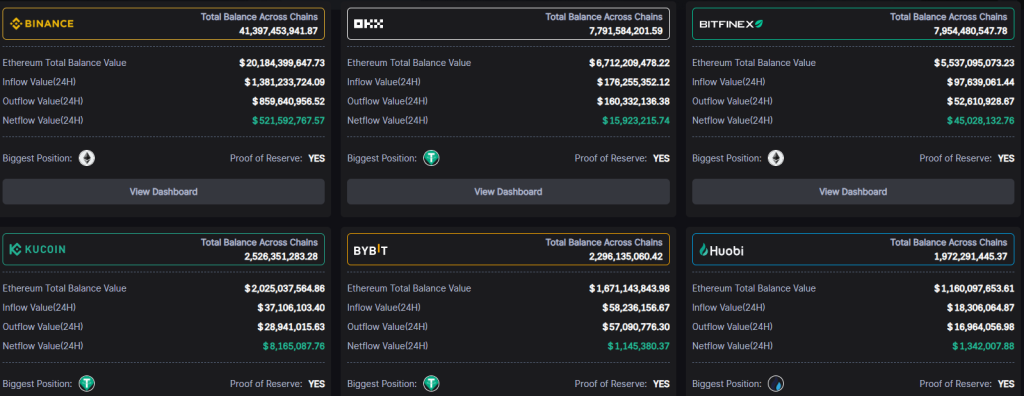

According to data from Scope Protocol’s Web3 analytics tool, centralized exchange Binance has experienced positive netflow despite the SEC’s ongoing lawsuit against them.

Despite almost $6bn in user assets being withdrawn from the platform over the last week, Binance has seen a surge in deposits over the last 24 hours, with stablecoins and Ether leading the way.

Despite facing regulatory challenges, Binance is gradually regaining trust as evidenced by their strong netflow, even though they have a long journey ahead to fully recover their exchange balance from before the lawsuit.

On the other hand, Binance U.S. tells a different tale as it experienced a consistent net outflow, with a cumulative sum of $142 million over the past week.

Further data indicates that market makers on the platform have departed following the lawsuit, potentially relocating their services in response to the ongoing investigations.

Former SEC Enforcement Co-Director Joins Binance US Amid Legal Battle

Facing allegations of operating an illegal securities exchange, Binance U.S. has enlisted the expertise of George Canellos, a former co-director of the Securities and Exchange Commission’s enforcement division, along with three other lawyers.

Canellos, currently heading the litigation and arbitration group at Milbank, brings extensive experience from overseeing high-profile investigations at the SEC and serving as the chief of the major crimes unit at the US Attorney’s Office in the Southern District of New York.

Binance/DOJ Newsflash:

— John Reed Stark (@JohnReedStark) June 12, 2023

Binance and CZ just added a uniquely qualified criminal defense all-star lawyer to their legal team: George Canellos, former Chief of the Major Crimes Unit in the U.S. Attorney's Office for the Southern District of New York and former head of the SEC's New… pic.twitter.com/lQlkZ6oxYc

The exchange also announced on June 9 that it will be temporarily suspending U.S. dollar deposits and potentially pausing fiat withdrawals, with the changes set to take effect as early as June 13.

They have also expressed concerns over the SEC’s approach, which has concurrently faced criticism from U.S. lawmakers and industry leaders. Representative Warren Davidson went as far as proposing a bill aimed at restructuring the commission and calling for the firing of SEC chair Gary Gensler on June 12.

Also Read: We Are in A Crypto Liquidity Crisis – But The Reason is Not What You Think

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief