Ever wondered how AI-focused Fetch.AI managed to raise USD6M in a flash on Binance Launchpad through its $FET token sale?

The @fetch_ai token sale on #Binance Launchpad took 11 minutes and 14 seconds to complete 🏁

— Fetch.ai (@Fetch_ai) February 25, 2019

Thank you to everyone who participated in the sale. This is just the beginning 🚀 pic.twitter.com/RSp4VMkfx3

As the saying goes, “the early bird catches the worm”. Getting in early to crypto projects can be immensely profitable for crypto investors. In September 2021, $FET reached an all-time high of $1.17, close to 14x of its price during the token sale!

However, given the sheer number of projects in the rapidly evolving world of crypto, discerning the promising ones can be a daunting task.

Fortunately for investors, they can leverage on the vetting and due diligence conducted by crypto launchpads to help them minimize the possibility of investing in low-quality or worse still, fraudulent projects which are outright scams.What are crypto launchpads and how can they help us spot the next $FET?

Also Read: 5 Resources You Need To Get A Job in Crypto & Upskill Yourself

What is a Crypto Launchpad and How Does It Work?

Following the 2017 Initial Coin Offering (ICO) craze, thought leaders in the crypto space have been deliberating ways to create a more structured, reliable and sustainable crowdfunding process.

Crypto launchpads are effectively platforms that act as incubators for early-stage crypto projects; they serve to connect these projects with potential investors.

Early investors get a headstart and stand to maximize their return on investment as they get to purchase tokens offered by these projects prior to them being publicly listed at an attractive price.

Most credible crypto launchpads also have a stringent due diligence process in place to screen projects before hosting onto their platforms. They also employ a comprehensive Know Your Customer (KYC) process to verify the identity of potential investors through a third party.

Launchpads will generally provide potential investors with important information on the projects hosted on their platform such as the price and date of the token launch, the business model and underlying technology involved.

Also, unlike traditional investment platforms, crypto launchpads seek to democratize access to funding and level the playing field for both retail and institutional investors.

Types of Crypto Launchpads

There are various forms of initial offerings.

Initial Coin Offerings (ICOs): Crypto project founders can offer investors tokens in exchange for funding. Examples include Binance Launchpad and Polkastarter.

Initial DEX Offerings (IDOs): Decentralized crowdfunding platforms where investors can purchase project tokens without the need for a centralized exchange. Examples include GameFi and Seedify.

Initial NFT Offerings (INOs): Content creators can offer investors early access to a specially curated limited edition digital collection. Examples include BSCStation and Seedify.

Initial Game Offerings (IGOs): Game developers can raise funding for their projects and monetize their tokenized in-game NFT creations. Examples include Enjinstarter and Gamestarter.

Benefits of Crypto Launchpads

From an investor’s perspective, beyond token price appreciation, stringent screening and due diligence conducted by crypto launchpads help to weed out scams which have unfortunately become commonplace.

Launchpads also do not custodize investors’ funds and assets. For IDOs in particular, it is decentralized and there is full transparency as to how funds are being utilized.

The benefits for new projects that are hosted on crypto launchpads are even more apparent. Listing fees on crypto launchpads are low and projects can access a wider pool of investors globally.

Besides access to liquidity, crypto launchpads also provide project founders with a platform to build a strong and loyal following.

Top 5 Crypto Launchpads

1. Binance Launchpad

Given that Binance is a leading and prominent crypto exchange, it should not come as a surprise that its launchpad has been exceptionally successful.

The BitTorrent token launch is a case in point, the project’s developers raised USD 7.2M in a matter of 15 minutes on Binance launchpad.

Other successful launches include MATIC on the Polygon blockchain and SAND, a ERC-20 utility token on Ethereum.

From its launch price of USD 0.00263 per token, MATIC soared to an all-time high (ATH) of USD 2.71 in late 2021. Also around the same period, the SAND token surged to an ATH of around USD 7.53, representing an increase of over 10,000% from its IEO price on Binance Launchpad.

2. DAO Maker

Arguably one of the most trusted IDO launchpad platforms, DAO Maker was one of the first to pioneer the reinvention of token offerings through Strong Holder Offerings (SHOs).

Instead of the regular ICO or IDO offerings, investors are selected based on their on-chain activities in the ecosystem and other criteria determined by the project.

One of the most successful launches on DAO Maker will have to be the ALICE token SHO, enabling participants to net a ROI of more than 10X.

Players of this play-to-earn crypto game called My Neighbour Alice built on the Chromia network can buy land and swap NFTs with the ALICE token.

3. Polkastarter

Polkastarter is a protocol that is built directly on top of the Polkadot network. It provides interoperability between blockchains and includes an auction system for project fundraising.

Investors can choose to stake their native token $POLS, earn rewards and gain priority access to new token pools.

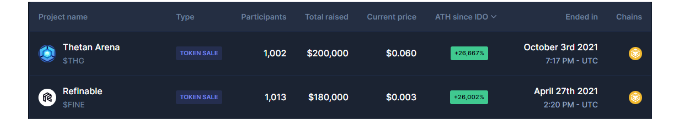

Top projects on Polkastarter that were launched on the BNB Chain include blockchain-based mobile game Thetan Arena and Refinable, a decentralized multi-chain NFT marketplace.

4. GameFi

As the name suggests, GameFi is a hub for all things related to game finance. Investors can participate in the initial token allocation of top gaming projects, stake these tokens and join gaming guilds.

Both the Kaby Arena and DeathRoad IGOs that were launched on Polygon and BNB Chain respectively proved to be popular.

5. Seedify

Also focused on blockchain gaming, Seedify is a decentralized DAO-driven launchpad and seed stage investment fund all in one.

It is entirely community-driven and the Seedify community votes on new gaming projects that are eligible for funding.

One of the most successful IGOs launched in 2021 was for Sidus Heroes, a AAA-quality Web 3 game.

Final Thoughts

Crypto launchpads work wonders for budding crypto projects that require the much needed funds to extend their runway by bringing new investors onboard.

Investors benefit from gaining early access to lucrative projects while mitigating potential risks as crypto launchpads perform a strict vetting process of these new projects.

However, it is important to note that such due diligence conducted by crypto launchpads can never be foolproof and there are always risks involved.

Be it the project or launchpad on which the project is hosted on, never forget that the golden rule in crypto is to Do Your Own Research (DYOR).

Also Read: Top 5 Chinese Crypto Projects With Massive Potential In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Clarence Lee and edited by Yusoff Kim.