NFT lending platform BendDAO is experiencing a DeFi (decentralized finance) bank run. In just 48 hours, the wallet went from 18,000 ETH to just 15wETH.

gm

— Cirrus (@CirrusNFT) August 21, 2022

While you were asleep the BendDAO bank run finally happened

15 wETH ($25,081) left in the wallet that had 18,000 ETH ($29,160,000) in it just 48 hours ago

Still 14,500 wETH owed to lenders….

Absolute shitshow pic.twitter.com/RKkdqVAVIf

While the website still shows that they have over 35,000 ETH in TVL, the developers have confirmed on discord that it is a front-end bug.

What Is BendDAO?

BendDAO is the first decentralized non-custodial NFT-backed lending protocol. The peer-to-peer lending platform allows users to borrow against their NFTs.

Lenders can typically borrow up to 40% of the floor value of their NFTs with the NFT pledge as collateral. The loan will come with an interest rate of 15-25%.

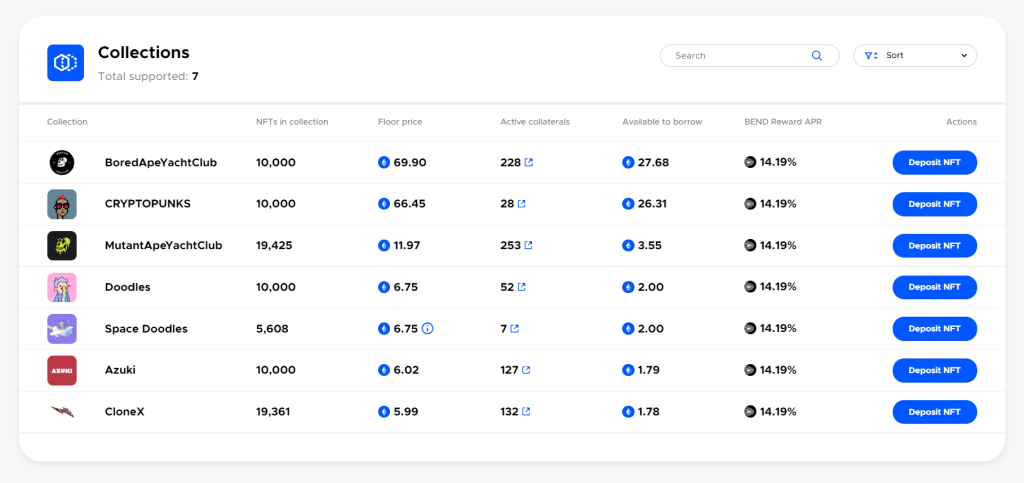

Currently, it supports a range of popular NFTs from blue-chip CRYPTOPUNKS to celebrity’s favourite BoredApeYachtClu (BAYC).

NFT market slum

All these Apes close to liquidation on BendDAO.

— Pete Fogden (@petroz_eth) August 19, 2022

Fire-sale coming soon 🤝 pic.twitter.com/mOKJpYW6nh

The recent NFT market slum saw many NFT’s floor prices tumbling down. This caused a number of NFTs on BendDAO to reach the danger zone due to low health factor loans.

This in turn led to market-wide panic last week as millions in Bored Apes and other NFTs were at risk of being liquidated.

Flawed model

Ok. Long thread on the BendDAO situation:

— NFTStatistics.eth (@punk9059) August 21, 2022

1) They've run out of ETH. There is just 12.5 WETH in the contract.

2) What does this mean? People who lent money to others via BendDAO to buy NFTs on leverage can't pull their money out. About 15,000 ETH was lent.

(1/9)

At the time of writing, the majority of NFTs have defaulted on loans and there are no bids on them.

This is because BendDAO required bidders to:

- Bid above both OpenSea floor price and also the borrowed debt.

- Lock up ETH for 48 hours.

The current system doesn’t incentive bidding as the debt is sometimes higher than the floor price and market participants generally do not want to risk a time lock of hours for floor NFTs.

At the end of the day, we could see a number of NFTs locked forever in BendDAO. The loan would continue accruing interest and snowball to an amount higher than the floor price and nobody would touch those NFTs.

Also Read: How Your MetaMask May Be Compromised – Even Without Approving Smart Contracts

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief