As it stands, cryptocurrency far exceeds the risk tolerance of many. However, on the other end of the spectrum, there are people who seem to thrive on volatility. For them, NFTs have emerged as an ideal outlet. They allow crypto holders to further utilise their existing investments.

With the rate at which the NFT space has been growing, it stands to reason whether blue chip NFTs offer better value than their underlying cryptocurrencies. In other words, are you better off storing 100ETH in your wallet or as a Bored Ape?

What are blue chips?

‘Blue chip’ is a term used to describe established companies which make for safe investments. They aren’t subject to large swings and have withstood the test of time.

The NFT space is far too new to have ‘blue chips’ in the same sense the stock market does. However, the term has still been co-opted to describe projects which are expected to stick around for years to come.

Although this is anecdotal evidence, the average NFT project doesn’t last more than a few months. In a trend-driven space, most new entrants are merely riding the wave and tend to fall off once something new comes up.

To start with, one-of-one artworks were all the rage. We saw artists such as Beeple bring mainstream attention to the NFT space with their monumental sales.

Then, gamification took over — the idea that NFTs could be used to represent playable characters in online games. For a small window of time, any project offering such a utility was getting minted instantly.

Once that played out, the metaverse took the spotlight. Virtual land started selling like hotcakes, and in fact, it still is.

Most projects which have come up off these trends haven’t survived. However, the small percentage which continue to be successful might be regarded as blue chip NFTs.

Which NFT projects fit the category?

As the first blockchain to support NFTs, Ethereum has the highest number of projects which can make a ‘blue chip’ claim.

For the purposes of this experiment, we look at projects which have been around for at least six months, and recorded a consistent trading volume throughout that time. In October 2021, the top 5 projects (by volume) on OpenSea were MekaVerse, CrypToadz, Mutant Cats, Crypto Punks, and Bored Ape Yacht Club (BAYC).

1/ Bored Ape Yacht Club

— NFT Daily (@NFTDaily) October 3, 2021

A series of #NFTs depicting 'bored' apes in various facial expressions. Even more notable, owners of the ape NFTs become members of an online club! #BAYC pic.twitter.com/8TJmhRripC

Around the time, all five of these projects were being referred to as blue chips within NFT communities. Today, they’re still within the top 100 projects on Opensea, when ranked by trading volume.

So, the question remains: would it have been more beneficial to buy into these projects rather than holding ETH?

ETH vs. blue chip NFTs

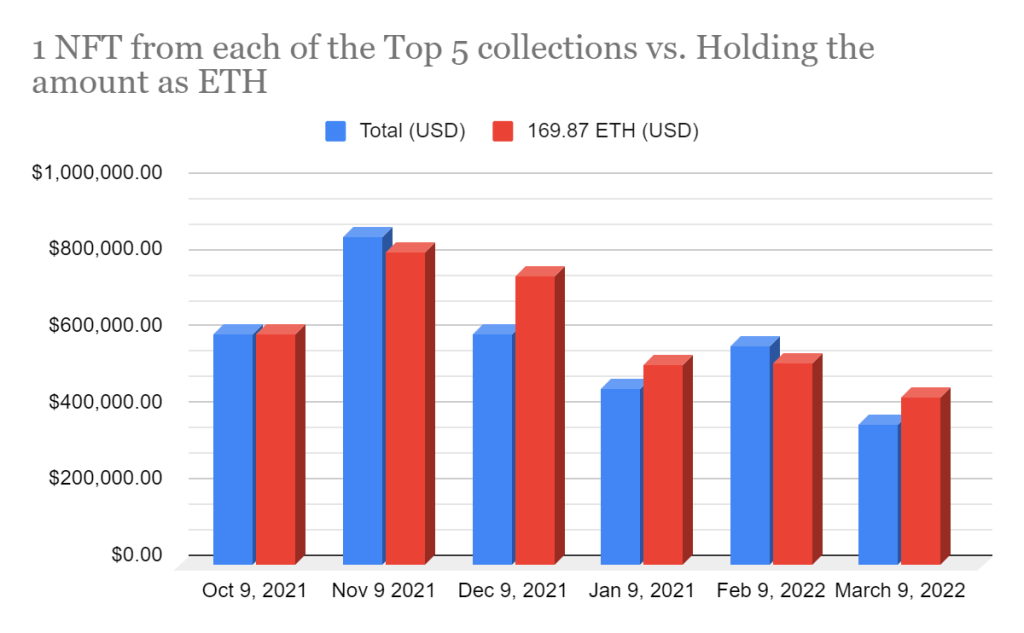

Let’s say you bought one NFT from each of these collections at the average sale price back in October 2021. The total investment would add up to 169.87 ETH. Here’s how that investment tracks compared to holding an equivalent amount of ETH in your crypto wallet.

In March 2022, the total value of the NFTs would add up to around US$370,000 whereas the value of 169.87 ETH was closer to US$440,000. The value of the NFT portfolio only exceeded that of an equivalent ETH holding in November and February.

Bear in mind, this experiment doesn’t take into account other ways of generating value through cryptocurrency such as staking and entering liquidity pools. For example, Crypto.com offers 6.5 percent interest per annum when you stake ETH for three months.

All things considered, it’s tough to make a judgement using these results. At most, they suggest that NFT prices don’t share a strong correlation with the value of their underlying cryptocurrency.

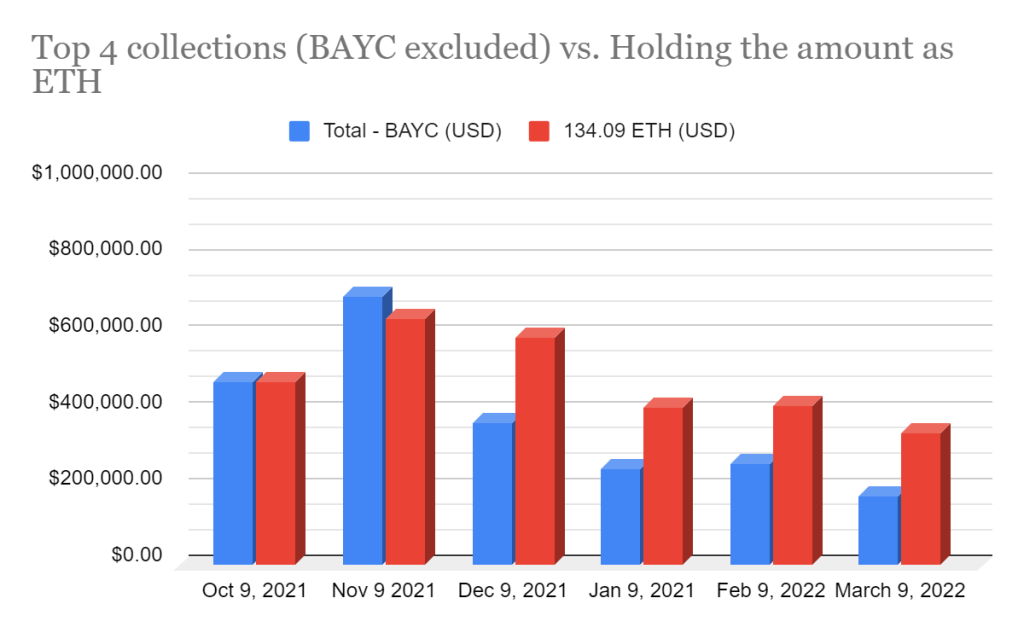

Things prove to be more interesting when BAYC is removed from the equation.

The total value of the investment adds up 134.09 ETH, and the NFT portfolio far underperforms an equivalent ETH holding across four of the following five months.

Apart from BAYC, the floor prices of all the other collections sit far lower today than they did back in October. This goes to prove that the NFT space is still far too new for true blue chips to have been established.

Is BAYC the most realistic case for a blue chip NFT?

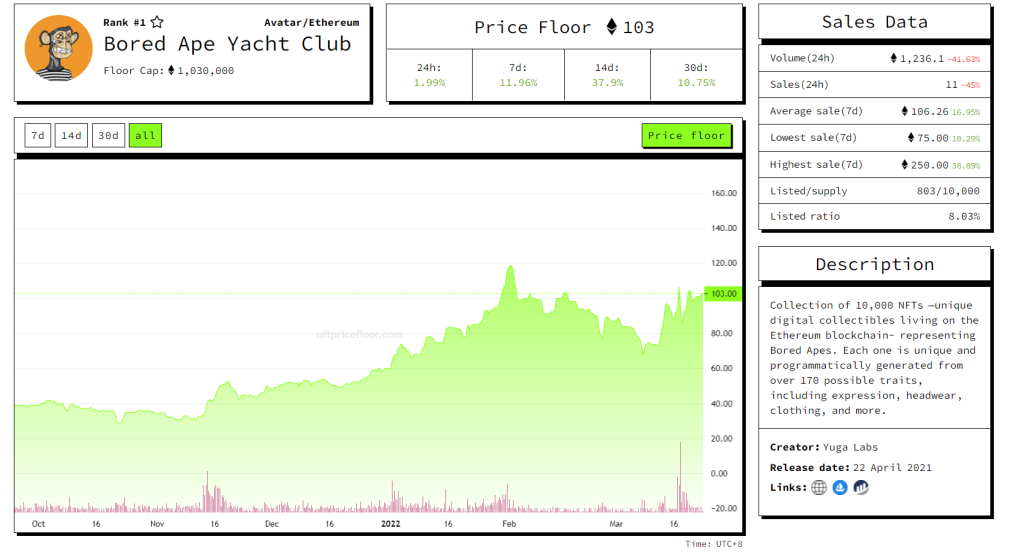

Out of the top 100 collections listed on OpenSea, BAYC ticks off the most boxes when it comes to determining a blue chip. The collection minted almost a year ago and now has the highest market cap out of any NFT project.

On top of that, it has remained largely unaffected by market swings and gained mainstream notoriety. The founding company Yuga Labs recently raised US$450 million for its upcoming metaverse projects, at a US$4 billion valuation.

Unfortunately, investing in BAYC has quite a high barrier to entry. The floor price currently sits at over 100ETH (~US$300,000).

While NFT projects can be a worthwhile addition to your portfolio, they often come associated with a lot more risk than their underlying cryptocurrencies — especially over a long time frame. In the same way investors diversify their holdings between cash and equity, it’s important to find the right balance between crypto and NFTs.

Was this article helpful for you? We also post bite-sized content related to NFTs — from tips and tricks, to NFT alphas on Instagram, and you can follow us here!

Featured Image Credit: Analytics Insight / Bored Ape Yacht Club

Also Read: High Floor Prices And Consistent Trading Volume: What Could Be The Next Blue Chip NFT?