Bitcoin’s price has been like a rollercoaster lately. It just hit an All Time High of $99,850, but then suddenly dropped all the way to $90,600, its lowest point in days. For a lot of people, it’s definitely disappointing. Bitcoin was so close to hitting that dream $100,000 mark, but it just didn’t make it. Still, if you’ve been following the crypto world for a while, you know this kind of up and down movement is totally normal here.

This drop didn’t really surprise some analysts. When prices shoot up too quickly, it’s pretty normal to see a correction, and this time it was a pretty big one. Whales, the big players in the market, seem to have cashed out at the top, which added even more pressure on the sell-off.

Right now, $90,000 is a key level to watch. If Bitcoin falls below this, it might slip into a longer bearish phase. But if it can hold steady at this support, there’s still a chance for a recovery and maybe another shot at breaking that $100,000 milestone everyone’s been waiting for.

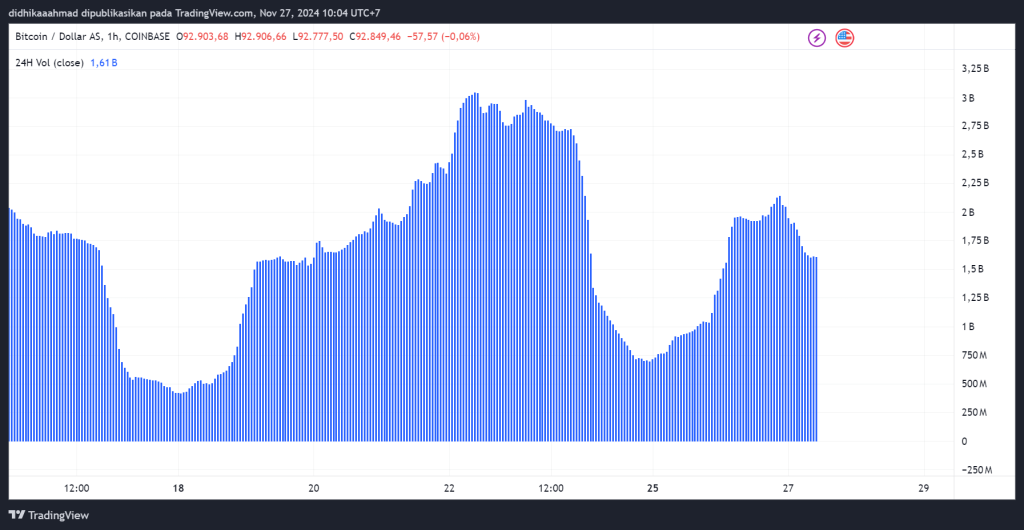

Dropping Volume and Most of the Top 20 Cryptos in the Red

When Bitcoin’s price dropped, trading volume shot up. This shows just how active the market was during that time. Big spikes in volume like this usually happen when the market is going through a correction phase, with big players like institutions and whales adjusting their portfolios.

Bitcoin’s drop had a ripple effect across the entire crypto market, especially on the top 20 coins. Almost all of them ended up in the red. Ethereum (ETH) fell 1.21%, Binance Coin (BNB) dropped 3.27%, and Cardano (ADA) was down 1.83%. Even Dogecoin (DOGE), which often moves differently from others, slipped by 3.08%.

The hardest hit was Stellar (XLM), which fell a massive 14.51% in just 24 hours. Solana (SOL) and Shiba Inu (SHIB) also saw significant drops.

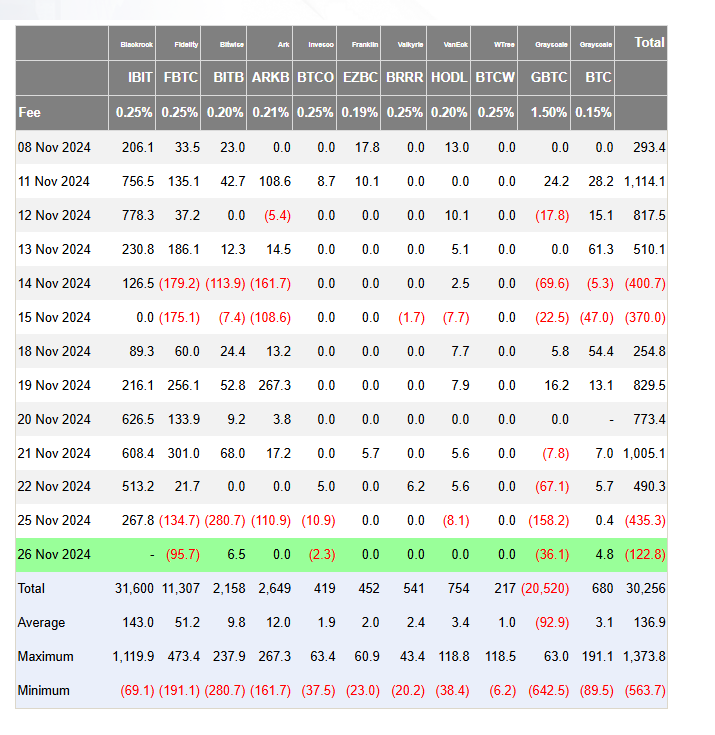

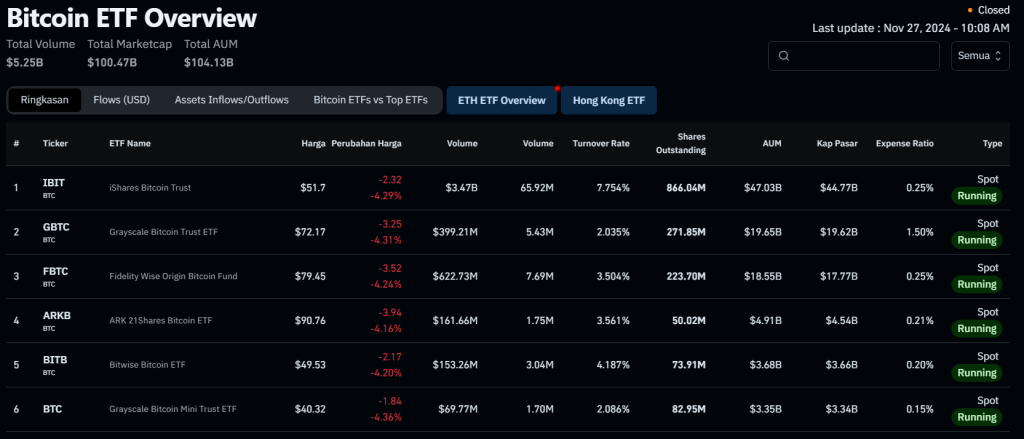

Bitcoin ETFs Stay Busy Amid Volatility

In the midst of the bearish market conditions discussed earlier, Bitcoin ETFs continue to show robust activity. The iShares Bitcoin Trust (IBIT) is leading the charge, recording a trading volume of $3.47 billion, despite experiencing a price drop of 4.29%. Similarly, the Grayscale Bitcoin Trust (GBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) also reported significant volumes at $399.21 million and $622.73 million, respectively.

Overall, the total trading volume for Bitcoin ETFs currently stands at $5.25 billion. This suggests that institutional investors remain highly engaged in the market, even as Bitcoin’s price faces downward pressure. A key highlight is the high turnover rate of ETFs like IBIT, which reached 7.75%.

However, the sell-off pressure is evident across the ETF market, with most ETFs experiencing price declines of around 4% to 5%. Despite this, the combined market capitalization of Bitcoin ETFs remains solid at $100.47 billion.

Related Bitcoin has a 50-50 chance of reaching $100K by year-end: Options data

Ethereum Stays Strong Amid Market Pressure

The Ethereum price chart shows some interesting movements over the past few days. It has been bouncing between $3,158 and $3,370, with the current price sitting around $3,359. The chart highlights how Ethereum is still facing a lot of pressure, but it’s managing to hold its ground near the $3,300 support level.

Looking at the pattern, it seems like Ethereum is trying to recover after some recent dips. The slight uptick near the end of the chart could be a positive sign, suggesting that buyers are stepping in to push the price back up.

For traders, this range could offer opportunities, especially if Ethereum manages to stay above $3,300. It’s not a breakout yet, but it’s also not breaking down further, which is encouraging.

What Should Traders Do in This Market?

Let’s face it, the market’s been a bit crazy lately. Prices are all over the place, and it feels like the bears are in control. But hey, it’s not all doom and gloom. This could actually be a great time to take a step back, refocus, and make some smart moves. The trick is staying calm and not letting the chaos mess with your head.

First things first, keep an eye on those support and resistance levels. Think of them as your guideposts. If prices hold steady at key supports, it might be a sign things are stabilizing or even gearing up for a rebound. But if they fall further, you’ve got to be ready to adjust. Also, watch out for spikes in volume and what the whales are up to.

Most importantly, don’t rush. Patience is your best friend right now. If you’re in it for the long haul, this might be the perfect chance to pick up some solid assets at a discount. If you’re trading short-term, stick to your plan, set clear goals, and don’t forget to manage your risks.

You can also read this Pump.fun Disables Live Streaming Feature Due to Vulgar and Harmful Content

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]