoinMarketCap is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. CoinMarketCap is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by CoinMarketCap of the site or any association with its operators. This report is intended to be used and must be used for informational purposes only. It is important to do your own research and analysis before making any material decisions related to any of the products or services described. This report is not intended as, and shall not be construed as, financial advice. The views and opinions expressed in this report are the author’s [company’s] own and do not necessarily reflect those of CoinMarketCap. CoinMarketCap is not responsible for the success or authenticity of any project, we aim to act as a neutral informational resource for end-users.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: CoinMarketCap