Axie Infinity, one of the largest play to earn blockchain gaming by market cap now, has overtaken popular mobile gaming app Candy Crush’s 2020 total realized revenue.

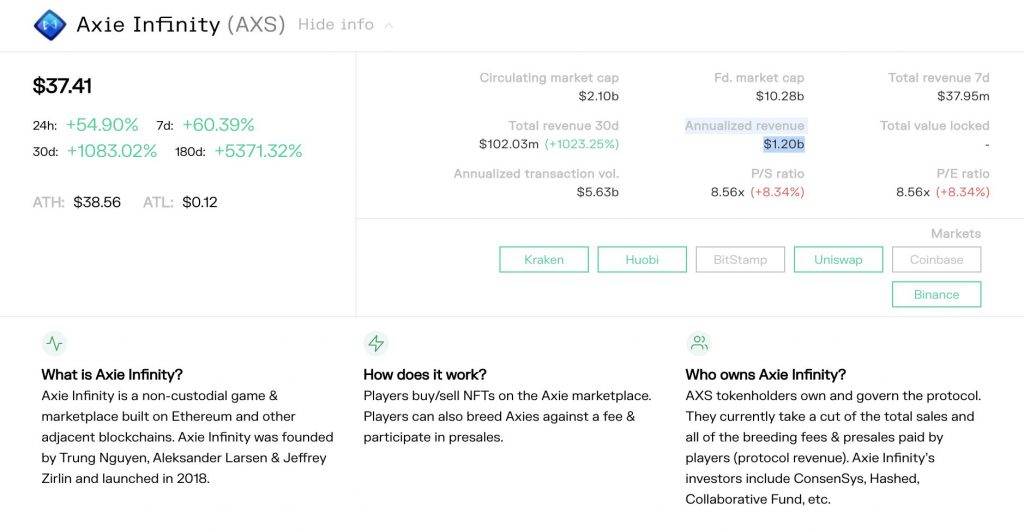

Here’s a look at Axie Infinity’s annualized revenue:

It is important to caveat that annualized revenue is essentially the amount of revenue the customer base would produce over the course of a year if there were no changes to it. According to its current revenue growth, Axie Infinity is projected to earn $1.2b in revenue from its users.

This week, the Axie protocol generated more fees than Ethereum & Bitcoin from:

— The Jiho (@Jihoz_Axie) July 15, 2021

• A 4.25% Marketplace fee

• Breeding fees

Player-owned digital economies will continue to shock the world.$axs pic.twitter.com/LOZSLU71yp

Boom. @AxieInfinity just crossed $100M in July revenue.

— Packy McCormick (@packyM) July 23, 2021

It's July 23rd.

Axie's made $21M since I wrote about it on Monday.

? pic.twitter.com/l9kpJ8XEhd

These revenue are generated by its current userbase of 600,000 users.

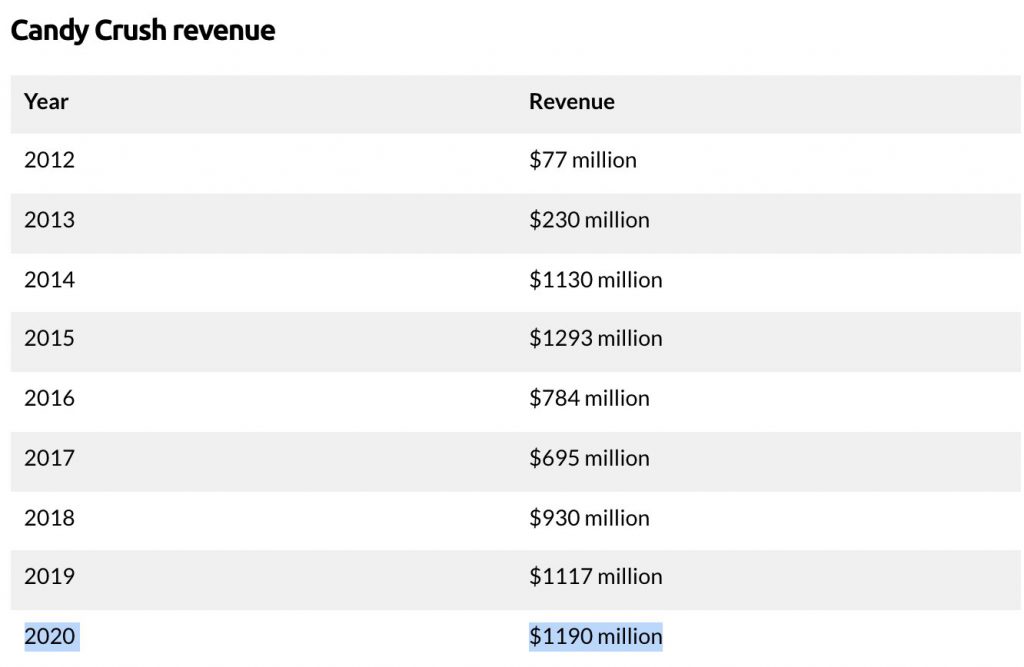

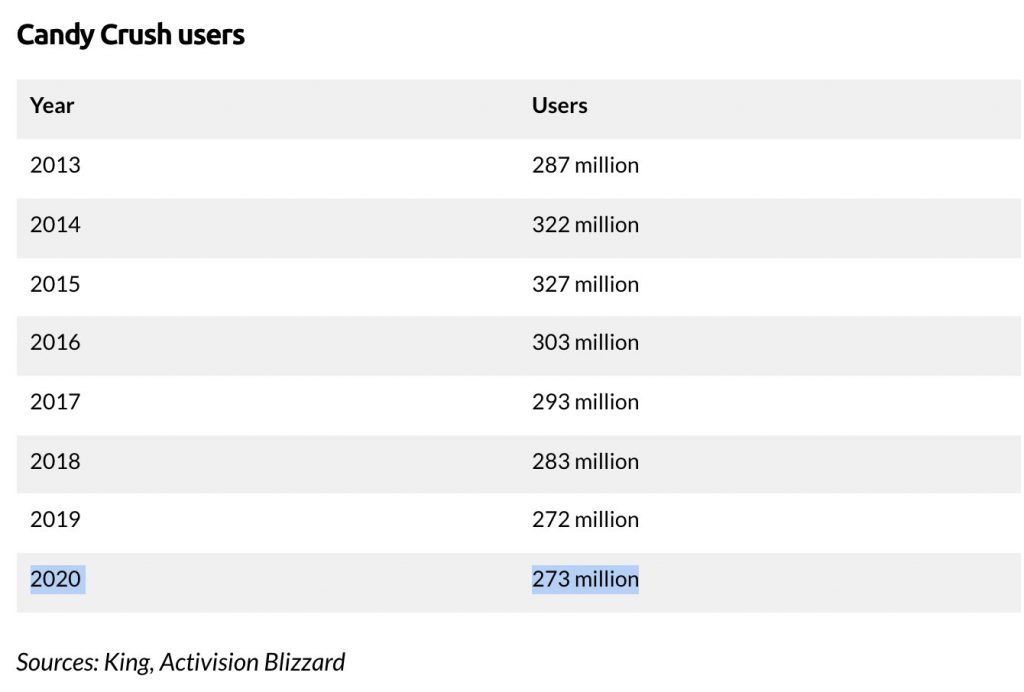

Candy Crush on the other hand, has 273 million users in 2020, and generated less than $1.2 billion in revenue to the game owner Activision Blizzard.

Here’s a table of comparison for easier reference:

| Axie Infinity | Candy Crush | |

| Revenue | $1.2 billion (annualized past 30 Days) | $1.19 billion (2020) |

| Users | 600,000 (2021) | 273,000,000 (2020) |

| Revenue per user | $2,000 | $4.4 |

Candy Crush owner Activision Blizzard, is trading at a 30.8 price over earning ratio, while Axie Infinity is trading at a P/E ratio of 8.8 at its current price of $42.

Activision Blizzard also owns other gaming titles such as Overwatch, Call of Duty, and Starcraft.

The growth of Axie Infinity showcases a new phenomenon in gaming – gives rise to a whole range of play to earn blockchain games. It also shows that cryptocurrencies coupled with smart tokenomics and proper game and incentives design can enable in-game economies at scale.

Also Read: A Look At Axie Infinity’s Growth Data And Metrics