Some of us might have heard that one of the next protocols slated to launch on Terra by the end of this year is a new Automated Market Maker (AMM). But what about Terraswap?

One of the major reasons Terraswap was originally created was to facilitate the trading of synthetic assets on Mirror Protocol. Terraswap pools make prices based on a constant product pool pioneered by Uniswap on Ethereum using the X*Y=K equation.

This video perfectly explains how a constant product pool works. While Terraswap works, allowing us to swap one token for another and even to provide liquidity, it is not exactly a best-in-class product for the ever-growing Terra ecosystem.

Before we go on, let’s take note of some important dates. Astroport has recently announced that it will go live on December 20.

Phase 1 will begin on December 6 and Phase 2 will follow immediately after on December 13. With that, let’s look at how Astroport aims to be an upgrade from Terraswap. Here are three main points:

Different pool types

Firstly, Astroport will debut with three different pool types. Different token markets will have different characteristics and properties.

Think about the usual stablecoin paired with a farm token or a pair of stablecoins. Both pairs will function differently. As such, different pool types cater to different token markets.

If used appropriately, it will increase the efficiency for both traders and liquidity providers. In general, the mechanics behind pool types are pretty technical so I will only briefly touch on each kind.

As mentioned earlier, Terraswap currently uses the constant product pool model and that is one of the models that Astroport will use as well.

A user will deposit equal amounts of two tokens into the pool. For example, in the ANC-UST pool, the user will deposit $50 worth of ANC and $50UST. However, for most pools using this method, the bulk of liquidity within them is not used to facilitate trades under normal conditions.

As such, this capital inefficency leads to high slippage. But in general, this pool is still a good choice for pairs with high volatility such as the one mentioned above.

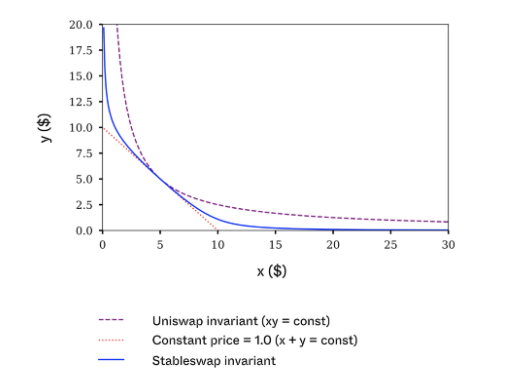

The second pool type is the stable invariant pool. You would have seen this on Curve Finance where it is used to swap between stablecoins.

This pool utilizes a modified swap formula which reduces slippage. When a user wants to swap between stablecoins, they would expect low slippage since each type of stablecoin is supposed to represent the same value (ie. $1USD).

This can work for “stable pairs” as well such as the bLUNA-LUNA pair. As this pool is mainly for pairs with a 1:1 rate, slippage becomes much higher if the exchange rate deviates too far from equilibrium.

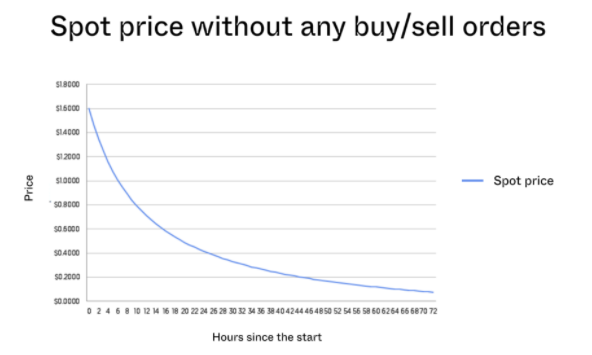

The last pool type is the Liquidity Bootstrapping (LBP) pools. This pool type seeks to address the issue of providing initial liquidity for a project.

The pool will be opened for users to deposit funds, such as UST, for a certain period. The more funds that are deposited into the pool, the lower the price of the token being launched.

This method allows for price discovery in a fair and non-volatile way and eliminates both bot activity and whale trades. Astroport itself will be launching in a similar fashion using what they call a lockdrop.

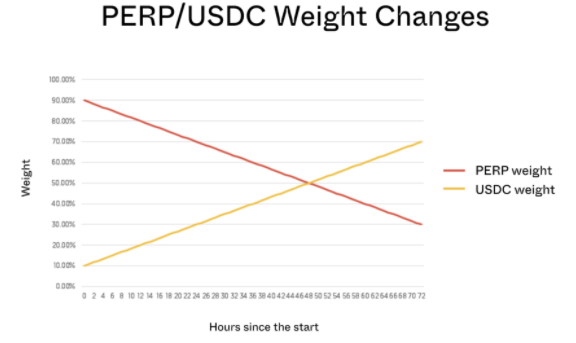

The two graphs below show how the price and weight of the token will move over the duration of an LBP launch.

Dual incentive for LP on Astroport

Moving on to the fun part. Currently, when we provide liquidity, we only earn one kind of reward. For example, if I provide liquidity for the MIR-UST pair, I will receive rewards in MIR.

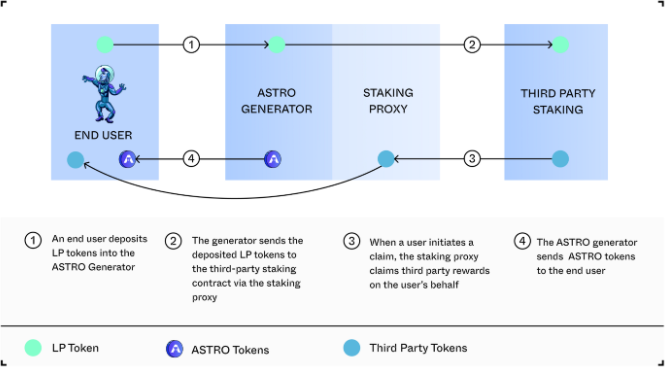

However, when Astroport launches, users can now LP on there instead of directly with Mirror. How it works is summarized in the illustration below. In return, the user gets two types of reward: the basic farm reward and ASTRO tokens.

The Astral Assembly

Lastly, Astroport will have its own governance token. Astral Assembly is its version of a Decentralised Autonomous Organisation (DAO). It will be in place to maintain and develop Astroport’s growth.

Users who hold xASTRO will have a say in governance matters and be able to vote on all proposals. xASTRO, inspired by SushiSwap’s xSUSHI token/pool, is obtained by staking ASTRO into the xASTRO pool.

How to get ASTRO

This project is rather special in the way they aim to distribute their tokens. As such, I would like to touch briefly on it before we end.

Phase 0

For a start, ASTRO tokens will be airdropped to active users of the Terra ecosystem instead of LUNA stakers. This is known as Phase 0. Basically, you will qualify if you have provided LP, governance staked, or voted in projects such as Mirror and Anchor in the past.

I assume that the longer you have been in the Terra ecosystem, the more ASTRO you would get. This is alongside the amount of capital you have invested into the ecosystem.

Unfortunately, the snapshot has already been taken and as such, you cannot do anything to qualify for this airdrop. Specific details on the quantity of airdrop allocated to each wallet will be released prior to Phase 1.

A user will be able to find this information by pasting their Terra address on the Astroport website in due time. This allows you to decide whether you want to hold it or put it into the ASTRO/LP pool in Phase 2.

Phase 1

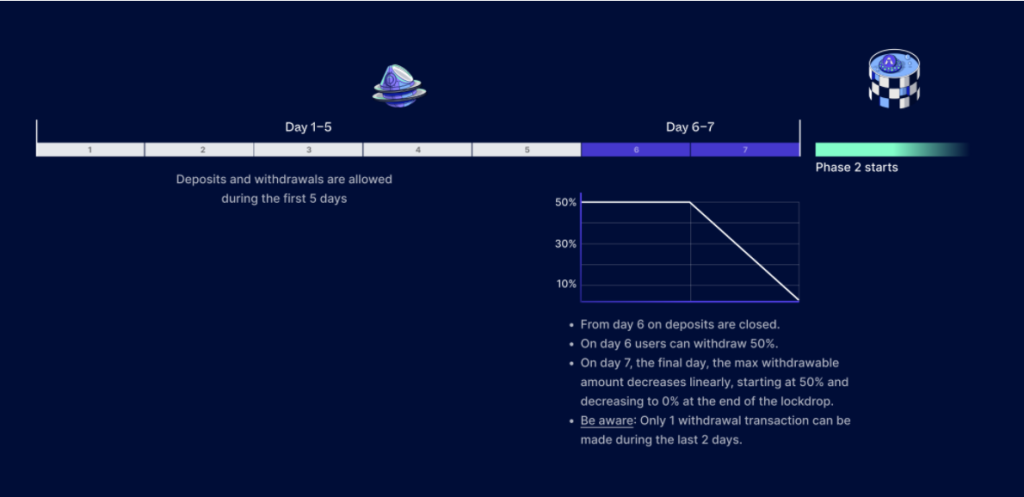

Next, we have Phase 1. This is the stage where everyone gets to participate.

All you would have to do is to migrate your current LPs on Terraswap over to Astroport. There will be a 7-day period for users to do so.

In moving your LPs over, the user would have to choose the amount of time to “lock-up” their LP. Generally, the longer the LP is locked up, the larger the one-time up-front ASTRO reward is when the protocol launches.

Aside from that, there are two other factors taken into consideration. The illustration below presents a clearer idea of how it will work.

Do note that there are certain risks from this stage forth and this is explained very clearly at the disclaimer portion of their litepaper.

Furthermore, this looks to be a medium to long-term play with the bulk of ASTRO tokens being earned from locking up liquidity or depositing airdropped ASTRO tokens from Phase 0 to earn more rewards.

Hence, one should carefully consider the trade-offs as your LPs will take time to unlock and tokens are vested over different periods of time.

Phase 2

Moving on to Phase 2, which is where the price discovery of ASTRO tokens occurs.

Say bye to crazy price volatility like Valkyrie or Nexus tokens during their IDO. The price will be determined by the amount of UST and ASTRO users add to the pool.

Remember the liquidity bootstrapping pool we talked about earlier? This is how it will look like in action. Therefore, the price of ASTRO tokens will largely be based on supply and demand and the amount of ASTRO and UST being deposited.

At the end of Phase 2, Astroport will be launched. At that time, ASTRO will be tradable and airdrops that were not committed to pools can be traded.

This is a rough explanation of the three different stages of how to obtain ASTRO. The process is slightly more intricate in reality. As such, it would be good to read their litepaper for a more in-depth understanding of the three phases.

Featured Image Credit: Astroport

Also Read: Back To Basics: Why Mirror Protocol Is Still My Favourite Yield Farm On Terra