One of the largest exchanges in the world, Binance, just announced that it will automatically convert all USDC (Circle), USDP (Pax Dollar) and TUSD (TrueUSD) into its native stablecoin BUSD.

This strategic move will effectively remove one of the largest stablecoin players, USDC, from the entire Binance trading platform.

This is hurting Circle’s (USDC issuer) plans to go public through a SPAC (special purpose acquisition corporation) deal.

What is BUSD?

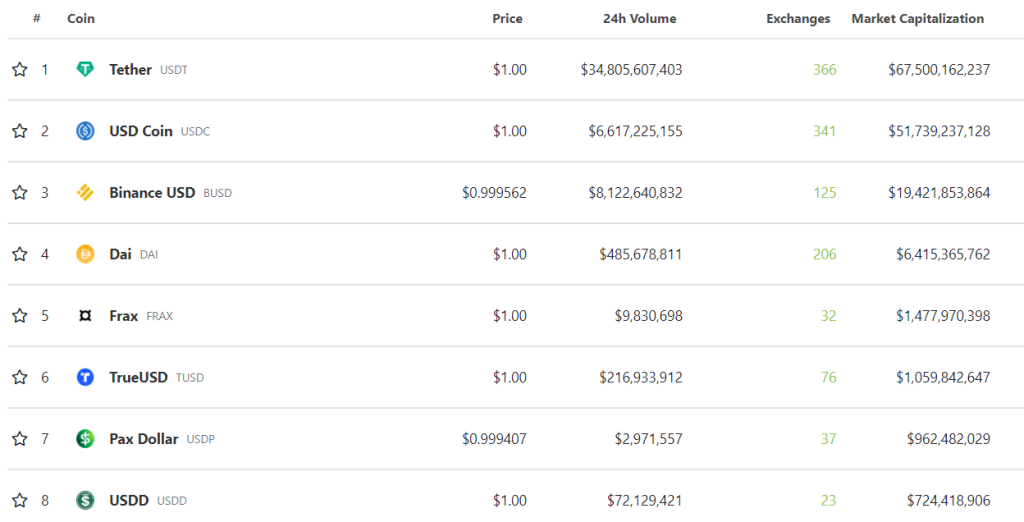

Binance USD or BUSD is Binance’s very own stablecoin. At the time of writing, it is the 3rd largest stablecoin based on market cap.

Similar to USDC, BUSD is also a regulated, fiat-backed stablecoin pegged to the US dollar. BUSD holders can swap their tokens at a 1:1 ratio for fiat and vice versa.

The Lucrative Business of Stables

Stablecoin issuer is one of the most lucrative businesses in Web3.0 as it is almost a risk-free business. Regulated stablecoins like BUSD are minted in exchange for fiat currency.

This means that for every 1 BUSD out in the market, there will be 1 USD held in the bank. The USD held in the bank also known as reserve assets are actually yield-generating assets.

Banks would typically pay out some interest for any deposits they are holding. While the interest paid out is very little, if you multiple it by 19 billion (BUSD market cap), the interest revenue can be quite substantial.

A typical stablecoin issuer would not keep all the deposits in a bank account. They would go for things like government bonds (Treasury bills) which generate more yield and at the same time, it is also highly liquid.

This is the start of a stablecoin war and I wouldn’t be surprised that Binance would come out on top. While USDC is a highly reputable stablecoin, being removed from one of the largest centralized exchanges is definitely a big hit.

That being said, I still think USDC would remain as one of the top stablecoins but BUSD would overtake its market cap in the near future.

Also Read: Binance Is Suspending Ethereum Withdrawals Ahead of The Merge- Here’s All You Need To Know

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief